|

市场调查报告书

商品编码

1801909

胰臟癌诊断市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pancreatic Cancer Diagnostic Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

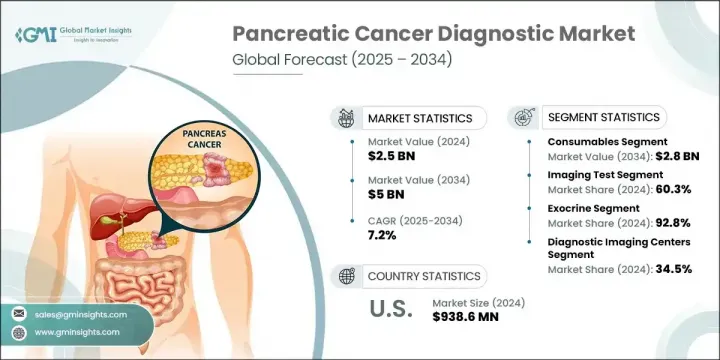

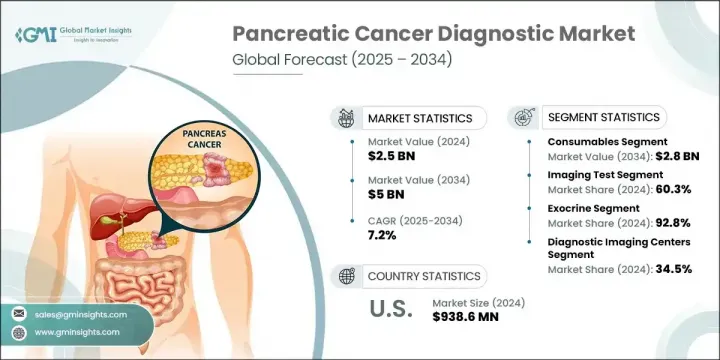

2024年,全球胰臟癌诊断市场规模达25亿美元,预计到2034年将以7.2%的复合年增长率成长,达到50亿美元。这一增长主要得益于全球胰腺癌发病率的上升、医疗基础设施投资的不断增加以及诊断技术的持续进步。随着人们对早期检测认识的提高,以及医疗保健系统对更快诊断和更佳疗效的重视,先进诊断工具的采用也随之加速。这些工具——从分子诊断到高解析度成像和基于生物标记的检测——在癌症的早期发现中发挥关键作用,尤其是在治疗效果最佳的无症状阶段。

各种创新技术持续重塑诊断格局,人工智慧整合成像、分子分析和液体活检技术提升了诊断的准确性、效率和安全性。此外,个人化医疗和以患者为中心的护理的推动也凸显了早期诊断的重要性。在工作流程效率提升和微创手术的支持下,临床应用的扩展已使胰臟癌诊断成为现代肿瘤学实践中不可或缺的一部分。人们日益增长的认知度,加上对及时精准诊断日益增长的需求,正在为未来十年的市场扩张创造有利条件。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 50亿美元 |

| 复合年增长率 | 7.2% |

2024年,耗材市场规模达14亿美元,预估到2034年将达28亿美元,复合年增长率为7%。该领域的强劲表现主要得益于试剂、检测试剂盒和检测材料在诊断领域的持续使用。随着液体活检、分子诊断和免疫测定需求的不断增长,对能够确保检测一致性、相容性和可重复性的可靠耗材的需求也日益增长。耗材在实现快速且可重复的检测方面发挥着重要作用,使其成为临床实验室和医院环境中不可或缺的一部分。

2024年,外分泌胰腺癌占了92.8%的市场份额,这得益于各种外分泌胰腺癌的高发病率,包括鳞状细胞癌、腺鳞癌、胶体癌和腺癌。由于大多数胰臟癌病例都属于此类,医疗保健提供者优先考虑先进的诊断解决方案,以实现早期发现、准确分期和简化治疗计划。自动化病变检测、冷冻活检创新和人工智慧辅助诊断等新兴技术正透过更快、更精准的结果来推动改善患者预后。

2024年,诊断影像中心市占率达34.5%,这得益于其专业的基础设施以及利用MRI、CT和内视镜超音波(EUS)等先进设备进行快速高解析度扫描的能力。这些中心在促进胰臟癌的准确诊断、分期和监测方面继续发挥至关重要的作用。其一体化的工作流程和先进的诊疗模式使其能够提供及时可靠的影像结果,这对于有效的临床决策至关重要。

