|

市场调查报告书

商品编码

1801910

水溶性肥料市场机会、成长动力、产业趋势分析及2025-2034年预测Water Soluble Fertilizer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

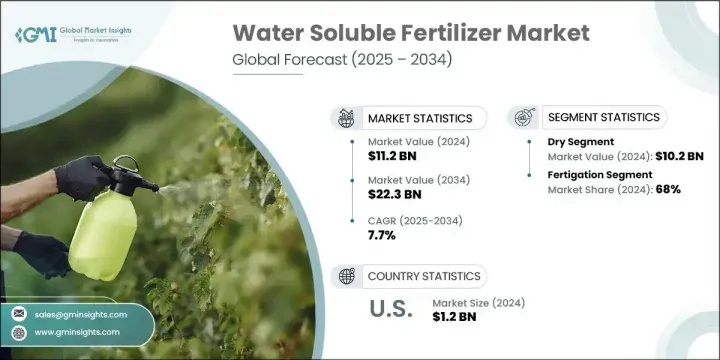

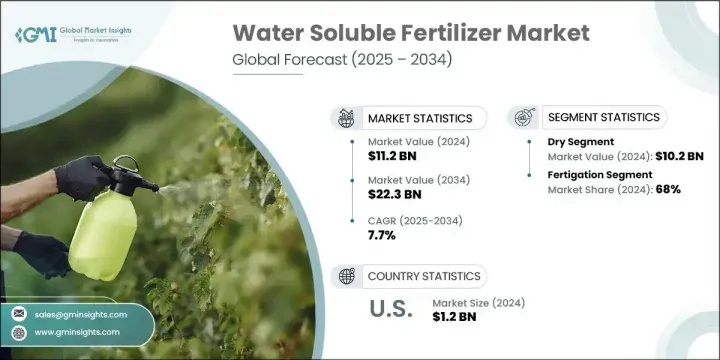

2024年,全球水溶性肥料市场规模达112亿美元,预计到2034年将以7.7%的复合年增长率成长,达到223亿美元。这一预期成长源于对高效速效肥料日益增长的需求,这些肥料能够支持精准农业并满足日益增长的粮食需求。随着人们对水溶性肥料优势(尤其是其与现代灌溉系统的兼容性)的认识不断提高,种植者正在逐步放弃使用传统肥料。这些肥料因其快速吸收、精准施肥以及与永续实践的兼容性而备受青睐。它们在温室农业和特种作物中的广泛应用也促进了需求的成长。高价值作物的种植以及对有限农地提高生产力的需求正在加速市场对水溶性肥料的采用。

儘管机会无限,市场仍面临一些挑战。高昂的产品价格、开发中国家先进灌溉系统有限、部分地区认知度低等因素,都可能限制市场扩张。水溶性肥料因其使用简单且易于种植而受到种植者的青睐。这些肥料可以整合到灌溉系统中,也可以直接施用于土壤,以便更好地控制用量和施肥时间。随着传统和高价值作物种植者对肥料的兴趣日益浓厚,对永续、环保肥料的偏好正在持续重塑市场模式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 112亿美元 |

| 预测值 | 223亿美元 |

| 复合年增长率 | 7.7% |

2024年,灌溉施肥占68%。随着养分施用和节水方法的不断改进,灌溉施肥(透过灌溉输送养分)已成为最高效的方法。它最大限度地减少了劳动力,并最大限度地提高了养分利用率。叶面施肥是另一种种植技术,它提供了一种快速输送养分的方法来治疗植物缺素症。此外,控释肥料也越来越普遍,它能确保稳定的养分供应,减少重复施肥的需求,进而有助于资源节约。

在各种产品类型中,粉状肥料因其保质期长、易于储存和计量简便而广受欢迎。然而,它们容易积尘且难以处理。液体肥料的养分吸收率更高,并且与其他液体肥料混合良好,但由于保质期较短,在运输和储存方面面临挑战。颗粒肥料则兼具易用性和较长的保质期,但价格往往较高。种植者会根据成本、施用便利性和特定的作物需求来选择这些剂型。

2024年,美国水溶性肥料市场产值达12亿美元。美国日益转向精准农业,并不断提高养分利用效率,这推动了对水溶性肥料的需求。农民正迅速采用滴灌和枢轴灌溉系统,这些系统非常适合水肥一体化灌溉。这项技术确保养分输送至植物根区,提高作物吸收率,并最大限度地减少径流损失,从而节省成本并提高肥料利用效率。

全球水溶性肥料市场的主要参与者包括中化香港(集团)有限公司、雅苒国际有限公司、Nutrien有限公司、海法集团和以色列化学有限公司(ICL)。为了巩固全球地位,水溶性肥料市场的领导者正在将产品创新、地理扩张和策略合作伙伴关係相结合。研发仍然是重中之重,各公司正在开发客製化的、针对特定作物的解决方案和与现代灌溉系统相容的配方。企业也在投资支持精准施肥并帮助种植者做出数据驱动决策的数位平台。向农业现代化势头强劲的新兴市场扩张有助于抓住新的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依形式,2021-2034

