|

市场调查报告书

商品编码

1801898

HIV 诊断市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测HIV Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

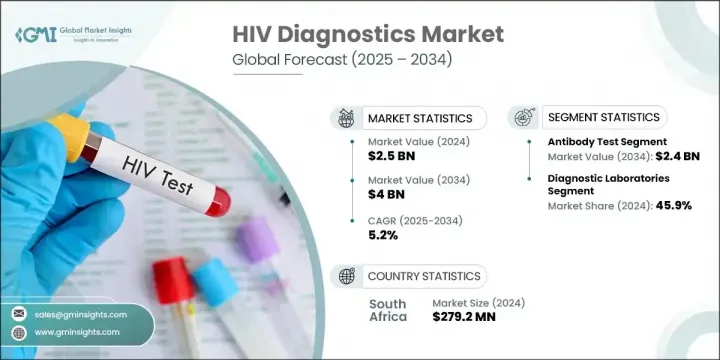

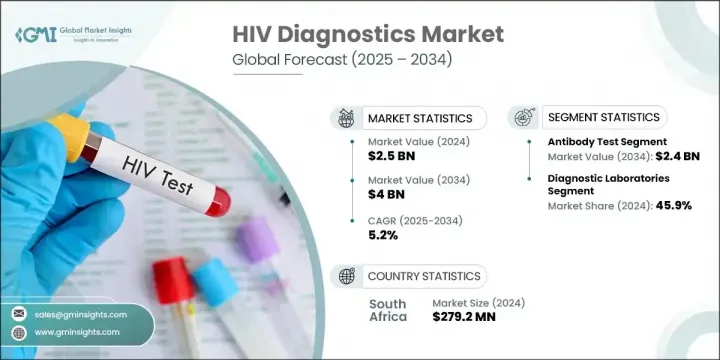

2024年,全球爱滋病毒诊断市场规模达25亿美元,预估年复合成长率将达5.2%,2034年将达40亿美元。这一成长趋势得益于中低收入地区爱滋病毒感染率的上升,以及对更可靠、更便利的诊断方法的需求。随着全球爱滋病毒检测意识的提升,公共和私人医疗体係都在越来越多地采用先进的检测解决方案。即时诊断因其快速、便捷且适用于基础设施匮乏的地区,正日益受到青睐。

用于识别爱滋病毒感染的诊断技术在早期介入、患者监测和确定合适的治疗方案方面发挥核心作用。全球各种卫生工作和资助计画持续推动对便利的爱滋病毒检测解决方案的需求。随着医疗保健可近性和健康素养的提高,爱滋病毒检测试剂盒的采用率持续上升,尤其是在医疗资源匮乏的社区。技术创新以及更快速、更经济的检测解决方案进一步支持了其在公共卫生计划和临床环境中的广泛应用。政策支持、公众意识的提升以及诊断技术的快速进步,这些因素共同重塑了全球爱滋病毒诊断格局。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 40亿美元 |

| 复合年增长率 | 5.2% |

抗体检测细分市场在2024年引领市场,并凭藉其成本效益、简单易行和快速出结果的优势占据最大份额。抗体检测在自测试剂盒中的日益普及也促进了其广泛应用,尤其是在资源匮乏的地区。这些检测是大规模筛检的理想选择,因为它们易于取得且易于操作,无需复杂的医疗环境。随着越来越多的人选择注重隐私的自测方法,抗体检测的重要性日益提升,尤其是在那些有医疗污名或就诊管道受限等问题的地区。

2024年,诊断实验室市场占有45.9%的份额。这些设施仍然是HIV检测的首选,因为它们能够有效地管理大量检测。随着HIV感染率的上升,对准确、高通量检测的需求也不断增加。实验室利用先进的仪器和自动化系统来提供可靠的结果,这使得它们对于支援公共卫生计画和大规模检测活动至关重要。

2024年,中东和非洲爱滋病毒诊断市场占据30.1%的市场。该地区不断上升的感染率持续刺激着对更有效、更便利的诊断工具的需求。随着人们的意识和资源投入到控制爱滋病毒传播方面,对可扩展且精准的检测解决方案的需求将继续推动市场发展。

HIV 诊断市场的领先公司包括 Bioneer、Hologic、Genlantis Diagnostics、Qiagen、ChemBio Diagnostics、OraSure Technologies、Becton, Dickinson and Company (BD)、F. Hoffmann-La Roche、Abbott Laboratories、Biomerieux 和 Cepheid。 HIV 诊断领域的主要参与者正在透过扩展检测组合、增强即时诊断平台以及投资研发来巩固其市场地位。许多公司正在推出下一代诊断试剂盒,这些试剂盒注重速度、便携性和准确性,专为分散的医疗保健环境量身定制。

与医疗机构、非政府组织和政府的合作有助于企业获得大规模供应合同,而透过本地合作伙伴关係进行区域扩张则能增强分销能力。为了保持竞争力,一些公司正在将数位工具与检测试剂盒集成,以实现即时资料追踪和远端监控。其他公司则专注于监管部门的审批和认证,以加速进入服务匮乏、爱滋病毒感染率不断上升的地区市场。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 中低收入国家爱滋病/爱滋病毒感染率上升