2024年,美国胰臟癌诊断市场规模达9.386亿美元。随着美国癌症发生率的稳定上升,以及人们认知度的提高和先进医疗服务可近性的不断提升,对创新诊断技术的需求强劲增长。良好的监管环境、大量的研发投入以及公众教育活动也促进了市场的成长,使美国成为全球诊断创新的关键参与者。

全球胰臟癌诊断市场的领先公司包括通用电气医疗集团 (GE Healthcare)、赛默飞世尔科技 (Thermo Fisher Scientific)、西门子医疗集团 (Siemens Healthineers)、荷兰皇家飞利浦 (Koninklijke Philips) 和罗氏製药 (F. Hoffmann-La Roche)。为了巩固在胰臟癌诊断市场的领先地位,各大公司正专注于产品创新、人工智慧驱动的诊断工具以及扩大其全球影响力。与医疗保健提供者和研究机构的合作使得新型生物标记和影像技术的共同开发成为可能。各公司也投入精准诊断和微创方法投入巨资,包括液体活检平台和先进的分子分析技术。下一代诊断试剂盒的监管批准以及成像自动化软体的整合正在帮助公司获得竞争优势。此外,透过数位健康平台扩大可及性以及在新兴市场开展策略合作是关键的成长倡议。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 胰臟癌发生率不断上升

- 诊断技术的进步

- 全球医疗保健支出不断增长

- 提高对早期癌症检测的认识

- 产业陷阱与挑战

- 严格的监管情景

- 诊断测试成本高昂

- 市场机会

- 人工智慧(AI)在成像技术中的日益融合

- 成长动力

- 成长潜力分析

- 监管格局

- 技术进步

- 当前的技术趋势

- 新兴技术

- 供应链分析

- 报销场景

- 2024年定价分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 仪器

- 耗材

第六章:市场估计与预测:按测试类型,2021 - 2034 年

- 主要趋势

- 影像学检查

- CT扫描

- 磁振造影

- 超音波

- 宠物

- 其他影像学检查

- 活检

- 验血

- 肝功能检查

- 肿瘤标记

- 其他血液检查

- 其他测试类型

第七章:市场估计与预测:按癌症类型,2021 - 2034 年

- 主要趋势

- 外分泌

- 腺癌

- 胶体癌

- 腺鳞癌

- 鳞状细胞癌

- 内分泌

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 癌症研究机构

- 医院和诊所

- 诊断实验室

- 诊断影像中心

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Abbott Laboratories

- Agilent Technologies

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Canon

- Danaher Corporation

- Esaote

- F Hoffmann-La Roche

- GE Healthcare

- Hitachi

- Illumina

- Koninklijke Philips

- Myriad Genetics

- Olympus Corporation

- QIAGEN

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific

The Global Pancreatic Cancer Diagnostic Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 5 billion by 2034. This growth is largely driven by the increasing global incidence of pancreatic cancer, rising investments in healthcare infrastructure, and ongoing advancements in diagnostic technologies. As awareness about early detection improves and healthcare systems focus on faster diagnosis and improved outcomes, the adoption of advanced diagnostic tools has accelerated. These tools-ranging from molecular diagnostics to high-resolution imaging and biomarker-based assays-play a pivotal role in detecting cancer early, especially in asymptomatic stages when treatment can be most effective.

A wide range of innovative technologies continues to reshape the diagnostic landscape, with AI-integrated imaging, molecular profiling, and liquid biopsy techniques improving accuracy, efficiency, and safety. Additionally, the push toward personalized medicine and patient-centric care is reinforcing the importance of early-stage identification. The expansion of clinical applications, supported by improved workflow efficiencies and minimally invasive procedures, has positioned pancreatic cancer diagnostics as an integral part of modern oncology practices. Increased awareness, combined with the growing demand for timely and precise diagnosis, is creating favorable conditions for market expansion over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5 Billion |

| CAGR | 7.2% |

In 2024, the consumables segment generated USD 1.4 billion and is forecasted to hit USD 2.8 billion by 2034, with a CAGR of 7%. This segment's strong performance is largely due to the continued use of reagents, assay kits, and testing materials across diagnostic settings. As the demand for liquid biopsy, molecular diagnostics, and immunoassays rises, so does the need for reliable consumables that ensure test consistency, compatibility, and reproducibility. Their role in enabling fast and repeatable testing has made them indispensable in both clinical laboratories and hospital environments.

