|

市场调查报告书

商品编码

1801935

脊椎融合设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Spinal Fusion Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球脊椎融合器材市场规模达89亿美元,预计2034年将以4%的复合年增长率成长,达到135亿美元。市场成长动能的驱动力源自于脊椎疾病发生率的上升、目标患者群体的扩大,以及持续的研发投入,旨在开发更先进、更微创的融合手术。儘管前景乐观,但一些新兴国家报销选择有限,仍是市场全面扩张的挑战。然而,脊椎外科手术的进步和全球老化人口的增加持续推高了需求。技术进步,尤其是术中影像、机器人技术和导航技术,正在帮助减少手术併发症并改善疗效。

2024年,胸腰椎器械市场占据64.5%的市场份额,这归因于腰椎退化性疾病和脊椎损伤的发生率较高,这些疾病需要对胸椎和腰椎进行手术固定。该领域的成长主要源自于老年人高衝击力创伤和脊椎退化发生率的上升。此外,诸如脊椎骨折和脊椎滑脱等疾病正在透过精密设计的器械进行治疗,以改善稳定性和恢復能力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 89亿美元 |

| 预测值 | 135亿美元 |

| 复合年增长率 | 4% |

2024年,退化性椎间盘疾病领域占据47.6%的市场。这一主导地位归因于与年龄相关的椎间盘退化病例的激增,以及微创脊椎融合术的广泛应用。随着越来越多的老年人出现椎间盘相关问题,对高效率、低风险治疗的需求持续成长。早期发现、患者认知度的提高以及对微创手术日益增长的信任,也对提升该领域的表现发挥着至关重要的作用。

2024年,美国脊椎融合器材市场规模达55亿美元。这一增长源于老年患者数量的增加、脊椎疾病负担的加重,以及创新手术器械和技术的日益普及。该地区拥有强大的医疗保健体系、先进的外科基础设施,以及对现代脊椎植入物和导航系统的广泛采用。 2021年,该市场规模达42亿美元,2022年达47亿美元,在临床需求和技术进步的推动下,市场规模逐年稳定成长。

全球脊椎融合器材市场的顶级公司包括史赛克 (Stryker)、Globus Medical、美敦力 (Medtronic)、NuVasive 和 DePuy Synthes。为了巩固市场地位,领先的脊椎融合器材製造商正在大力投资机器人辅助手术、人工智慧导航系统和微创产品开发。这些公司正在透过研发和有针对性的收购来扩展其产品组合,以提供端到端的脊椎解决方案。与医院和外科中心的策略合作伙伴关係也使先进器械的采用速度更快。一些公司正在本地化生产并加强分销网络,以更好地服务高成长市场。持续的外科医生培训计划和数位平台整合正在进一步提高手术的精确度和跨地区的采用率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 脊椎疾病盛行率不断上升

- 技术进步

- 创伤和损伤病例数上升

- 老年人口不断增加,对微创手术的需求也不断增加

- 产业陷阱与挑战

- 严格的监管情景

- 脊椎手术费用高昂

- 市场机会

- 门诊手术中心(ASC)的成长

- 机器人和导航辅助手术的采用率不断提高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 当前的技术趋势

- 导航与机器人系统的集成

- PEEK 和钛合金笼的广泛使用

- 新兴技术

- 3D列印和脊椎植入物的进步

- 整合感测器的智慧植入物

- 当前的技术趋势

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

- 价值链分析

- 报销场景

- 消费者行为分析

- 比较分析:前路与后路手术入路

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 胸腰椎装置

- 椎弓根螺钉

- 椎间融合装置(IBFD)

- 桿

- 盘子

- 其他胸腰椎装置

- 颈椎固定装置

- 椎间融合装置(IBFD)

- 盘子

- 桿

- 钩子

- 其他子宫颈装置

第六章:市场估计与预测:依疾病类型,2021 - 2034 年

- 主要趋势

- 椎间盘退化

- 脊椎畸形

- 创伤与骨折

- 脊椎肿瘤

- 其他疾病类型

第七章:市场估计与预测:按手术,2021 - 2034 年

- 主要趋势

- 开放性脊椎手术

- 微创脊椎手术

第八章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 钛

- 聚醚醚酮(PEEK)

