|

市场调查报告书

商品编码

1801942

同步发电机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Synchronous Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

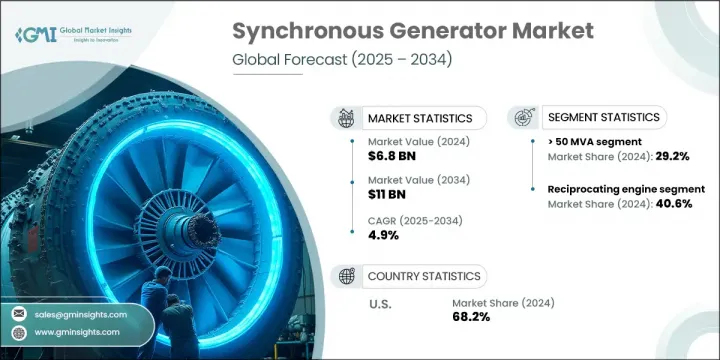

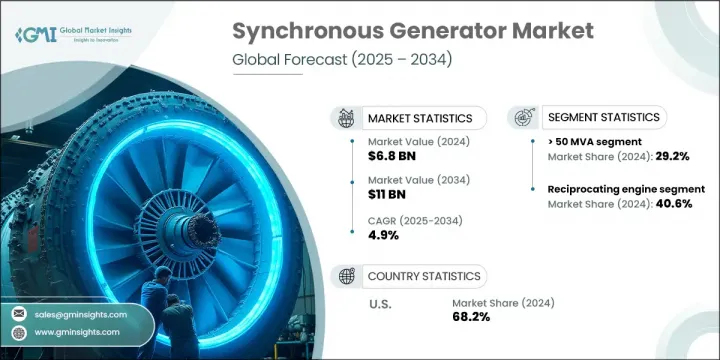

2024年,全球同步发电机市场规模达68亿美元,预计2034年将以4.9%的复合年增长率成长,达到110亿美元。对节能技术的日益重视以及对高性能、可靠电力基础设施日益增长的需求是推动市场扩张的关键因素。再生能源专案的成长,加上绝缘和材料科学的进步,持续塑造该产业的发展。同步发电机是现代电力系统不可或缺的一部分,提供稳定的电压和频率,以支援电网的稳定性。它们的应用正变得越来越多样化,从传统的备用电源扩展到分散式和尖峰负载能源系统中的主动元件。

随着全球电力需求激增,配备物联网功能的智慧发电机系统的整合正在改变营运模式。这些新一代发电机支援远端诊断、预测性维护和能源优化——所有这些在现代能源框架中都至关重要。人们对能源可靠性日益增长的担忧,加上老化基础设施的升级和电网中断频率的上升,也加速了这些系统的采用。对永续性和法规遵循的日益重视,推动了设计、控制功能和智慧连接方面的创新,使这些机器在更广泛的行业和应用中成为不可或缺的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 68亿美元 |

| 预测值 | 110亿美元 |

| 复合年增长率 | 4.9% |

发电机细分市场在2024年占据40.6%的市场份额,预计到2034年将以超过4.5%的复合年增长率成长。发电机性能强劲、维护简便、输出可靠,使其成为各种营运场景的理想选择。此细分市场的持续相关性在于其适应性强,并具有成本效益,可满足各种最终用户的需求。

预计到2034年,额定功率小于等于5 MVA的机组将以5%的复合年增长率增长,这得益于其在分散式电力系统、备用系统以及中小型工业应用中日益增长的使用。智慧控制系统、升级的冷却功能和远端监控介面等增强功能正在帮助其在现代电力生态系统中发挥更大的作用。

2024年,亚太同步发电机市场占37.5%的市占率。工业活动的加速发展,加上对能源发电基础设施的大规模投资,正在推动该地区的成长。向分散式发电和智慧微电网的转变正在进一步增强成长动力,尤其是在地方政府推出需求响应计画并投资于电网弹性建设的情况下。

全球同步发电机市场的主要参与者包括 TMEIC、POWERTEC GENERATOR SYSTEM、西门子能源、明电舍、卧龙电气集团、ABB、Alconz、PARTZSCH 集团、施耐德电机、WEG、TD Power Systems、EvoTec Power Generation、Ingeteam、Marelli Motori、Elin Motoren、GEN、EvoTec Power Gene、Ingeteam、Marelli Motori、Eliner Motor ELEKTROMOTOREN、Ansaldo Energia、Koncar、CG Power & Industrial Solutions 和 Mecc Alte。同步发电机市场的领先公司正在大力投资先进产品开发,旨在透过智慧连接和物联网系统实现数位转型。许多公司正在透过加强本地生产能力和服务网络来扩大其地理覆盖范围,尤其是在高成长市场。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原料可用性和采购分析

