|

市场调查报告书

商品编码

1801934

OTC助听器市场机会、成长动力、产业趋势分析及2025-2034年预测OTC Hearing Aids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

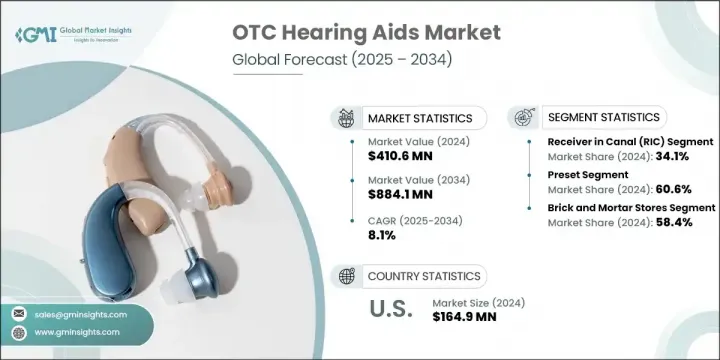

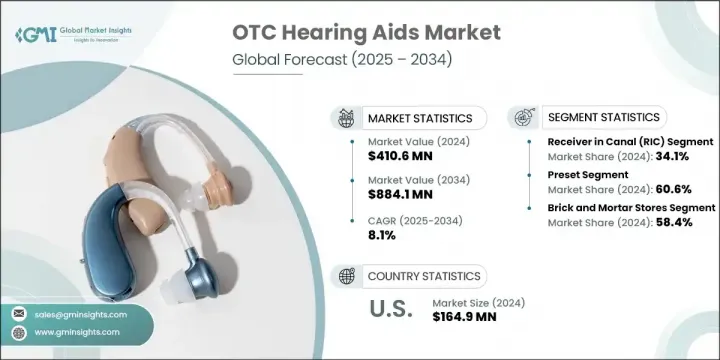

2024 年全球非处方助听器市值为 4.106 亿美元,预计到 2034 年将以 8.1% 的复合年增长率增长至 8.841 亿美元。听力损失病例的增加、人口快速老化以及与传统处方助听器相比非处方助听器的价格更实惠,共同推动了市场的成长。监管支持措施(尤其是来自卫生机构的措施)以及处方助听器缺乏足够的保险覆盖,促使更多消费者寻求可自行管理、方便取得的替代品。此外,消费者意识的增强以及蓝牙连接、智慧型手机整合和应用程式控制的声音调节等科技功能的日益普及,使得非处方助听器更具吸引力,尤其是对数位原生代用户而言。这些创新正在缩小经济型助听解决方案与高端助听解决方案之间的绩效差距,扩大消费者群体并推动市场渗透。

随着对支援积极生活方式且相容智慧型手机的紧凑型无线音讯设备的需求激增,预计到2034年,耳塞市场将以8.4%的复合年增长率成长。轻巧的结构和舒适的佩戴体验是其核心驱动力,而开放式设计的加入则确保了更佳的环境声音感知。配备独立扬声器和麦克风组件的RIC型号可最大限度地减少回馈,并提高清晰度,满足不同程度的听力损失需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.106亿美元 |

| 预测值 | 8.841亿美元 |

| 复合年增长率 | 8.1% |

2024年,预设型非处方助听器市场占60.6%的份额,这得益于其简单易用、即时可用和成本优势。预设型助听器无需编程,吸引了追求便利功能的消费者,尤其是初次使用者和老年人。药局和电商平台的零售成长也促进了助听器的广泛普及。放大技术的进步进一步提升了助听质量,使其成为轻度至中度听力需求人士的可靠选择。

2024年,北美非处方助听器市场占据42.6%的市场。该地区受益于庞大的老龄化人口,尤其是在美国和加拿大,以及消费者越来越多地采用自主照护工具的医疗保健环境。高数位化水准和便捷的技术获取加速了这一趋势。强大的零售生态系统,包括大型连锁药局和线上平台,提升了产品的可近性。这有助于非处方助听器覆盖更广泛的受众,尤其是在註重健康和精通科技的用户群中。

非处方助听器市场的知名公司包括 NuvoMed、SOUNDWAVE HEARING、Lucid Hearing、AUDICUS、Starkey、AcoSound、NUHEARA、EARGO、AUSTAR、HearX Group、Audien Hearing、WS Audiology、B. Braun、GN Store Nord、MD Hearing 和 Sonova。领先的非处方助听器製造商的关键策略包括积极投资研发,以提高声音清晰度、电池寿命和连接性。各公司正在优化基于应用程式的控制功能,以便于定制,并推出与消费者耳塞的舒适度和风格相符的产品。与零售连锁店和线上商店的策略联盟扩大了知名度,而有针对性的行销正在提高年轻人和首次购买者的品牌回忆率。此外,参与者正在参与监管合作,以加快产品审批并获得早期市场优势。提供订阅方案和远端支援也有助于建立长期客户忠诚度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 听力损失盛行率不断上升

- 老年人口基数上升

- 技术进步

- 助听器认知度和普及率稳定上升

- 产业陷阱与挑战

- 配戴助听器的意识不足与社会耻辱

- 对设备品质和功效的担忧

- 市场机会

- 新兴市场的渗透

- 对客製化和用户友善产品创新的需求激增

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 报销场景

- 按地区进行定价分析

- 非处方助听器立法

- 市集情境

- 竞争格局

- 融资趋势

- 品牌分析

- 消费者途径

- 流行病学情景

- 消费者洞察

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势包括:

