|

市场调查报告书

商品编码

1801893

智慧电錶市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Smart Meter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

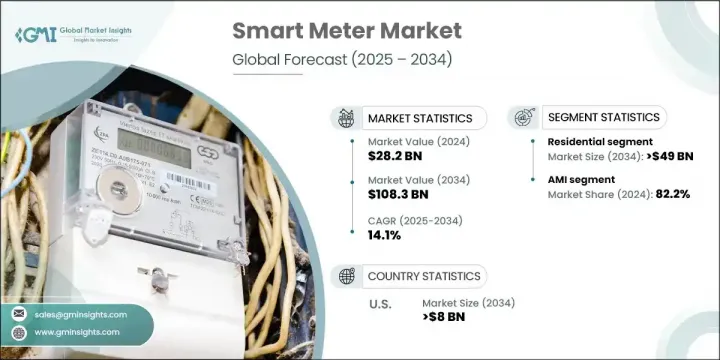

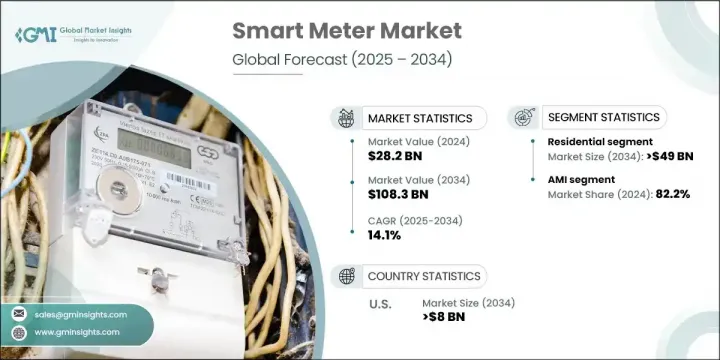

2024年,全球智慧电錶市场规模达282亿美元,预计年复合成长率将达14.1%,到2034年将达到1,083亿美元。这一显着增长得益于监管支持力度的加大、计量技术的持续创新以及消费者对可持续能源利用日益增长的关注。随着数位化不断重塑能源格局,智慧电錶正成为能源管理系统的核心组成部分。这些设备能够即时采集电力、天然气或水的消耗资料,并将资讯直接传输给公用事业公司,从而提高营运效率和计费准确性。

在许多经济体中,政府支持的旨在升级国家电网的项目将智慧电錶置于其现代化战略的核心位置。向智慧电网的转型不仅在于提高可靠性,还在于整合清洁能源并最大限度地减少传输损耗。随着对减少碳足迹和提高能源透明度的重视,公用事业供应商正在迅速用能够提供双向通讯和即时分析的智慧系统取代传统电錶。随着电网优化、节能减排和消费者赋能日益成为优先事项,智慧电錶市场在住宅、商业和工业领域持续蓬勃发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 282亿美元 |

| 预测值 | 1083亿美元 |

| 复合年增长率 | 14.1% |

预计到2034年,住宅能源市场规模将达到490亿美元,这得益于政府大力推动家庭能源基础建设现代化。大众对能源效率和环境责任的意识不断增强,也促使消费者采用智慧计量解决方案。这些数位计量表允许使用者存取即时资料,从而更好地控制能源消耗,帮助降低水电费,同时支持永续生活。随着需求面管理和节能专案的推进,住宅应用领域仍将维持成长的领先地位。

2024年,先进计量基础设施 (AMI) 占据了82.2%的市场份额,这得益于其广泛的功能。 AMI 支援公用事业公司和终端用户之间的即时双向资料通信,这对于能源优化和电网可靠性至关重要。透过远端抄表、动态定价、负载平衡和快速故障检测等功能,AMI 使能源供应商能够主动回应需求变化。这些系统还可以轻鬆与智慧家庭和消费者级能源仪錶板集成,从而提高透明度并鼓励高效的能源行为。

到2034年,美国智慧电錶市场规模将达到80亿美元,其中工业和住宅升级将贡献这一成长动力。美国正在加强电网基础设施建设,以应对日益增长的能源需求和更高比例的再生能源。监管措施正在推动先进的监控和管理工具的发展,将智慧电錶定位为关键基础设施。此外,智慧电錶正在能源密集产业广泛应用,进一步提升营运效率、合规性和供电可靠性。

引领全球智慧电錶市场的知名企业包括西门子、施耐德电机、Itron、霍尼韦尔国际和 Landis + Gyr。智慧电錶产业的主要公司正在透过创新、策略联盟和区域扩张等多种方式来提升其市场地位。研发投入持续发挥关键作用,各公司专注于开发整合人工智慧、物联网和云端分析技术的下一代电錶。领先的公司也正在与公用事业供应商和政府建立合作伙伴关係,以赢得长期部署合约。为了满足不断增长的需求,企业正在扩大生产能力并在战略区域实现本地化製造。此外,他们还透过包括提供能源洞察、远端诊断和预测性维护的软体平台来增强其服务产品,以提高客户价值和营运可靠性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 进出口贸易分析

- 各地区价格趋势分析(美元/单位)

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

- 新兴机会和趋势

- 数位化和物联网集成

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争性基准描述

- 策略仪表板

- 创新与技术格局

第五章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 住宅

- 商业的

- 公用事业

第六章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 急性心肌梗塞

- 抗肿瘤药物

第七章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 智慧瓦斯

- 智慧水务

- 智慧电动

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 瑞典

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第九章:公司简介

- Apator SA

- ABB

- AEM

- Aclara Technologies LLC

- ARAD Group

- B Meters Metering Solutions

- Badger Meter, Inc.

