|

市场调查报告书

商品编码

1801941

金属切削工具市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Metal Cutting Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

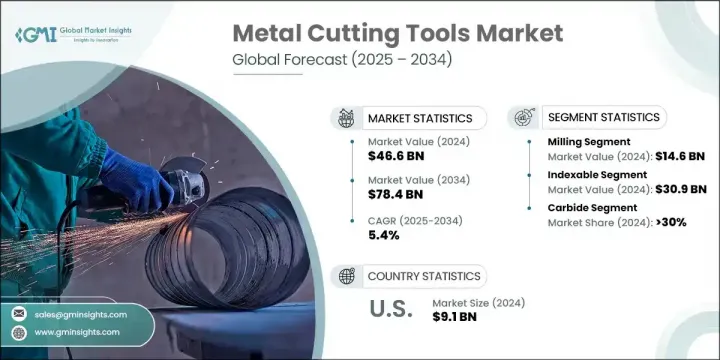

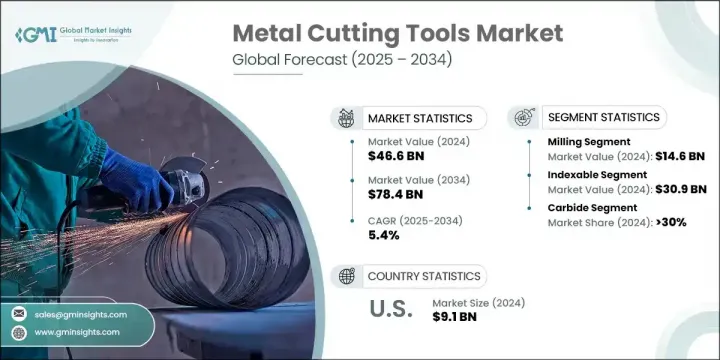

2024 年全球金属切削刀具市场价值为 466 亿美元,预计到 2034 年将以 5.4% 的复合年增长率增长至 784 亿美元。随着尖端 CNC 和多轴加工不断发展,金属切削刀具从简单的独立设备演变为智慧互联的製造系统,市场发展势头强劲。随着物联网整合和自适应工具变得越来越普遍,现代机械师需要将自动化能力与资料分析和高精度技能相结合。向智慧製造环境的转变推动了对高级技术培训和持续技能提升的需求。亚太地区凭藉着强大的製造业基础和政府主导的工业扩张,引领全球市场。该地区对 CNC 和智慧加工平台的快速采用正在提高各行各业的生产力并简化产出。

尤其是在日本、印度和中国等国家,汽车和电子产品生产的大量投资显着推动了对精密工具的需求。旨在促进工业现代化的政策激励措施进一步加速了製造工厂的设备升级。铣削刀具凭藉其适应性强、材料去除率高以及与数控系统和多轴机床的兼容性,在金属切削领域占据主导地位。这些刀具广泛应用于需要粗加工和精加工的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 466亿美元 |

| 预测值 | 784亿美元 |

| 复合年增长率 | 5.4% |

铣削刀具在2024年的市场规模为146亿美元,预计到2034年将以6.6%的复合年增长率成长。铣削刀具凭藉其精度以及处理复杂形状和表面光洁度的能力,在汽车和工业领域得到了广泛的应用,这推动了其主导。铣削兼具灵活性和功能性,使其成为一次加工和二次加工过程中不可或缺的环节。

可转位刀具在2024年创造了309亿美元的市场规模,预计在2025-2034年期间的复合年增长率将达到5.8%。这类刀具的突出之处在于其采用可更换刀片,刀片可旋转以露出新的切削麵,从而能够减少停机时间和成本。这种设计无需频繁重磨和设置,使其成为大规模生产场景中连续高速加工的理想选择。重型设备製造和通用工程等行业受益于其耐用性和始终如一的性能。

美国金属切削刀具市场占87.5%的市场份额,2024年市场规模达91亿美元。该国坚实的製造业基础设施和CNC工具机的广泛应用持续推动市场扩张。在工业自动化趋势以及国防和汽车等行业强劲需求的推动下,美国仍然是精密刀具的主要生产国和主要消费国。监管支持和出口竞争力也为美国稳固的市场地位做出了贡献。

影响全球金属切削刀具市场的关键公司包括那智不二越 (Nachi-Fujikoshi)、艾默生 (Emerson)、瓦尔特 (Walter)、史丹利百得 (Stanley Black & Decker)、森拉天时 (Ceratizit)、山高工具 (Seco Tools)、特固合金 (TTopy)、Pintae (Thiae)、硬瓷质合金设Hardmetal)、博世 (Bosch)、Guhring、山特维克 (Sandvik)、OSG、阿特拉斯·科普柯 (Atlas Copco) 和马帕尔 (Mapal)。为了巩固其地位,金属切削刀具市场的公司正在大力投资研发,以开发可提高精度、耐用性和加工速度的下一代刀具。他们正致力于整合人工智慧 (AI) 和数位监控,以增强刀俱生命週期管理和效能分析。领先的製造商正在扩大生产能力,并与当地企业组成合资企业,以进入新兴市场。另一项核心策略是实现产品组合多样化,包括智慧、可转位和节能切削刀具。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特五力分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- MEA