- 政府加大爱滋病毒宣导力度

- HIV即时诊断技术的发展

- 美国有利的监管环境

- 产业陷阱与挑战

- 欠发达市场渗透率低

- 社会耻辱和歧视

- 市场机会

- 持续的技术进步

- 与数位健康平台整合

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术进步

- 2024年定价分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 战略仪表板

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按测试类型,2021 - 2034 年

- 主要趋势

- 抗体检测

- 病毒量测试

- CD4侦测

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 诊断实验室

- 医院和诊所

- 家庭设定

- 其他最终用途

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- Biomerieux

- Bioneer

- Cepheid

- ChemBio Diagnostics

- F. Hoffmann-La Roche

- Genlantis Diagnostics

- Hologic

- OraSure Technologies

- Qiagen

The Global HIV Diagnostics Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 4 billion by 2034. This upward trend is supported by rising HIV incidence in lower- and middle-income regions, combined with the demand for more reliable and accessible diagnostic methods. As awareness surrounding HIV testing grows through global campaigns, both public and private healthcare systems are increasingly adopting advanced testing solutions. Point-of-care diagnostics are gaining momentum due to their speed, convenience, and suitability in regions with limited infrastructure.

Diagnostic technologies used to identify HIV infections play a central role in early intervention, patient monitoring, and determining suitable treatment paths. Various global health efforts and funding initiatives continue to create demand for accessible HIV testing solutions. As access to healthcare and health literacy improve, the adoption of HIV testing kits, especially in underserved communities, continues to rise. Technological innovation and faster, cost-efficient testing solutions are further supporting widespread adoption across both public health initiatives and clinical settings. The combination of policy support, increasing public awareness, and rapid diagnostic advancements continues to reshape the HIV diagnostics landscape globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4 Billion |

| CAGR | 5.2% |

The antibody tests segment led the market in 2024 and held the largest share due to their cost-effectiveness, simplicity, and ability to deliver quick results. Their growing use in self-testing kits has also contributed to widespread adoption, particularly in low-resource environments. These tests are ideal for mass screening as they are both accessible and easy to administer without requiring complex medical settings. Their relevance continues to grow as more individuals opt for privacy-driven self-testing methods, especially in regions where healthcare stigma or limited access to clinics is a concern.

The diagnostic laboratories segment held 45.9% share in 2024. These facilities remain the preferred choice for HIV testing because they are equipped to manage a large volume of tests efficiently. With growing HIV prevalence, the need for accurate and high-throughput testing is expanding. Laboratories utilize sophisticated instruments and automated systems to deliver reliable results, making them essential for supporting public health programs and large-scale testing campaigns.

Middle East and Africa HIV Diagnostics Market held 30.1% share in 2024. Rising infection rates in this region continue to fuel demand for more effective and accessible diagnostic tools. As more awareness and resources are directed toward managing the spread of HIV, the need for scalable and accurate testing solutions continues to drive the market forward.

Leading companies in the HIV Diagnostics Market include Bioneer, Hologic, Genlantis Diagnostics, Qiagen, ChemBio Diagnostics, OraSure Technologies, Becton, Dickinson and Company (BD), F. Hoffmann-La Roche, Abbott Laboratories, Biomerieux, and Cepheid. Major players in the HIV diagnostics sector are reinforcing their market presence by expanding testing portfolios, enhancing point-of-care platforms, and investing in R&D. Many are launching next-generation diagnostic kits that prioritize speed, portability, and accuracy, tailored for decentralized healthcare settings.

Collaborations with healthcare agencies, NGOs, and governments help companies secure large-scale supply contracts, while regional expansion through local partnerships strengthens distribution. To remain competitive, several firms are integrating digital tools with testing kits, enabling real-time data tracking and remote monitoring. Others focus on regulatory approvals and certifications to accelerate market entry in underserved regions with rising HIV incidence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Test type

- 2.2.3 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising AIDS/HIV prevalence in low and middle-income countries

- 3.2.1.2 Increasing government initiatives for HIV awareness

- 3.2.1.3 Point-of-care (POC) HIV diagnostics development

- 3.2.1.4 Favorable regulatory landscape in the U.S.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Low degree of penetration in underdeveloped market

- 3.2.2.2 Social stigma and discrimination

- 3.2.3 Market opportunities

- 3.2.3.1 Ongoing technology advancement

- 3.2.3.2 Integration with digital health platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technological advancements

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

- 4.7 Strategic dashboard

- 4.8 Key developments

- 4.8.1 Mergers and acquisitions

- 4.8.2 Partnerships and collaborations

- 4.8.3 New product launches

- 4.8.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antibody test

- 5.3 Viral load test

- 5.4 CD4 test

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostic laboratories

- 6.3 Hospitals and clinics

- 6.4 Home settings

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 Becton, Dickinson and Company (BD)

- 8.3 Biomerieux

- 8.4 Bioneer

- 8.5 Cepheid

- 8.6 ChemBio Diagnostics

- 8.7 F. Hoffmann-La Roche

- 8.8 Genlantis Diagnostics

- 8.9 Hologic

- 8.10 OraSure Technologies

- 8.11 Qiagen