- Chint Group

- General Electric

- Honeywell International, Inc.

- Itron, Inc.

- Iskraemeco Group

- Kamstrup

- Larsen & Toubro Limited

- Landis + Gyr

- Ningbo Water Meter Co., Ltd.

- Osaki Electric Co., Ltd.

- Raychem RPG Private Limited

- Schneider Electric SE

- Siemens

- Sensus

- Sontex SA

- Wasion Group

The Global Smart Meter Market was valued at USD 28.2 billion in 2024 and is estimated to grow at a CAGR of 14.1% to reach USD 108.3 billion by 2034. This remarkable growth is being fueled by rising regulatory support, continued innovation in metering technologies, and growing consumer focus on sustainable energy usage. As digitalization continues to reshape the energy landscape, smart meters are becoming a central component of energy management systems. These devices capture real-time consumption data for electricity, gas, or water, transmitting the information directly to utilities for improved operational efficiency and billing accuracy.

Across many economies, government-backed programs aimed at upgrading national grids are placing smart meters at the core of their modernization strategies. The transition to smart grids is not only about enhancing reliability but also about integrating clean energy and minimizing transmission losses. With greater emphasis on reducing carbon footprints and improving energy transparency, utility providers are rapidly replacing conventional meters with intelligent systems that deliver two-way communication and real-time analytics. As grid optimization, energy conservation, and consumer empowerment rise in priority, the smart meter market continues to gain momentum across residential, commercial, and industrial sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.2 Billion |

| Forecast Value | $108.3 Billion |

| CAGR | 14.1% |

The residential sector is projected to reach USD 49 billion by 2034, supported by widespread government efforts to modernize household energy infrastructure. Increasing public awareness of energy efficiency and environmental responsibility is also influencing consumers to adopt smart metering solutions. These digital meters allow users to access real-time data, offering better control over energy consumption and helping reduce utility bills while supporting sustainable living. With demand-side management and energy-saving programs gaining ground, the residential application segment remains at the forefront of growth.

The advanced metering infrastructure (AMI) held an 82.2% share in 2024, driven by its wide functionality. AMI enables real-time, bidirectional data communication between utility companies and end users, making it essential for energy optimization and grid reliability. Through features such as remote meter reading, dynamic pricing, load balancing, and quick fault detection, AMI allows energy providers to respond proactively to changes in demand. These systems also integrate easily with smart homes and consumer-level energy dashboards, boosting transparency and encouraging efficient energy behaviors.

U.S. Smart Meter Market will reach USD 8 billion by 2034, with contributions coming from industrial and residential upgrades. The country is strengthening its grid infrastructure to handle growing energy demands and a higher share of variable renewable sources. Regulatory actions are pushing for advanced monitoring and management tools, positioning smart meters as critical infrastructure. Additionally, smart meters are seeing adoption in energy-intensive sectors, adding further value to operational efficiency, compliance, and supply reliability.

Prominent players leading the Global Smart Meter Market include Siemens, Schneider Electric, Itron, Honeywell International, and Landis + Gyr. Major companies in the smart meter industry are enhancing their market positioning through a mix of innovation, strategic alliances, and regional expansion. Investments in R&D continue to play a key role, with companies focusing on developing next-generation meters that integrate AI, IoT, and cloud-based analytics. Leading firms are also forming partnerships with utility providers and governments to win long-term deployment contracts. To meet growing demand, businesses are expanding production capabilities and localizing manufacturing in strategic regions. Furthermore, they are strengthening their service offerings by including software platforms that provide energy insights, remote diagnostics, and predictive maintenance to enhance customer value and operational reliability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Import/Export trade analysis

- 3.4 Price trend analysis, by region (USD/Unit)

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 Residential

- 5.3 Commercial

- 5.4 Utility

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 AMI

- 6.3 AMR

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Smart gas

- 7.3 Smart water

- 7.4 Smart electric

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 South Africa

- 8.5.4 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 Apator SA

- 9.2 ABB

- 9.3 AEM

- 9.4 Aclara Technologies LLC

- 9.5 ARAD Group

- 9.6 B Meters Metering Solutions

- 9.7 Badger Meter, Inc.

- 9.8 Chint Group

- 9.9 General Electric

- 9.10 Honeywell International, Inc.

- 9.11 Itron, Inc.

- 9.12 Iskraemeco Group

- 9.13 Kamstrup

- 9.14 Larsen & Toubro Limited

- 9.15 Landis + Gyr

- 9.16 Ningbo Water Meter Co., Ltd.

- 9.17 Osaki Electric Co., Ltd.

- 9.18 Raychem RPG Private Limited

- 9.19 Schneider Electric SE

- 9.20 Siemens

- 9.21 Sensus

- 9.22 Sontex SA

- 9.23 Wasion Group