|

市场调查报告书

商品编码

1801916

电动车平台市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测EV Platform Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球电动车平台市场规模达1,65亿美元,预计到2034年将以21.1%的复合年增长率成长,达到960亿美元。人们日益转向可持续和零排放出行解决方案,这推动了电动车平台的快速创新。这些平台目前正在演变为模组化、软体定义的系统,支援自动驾驶、电池整合和可扩展动力系统等高级功能。汽车製造商正在设计平台,以实现跨车型的灵活架构,同时实现经济高效的生产和更高的能源效率。

人工智慧驱动的功能和无线更新在优化续航里程和性能方面发挥着至关重要的作用。疫情加速了人们对数位优先车辆体验的需求,促使企业将非接触式功能和即时连接工具整合到平台设计中。远端诊断、语音辅助控制和智慧路线管理的进步,已将电动车平台从基础结构部件提升为下一代出行的智慧化、适应性强的骨干。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 165亿美元 |

| 预测值 | 960亿美元 |

| 复合年增长率 | 21.1% |

纯电动车市场占16.5%的市场份额,预计到2034年将以21%的复合年增长率成长。纯电动车因其简洁的架构和与滑板式平台的兼容性而备受青睐,该平台可最大限度地利用内部空间、优化电池布局和设计灵活性。纯电动特性无需内燃机系统,使製造商能够设计出流线型结构,降低生产成本,并提高性能效率。

乘用车市场在2024年占据最高份额,达到58%,预计2025年至2034年将维持强劲成长,复合年增长率达20%。不断增长的消费者需求,以及OEM在平台开发方面的大量投资,推动了电动乘用车的广泛普及。各大汽车厂商正在打造针对轿车、掀背车和小型SUV优化的专用电动车架构,提供灵活的设计、更长的续航里程和对连网功能的支援。这种广泛的适应性使汽车製造商能够以更好的续航里程、更高的安全性和更强大的数位整合度瞄准大众市场。

中国电动车平台市场占69%的市场份额,2024年市场规模达39.8亿美元。作为主要的电动车製造商和消费者,中国在电动车市场中扮演着举足轻重的角色。政府透过补贴、强制生产和充电基础设施投资等策略性支持,为平台创新註入了强劲动力。国内企业持续研发可扩展且价格合理的电动车平台,在性能和续航里程之间取得平衡,同时满足日益增长的电动车用户群的需求。

塑造全球电动车平台市场的领先公司包括福特、特斯拉、丰田、福斯、宝马、通用汽车和沃尔沃。为了巩固其市场地位,电动车平台领域的公司正在优先考虑一系列策略性投资和合作伙伴关係。原始设备製造商正在大力投资研发,以开发支援各种车辆尺寸和功能的模组化平台,同时确保与新兴软体驱动技术的兼容性。汽车製造商还与电池生产商和科技公司合作,创建用于连接、充电和自动驾驶的整合生态系统。此外,许多公司正在采用垂直整合模式来控制马达、控制器和电池组等关键零件,从而提高性能和成本控制。这些策略有助于确保在不断发展的电动车领域中的可扩展性、适应性和长期竞争力。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 零件供应商

- 平台开发者

- 製造商

- 配销通路

- 最终用户

- 产业衝击力

- 成长动力

- 全球电动车普及率激增

- 电池技术的进步

- OEM转向模组化电动车架构

- 扩大电动车充电基础设施

- 产业陷阱与挑战

- 电动车平台的初始投资高

- 新兴地区基础设施欠发达

- 市场机会

- 电动汽车即服务 (EVaaS) 模式的成长

- 与自主和互联技术的集成

- 商业车队电气化

- 城市微型交通解决方案需求不断成长

- 成长动力

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利分析

- 价格趋势

- 按地区

- 搭车

- 利润率分析

- 成本細項分析

- 原料成本构成

- 製造和机械成本

- 物流和配送成本

- 劳动力和组装成本

- 研发和测试成本

- 电动车平台市场演变与成熟度分析

- 从 ICE 改装到专用平台的历史发展

- 平台架构演进时间表

- 技术采用生命週期分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 纯电动车(BEV)

- 混合动力电动车(HEV)

- 插电式混合动力车(PHEV)

