|

市场调查报告书

商品编码

1801904

旋风分离器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cyclone Separator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

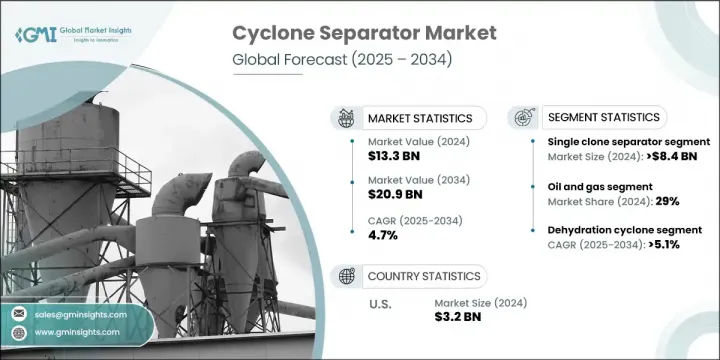

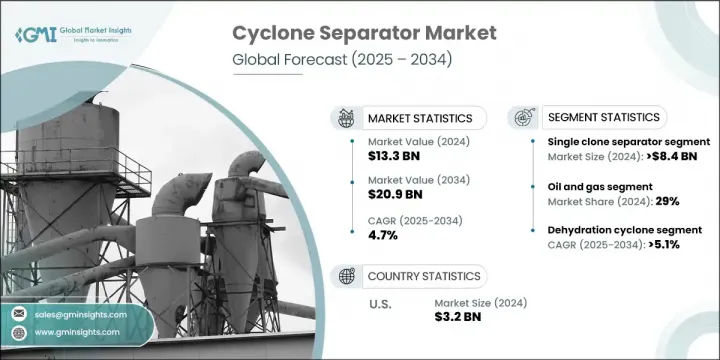

2024年,全球旋风分离器市场规模达133亿美元,预计到2034年将以4.7%的复合年增长率成长,达到209亿美元。随着清洁能源解决方案的日益普及以及全球环境法规的日益严格,该市场的发展势头强劲。随着对生物质、太阳能和其他替代能源的需求不断增长,对高性能空气过滤系统的需求也随之增长,以减少排放并保护设备。旋风分离器因其高效处理颗粒物、支援多个产业永续发展目标而成为至关重要的解决方案。

多级过滤、CFD优化设计和混合系统等技术进步显着提高了性能和能源效率。它们的作用正在迅速演变,尤其是在化学、电子和製药等精密密集型行业。在亚太地区,由于排放法规日益严格,正在经历快速工业化的国家正在推动需求成长。为了应对日益增长的基础设施和製造业活动,旋风分离器正被广泛采用。在当今竞争激烈的环境中,产品客製化和材料耐用性等特性对于买家的决策至关重要,尤其是在各行各业都优先考虑长期可靠性和低维护成本的情况下。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 133亿美元 |

| 预测值 | 209亿美元 |

| 复合年增长率 | 4.7% |

单旋风分离器市场规模在2024年达到84亿美元,预计2034年将以4.6%的复合年增长率成长。其广泛应用归因于较低的前期成本、简单的机械结构和极低的维护要求。由于没有活动部件,这些系统在需要持续正常运作和预算控制的环境中提供了一种经济高效的解决方案,因此在註重运作可靠性的重工业中尤其具有吸引力。

2024年,石油和天然气产业占据29%的市场份额,预计2025年至2034年期间的复合年增长率将达到5.2%。旋风分离器在整个价值链中都至关重要——从需要除砂和液气分离设备的上游作业,到涉及天然气加工、精炼和管道维护的下游应用。这些分离器在降低颗粒物负荷、保护高价值机械设备以及确保高压、大流量环境下不间断的运作方面发挥着至关重要的作用。

美国旋风分离器市场占79%的市场份额,2024年市场规模达32亿美元。这一增长主要得益于严格的环境政策,这些政策要求采用先进的空气品质管理解决方案。相关法规要求各行业部署高效率的颗粒物去除技术。旋风分离器通常用作预过滤工具,可有效减轻最终过滤系统的负担,确保合规性,并优化整体运作效率。

积极影响旋风分离器市场的关键参与者包括 Mikropor、Sulzer、FLSmidth、Gulf Coast Air & Hydraulics、Cyclone Engineering Projects、Multotec、The Weir Group、KREBS、Exterran Corporation、Air Dynamics、Cyclotech、Haiwang Hydrocyclone、Mahleparator, Seirginal Solutions。旋风分离器市场的领先製造商正专注于策略性产品创新和区域扩张,以增强其竞争地位。公司越来越多地整合 CFD 等先进模拟工具来优化分离器设计,从而提高效率并降低能耗。产品多样化也不断成长,以服务製药、电子和清洁能源等高精度产业。参与者正在与工业客户建立合作伙伴关係,以提供符合严格排放和营运标准的客製化解决方案。许多公司正在扩大其全球製造和分销网络,以服务新兴市场,尤其是亚太地区。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 轴流

- 逆流

第六章:市场估计与预测:按克隆类型,2021 - 2034 年

- 主要趋势

- 单克隆分离器

- 多克隆分离器

第七章:市场估计与预测:依产能,2021 - 2034 年

- 主要趋势

- 高达 2000 公斤/小时

- 2000公斤/小时 - 3000公斤/小时

- 3000公斤/小时以上

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 脱水旋风器

- 脱泥旋流器

- 除渣旋风器

- 其他(浓缩旋风器、旋风器组等)

