|

市场调查报告书

商品编码

1801937

智慧环网柜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Smart Ring Main Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球智慧环网柜市场规模达22亿美元,预计到2034年将以8.3%的复合年增长率成长,达到49亿美元。由于对可靠、自动化中压配电系统的需求不断增长,尤其是在城市环境中,市场发展势头强劲。电网现代化投资的不断增长、再生能源的整合度不断提高以及电网日益复杂化,都在推动需求成长。智慧环网柜 (RMU) 提供增强的故障侦测、远端切换和即时资料分析功能,这使其成为现代电网基础设施的关键。提高能源效率和最大限度缩短停电时间的倡议正促使公用事业提供者大规模采用这些智慧系统。环境法规和智慧城市计画进一步推动了对节省空间、自动化和环保开关设备的需求。

2024年,气体绝缘领域占据市场主导地位,市场占有率超过73%,这主要得益于其紧凑的设计、极低的维护成本以及在有限空间内的可靠性。随着减少温室气体排放的监管压力日益加大,製造商正在开发不含SF6的替代品,例如氟腈基气体,这种替代品在维持绝缘品质的同时,也能减少对环境的影响。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 22亿美元 |

| 预测值 | 49亿美元 |

| 复合年增长率 | 8.3% |

2024年,电动智慧环网柜(RMU)占据61%的市场份额,预计到2034年将达到32亿美元。它们与SCADA系统和物联网平台整合,使公用事业公司能够执行即时诊断、远端故障隔离和自动负载管理,使其成为工业枢纽、智慧电网系统和可再生能源园区的理想选择。这些先进的环网柜使电网营运商能够避免人工干预,显着缩短停电时间,并增强动态电网环境中的营运控制。

2024年,美国智慧环网柜市场规模达3.639亿美元,占68.7%。旨在实现电网现代化的联邦计画是推动这一成长的主要动力。智慧环网柜的采用旨在提高气候适应能力、实现中压系统自动化以及支援不断发展的城市基础设施。对远端操作、故障管理和即时监控的投资,使这些设备成为各大都市和工业区电网转型议程的重要组成部分。

塑造全球智慧环网柜市场的关键参与者包括伊顿、Lucy Electric、ABB、西门子和施耐德电机。为了巩固其在智慧环网柜市场的地位,领先公司正在推行专注于先进产品开发和永续性的策略。这些策略包括创新无SF6气体绝缘技术和整合人工智慧预测性维护功能。与公用事业供应商和智慧城市规划者的合作有助于扩大城市电网的部署。各公司也正在投资数位孪生技术、网路安全增强功能和相容SCADA的平台,以提供完全整合的解决方案。透过在地化製造、强大的售后支援以及收购区域企业进行全球扩张是推动市场渗透的其他策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 供应链弹性和风险评估

- 原物料采购挑战

- 製造能力分析

- 物流及配送网络

- 地缘政治风险因素

- 进出口贸易分析

- 主要进口国

- 主要出口国

- 价格趋势分析,(美元/单位)

- 依技术

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依绝缘材料,2021 - 2034

- 主要趋势

- 气体

- 空气

- 油

- 固体介电体

- 其他的

第六章:市场规模及预测:依位置,2021 - 2034

- 主要趋势

- 2-3-4位置

- 5-6位置

- 7-10位置

- 其他的

第七章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 电动环网柜

- 非机动环网柜

第 8 章:市场规模与预测:按安装量,2021 年至 2034 年

- 主要趋势

- 室内的

- 户外的

第九章:市场规模及预测:依组件划分,2021 - 2034 年

- 主要趋势

- 开关和保险丝

- 自供电电子继电器

- 传染性

- 传统 CT/VT 感测器

- 低功率 CT/VT 感测器

- 非传染性

- 传染性

- 自动化 RTU

- UPS

- 故障通道指示器/短路指示器

- 传染性

- 传统 CT/VT 感测器

- 传统 CT/VT 感测器

- 非传染性

- 传染性

- 虚拟磁碟

第 10 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 配电设施

- 电动环网柜

- 非机动环网柜

- 产业

- 基础设施

- 电动环网柜

- 非机动环网柜

- 运输

- 其他的

第 11 章:市场规模与预测:按地区,2021 年至 2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 义大利