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- SUV/跨界车

- 掀背车

- 商用车

- 轻型商用车

- 重型商用车

第七章:市场估计与预测:依平台,2021 - 2034 年

- 主要趋势

- P0

- P1

- P2

- P3

- P4

第八章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 电池

- 悬挂系统

- 运动系统

- 机壳

- 电子控制单元(ECU)

- 其他的

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- BMW

- Ford

- General Motors

- Hyundai Motor

- Nissan Motor

- Renault

- Stellantis

- Tesla

- Toyota Motor

- Volkswagen

- 区域参与者

- Avatar Technology

- BYD Auto

- Leapmotor

- Mahindra Electric

- Seres

- Tata Motors

- Zeekr

- 新兴玩家

- Bollinger Motors

- Canoo

- Cenntro

- Foxconn

- Geely

- Gaussin

- Lucid Motors

- NIO

- OSVehicle

- REE Automotive

- Rivian Automotive

- XPeng Motors

- Zero Labs Automotive

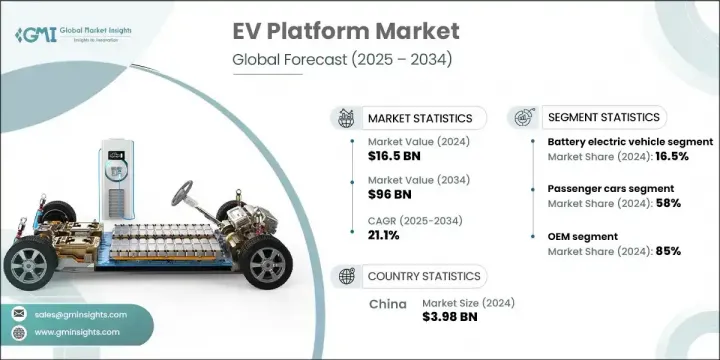

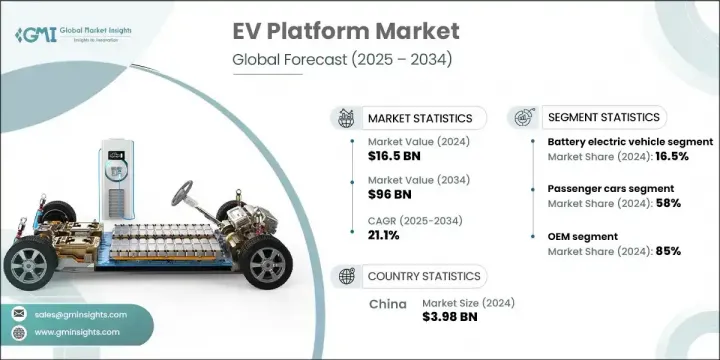

The Global EV Platform Market was valued at USD 16.5 billion in 2024 and is estimated to grow at a CAGR of 21.1% to reach USD 96 billion by 2034. The increasing shift toward sustainable and zero-emission mobility solutions has sparked rapid innovation in EV platforms. These platforms are now evolving into modular, software-defined systems that support advanced features like autonomous driving, battery integration, and scalable powertrains. Automakers are designing platforms that allow flexible architecture across vehicle classes while enabling cost-efficient production and improved energy efficiency.

AI-driven features and over-the-air updates play a crucial role in optimizing range and performance. The pandemic accelerated demand for digital-first vehicle experiences, pushing companies to integrate contactless functionalities and real-time connectivity tools into platform design. Advancements in remote diagnostics, voice-assisted controls, and intelligent route management have elevated EV platforms from basic structural components to intelligent, adaptable backbones for next-gen mobility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.5 Billion |

| Forecast Value | $96 Billion |

| CAGR | 21.1% |

The battery electric vehicles segment held 16.5% share and is forecasted to grow at a CAGR of 21% through 2034. BEVs are favored due to their clean architecture and compatibility with skateboard-style platforms that maximize interior space, battery placement, and design flexibility. Their pure electric nature eliminates combustion systems, allowing manufacturers to engineer streamlined structures, reduce production costs, and boost performance efficiency.

The passenger car segment held the highest share at 58% in 2024 and is projected to maintain strong growth with a CAGR of 20% from 2025 to 2034. Widespread adoption of electric passenger vehicles has been fueled by growing consumer demand, paired with substantial OEM investment in platform development. Companies are creating dedicated EV architectures optimized for sedans, hatchbacks, and compact SUVs, offering flexible designs, enhanced battery life, and support for connected features. This broad adaptability enables automakers to target a mass-market audience with improved range, safety, and digital integration.

