|

市场调查报告书

商品编码

1801926

医学影像市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Medical Imaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

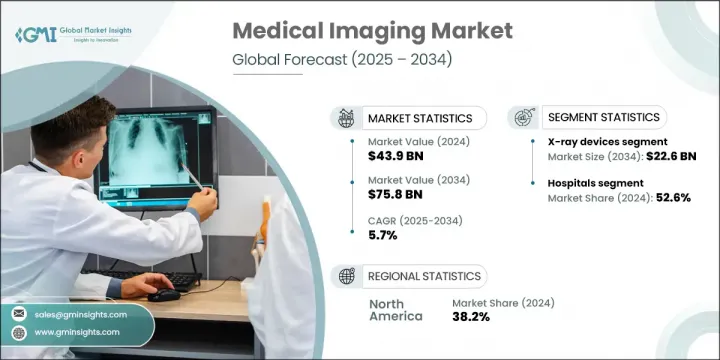

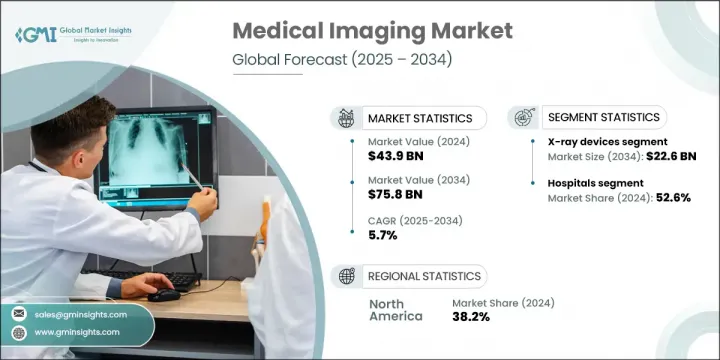

2024年,全球医学影像市场规模达439亿美元,预计到2034年将以5.7%的复合年增长率成长,达到758亿美元。这一增长主要得益于慢性病负担的加重、人口老化加剧、影像技术的持续进步以及新兴国家和已开发国家医疗支出的增加。医学影像仍然是临床诊断和治疗计划的基石,因为它使医护人员能够清楚地观察内臟器官、组织和骨骼。这些技术有助于早期疾病发现、指导微创手术,并有助于患者的长期管理。硬体和软体的创新、影像清晰度的提升以及影像处理速度的加快,正在进一步提升临床决策水平,改善患者预后,并刺激全球医学影像市场的需求。

医学影像依赖产生高清视觉资料的技术,以协助临床评估和外科手术干预。这些工具已发展成为诊断的重要组成部分,为各个医学学科提供精准度和速度。 MRI 系统、X 光、CT 扫描仪和超音波等设备已广泛应用于临床,用于评估内伤、慢性病和异常情况。它们的即时成像功能支援诊断并提高工作流程效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 439亿美元 |

| 预测值 | 758亿美元 |

| 复合年增长率 | 5.7% |

2024年,X射线设备细分市场引领市场,主要得益于其在慢性病早期诊断的应用日益广泛。该细分市场的成长得益于X射线技术的不断升级,如今包括人工智慧成像解决方案在内的先进技术旨在确保准确性、简化工作流程并减轻放射科医生的负担。这些先进的系统已在多中心评估中证明了其有效性,并在临床机构中广泛使用。智慧诊断功能的融入显着增强了医疗机构的信心,并促进了X光系统在现代医学影像实践中的应用不断提升。

2024年,医院市场占据52.6%的市场。快速城镇化、人口成长以及医疗基础设施投资的增加推动了医院市场份额的成长。先进诊断设备的广泛应用,加上熟练操作这些设备的专业人员,使得医院成为该市场的主要终端使用者。此外,医院升级和新建专案的资金投入增加,尤其是在发展中地区,也推动了影像设备的普及。政府和私人部门对医院基础设施改善的投资,正在推动对高性能影像技术的巨大需求。

2024年,美国医学影像市场规模达151亿美元。受环境和生活方式因素影响,美国癌症发病率不断上升,这加剧了对用于早期癌症检测和监测的有效先进影像工具的需求。此类疾病的发生率不断上升,促使医院和诊所投资于具有高诊断价值和患者特异性精准度的影像系统,加速美国整体市场的成长。

在全球医学影像市场营运的知名公司包括 GE HealthCare Technologies、Shimadzu、Samsung Medison、Carestream Health、佳能医疗系统、富士胶片控股、Hologic、柯尼卡美能达、Esaote、西门子医疗和荷兰皇家飞利浦。领先的医学成像公司正在优先考虑创新,透过投资人工智慧整合、机器学习演算法和自动化来提高影像准确性和诊断速度。他们正在扩展其数位健康平台,以支援远端诊断、基于云端的影像储存和资料互通性。全球市场参与者正在积极寻求与医院和科技公司的合併、收购和合作,以拓宽其解决方案组合。在本地化製造和服务中心的支持下,向高成长的新兴市场扩张是另一个关键策略。为了保持竞争力,製造商还提供模组化成像系统,以减少维护并允许更容易的升级。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 医学影像技术的渐进式创新与进步