- 西班牙

- 法国

- 瑞典

- 希腊

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 科威特

- 南非

- 卡达

- 拉丁美洲

- 巴西

- 阿根廷

第十二章:公司简介

- ABB

- alfanar

- Bonomi Eugenio

- CG Power

- CHINT

- C-Sec

- Eaton

- Electric & Electronic

- Eswari Electricals

- HD HYUNDAI ELECTRIC

- Holley Technology

- LS ELECTRIC

- Lucy Group

- Orecco

- Rockwill

- Schneider Electric

- Siemens

- TIEPCO

- Toshiba Energy

- Zhejiang Volcano

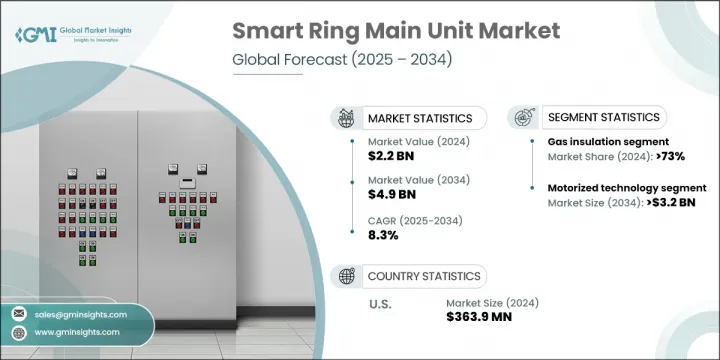

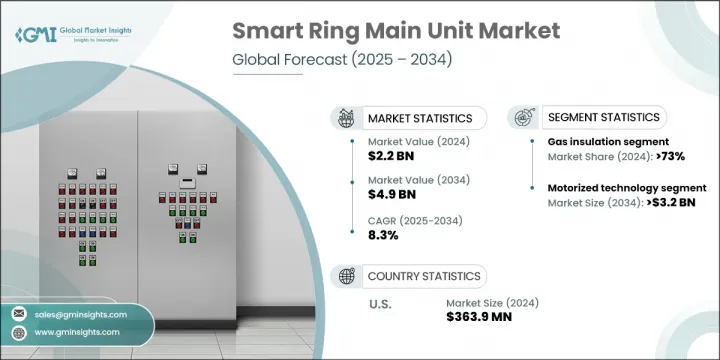

The Global Smart Ring Main Unit Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 4.9 billion by 2034. The market is gaining momentum due to rising demand for reliable and automated medium-voltage distribution systems, especially in urban environments. Growing investments in grid modernization, increased integration of renewables, and the rising complexity of electrical networks are all fueling demand. Smart RMUs offer enhanced fault detection, remote switching, and real-time data analysis, which makes them critical for modern grid infrastructure. Initiatives to enhance energy efficiency and minimize outage durations are prompting utility providers to adopt these intelligent systems at scale. Environmental regulations and smart city initiatives further boost adoption by reinforcing the need for space-saving, automated, and environmentally friendly switchgear.

The gas-insulated segment led the market in 2024 with over 73% share, largely due to its compact design, minimal maintenance, and reliability in constrained spaces. With increasing regulatory pressure to reduce greenhouse gas emissions, manufacturers are developing SF6-free alternatives like fluoronitrile-based gases that preserve insulation quality while reducing environmental impact.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 8.3% |

The Motorized smart RMUs held a 61% share in 2024 and is projected to reach USD 3.2 billion by 2034. Their integration with SCADA systems and IoT platforms enables utilities to perform real-time diagnostics, remote fault isolation, and automated load management, making them ideal for industrial hubs, smart grid systems, and renewable parks. These advanced RMUs allow grid operators to avoid manual intervention, significantly reducing outage durations and enhancing operational control in dynamic grid environments.

United States Smart Ring Main Unit Market generated USD 363.9 million in 2024, with a 68.7% share. Federal programs aimed at modernizing the electrical grid are the primary drivers of this growth. Smart RMUs are adopted to improve climate resilience, automate medium-voltage systems, and support evolving urban infrastructures. Investments in remote operability, fault management, and real-time monitoring have made these units an essential part of the grid transformation agenda across major metropolitan and industrial regions.