- 钴铬合金

- 不銹钢

- 其他材料

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 骨科诊所

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- ATEC

- B. Braun

- Captiva Spine

- ChoiceSpine

- DePuy Synthes

- Globus Medical

- K2M

- Life Spine

- Medtronic

- NuVasive

- Orthofix

- Premia Spine

- Stryker

- Xtant Medical

- Zimmer Biomet

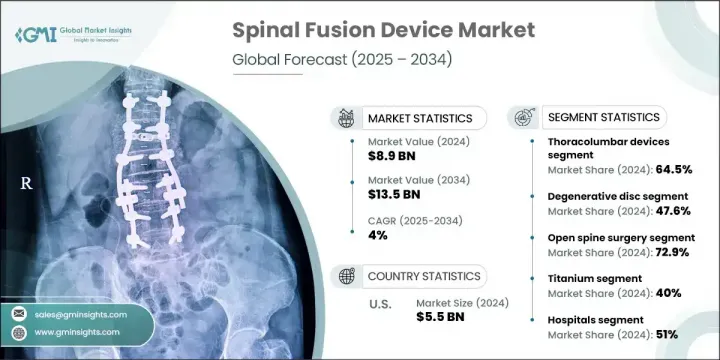

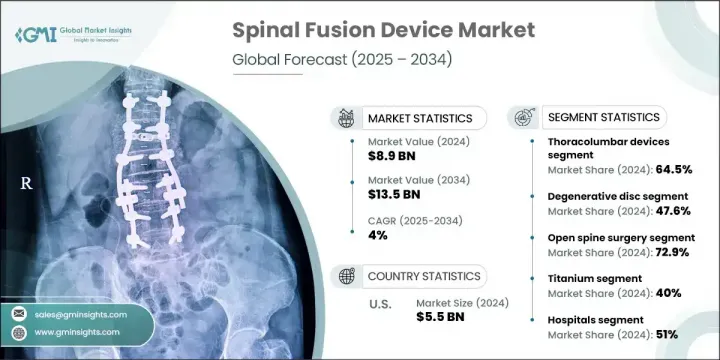

The Global Spinal Fusion Device Market was valued at USD 8.9 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 13.5 billion by 2034. The market's upward momentum is fueled by the rising number of spinal disorders, a growing pool of target patients, and ongoing investments in R&D to develop more advanced and minimally invasive fusion procedures. Despite the positive outlook, limited reimbursement options in several emerging countries remain a challenge for full market scalability. Nevertheless, advancements in spinal surgery and the rise in aging populations worldwide continue to elevate demand. Technological evolution, particularly in intraoperative imaging, robotics, and navigation, is helping reduce surgical complications and improve outcomes.

The thoracolumbar devices segment held 64.5% share in 2024, owing to the high frequency of lumbar degenerative disorders and spinal injuries that necessitate surgical stabilization in both the thoracic and lumbar spine. Growth in this segment is largely driven by increasing rates of high-impact trauma and spine degeneration among older adults. Additionally, conditions like spinal fractures and spondylolisthesis are being addressed with precision-engineered devices to improve stability and recovery.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $13.5 Billion |

| CAGR | 4% |

In 2024, the degenerative disc disorder segment held a 47.6% share. This dominance is attributed to a surge in cases of age-related disc degeneration and the broader adoption of less invasive spinal fusion methods. As more elderly individuals experience disc-related issues, the need for efficient, lower-risk treatment continues to climb. Earlier detection, patient awareness, and growing trust in minimally invasive procedures also play vital roles in boosting the segment's performance.

US Spinal Fusion Device Market generated USD 5.5 billion in 2024. This growth stems from an increasing number of geriatric patients and a high burden of spinal disorders, along with broader acceptance of innovative surgical tools and techniques. The region benefits from a robust healthcare system, advanced surgical infrastructure, and favorable adoption of modern spinal implants and navigation systems. The market was valued at USD 4.2 billion in 2021 and USD 4.7 billion in 2022, showing steady annual increases fueled by clinical demand and technological improvements.

Top companies in the Global Spinal Fusion Device Market include Stryker, Globus Medical, Medtronic, NuVasive, and DePuy Synthes. To strengthen their market presence, leading spinal fusion device manufacturers are investing heavily in robotic-assisted surgery, AI-powered navigation systems, and minimally invasive product development. These firms are expanding their product portfolios through R&D and targeted acquisitions to offer end-to-end spinal solutions. Strategic partnerships with hospitals and surgical centers are also enabling quicker adoption of advanced devices. Several companies are localizing production and strengthening distribution networks to better serve high-growth markets. Continuous surgeon training programs and digital platform integration are further enhancing procedural precision and adoption rates across geographies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Disease type trends

- 2.2.3 Surgery trends

- 2.2.4 Material type trends

- 2.2.5 End use trends

- 2.2.6 Region trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of spinal diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rise in number of trauma and injury cases

- 3.2.1.4 Rising geriatric population coupled with high demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High cost of spinal procedures

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of ambulatory surgical centers (ASCs)

- 3.2.3.2 Increasing adoption of robotic and navigation-assisted surgery

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Integration of navigation and robotic systems

- 3.5.1.2 Widespread use of PEEK and titanium cages

- 3.5.2 Emerging technologies

- 3.5.2.1 3D Printing, and advances in spinal implants

- 3.5.2.2 Smart implants with sensor integration

- 3.5.1 Current technological trends

- 3.6 Future market trends

- 3.7 Spinal Fusion Device Market, By Region, 2021 - 2034 (Units)

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East and Africa

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Value chain analysis

- 3.12 Reimbursement scenario

- 3.13 Consumer behaviour analysis

- 3.14 Comparative analysis: anterior Vs posterior surgical approach

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Thoracolumbar devices

- 5.2.1 Pedicle screws

- 5.2.2 Intervertebral body fusion device (IBFD)

- 5.2.3 Rods

- 5.2.4 Plates

- 5.2.5 Other thoracolumbar devices

- 5.3 Cervical fixation devices

- 5.3.1 Intervertebral body fusion device (IBFD)

- 5.3.2 Plates

- 5.3.3 Rods

- 5.3.4 Hooks

- 5.3.5 Other cervical devices

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Degenerative disc

- 6.3 Spinal deformity

- 6.4 Trauma and fractures

- 6.5 Spinal tumors

- 6.6 Other disease types

Chapter 7 Market Estimates and Forecast, By Surgery, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Open spine surgery

- 7.3 Minimally invasive spine surgery

Chapter 8 Market Estimates and Forecast, By Material Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Titanium

- 8.3 Polyether ether ketone (PEEK)

- 8.4 Cobalt chrome

- 8.5 Stainless steel

- 8.6 Other materials

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Orthopedic clinics

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ATEC

- 11.2 B. Braun

- 11.3 Captiva Spine

- 11.4 ChoiceSpine

- 11.5 DePuy Synthes

- 11.6 Globus Medical

- 11.7 K2M

- 11.8 Life Spine

- 11.9 Medtronic

- 11.10 NuVasive

- 11.11 Orthofix

- 11.12 Premia Spine

- 11.13 Stryker

- 11.14 Xtant Medical

- 11.15 Zimmer Biomet