|

市场调查报告书

商品编码

1801890

冷藏箱市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cooler Box Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

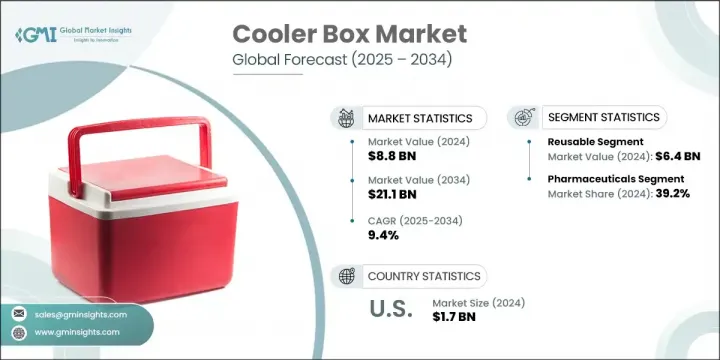

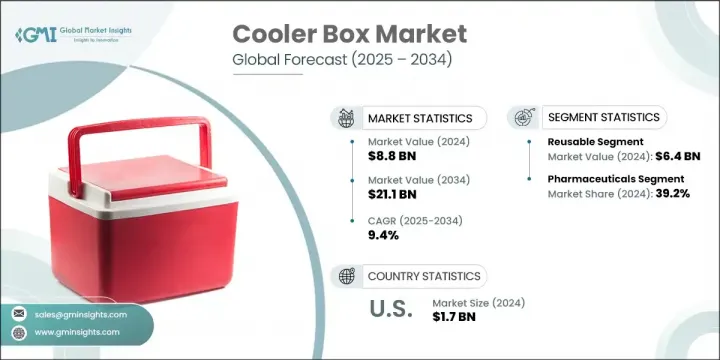

2024 年全球冷藏箱市场价值为 88 亿美元,预计到 2034 年将以 9.4% 的复合年增长率增长至 211 亿美元。市场发展势头强劲,得益于对温度敏感型商品的需求不断增长,以及市场普遍转向可持续冷藏解决方案。从低瓦数设备到超过 1.5 兆瓦的系统,冷藏箱的冷却能力范围广泛,显示其在住宅、商业和工业领域的适应性。随着消费者对环境责任的日益关注,可重复使用的冷藏箱成为一次性容器的经济高效、耐用的替代品。随着越来越多的环保意识影响购买行为,可重复使用的冷藏箱正成为消费者和企业减少浪费策略中不可或缺的一部分。随着公司和产业与全球永续发展目标保持一致,未来几年,耐用、环保的冷藏产品市场将稳步发展。

对温控物流的依赖已成为保障产品品质和公共卫生的关键。冷链解决方案的缺乏持续影响着关键产业,尤其是在医疗保健领域,数百万名可预防的儿童死亡与疫苗储存和运输故障有关。随着对可靠、节能冷却系统的需求不断增长,冷藏箱在各种温度范围内(包括超低储存条件下)提供可靠性能方面发挥着至关重要的作用。这些冷链物流需求预计将维持全球市场的扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 88亿美元 |

| 预测值 | 211亿美元 |

| 复合年增长率 | 9.4% |

可重复使用冷藏箱市场在2024年引领市场,达到64亿美元,预计2025年至2034年期间的复合年增长率将达到9.8%。随着一次性包装的逐渐减少,人们对可重复使用、使用寿命更长的冷藏箱产品产生了浓厚的兴趣。这些冷藏箱采用弹性材料製成,可重复使用,且不会影响隔热性能或结构耐久性。这一发展趋势不仅支持全球永续发展目标,还能满足现代供应链的成本效益需求。

2024年,製药业创造了34亿美元的市场规模,占39.2%。冷链完整性仍然是製药业的重中之重,严格的合规标准要求运输和储存过程中必须保持稳定的热环境。全球对疫苗分发和温敏药物规范储存的需求,进一步加剧了对温控解决方案的需求。为确保产品功效的一致性和合规性,符合严格製药标准的冷藏箱正广泛应用。

