|

市场调查报告书

商品编码

1801895

超疏水涂层(莲花效应)市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Superhydrophobic Coatings (Lotus Effect) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球超疏水涂料市场规模达8,010万美元,预计到2034年将以22.9%的复合年增长率成长,达到6.048亿美元。由于各终端用户对高防水、自清洁和防腐表面的需求不断增长,市场成长正在加速。汽车、电子、建筑和航太等行业是领先的应用者,他们采用这些涂料来提高性能并减少维护。对永续解决方案的日益追求以及更严格的监管——尤其是在氟化学领域——正在推动整个产业的创新。

製造商如今专注于替代化学品,包括有机硅化合物、天然聚合物和其他无毒生物基原料,这些原料符合更严格的环境和安全标准。这些压力非但没有阻碍产业进步,反而激发了对智慧财产权开发、协作创新试点以及下一代涂料系统商业化的新投资,使这些涂料在各个产业和地区更容易获得。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8010万美元 |

| 预测值 | 6.048亿美元 |

| 复合年增长率 | 22.9% |

受可生物降解和无毒特性的驱动,生物基和自然基涂料材料领域在2024年将占据6%的市场份额。配方师正在利用多醣、木质素和角质模拟物等农业副产品,创造更安全、可再生的涂料解决方案。这些发展正在改变防水涂料在从纺织品、包装到电子产品和建筑材料等各种领域的应用方式。这种转变在安全和环保要求严格的行业中尤其明显,因为这些涂料无需依赖含氟化学品即可提供优异的性能。新兴市场正在利用丰富的农业废弃物来建构循环供应链,从而加快商业化进程并扩大本地产能。

汽车和运输领域在2024年的市占率为23.8%。这些涂层广泛应用于喷漆面板、挡风玻璃和感测器外壳等部件,以减少清洁频率并提高可视性。它们的整合也支援了车辆外观低维护和增强耐用性的趋势。

2024年,亚太地区超疏水涂层(莲花效应)市场占有38%的份额。中国和日本引领区域需求,尤其是在电子、能源和运输领域,而印度和东南亚正迅速崛起,成为成长中心。基础设施建设和永续发展计画的政策支援正在催化对先进表面涂层技术的新需求。

超疏水涂层(莲花效应)市场的主要公司包括NEI Corporation、UltraTech International Inc.、BASF SE和3M Company。在超疏水涂层领域营运的公司优先考虑永续创新,以应对日益严格的全球法规和不断变化的客户偏好。各公司正在扩大研发投入,以开发生物基和非氟配方,在保持高性能的同时降低环境风险。与研究机构和产业伙伴的合作,使得符合生态标准的技术能够更快地进行测试和商业化。为了有效扩大规模,许多参与者正在利用许可模式以及与汽车、电子和包装行业的原始设备製造商建立策略联盟。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- 二氧化硅基超疏水涂层

- 含氟聚合物基涂料

- PDMS 和硅基涂层

- 碳奈米管和石墨烯基涂层

- 仿生和植物性涂料

第六章:市场估计与预测:依工艺,2021-2034

- 主要趋势

- 喷涂方法

- 浸涂工艺

- 溶胶-凝胶工艺

- 电沉积方法

- 化学气相沉积(CVD)

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 汽车和运输

- 航太和国防

- 海洋和近海

- 建筑与建筑

- 纺织品和服装

- 电子和电信

- 医疗保健

- 其他的

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- PPG Industries Inc.

- BASF SE

- 3M Company

- DuPont de Nemours Inc.