The exocrine segment held a 92.8% share in 2024, driven by the high prevalence of various exocrine pancreatic cancers, including squamous cell carcinoma, adenosquamous carcinoma, colloid carcinoma, and adenocarcinoma. With most pancreatic cancer cases falling under this category, healthcare providers are prioritizing advanced diagnostic solutions for early detection, accurate staging, and streamlined treatment planning. Emerging technologies such as automated lesion detection, cryo-biopsy innovations, and AI-assisted diagnostics are driving better patient outcomes through faster and more precise results.

The Diagnostic imaging centers segment held a 34.5% share in 2024, attributed to their specialized infrastructure and capability to deliver rapid, high-resolution scans using advanced equipment such as MRI, CT, and endoscopic ultrasound (EUS). These centers continue to play a vital role in facilitating accurate diagnosis, staging, and monitoring of pancreatic cancer. Their integrated workflows and access to cutting-edge modalities allow them to deliver timely, reliable imaging results essential for effective clinical decision-making.

United States Pancreatic Cancer Diagnostic Market reached USD 938.6 million in 2024. The steady rise in cancer incidence across the country, coupled with increasing awareness and access to advanced healthcare, has created strong demand for innovative diagnostic technologies. The favorable regulatory environment, extensive R&D investments, and public education campaigns have also contributed to the growth of the market, positioning the U.S. as a key player in global diagnostics innovation.

Leading companies operating in the Global Pancreatic Cancer Diagnostic Market include GE Healthcare, Thermo Fisher Scientific, Siemens Healthineers, Koninklijke Philips, and F. Hoffmann-La Roche. To strengthen their foothold in the pancreatic cancer diagnostic market, major companies are focusing on product innovation, AI-driven diagnostic tools, and expanding their global presence. Partnerships with healthcare providers and research institutions are enabling co-development of novel biomarkers and imaging techniques. Firms are also investing heavily in precision diagnostics and minimally invasive methods, including liquid biopsy platforms and advanced molecular profiling. Regulatory approvals for next-generation diagnostic kits and integration of software for imaging automation are helping companies gain a competitive advantage. Additionally, expanding access through digital health platforms and strategic collaborations in emerging markets are key growth initiatives.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Test type trends

- 2.2.4 Cancer type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of pancreatic cancer

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Growing healthcare expenditure globally

- 3.2.1.4 Rising awareness regarding early cancer detection

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenarios

- 3.2.2.2 High cost of diagnostic tests

- 3.2.3 Market opportunities

- 3.2.3.1 Rising integration of artificial intelligence (AI) in imaging technology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Imaging test

- 6.2.1 CT scan

- 6.2.2 MRI

- 6.2.3 Ultrasound

- 6.2.4 PET

- 6.2.5 Other imaging tests

- 6.3 Biopsy

- 6.4 Blood test

- 6.4.1 Liver function tests

- 6.4.2 Tumor markers

- 6.4.3 Other blood tests

- 6.5 Other test types

Chapter 7 Market Estimates and Forecast, By Cancer Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Exocrine

- 7.2.1 Adenocarcinoma

- 7.2.2 Colloid carcinoma

- 7.2.3 Adenosquamous carcinoma

- 7.2.4 Squamous cell carcinoma

- 7.3 Endocrine

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cancer research institutes

- 8.3 Hospitals and clinics

- 8.4 Diagnostic laboratories

- 8.5 Diagnostic imaging centers

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Agilent Technologies

- 10.3 Becton, Dickinson and Company

- 10.4 Boston Scientific Corporation

- 10.5 Canon

- 10.6 Danaher Corporation

- 10.7 Esaote

- 10.8 F Hoffmann-La Roche

- 10.9 GE Healthcare

- 10.10 Hitachi

- 10.11 Illumina

- 10.12 Koninklijke Philips

- 10.13 Myriad Genetics

- 10.14 Olympus Corporation

- 10.15 QIAGEN

- 10.16 Siemens Healthineers

- 10.17 Sysmex Corporation

- 10.18 Thermo Fisher Scientific