- 医疗支出增加

- 老年人口基数快速成长,疾病负担不断加重

- 人工智慧(AI)在放射学领域的出现

- 有利的政府倡议

- 产业陷阱与挑战

- 成像设备成本高

- 报销政策的变化

- 市场机会

- 新兴市场的扩张

- 成长动力

- 成长潜力分析

- 技术格局

- 监管格局

- 我们

- 欧洲

- 亚太地区

- 未来市场趋势

- 2024年定价分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- X射线设备

- 数位的

- 直接射线照相繫统

- 电脑放射成像系统

- 模拟

- 数位的

- 磁振造影

- 超音波

- 二维超音波

- 3D超音波

- 其他超音波检查

- 电脑断层扫描

- 核子造影

- 乳房X光检查

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 诊断中心

- 其他最终用途

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Canon Medical Systems

- Carestream Health

- Esaote

- Fujifilm Holdings

- GE HealthCare Technologies

- Hologic

- Konica Minolta

- Koninklijke Philips

- Samsung Medison

- Shimadzu

- Siemens Healthineers

The Global Medical Imaging Market was valued at USD 43.9 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 75.8 billion by 2034. This growth is largely supported by the increasing burden of chronic diseases, a rising aging population, ongoing advancements in imaging technologies, and greater healthcare spending across both emerging and developed nations. Medical imaging continues to be a cornerstone in clinical diagnostics and treatment planning, as it enables healthcare providers to visualize internal organs, tissues, and bones in detail. These technologies help in early disease detection, guide minimally invasive procedures, and contribute to long-term patient management. Innovations in hardware and software, improved image clarity, and faster image processing are further elevating clinical decision-making, improving patient outcomes, and boosting demand worldwide.

Medical imaging relies on technologies that produce high-definition visual data to assist in clinical evaluations and surgical interventions. These tools have evolved into essential components of diagnostics, offering precision and speed across medical disciplines. Devices such as MRI systems, X-rays, CT scanners, and ultrasound machines are deployed across clinical settings to evaluate internal injuries, chronic conditions, and abnormalities. Their real-time imaging capabilities support diagnosis and improve workflow efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.9 Billion |

| Forecast Value | $75.8 Billion |

| CAGR | 5.7% |

In 2024, the X-ray devices segment led the market, primarily due to its increased usage for early diagnosis of chronic illnesses. This segment's growth is supported by the constant upgrades in X-ray technologies that now include AI-powered imaging solutions designed to ensure accuracy, streamline workflows, and reduce the burden on radiologists. These advanced systems have proven their efficacy in multicenter evaluations and are widely adopted across clinical setups. The incorporation of smart diagnostic capabilities is significantly enhancing provider confidence and contributing to the rising utilization of X-ray systems in modern medical imaging practices.

The hospitals segment held a 52.6% share in 2024. Their growing share is influenced by rapid urbanization, population growth, and a rise in healthcare infrastructure investments. The widespread installation of advanced diagnostic equipment, coupled with skilled professionals available to operate them, is positioning hospitals as dominant end-users in this market. Additionally, increased funding for hospital upgrades and new construction, especially across developing regions, is elevating the adoption of imaging equipment. Government and private investments in improving hospital infrastructure are driving significant demand for high-performance imaging technologies.

United States Medical Imaging Market was valued at USD 15.1 billion in 2024. The rising cancer prevalence across the country, stemming from environmental and lifestyle-related factors, has intensified the need for effective and advanced imaging tools for early cancer detection and monitoring. The growing incidence of such conditions is pushing hospitals and clinics to invest in imaging systems that offer high diagnostic value and patient-specific accuracy, thus accelerating overall market growth in the U.S.

Prominent companies operating in the Global Medical Imaging Market include GE HealthCare Technologies, Shimadzu, Samsung Medison, Carestream Health, Canon Medical Systems, Fujifilm Holdings, Hologic, Konica Minolta, Esaote, Siemens Healthineers, and Koninklijke Philips. Leading medical imaging companies are prioritizing innovation by investing in AI integration, machine learning algorithms, and automation to boost image accuracy and diagnostic speed. They are expanding their digital health platforms to support remote diagnostics, cloud-based image storage, and data interoperability. Global market players are actively pursuing mergers, acquisitions, and collaborations with hospitals and technology firms to broaden their solution portfolios. Expansion into high-growth emerging markets is another critical strategy, supported by localized manufacturing and service centers. To remain competitive, manufacturers are also offering modular imaging systems that reduce maintenance and allow for easier upgrades.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product

- 2.2.2 End use

- 2.2.3 Regional

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Incremental innovations and advancements in medical imaging technology

- 3.2.1.2 Rise in healthcare expenditure

- 3.2.1.3 Increasing disease burden along with rapidly growing geriatric population base

- 3.2.1.4 Emergence of artificial intelligence (AI) in radiology

- 3.2.1.5 Favorable government initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of imaging devices

- 3.2.2.2 Changes in reimbursement policies

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Regulatory landscape

- 3.5.1 U.S.

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy outlook matrix

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 X-ray devices

- 5.2.1 Digital

- 5.2.1.1 Direct radiography systems

- 5.2.1.2 Computed radiography systems

- 5.2.2 Analog

- 5.2.1 Digital

- 5.3 MRI

- 5.4 Ultrasound

- 5.4.1 2D Ultrasound

- 5.4.2 3D Ultrasound

- 5.4.3 Other ultrasounds

- 5.5 Computed tomography

- 5.6 Nuclear imaging

- 5.7 Mammography

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Canon Medical Systems

- 8.2 Carestream Health

- 8.3 Esaote

- 8.4 Fujifilm Holdings

- 8.5 GE HealthCare Technologies

- 8.6 Hologic

- 8.7 Konica Minolta

- 8.8 Koninklijke Philips

- 8.9 Samsung Medison

- 8.10 Shimadzu

- 8.11 Siemens Healthineers