2024年,美国冷藏箱市场规模达17亿美元,预计2025年至2034年的复合年增长率将达到10.3%。美国市场的成长主要得益于依赖冷藏基础设施的产业规模的不断扩大。从送餐服务到医药物流和食品杂货配送,随着基础设施的改善,需求也不断攀升。住宅和商业用电量的激增也推动了高效製冷技术的普及。这些因素预示着冷链投资将持续成长,为在全国部署冷藏箱创造了有利条件。

活跃于全球冷藏箱市场的知名公司包括 Cold Chain Technologies Inc.、va-Q-tec Thermal Solutions GmbH、WILD Coolers、FEURER Group GmbH、Pelican Products Inc.、Igloo Products Corp.、YETI COOLERS, LLC.、K2Coolers、Sourogam Group、Sonoco Theonomot、Conoco Themotive、Coolers、Souroel、Tonoco Themoce、Conoco Themoce。冷藏箱产业的公司正在投资材料创新、模组化产品设计和技术集成,以打造长期竞争力。许多参与者专注于生产可重复使用、耐用且热效率高的冷藏箱,以应对日益严重的环境问题。包括医疗保健和食品物流在内的不同行业的客製化选项正在扩大,以扩大市场范围。与物流供应商和冷链基础设施开发商的策略合作伙伴关係也在加强供应链连通性。领先的製造商正在积极加强研发力度,设计与智慧温度监控系统相容的轻型高效能设备。一些公司正在透过建立区域製造中心来提升其地理影响力,帮助降低运输成本并更有效地回应已开发市场和新兴市场的在地化需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业影响力量

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区和类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 可重复使用的

- 一次性的

第六章:市场估计与预测:依原料,2021 - 2034 年

- 主要趋势

- 挤塑聚苯乙烯

- 发泡聚苯乙烯

- 发泡聚丙烯

第七章:市场估计与预测:依价格区间,2021 年至 2034 年

- 主要趋势

- 低(最高 30 美元)

- 中(30 - 50 美元)

- 高(50 美元以上)

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 製药

- 食品和饮料

- 其他

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 公司网站

- 电子商务网站

- 离线

- 超市和大卖场

- 专业户外用品商店

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- B Medical System

- Bison Coolers

- Blowkings

- Cold Chain Technologies Inc.

- Cool Ice Box Company

- Eurobox Logistics

- FEURER Group GmbH

- Igloo Products Corp.

- K2Coolers

- Pelican Products Inc.

- Sofrigam Group

- Sonoco ThermoSafe

- va-Q-tec Thermal Solutions GmbH

- WILD Coolers

- YETI COOLERS, LLC.

The Global Cooler Box Market was valued at USD 8.8 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 21.1 billion by 2034. Market momentum is being driven by a combination of rising demand for temperature-sensitive goods and a broader shift toward sustainable cold storage solutions. The diverse range of cooling capacities, from low-wattage units to systems exceeding 1.5 MW, illustrates the adaptability of cooler boxes across residential, commercial, and industrial sectors. Increasing attention on environmental responsibility is also steering buyers toward reusable cooler boxes, which emerge as cost-effective, durable alternatives to disposable containers. With growing environmental awareness influencing buying behavior, reusable cooler boxes are becoming integral to waste-reduction strategies for both consumers and businesses. As companies and industries align with global sustainability goals, the market for long-lasting, eco-conscious cold storage products is set to advance steadily in the years ahead.

The dependence on temperature-controlled logistics has become essential for protecting product quality and ensuring public health. A lack of cold chain solutions continues to impact critical sectors, particularly in healthcare, where millions of preventable child deaths are linked to failures in vaccine storage and transport. As the need for dependable, energy-efficient cooling systems expands, cooler boxes are proving vital in delivering reliable performance across variable temperature ranges, including ultra-low storage conditions. These cold chain logistics requirements are expected to sustain market expansion globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 9.4% |

The reusable cooler box segment led the market in 2024, reaching USD 6.4 billion and is anticipated to grow at a CAGR of 9.8% between 2025 and 2034. The rising shift away from single-use packaging is fueling interest in reusable models engineered for extended service life. Built from resilient materials, these cooler boxes are designed for repeated use without compromising insulation performance or structural durability. This evolution supports global sustainability targets while meeting the cost-efficiency needs of modern supply chains.