- 主要趋势

- 干燥

- 粉末

- 颗粒

- 液体

第六章:市场规模及预测:依产品,2021-2034

- 主要趋势

- 含氮

- 尿素

- 硝酸铵

- 硝酸钙

- 其他的

- 微量营养素

- 铁

- 锰

- 其他的

- 磷酸盐

- 磷酸一铵

- 磷酸

- 其他的

- 钾

- 氯化钾

- 硫酸钾

- 硝酸钾

第七章:市场规模及预测:依应用模式,2021-2034

- 主要趋势

- 叶面

- 水肥一体化

第八章:市场规模及预测:依作物,2021-2034

- 主要趋势

- 谷物

- 蔬菜

- 水果

- 种植园

- 草坪和观赏植物

- 温室作物

第九章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Yara International

- Israel Chemicals

- Nutrien

- Everris

- Sinochem Hong Kong

- Haifa Group

- AGAFERT

- K+S Aktiengesellschaft

- COMPO EXPERT

- The Mosaic Company

- Coromandel International

- VAKI-CHIM

The Global Water Soluble Fertilizer Market was valued at USD 11.2 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 22.3 billion by 2034. This anticipated growth stems from rising demand for efficient, fast-acting fertilizers that support precision farming and meet growing food requirements. As awareness around the advantages of water-soluble formulations increases-especially their compatibility with modern irrigation systems-growers are steadily shifting away from conventional fertilizers. These fertilizers are favored for their rapid absorption, targeted nutrient delivery, and compatibility with sustainable practices. Their widespread use in greenhouse farming and specialty crops also contributes to demand. High-value crops and the need for increased productivity from limited farmland are accelerating market adoption.

Despite these opportunities, the market faces some hurdles. High product prices, limited access to advanced irrigation in developing nations, and low awareness in some areas may restrict market expansion. Water-soluble fertilizers appeal to growers due to their simplicity in application and plant availability. These fertilizers can be integrated into irrigation systems or applied directly to the soil, offering greater control over dosage and timing. As interest grows among traditional and high-value crop growers, the preference for sustainable, eco-conscious options continues to reshape the market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.2 Billion |

| Forecast Value | $22.3 Billion |

| CAGR | 7.7% |

The fertigation segment accounted for a 68% share in 2024. With ongoing improvements in nutrient application and water conservation methods, fertigation-delivering nutrients through irrigation-has emerged as the most efficient approach. It minimizes labor and maximizes nutrient use. Foliar feeding is another growing technique, offering a fast nutrient delivery method to treat plant deficiencies. Additionally, controlled-release fertilizers are becoming more common, ensuring a steady nutrient supply and reducing the need for repeated applications, thus supporting resource conservation.

Among product types, the powdered formulations are popular due to their long shelf life, ease of storage, and simple measurement. However, they can be dusty and difficult to handle. Liquid fertilizers offer superior nutrient uptake and mix well with other liquids but face challenges in transport and storage due to shorter shelf life. Granules offer a balance of ease of use and long shelf life, though they tend to be pricier. Growers select among these forms based on cost, application convenience, and specific crop needs.

U.S. Water Soluble Fertilizer Market generated USD 1.2 billion in 2024. The nation's increasing shift toward precision agriculture and enhanced nutrient use efficiency has pushed demand for water-soluble fertilizers. Farmers are rapidly adopting drip and pivot irrigation systems, which are well-suited for fertigation. This technique ensures nutrient delivery to plant root zones, improves uptake, and minimizes losses through runoff, leading to cost savings and more efficient fertilizer use.

Key players active in the Global Water Soluble Fertilizer Market include Sinochem Hong Kong (Group) Co., Ltd., Yara International ASA, Nutrien Ltd., Haifa Group, and Israel Chemicals Ltd. (ICL). To strengthen their global position, leading companies in the water-soluble fertilizer market are pursuing a combination of product innovation, geographic expansion, and strategic partnerships. R&D remains a top priority, with firms developing customized, crop-specific solutions and formulations compatible with modern irrigation systems. Companies are also investing in digital platforms that support precision application and enable growers to make data-driven decisions. Expanding into emerging markets where agricultural modernization is gaining momentum helps capture new demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Form

- 2.2.2 Product

- 2.2.3 Crop

- 2.2.4 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dry

- 5.2.1 Powder

- 5.2.2 Granules

- 5.3 Liquid

Chapter 6 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Nitrogenous

- 6.2.1 Urea

- 6.2.2 Ammonium nitrate

- 6.2.3 Calcium nitrate

- 6.2.4 Others

- 6.3 Micronutrient

- 6.3.1 Iron

- 6.3.2 Manganese

- 6.3.3 Others

- 6.4 Phosphatic

- 6.4.1 Mono-ammonium phosphate

- 6.4.2 Phosphoric acid

- 6.4.3 Others

- 6.5 Potassium

- 6.5.1 Potassium chloride

- 6.5.2 Potassium sulfate

- 6.5.3 Potassium nitrate

Chapter 7 Market Size and Forecast, By Mode of Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Foliar

- 7.3 Fertigation

Chapter 8 Market Size and Forecast, By Crop, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Cereals

- 8.3 Vegetables

- 8.4 Fruits

- 8.5 Plantation

- 8.6 Turf & ornamentals

- 8.7 Greenhouse crops

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Yara International

- 10.2 Israel Chemicals

- 10.3 Nutrien

- 10.4 Everris

- 10.5 Sinochem Hong Kong

- 10.6 Haifa Group

- 10.7 AGAFERT

- 10.8 K+S Aktiengesellschaft

- 10.9 COMPO EXPERT

- 10.10 The Mosaic Company

- 10.11 Coromandel International

- 10.12 VAKI-CHIM