- 眼镜式助听器

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 耳道内接收器 (RIC)

- 完全耳道式(CIC)

- 耳塞

- 真正的无线立体声(TWS)

- 耳钩

- 颈带

- 其他产品

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 预设

- 自适应

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 实体店面

- 电子商务

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- AUDICUS

- AcoSound

- Audien Hearing

- AUSTAR

- EARGO

- GN Store Nord

- HearX Group

- Lucid HEARING

- MD Hearing

- NUHEARA

- NuvoMed

- sonova

- SOUNDWAVE HEARING

- Starkey

- WS Audiology

The Global OTC Hearing Aids Market was valued at USD 410.6 million in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 884.1 million by 2034. The rise in hearing loss cases, along with a rapidly aging population and the affordability of over-the-counter options compared to traditional prescription hearing aids, is fueling market growth. Supportive regulatory moves, particularly from health agencies, and the lack of sufficient insurance coverage for prescription models have driven more consumers to seek self-managed, accessible alternatives. In addition, growing awareness and the increasing availability of tech-enabled features like Bluetooth connectivity, smartphone integration, and app-controlled sound adjustment are making OTC hearing aids more appealing, especially to digital-native users. These innovations are narrowing the performance gap between budget-friendly and high-end hearing solutions, expanding the consumer base and pushing market penetration.

The earbuds segment is projected to grow at a CAGR of 8.4% through 2034, as demand surges for compact, wireless audio devices that support active lifestyles and are compatible with smartphones. Lightweight construction and comfort are core drivers, while the inclusion of open-fit designs ensures better ambient sound perception. RIC models with separate speaker and mic components minimize feedback and offer improved clarity, catering to varied degrees of hearing loss.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $410.6 Million |

| Forecast Value | $884.1 Million |

| CAGR | 8.1% |

In 2024, the preset OTC hearing aids segment held share at 60.6%, owing to their simplicity, immediate usability, and cost advantages. With no need for programming, preset models appeal to consumers seeking straightforward functionality, particularly first-time users and older adults. Retail growth across pharmacies and e-commerce platforms has also supported widespread availability. Advances in amplification technology have further improved quality, making these devices a reliable option for those with mild to moderate hearing needs.

North America OTC Hearing Aids Market held 42.6% share in 2024. The region benefits from a large aging population, especially in the U.S. and Canada, and a healthcare environment where consumers are increasingly adopting self-directed care tools. High digital fluency and easy access to technology accelerate adoption. A strong retail ecosystem, including major pharmacy chains and online marketplaces, enhances product accessibility. This has helped OTC hearing aids reach broader audiences, particularly among health-conscious and tech-savvy users.

Prominent companies in the OTC Hearing Aids Market include NuvoMed, SOUNDWAVE HEARING, Lucid Hearing, AUDICUS, Starkey, AcoSound, NUHEARA, EARGO, AUSTAR, HearX Group, Audien Hearing, WS Audiology, B. Braun, GN Store Nord, MD Hearing, and Sonova. Key strategies among leading OTC hearing aid manufacturers include aggressive investment in R&D to enhance sound clarity, battery life, and connectivity. Companies are optimizing app-based controls for ease of customization and rolling out products that mirror the comfort and style of consumer earbuds. Strategic alliances with retail chains and online stores have expanded visibility, while targeted marketing is improving brand recall among younger and first-time buyers. In addition, players are engaging in regulatory collaborations to expedite product approvals and gain early market advantage. Offering subscription plans and remote support also helps in building long-term customer loyalty.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Type trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of hearing loss

- 3.2.1.2 Rising geriatric population base

- 3.2.1.3 Technological advancements

- 3.2.1.4 Steadily surging awareness and penetration of hearing devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Poor awareness and social stigma associated with wearing hearing aids

- 3.2.2.2 Concerns over device quality and efficacy

- 3.2.3 Market opportunities

- 3.2.3.1 Penetration in emerging markets

- 3.2.3.2 Surging need for customized and user-friendly product innovations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis, by region

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 MEA

- 3.8 OTC hearing aids legislation

- 3.9 Market scenario

- 3.9.1 Competitive landscape

- 3.9.2 Funding trends

- 3.10 Brand analysis

- 3.11 Consumer pathway

- 3.12 Epidemiology scenario

- 3.13 Consumer insights

- 3.14 Gap analysis

- 3.15 Porter's analysis

- 3.16 PESTEL analysis

- 3.17 Future market trends including:

- 3.17.1 Eyeglass-style hearing aids

- 3.18 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Receiver in canal (RIC)

- 5.3 Completely-in-the-canal (CIC)

- 5.4 Earbuds

- 5.4.1 True wireless stereo (TWS)

- 5.4.2 Ear-hook

- 5.4.3 Neckband

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Preset

- 6.3 Self-fitting

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AUDICUS

- 9.2 AcoSound

- 9.3 Audien Hearing

- 9.4 AUSTAR

- 9.5 EARGO

- 9.6 GN Store Nord

- 9.7 HearX Group

- 9.8 Lucid HEARING

- 9.9 MD Hearing

- 9.10 NUHEARA

- 9.11 NuvoMed

- 9.12 sonova

- 9.13 SOUNDWAVE HEARING

- 9.14 Starkey

- 9.15 WS Audiology