Key players shaping this Global Smart Ring Main Unit Market include Eaton, Lucy Electric, ABB, Siemens, and Schneider Electric. To strengthen their position in the smart ring main unit market, leading companies are pursuing strategies focused on advanced product development and sustainability. These include innovating SF6-free gas insulation technologies and integrating AI-powered predictive maintenance features. Collaborations with utility providers and smart city planners help expand deployment across urban grids. Companies are also investing in digital twin technologies, cybersecurity enhancements, and SCADA-compatible platforms to offer fully integrated solutions. Global expansion through localized manufacturing, robust after-sales support, and acquisitions of regional players are additional tactics driving market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Insulation trends

- 2.1.3 Position trends

- 2.1.4 Technology trends

- 2.1.5 Installation trends

- 2.1.6 Component trends

- 2.1.7 Application trends

- 2.1.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Supply chain resilience and risk assessment

- 3.3.1 Raw material sourcing challenges

- 3.3.2 Manufacturing capacity analysis

- 3.3.3 Logistics and distribution networks

- 3.3.4 Geopolitical risk factors

- 3.4 Import export trade analysis

- 3.4.1 Key importing countries

- 3.4.2 Key exporting countries

- 3.5 Price trend analysis, (USD/Unit)

- 3.5.1 By technology

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.2 Industry pitfalls & challenges

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.8.1 Bargaining power of suppliers

- 3.8.2 Bargaining power of buyers

- 3.8.3 Threat of new entrants

- 3.8.4 Threat of substitutes

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Insulation, 2021 - 2034 (‘000 Units & USD Million)

- 5.1 Key trends

- 5.2 Gas

- 5.3 Air

- 5.4 Oil

- 5.5 Solid-Di-Electric

- 5.6 Others

Chapter 6 Market Size and Forecast, By Position, 2021 - 2034 (‘000 Units & USD Million)

- 6.1 Key trends

- 6.2 2-3-4 Position

- 6.3 5-6 Position

- 6.4 7-10 Position

- 6.5 Others

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (‘000 Units & USD Million)

- 7.1 Key trends

- 7.2 Motorized RMU

- 7.3 Non - motorized RMU

Chapter 8 Market Size and Forecast, By Installation, 2021 - 2034 (‘000 Units & USD Million)

- 8.1 Key trends

- 8.2 Indoor

- 8.3 Outdoor

Chapter 9 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Switch & Fuses

- 9.3 Self-Powered Electronic Relay

- 9.3.1 Communicable

- 9.3.1.1 Conventional CT/VT Sensors

- 9.3.1.2 Low Power CT/VT Sensors

- 9.3.2 Non-Communicable

- 9.3.1 Communicable

- 9.4 Automations RTU’s

- 9.5 UPS

- 9.6 Fault Passage Indicators/Short Circuit Indicators

- 9.6.1 Communicable

- 9.6.1.1 Conventional CT/VT Sensors

- 9.6.1.2 Conventional CT/VT Sensors

- 9.6.2 Non-Communicable

- 9.6.1 Communicable

- 9.7 VDIS

Chapter 10 Market Size and Forecast, By Application, 2021 - 2034 (‘000 Units & USD Million)

- 10.1 Key trends

- 10.2 Distribution Utilities

- 10.2.1 Motorized RMU

- 10.2.2 Non - Motorized RMU

- 10.3 Industries

- 10.4 Infrastructure

- 10.4.1 Motorized RMU

- 10.4.2 Non - Motorized RMU

- 10.5 Transportation

- 10.6 Others

Chapter 11 Market Size and Forecast, By Region, 2021 - 2032 (‘000 Units & USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 Italy

- 11.3.3 Spain

- 11.3.4 France

- 11.3.5 Sweden

- 11.3.6 Greece

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Middle East & Africa

- 11.5.1 Saudi Arabia

- 11.5.2 UAE

- 11.5.3 Kuwait

- 11.5.4 South Africa

- 11.5.5 Qatar

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Argentina

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 alfanar

- 12.3 Bonomi Eugenio

- 12.4 CG Power

- 12.5 CHINT

- 12.6 C-Sec

- 12.7 Eaton

- 12.8 Electric & Electronic

- 12.9 Eswari Electricals

- 12.10 HD HYUNDAI ELECTRIC

- 12.11 Holley Technology

- 12.12 LS ELECTRIC

- 12.13 Lucy Group

- 12.14 Orecco

- 12.15 Rockwill

- 12.16 Schneider Electric

- 12.17 Siemens

- 12.18 TIEPCO

- 12.19 Toshiba Energy

- 12.20 Zhejiang Volcano