China EV Platform Market held 69% share, generating USD 3.98 billion in 2024. The country plays a pivotal role in the market as both a major EV manufacturer and consumer. Strategic government support through subsidies, production mandates, and charging infrastructure investments has created strong momentum in platform innovation. Domestic firms continue to engineer scalable, affordable EV platforms that balance performance and range while catering to the needs of their expanding electric vehicle user base.

Leading companies shaping the Global EV Platform Market include Ford, Tesla, Toyota, Volkswagen, BMW, General Motors, and Volvo. To reinforce their market position, companies in the EV platform sector are prioritizing a mix of strategic investments and partnerships. OEMs are heavily investing in R&D to develop modular platforms that support a wide range of vehicle sizes and functions, while ensuring compatibility with emerging software-driven technologies. Automakers are also collaborating with battery producers and tech firms to create integrated ecosystems for connectivity, charging, and autonomy. Furthermore, many are adopting vertical integration models to control key components such as motors, controllers, and battery packs, which enhances performance and cost control. These strategies help ensure scalability, adaptability, and long-term competitiveness in the evolving EV landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Propulsion

- 2.2.3 Vehicle

- 2.2.4 Platform

- 2.2.5 Component

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Component suppliers

- 3.1.3 Platform developers

- 3.1.4 Manufacturers

- 3.1.5 Distribution channel

- 3.1.6 End users

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in global electric vehicle adoption

- 3.2.1.2 Advancements in battery technology

- 3.2.1.3 OEM shift to modular EV architectures

- 3.2.1.4 Expansion of EV charging infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment in EV platforms

- 3.2.2.2 Underdeveloped infrastructure in emerging regions

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in EV-as-a-service (EVaaS) models

- 3.2.3.2 Integration with autonomous & connected tech

- 3.2.3.3 Electrification of commercial fleets

- 3.2.3.4 Rising demand for urban micro-mobility solutions

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter’s analysis

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Price Trend

- 3.8.1 By region

- 3.8.2 By Vehicle

- 3.9 Profit margin analysis

- 3.10 Cost breakdown analysis

- 3.10.1 Raw material cost components

- 3.10.2 Manufacturing and machinery costs

- 3.10.3 Logistics and distribution costs

- 3.10.4 Labor and assembly costs

- 3.10.5 R&D and testing costs

- 3.11 EV platform market evolution and maturity analysis

- 3.11.1 Historical development from ICE adaptations to dedicated platforms

- 3.11.2 Platform architecture evolution timeline

- 3.11.3 Technology adoption lifecycle analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Battery electric vehicles (BEV)

- 5.3 Hybrid electric vehicles (HEV)

- 5.4 Plug-in hybrid electric vehicles (PHEV)

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 SUVs/crossovers

- 6.2.3 Hatchbacks

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 P0

- 7.3 P1

- 7.4 P2

- 7.5 P3

- 7.6 P4

Chapter 8 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery

- 8.3 Suspension system

- 8.4 Motor system

- 8.5 Chassis

- 8.6 Electronic Control Units (ECUs)

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 BMW

- 11.1.2 Ford

- 11.1.3 General Motors

- 11.1.4 Hyundai Motor

- 11.1.5 Nissan Motor

- 11.1.6 Renault

- 11.1.7 Stellantis

- 11.1.8 Tesla

- 11.1.9 Toyota Motor

- 11.1.10 Volkswagen

- 11.2 Regional Players

- 11.2.1 Avatar Technology

- 11.2.2 BYD Auto

- 11.2.3 Leapmotor

- 11.2.4 Mahindra Electric

- 11.2.5 Seres

- 11.2.6 Tata Motors

- 11.2.7 Zeekr

- 11.3 Emerging Players

- 11.3.1 Bollinger Motors

- 11.3.2 Canoo

- 11.3.3 Cenntro

- 11.3.4 Foxconn

- 11.3.5 Geely

- 11.3.6 Gaussin

- 11.3.7 Lucid Motors

- 11.3.8 NIO

- 11.3.9 OSVehicle

- 11.3.10 REE Automotive

- 11.3.11 Rivian Automotive

- 11.3.12 XPeng Motors

- 11.3.13 Zero Labs Automotive