|

市场调查报告书

商品编码

1801903

携带式 X 光设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Portable X-ray Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

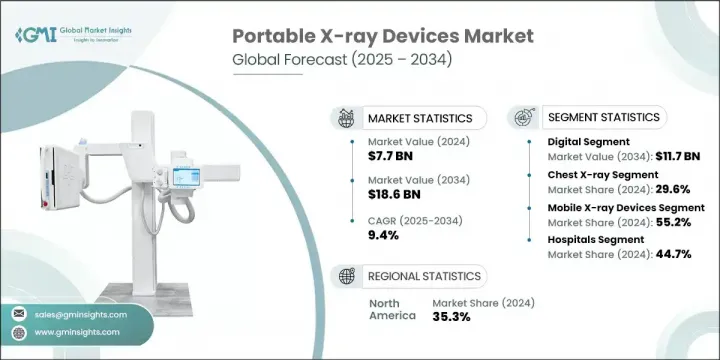

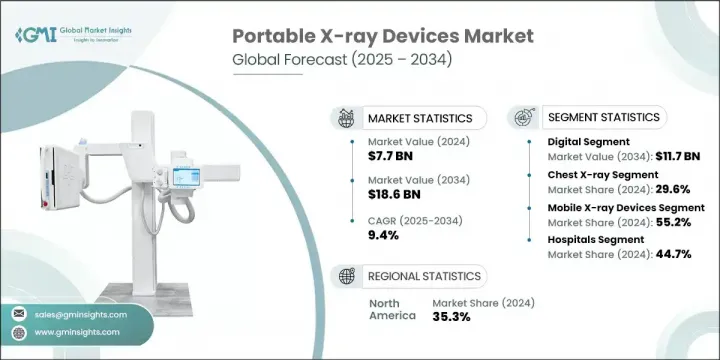

2024年,全球便携式X射线设备市场规模达77亿美元,预计到2034年将以9.4%的复合年增长率成长,达到186亿美元。市场持续成长的动力源自于慢性病负担的加重以及人们对即时诊断的日益青睐。随着早期便捷的影像学检查对健康状况管理至关重要,便携式X射线设备的需求持续成长。另一个关键驱动因素是老年人口的成长,他们更容易需要定期进行影像学检查。人工智慧增强成像、云端整合和无线资料传输等技术进步也有助于简化诊断流程,同时提高准确性和效率,使便携式X光设备成为多种医疗环境中的首选解决方案。

便携式X射线设备专为移动性和高效性而设计,如今已成为常规诊断中的重要工具,尤其是在无法进行院内成像的情况下。这些系统因其易于使用、快速设置以及与现有数位基础设施的兼容性,在急诊室、家庭护理环境和现场应用中的应用日益广泛。这些设备透过无线功能提供即时成像,不仅提高了速度,还减少了不必要的患者移动,从而提高了护理和工作流程的效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 77亿美元 |

| 预测值 | 186亿美元 |

| 复合年增长率 | 9.4% |

数位系统领域在2024年创造了48亿美元的市场规模,预计到2034年将达到117亿美元,复合年增长率为9.6%。数位便携式X光设备凭藉其快速的成像速度、高解析度输出以及与医院内IT生态系统互联互通的能力占据主导地位。这些系统支援人工智慧整合、即时检视和精简的云端共享功能,这些功能对于重症监护、远距放射学和远端诊断尤其重要。其更低的辐射输出和更高的清晰度是其在各个临床领域日益受到青睐的主要原因。

2024年,行动X射线系统的市占率达到55.2%。这一高份额源于其在住院病房、重症监护病房以及需要床边成像的医疗机构中的广泛应用。行动系统减少了转运患者的需要,并配备了增强型数位成像技术和无线连接,使其成为创伤护理、感染控制区和慢性病管理中不可或缺的一部分。移动系统能够适应各种临床需求,并能够在床边进行成像,这将继续推动该领域的成长。

2024年,北美便携式X光设备市场占据35.3%的市场。这一优势得益于该地区先进的医疗基础设施、早期的技术应用以及对远端诊断和自动化工作流程解决方案日益增长的需求。高发病率以及专业人士对数位医学影像日益增长的需求,持续推动便携式解决方案的普及。强而有力的公共卫生倡议,加上私部门的快速创新,共同支撑着这一强劲的成长前景。

全球便携式X光设备市场的主要参与者包括佳能医疗系统、通用电气医疗、飞利浦、西门子医疗和富士胶片。便携式X射线设备市场的公司正大力投入研发,将人工智慧、边缘运算和云端连接等先进技术融入其係统。他们正在扩展产品组合,包括专为紧急情况和远端使用而设计的轻型电池供电型号。与医疗机构和IT提供者的策略联盟使成像解决方案能够更顺畅地整合到医院基础设施中。此外,该公司正在利用数位平台进行即时诊断和远端咨询,从而提升服务价值。对培训项目和服务网络的投资有助于增强客户保留率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- X射线设备的技术进步