- AkzoNobel NV

- The Sherwin-Williams Company

- Hempel A/S

- Jotun A/S

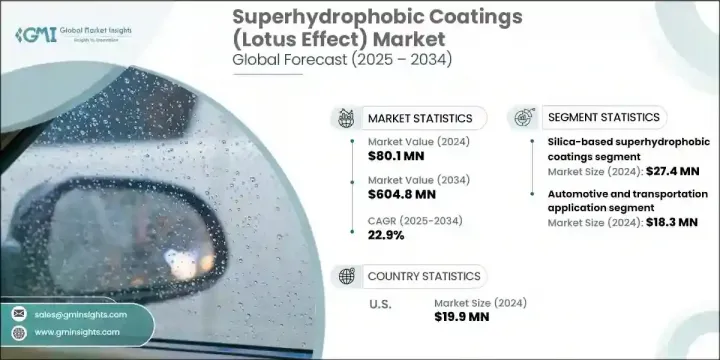

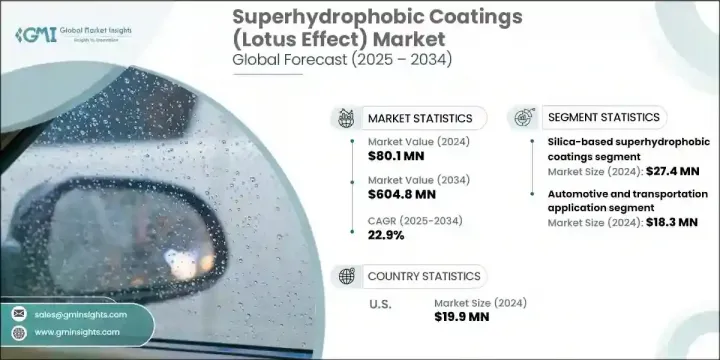

The Global Superhydrophobic Coatings Market was valued at USD 80.1 million in 2024 and is estimated to grow at a CAGR of 22.9% to reach USD 604.8 million by 2034. Market growth is accelerating due to rising demand from various end-use sectors seeking highly water-repellent, self-cleaning, and anti-corrosive surfaces. Industries such as automotive, electronics, construction, and aerospace are leading adopters, turning to these coatings for performance enhancement and reduced maintenance. The increasing push for sustainable solutions and tougher regulatory oversight-especially around fluorochemicals-is driving innovation across the board.

Manufacturers are now focused on alternative chemistries, including silicone-based compounds, natural polymers, and other non-toxic bio-based feedstocks, which align with stricter environmental and safety standards. Rather than stalling industry progress, these pressures are sparking new investments in IP development, collaborative innovation pilots, and the commercialization of next-generation coating systems, making these coatings more accessible across industries and regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $80.1 Million |

| Forecast Value | $604.8 Million |

| CAGR | 22.9% |

The bio-based and nature-inspired coating materials segment held 6% share in 2024 driven by biodegradable and non-toxic attributes. Formulators are leveraging agricultural byproducts like polysaccharides, lignin, and cutin mimics to create safer, renewable coating solutions. These developments are transforming how water-repellent finishes are applied to everything from textiles and packaging to electronics and construction materials. The shift is particularly prominent in sectors with strict safety and environmental mandates, as these coatings offer performance without reliance on fluorinated chemicals. Emerging markets are leveraging abundant agricultural waste to build circular supply chains, leading to faster commercialization and expanded local production capacity.

The automotive and transportation segment held 23.8% share in 2024. These coatings are used extensively on components like painted panels, windshields, and sensor enclosures to reduce cleaning frequency and improve visibility. Their integration also supports the trend toward low-maintenance vehicle exteriors and enhanced durability.

Asia Pacific Superhydrophobic Coatings (Lotus Effect) Market held 38% share in 2024. While China and Japan lead regional demand-particularly from electronics, energy, and transport sectors-India and Southeast Asia are rising rapidly as growth hubs. Infrastructure development and policy support for sustainability initiatives are catalyzing new demand for advanced surface coating technologies.

Major companies in the Superhydrophobic Coatings (Lotus Effect) Market include NEI Corporation, UltraTech International Inc., BASF SE, and 3M Company. Companies operating in the superhydrophobic coatings space are prioritizing sustainable innovation to align with tightening global regulations and shifting customer preferences. Firms are expanding their R&D investments to develop bio-based and non-fluorinated formulations that maintain high performance while reducing environmental risks. Collaborations with research institutions and industry partners are enabling faster testing and commercialization of eco-compliant technologies. To scale efficiently, many players are leveraging licensing models and strategic alliances with OEMs across automotive, electronics, and packaging sectors.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Process

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Silica-based superhydrophobic coatings

- 5.3 Fluoropolymer-based coatings

- 5.4 PDMS and silicone-based coatings

- 5.5 Carbon nanotube and graphene-based coatings

- 5.6 Bio-inspired and plant-based coatings

Chapter 6 Market Estimates & Forecast, By Process, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Spray coating methods

- 6.3 Dip coating processes

- 6.4 Sol-gel processing

- 6.5 Electrodeposition methods

- 6.6 Chemical vapor deposition (CVD)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive and transportation

- 7.3 Aerospace and defense

- 7.4 Marine and offshore

- 7.5 Construction and architecture

- 7.6 Textiles and apparel

- 7.7 Electronics and telecommunications

- 7.8 Medical and healthcare

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 PPG Industries Inc.

- 9.2 BASF SE

- 9.3 3M Company

- 9.4 DuPont de Nemours Inc.

- 9.5 AkzoNobel N.V.

- 9.6 The Sherwin-Williams Company

- 9.7 Hempel A/S

- 9.8 Jotun A/S