|

市场调查报告书

商品编码

1801911

柔性内视镜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Flexible Endoscopes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

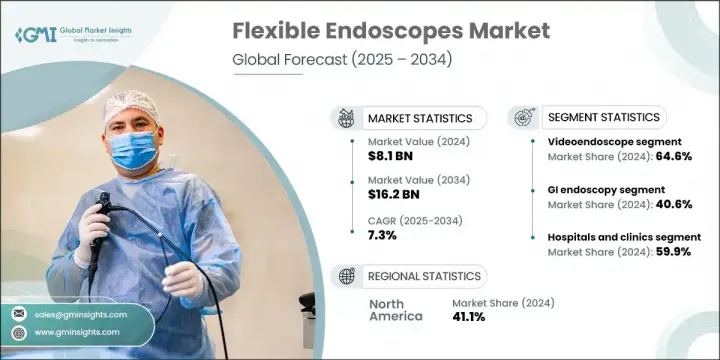

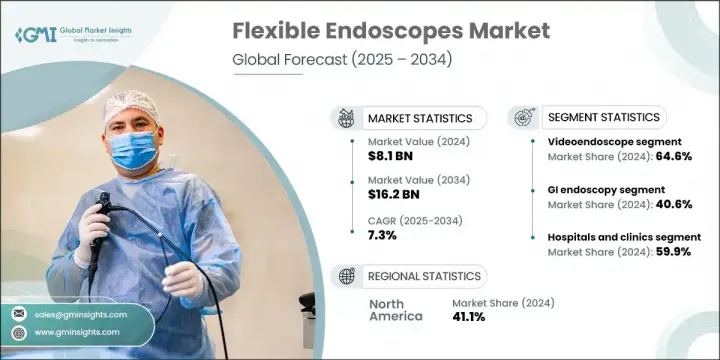

2024年,全球柔性内视镜市场规模达81亿美元,预计到2034年将以7.3%的复合年增长率成长,达到162亿美元。这一成长趋势的推动因素包括慢性病病例的增加、微创手术的日益普及以及人们对早期诊断护理的认识的提高。随着越来越多的患者寻求风险更低、恢復更快、成本更低的手术,柔性内视镜在医疗保健系统中的应用日益广泛。可视化技术的持续创新、精密工具的增强以及患者舒适度的提升也提升了这些设备的吸引力。此外,门诊和流动护理环境的日益普及也创造了新的需求,而柔性内视镜为各个临床学科提供了可扩展且经济高效的诊断和治疗解决方案。

柔性内视镜具有柔韧的插入管,使医生能够在诊断和外科手术过程中轻鬆导航复杂的解剖结构,而无需进行大切口。它们在支持微创医疗方面的作用正在迅速扩大。由于其恢復速度更快、创伤更小、整体成本更低等优势,患者和医生对这些设备的偏好日益增长。这些设备已成为现代治疗工作流程中的基础,能够提供精准高效的护理,尤其是在复杂病例中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 81亿美元 |

| 预测值 | 162亿美元 |

| 复合年增长率 | 7.3% |

2024年,视讯内视镜占据全球市场份额的64.6%。这一优势归功于其卓越的影像清晰度、即时视觉化以及在广泛临床专科领域的适应性。视讯内视镜采用微型摄影机和先进的光学元件,可将高清影像传输至外部显示器,从而显着提高诊断准确性并支援复杂的干预措施。其应用领域涵盖胃肠病学、肺病学、妇科和泌尿科。这些特性巩固了其作为微创医疗领域精准医疗重要工具的地位。

2024年,胃肠内视镜检查市场占有40.6%的份额。消化道疾病发生率的上升以及公众对常规筛检日益增长的兴趣是推动该领域发展的关键因素。胃肠内视镜检查因其能够减少住院时间并提高患者舒适度,正持续成为一种首选的诊断方法。该领域的成长也反映了内视镜技术的持续进步,这些技术使检查更加高效、安全,并推动了全球医疗保健机构对其的广泛采用。

2024年,美国柔性内视镜市场规模达32亿美元。该地区受益于强大的医疗基础设施、先进医疗设备的广泛应用以及日益增长的老年人口,老年人口的医疗保健需求也日益增长。由于对早期诊断和频繁筛检的高需求,美国仍然是该地区成长的主要贡献者。现代内视镜系统在医院和门诊中心的强劲渗透,将继续推动这个成熟且持续成长的市场扩张。

全球柔性内视镜市场的主要参与者包括 CooperSurgical、XION、PENTAX Medical、STORZ、RICHARD WOLF、Machida、Boston Scientific、FUJIFILM、BD、ENDOMED SYSTEMS、Laborie 和 OLYMPUS。在柔性内视镜市场营运的公司正专注于透过技术先进且用户友好的系统扩展其产品供应。研发方面的策略性投资旨在开发具有增强机动性和 AI 辅助视觉化的超薄、高清内视镜。製造商还利用与医院和专科诊所的合作伙伴关係,以促进产品在各种护理环境中的获取和部署。此外,他们正在努力透过监管部门的批准和在新兴经济体建立本地製造中心来扩大地理覆盖范围。市场领导者正在投资售后支援、维护服务和医生培训计划,以增强品牌忠诚度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率不断上升