- 全球慢性病盛行率不断上升

- 诊断成像程序的数量不断增加

- 老年人口不断增加

- 产业陷阱与挑战

- 严格的监管情景

- 辐射暴露风险高

- 市场机会

- 人工智慧成像和智慧集成

- 政府筛选和健康计划

- 成长动力

- 成长潜力分析

- 监管格局

- 技术进步

- 当前的技术趋势

- 新兴技术

- 供应链分析

- 报销场景

- 2024年定价分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 数位X射线

- 模拟X射线

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 牙科X光

- 乳房X光检查

- 胸部X光检查

- 心血管

- 骨科

- 其他应用

第七章:市场估计与预测:按方式,2021 - 2034 年

- 主要趋势

- 行动X射线设备

- 手持式X射线设备

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 诊断中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- GE Healthcare

- Siemens Healthineers

- Canon Medical Systems

- Philips

- Shimadzu

- MinXray

- Hitachi Medical

- Hologic

- Carestream Health

- Samsung Electronics

- Ziehm Imaging

- Fujifilm

- Agfa HealthCare

- DRGEM

- OR Technology

The Global Portable X-ray Devices Market was valued at USD 7.7 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 18.6 billion by 2034. The market's consistent growth is attributed to the rising burden of chronic illnesses and the increasing preference for point-of-care diagnostics. As early and accessible imaging becomes essential for managing health conditions, demand continues to grow. Another key driver is the expanding elderly population, which is more prone to requiring regular imaging procedures. Technological advancements such as AI-enhanced imaging, cloud integration, and wireless data transfer are also helping streamline diagnostics while improving accuracy and efficiency, making portable X-ray devices a go-to solution across multiple healthcare settings.

Portable X-ray units, designed for mobility and efficiency, are now vital tools in diagnostic routines, especially where in-hospital imaging is impractical. These systems are increasingly used in emergency departments, home-care environments, and field applications due to their ease of use, quick setup, and compatibility with existing digital infrastructure. By offering real-time imaging with wireless capabilities, these devices not only enhance speed but also reduce unnecessary patient movement, improving both care and workflow efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $18.6 Billion |

| CAGR | 9.4% |

The digital systems segment generated USD 4.8 billion in 2024 and is projected to reach USD 11.7 billion by 2034 at a CAGR of 9.6%. Digital portable X-ray units dominate due to their rapid imaging speed, high-resolution outputs, and ability to link with IT ecosystems within hospitals. These systems support AI integration, real-time viewing, and streamlined cloud-based sharing-features that are particularly important for critical care, tele-radiology, and remote diagnostics. Their reduced radiation output and improved clarity are major contributors to their growing preference across various clinical domains.

The mobile X-ray systems held a 55.2% share in 2024. This high share results from their widespread use in inpatient wards, intensive care units, and healthcare facilities requiring bedside imaging. Mobile systems reduce the need to transport patients and come equipped with enhanced digital imaging technology and wireless connectivity, making them essential for trauma care, infection control zones, and chronic disease management. Their adaptability to varied clinical needs and ability to perform imaging at the point of care continue to drive growth in this segment.

North America Portable X-ray Devices Market held a 35.3% share in 2024. This dominance can be credited to the region's advanced healthcare infrastructure, early technology adoption, and growing demand for remote diagnostics and automated workflow solutions. High disease prevalence, along with the increasing demand for digital medical imaging among professionals, continues to fuel the uptake of portable solutions. Strong public health initiatives, combined with rapid private sector innovation, are supporting this robust growth outlook.

Key players involved in the Global Portable X-ray Devices Market include Canon Medical Systems, GE Healthcare, Philips, Siemens Healthineers, and Fujifilm. Companies in the portable X-ray devices market are focusing heavily on R&D to incorporate advanced technologies like AI, edge computing, and cloud connectivity into their systems. They are expanding their portfolios to include lightweight, battery-operated models tailored for emergency and remote use. Strategic alliances with healthcare institutions and IT providers are enabling smoother integration of imaging solutions into hospital infrastructures. Additionally, firms are leveraging digital platforms for real-time diagnostics and remote consultations, enhancing service value. Investments in training programs and service networks are helping strengthen customer retention.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Modality trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancement in x-ray devices

- 3.2.1.2 Rising prevalence of chronic diseases worldwide

- 3.2.1.3 Growing number of diagnostic imaging procedures

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High risk of radiation exposure

- 3.2.3 Market opportunities

- 3.2.3.1 AI-powered imaging and smart integration

- 3.2.3.2 Government screening and health programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Digital X-ray

- 5.3 Analog X-ray

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dental X-ray

- 6.3 Mammography

- 6.4 Chest X-ray

- 6.5 Cardiovascular

- 6.6 Orthopedics

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Mobile X-ray devices

- 7.3 Handheld X-ray devices

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 GE Healthcare

- 10.2 Siemens Healthineers

- 10.3 Canon Medical Systems

- 10.4 Philips

- 10.5 Shimadzu

- 10.6 MinXray

- 10.7 Hitachi Medical

- 10.8 Hologic

- 10.9 Carestream Health

- 10.10 Samsung Electronics

- 10.11 Ziehm Imaging

- 10.12 Fujifilm

- 10.13 Agfa HealthCare

- 10.14 DRGEM

- 10.15 OR Technology