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按工具,2021-2034

- 主要趋势

- 可转位

- 坚硬的

第六章:市场估计与预测:依工艺,2021-2034

- 主要趋势

- 铣削

- 钻孔

- 无聊的

- 转弯

- 研磨

- 其他的

第七章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 碳化物

- 高速钢

- 不銹钢

- 陶瓷

- 其他的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 汽车

- 航太与国防

- 石油和天然气

- 普通加工

- 医疗的

- 电气和电子产品

- 其他的

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Atlas Copco

- Bosch

- Ceratizit

- Emerson

- Guhring

- Iscar

- Kyocera

- Mapal

- Nachi-Fujikoshi

- OSG

- Sandvik

- Seco Tools

- Stanley Black & Decker

- Sumitomo Electric Hardmetal

- TaeguTec

- Walter

The Global Metal Cutting Tools Market was valued at USD 46.6 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 78.4 billion by 2034. The market is witnessing strong momentum as cutting-edge CNC and multi-axis machining continue to evolve metal cutting tools from simple standalone devices into smart, interconnected manufacturing systems. As IoT integration and adaptive tooling become more prevalent, modern-day machinists are now required to merge automation proficiency with data analytics and high-precision skills. This shift toward intelligent manufacturing environments is pushing demand for advanced technical training and continuous upskilling. Asia-Pacific leads the global market, propelled by a robust manufacturing base and government-led industrial expansion. The region's quick uptake of CNC and intelligent machining platforms is enhancing productivity and streamlining output across industries.

Heavy investments in automotive and electronics production, especially in countries like Japan, India, and China, are significantly boosting demand for precision tooling. Policy-driven incentives aimed at industrial modernization are further accelerating equipment upgrades across manufacturing plants. Milling tools dominate the metal cutting segment, owing to their adaptability, high material removal rates, and compatibility with CNC systems and multi-axis machines. These tools are widely deployed in applications that require both rough cutting and fine finishing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.6 Billion |

| Forecast Value | $78.4 Billion |

| CAGR | 5.4% |

Milling tools generated USD 14.6 billion in 2024 and are projected to grow at a CAGR of 6.6% through 2034. Their widespread use in automotive and industrial sectors drives this dominance, thanks to their accuracy and ability to handle intricate shapes and surface finishes. The combination of flexibility and functionality makes milling essential for both primary and secondary machining processes.

The Indexable tools generated USD 30.9 billion in 2024 and are expected to register a CAGR of 5.8% during 2025-2034. These tools stand out due to their ability to reduce downtime and costs by using replaceable inserts that can be rotated to expose fresh cutting surfaces. This design eliminates the need for frequent regrinding and setup, making indexable tools ideal for continuous, high-speed machining in mass production scenarios. Sectors like heavy equipment manufacturing and general engineering benefit from their durability and consistent performance.

United States Metal Cutting Tools Market held an 87.5% share, generating USD 9.1 billion in 2024. The country's solid manufacturing infrastructure and widespread adoption of CNC machinery continue to fuel market expansion. Backed by industrial automation trends and strong demand from sectors such as defense and automotive, the US remains both a leading producer and a major consumer of precision tooling. Regulatory support and export competitiveness also contribute to the country's solid market foothold.

Key companies shaping the Global Metal Cutting Tools Market include Nachi-Fujikoshi, Emerson, Walter, Stanley Black & Decker, Ceratizit, Seco Tools, TaeguTec, Kyocera, Iscar, Sumitomo Electric Hardmetal, Bosch, Guhring, Sandvik, OSG, Atlas Copco, and Mapal. To strengthen their presence, companies operating in the metal cutting tools market are investing heavily in R&D to develop next-generation tools that improve precision, durability, and machining speed. Focused efforts are being made to integrate AI and digital monitoring to enhance tool lifecycle management and performance analytics. Leading manufacturers are expanding production capabilities and forming joint ventures with local players to gain access to emerging markets. Diversifying product portfolios to include smart, indexable, and energy-efficient cutting tools is another core strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Tool

- 2.2.3 Process

- 2.2.4 Material

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Tool, 2021-2034 ($Bn, Million Units)

- 5.1 Key trends

- 5.2 Indexable

- 5.3 Solid

Chapter 6 Market Estimates & Forecast, By Process, 2021-2034 ($Bn, Million Units)

- 6.1 Key trends

- 6.2 Milling

- 6.3 Drilling

- 6.4 Boring

- 6.5 Turning

- 6.6 Grinding

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Material, 2021-2034 ($Bn, Million Units)

- 7.1 Key trends

- 7.2 Carbide

- 7.3 High speed steel

- 7.4 Stainless steel

- 7.5 Ceramics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Million Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace & defense

- 8.4 Oil & gas

- 8.5 General machining

- 8.6 Medical

- 8.7 Electrical & electronics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Million Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Atlas Copco

- 11.2 Bosch

- 11.3 Ceratizit

- 11.4 Emerson

- 11.5 Guhring

- 11.6 Iscar

- 11.7 Kyocera

- 11.8 Mapal

- 11.9 Nachi-Fujikoshi

- 11.10 OSG

- 11.11 Sandvik

- 11.12 Seco Tools

- 11.13 Stanley Black & Decker

- 11.14 Sumitomo Electric Hardmetal

- 11.15 TaeguTec

- 11.16 Walter