- 技术进步

- 微创疗法日益普及

- 健康意识不断提高,早期诊断需求不断增加

- 产业陷阱与挑战

- 严格的监管流程

- 市场机会

- 人工智慧与机器人系统的集成

- 医疗保健投资不断增加

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 技术进步

- 当前的技术趋势

- 新兴技术

- 2024年定价分析

- 报销场景

- 向一次性/一次性柔性内视镜过渡

- 管道分析

- 启动场景

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 差距分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 电子内视镜

- 纤维镜

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 胃肠内视镜检查

- 肺内视镜检查

- 耳鼻喉内视镜检查

- 泌尿科

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心

- 其他最终用户

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- BD

- Boston Scientific

- CooperSurgical

- ENDOMED SYSTEMS

- FUJIFILM

- Laborie

- Machida

- OLYMPUS

- PENTAX Medical

- RICHARD WOLF

- STORZ

- XION

The Global Flexible Endoscopes Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 16.2 billion by 2034. This growth trajectory is fueled by the rising number of chronic disease cases, the increasing shift toward minimally invasive procedures, and heightened awareness of early-stage diagnostic care. As more patients seek procedures with lower risks, faster recovery, and lower costs, flexible endoscopy continues to gain ground across healthcare systems. Continuous innovation in visualization technologies, enhanced precision tools, and improved patient comfort is also elevating the appeal of these devices. Additionally, the rising popularity of outpatient and ambulatory care settings is creating new demand, with flexible endoscopes offering scalable, cost-effective diagnostic and therapeutic solutions across clinical disciplines.

The flexible endoscopes feature a pliable insertion tube that allows physicians to navigate complex anatomical structures during diagnostic and surgical procedures without large incisions. Their role in supporting less-invasive healthcare is expanding rapidly. The preference for these devices is rising among both patients and physicians due to advantages such as faster recovery, reduced trauma, and lower overall costs. These devices have become fundamental in modern treatment workflows by enabling precise and efficient care delivery, particularly in complex cases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $16.2 Billion |

| CAGR | 7.3% |

In 2024, the videoendoscope segment accounted for 64.6% of the global market. This dominance is attributed to their superior image clarity, real-time visualization, and adaptability across a wide range of clinical specialties. Videoendoscopes use miniaturized cameras and advanced optics that deliver high-definition visuals to external displays, greatly enhancing diagnostic accuracy and supporting complex interventions. Their use spans across gastroenterology, pulmonology, gynecology, and urology. These features have cemented their place as essential tools for precision medicine in minimally invasive care settings.

The gastrointestinal (GI) endoscopy segment held a 40.6% share in 2024. Increasing rates of digestive tract disorders and growing public interest in routine screening are key factors boosting this segment. GI endoscopy continues to grow as a preferred diagnostic method due to its ability to reduce hospital stays and improve patient comfort. This segment's growth also reflects ongoing advancements in endoscopic technology that make procedures more efficient and safer, driving increased adoption across healthcare providers globally.

U.S. Flexible Endoscopes Market was valued at USD 3.2 billion in 2024. The region benefits from a robust healthcare infrastructure, widespread use of advanced medical equipment, and a growing senior population with increasing healthcare needs. The U.S. remains a primary contributor to growth within the region, supported by high demand for early diagnostics and frequent screenings. Strong penetration of modern endoscopy systems across hospitals and outpatient centers continues to fuel expansion in this mature yet growing market.

Key players in the Global Flexible Endoscopes Market include CooperSurgical, XION, PENTAX Medical, STORZ, RICHARD WOLF, Machida, Boston Scientific, FUJIFILM, BD, ENDOMED SYSTEMS, Laborie, and OLYMPUS. Companies operating in the flexible endoscopes market are focusing on expanding their product offerings with technologically advanced and user-friendly systems. The strategic investments in R&D aim to develop ultra-thin, high-definition scopes with enhanced maneuverability and AI-assisted visualization. Manufacturers are also leveraging partnerships with hospitals and specialty clinics to boost product access and deployment across varied care settings. Additionally, efforts are underway to expand their geographic reach through regulatory approvals and local manufacturing hubs in emerging economies. Market leaders are investing in after-sales support, maintenance services, and physician training programs to strengthen brand loyalty.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic conditions

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing popularity of minimally invasive therapies

- 3.2.1.4 Rising health awareness and demand for early-stage diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory process

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and robotic systems

- 3.2.3.2 Rising healthcare investments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Reimbursement scenario

- 3.8 Transition toward single-use/disposable flexible endoscopes

- 3.9 Pipeline analysis

- 3.10 Start-up scenario

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Future market trends

- 3.14 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Videoendoscope

- 5.3 Fiberscope

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 GI endoscopy

- 6.3 Pulmonary endoscopy

- 6.4 ENT endoscopy

- 6.5 Urology

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BD

- 9.2 Boston Scientific

- 9.3 CooperSurgical

- 9.4 ENDOMED SYSTEMS

- 9.5 FUJIFILM

- 9.6 Laborie

- 9.7 Machida

- 9.8 OLYMPUS

- 9.9 PENTAX Medical

- 9.10 RICHARD WOLF

- 9.11 STORZ

- 9.12 XION