The pharmaceuticals segment generated USD 3.4 billion in 2024 holding a 39.2% share. Cold chain integrity remains a top priority in the pharmaceutical industry, where strict compliance standards require stable thermal environments for transportation and storage. The need for temperature-controlled solutions is amplified by the global demand for vaccine distribution and regulated storage of temperature-sensitive medications. Cooler boxes built to meet exacting pharmaceutical standards are seeing strong adoption to support consistent product efficacy and regulatory adherence.

United States Cooler Box Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 10.3% from 2025 to 2034. Market growth in the US is driven by the expanding footprint of industries that depend on cold storage infrastructure. From meal delivery services to pharmaceutical logistics and grocery distribution, demand is climbing alongside infrastructure improvements. A surge in electricity usage across residential and commercial spaces is also supporting the adoption of high-efficiency cooling technologies. These factors point to a sustained rise in cold chain investments, creating favorable conditions for cooler box deployment across the country.

Notable companies active in the Global Cooler Box Market include Cold Chain Technologies Inc., va-Q-tec Thermal Solutions GmbH, WILD Coolers, FEURER Group GmbH, Pelican Products Inc., Igloo Products Corp., YETI COOLERS, LLC., K2Coolers, Sofrigam Group, Sonoco ThermoSafe, Cool Ice Box Company, Bison Coolers, Eurobox Logistics, Blowkings, and B Medical System. Companies operating in the cooler box industry are investing in material innovation, modular product design, and technological integration to build long-term competitiveness. Many players are focusing on producing reusable, durable, and thermally efficient cooler boxes to address rising environmental concerns. Customization options for diverse industries, including healthcare and food logistics, are being expanded to enhance market reach. Strategic partnerships with logistics providers and cold chain infrastructure developers are also strengthening supply chain connectivity. Leading manufacturers are actively enhancing R&D efforts to design lightweight, high-performance units compatible with smart temperature monitoring systems. Several firms are boosting their geographic presence by establishing regional manufacturing hubs, helping reduce shipping costs and respond more efficiently to localized demand across both developed and emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Type

- 2.2.2 Raw Material

- 2.2.3 Price Range

- 2.2.4 End Use

- 2.2.5 Distribution Channel

- 2.2.6 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Reusable

- 5.3 Disposable

Chapter 6 Market Estimates & Forecast, By Raw Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Extruded polystyrene

- 6.3 Expanded polystyrene

- 6.4 Expanded polypropylene

Chapter 7 Market Estimates & Forecast, By Price Range, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low (Upto USD 30)

- 7.3 Medium (USD 30 - USD 50)

- 7.4 High (Above USD 50)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Pharmaceuticals

- 8.3 Food & beverages

- 8.4 Other

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 Company Website

- 9.2.2 E-commerce website

- 9.3 Offline

- 9.3.1.1 Supermarkets and hypermarkets

- 9.3.1.2 Specialty outdoor stores

- 9.3.1.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 B Medical System

- 11.2 Bison Coolers

- 11.3 Blowkings

- 11.4 Cold Chain Technologies Inc.

- 11.5 Cool Ice Box Company

- 11.6 Eurobox Logistics

- 11.7 FEURER Group GmbH

- 11.8 Igloo Products Corp.

- 11.9 K2Coolers

- 11.10 Pelican Products Inc.

- 11.11 Sofrigam Group

- 11.12 Sonoco ThermoSafe

- 11.13 va-Q-tec Thermal Solutions GmbH

- 11.14 WILD Coolers

- 11.15 YETI COOLERS, LLC.