第九章:市场估计与预测:依最终用途产业,2021 - 2034 年

- 主要趋势

- 石油和天然气

- 化学

- 采矿和矿物加工

- 发电

- 食品和饮料

- 其他(纸浆及造纸、纺织、製药等)

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Air Dynamics

- Cyclone Engineering Projects

- Cyclone Separator Australia

- Cyclotech

- Elgin Separation Solutions

- Exterran Corporation

- FLSmidth

- Gulf Coast Air & Hydraulics

- Haiwang Hydrocyclone

- KREBS

- Mahle Industrial Filtration

- Mikropor

- Multotec

- Sulzer

- The Weir Group

The Global Cyclone Separator Market was valued at USD 13.3 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 20.9 billion by 2034. The market is gaining traction due to the increasing push toward clean energy solutions and stringent global environmental regulations. As the demand for biomass, solar, and other alternative energy sources increases, so does the requirement for high-performance air filtration systems to reduce emissions and protect equipment. Cyclone separators have emerged as vital solutions due to their efficiency in handling particulates, supporting sustainability goals across multiple industries.

Technological advancements such as multi-stage filtration, CFD-optimized designs, and hybrid systems have significantly improved performance and energy efficiency. Their role is rapidly evolving, especially in precision-intensive sectors like chemicals, electronics, and pharmaceuticals. In the Asia-Pacific region, countries experiencing fast industrialization are driving demand due to tighter emission regulations. Cyclone separators are being widely adopted in response to growing infrastructure and manufacturing activity. In today's competitive landscape, features such as product customization and material durability are becoming critical for buyer decision-making, especially as industries prioritize long-term reliability and low maintenance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.3 Billion |

| Forecast Value | $20.9 Billion |

| CAGR | 4.7% |

Single cyclone separators reached USD 8.4 billion in 2024 and is anticipated to grow at a CAGR of 4.6% through 2034. Their widespread adoption is attributed to low upfront costs, simple mechanical structure, and minimal maintenance requirements. With no moving parts, these systems offer a cost-efficient solution in environments where continuous uptime and budget control are essential, making them especially appealing in heavy industries seeking operational reliability.

The oil & gas sector held a 29% share in 2024 and is set to grow at a CAGR of 5.2% between 2025 and 2034. Cyclone separators are critical throughout the entire value chain-from upstream operations requiring devices for desanding and liquid-gas separation to downstream applications involving gas processing, refining, and pipeline maintenance. These separators play a crucial role in reducing particulate load, safeguarding high-value machinery, and ensuring uninterrupted operations in high-pressure, high-volume environments.

United States Cyclone Separator Market held a 79% share generating USD 3.2 billion in 2024. This growth is fueled by strict environmental policies requiring advanced air quality management solutions. Regulations compel industries to deploy efficient particulate removal technologies. Cyclone separators are commonly used as pre-filtration tools, effectively decreasing the burden on final filtration systems, ensuring regulatory compliance, and optimizing overall operational efficiency.

Key players actively shaping the Cyclone Separator Market include Mikropor, Sulzer, FLSmidth, Gulf Coast Air & Hydraulics, Cyclone Engineering Projects, Multotec, The Weir Group, KREBS, Exterran Corporation, Air Dynamics, Cyclotech, Haiwang Hydrocyclone, Mahle Industrial Filtration, Elgin Separation Solutions, and Cyclone Separator Australia. Leading manufacturers in the cyclone separator market are focusing on strategic product innovation and regional expansion to strengthen their competitive positions. Companies are increasingly integrating advanced simulation tools like CFD to optimize separator designs for greater efficiency and lower energy consumption. Product diversification to serve high-precision industries such as pharmaceuticals, electronics, and clean energy is also on the rise. Players are forming partnerships with industrial clients to deliver tailored solutions that meet strict emission and operational standards. Many firms are expanding their global manufacturing and distribution networks to serve emerging markets, especially in Asia-Pacific.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By type

- 2.2.3 By clone type

- 2.2.4 By capacity

- 2.2.5 By application

- 2.2.6 By end use industry

- 2.2.7 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Axial flow

- 5.3 Reverse flow

Chapter 6 Market Estimates & Forecast, By Clone type, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Single clone separator

- 6.3 Multi-clone separator

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Up to 2000 kg/hr

- 7.3 2000 kg/hr. - 3000 kg/hr

- 7.4 Above 3000 kg/hr

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Dehydration cyclone

- 8.3 Desliming cyclone

- 8.4 Slag removal cyclones

- 8.5 Others (concentration cyclone, cyclone group etc.)

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Oil and gas

- 9.3 Chemical

- 9.4 Mining and mineral processing

- 9.5 Power generation

- 9.6 Food and beverages

- 9.7 Others (pulp & paper, textiles, pharmaceutical etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Air Dynamics

- 12.2 Cyclone Engineering Projects

- 12.3 Cyclone Separator Australia

- 12.4 Cyclotech

- 12.5 Elgin Separation Solutions

- 12.6 Exterran Corporation

- 12.7 FLSmidth

- 12.8 Gulf Coast Air & Hydraulics

- 12.9 Haiwang Hydrocyclone

- 12.10 KREBS

- 12.11 Mahle Industrial Filtration

- 12.12 Mikropor

- 12.13 Multotec

- 12.14 Sulzer

- 12.15 The Weir Group