- 製造能力评估

- 供应链弹性和风险因素

- 配电网路分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

- 同步发电机成本结构分析

- 新兴机会和趋势

- 利用物联网技术进行数位转型

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪表板

- 策略倡议

- 重要伙伴关係与合作

- 重大併购活动

- 产品创新与发布

- 市场扩张策略

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依主要推动因素,2021 - 2034 年

- 主要趋势

- 瓦斯涡轮机

- 蒸汽涡轮机

- 往復式发动机

- 其他的

第六章:市场规模及预测:依阶段,2021 - 2034

- 主要趋势

- 单相

- 三相

第七章:市场规模及预测:依功率等级,2021 - 2034

- 主要趋势

- ≤5兆伏安

- > 5 兆伏安 - 15 兆伏安

- > 15 兆伏安 - 30 兆伏安

- > 30 兆伏安 - 50 兆伏安

- > 50 兆伏安

第 8 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 工业的

- 公用事业

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 马来西亚

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 埃及

- 南非

- 奈及利亚

- 土耳其

- 约旦

- 拉丁美洲

- 巴西

- 秘鲁

- 智利

- 阿根廷

第十章:公司简介

- ABB

- Alconza

- ANDRITZ

- Ansaldo Energia

- CG Power & Industrial Solutions

- Elin Motoren

- EvoTec Power Generation

- GE Vernova

- Ingeteam

- Jeumont Electric

- Koncar

- Marelli Motori

- Mecc Alte

- Meidensha Corporation

- MENZEL ELEKTROMOTOREN

- Nidec

- PARTZSCH Group

- POWERTEC GENERATOR SYSTEM

- Schneider Electric

- Siemens Energy

- TD Power Systems

- TMEIC

- WEG

- Wolong Electric Group

The Global Synchronous Generator Market was valued at USD 6.8 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 11 billion by 2034. Increasing emphasis on energy-efficient technologies and the rising need for high-performance, reliable power infrastructure are key factors fueling market expansion. Growth in renewable energy projects, combined with advancements in insulation and material science, continues to shape the evolution of this sector. Synchronous generators are integral to modern power systems, offering consistent voltage and frequency that support the stability of electrical grids. Their use is becoming more dynamic, extending from conventional backup roles to active components in distributed and peak-load energy systems.

As global power demands surge, the integration of intelligent generator systems equipped with IoT features is transforming operational models. These next-generation generators support remote diagnostics, predictive maintenance, and energy optimization-all crucial in modern energy frameworks. Escalating concerns over energy reliability, coupled with upgrades to aging infrastructure and greater frequency of grid disruptions, are also accelerating the adoption of these systems. Growing emphasis on sustainability and regulatory compliance is pushing innovation in design, control features, and smart connectivity, making these machines indispensable across a wider range of industries and applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $11 Billion |

| CAGR | 4.9% |

The generators segment accounted for a 40.6% share in 2024 and is projected to grow at over 4.5% CAGR by 2034. Their strong performance, ease of maintenance, and dependable output make them ideal for a range of operational scenarios. The segment's continued relevance lies in its adaptability and cost-effectiveness for diverse end-user requirements.

The Units with a power rating of <= 5 MVA are expected to grow at a CAGR of 5% through 2034, driven by their increasing use in decentralized power setups, backup systems, and small to mid-sized industrial applications. Enhancements such as intelligent control systems, upgraded cooling features, and remote monitoring interfaces are helping to expand their role in modern power ecosystems.

Asia Pacific Synchronous Generator Market held a 37.5% share in 2024. Accelerating industrial activity, together with large-scale investment in energy generation infrastructure, is fostering growth in the region. The shift toward distributed generation and smart microgrids is adding further momentum, especially as local governments roll out demand-response programs and invest in power grid resilience.

Key players in the Global Synchronous Generator Market include TMEIC, POWERTEC GENERATOR SYSTEM, Siemens Energy, Meidensha Corporation, Wolong Electric Group, ABB, Alconz, PARTZSCH Group, Schneider Electric, WEG, TD Power Systems, EvoTec Power Generation, Ingeteam, Marelli Motori, Elin Motoren, GE Vernova, Nidec, Jeumont Electric, ANDRITZ, MENZEL ELEKTROMOTOREN, Ansaldo Energia, Koncar, CG Power & Industrial Solutions, and Mecc Alte. Leading companies in the synchronous generator market are investing heavily in advanced product development, targeting digital transformation with smart connectivity and IoT-enabled systems. Many firms are expanding their geographic footprint by strengthening local production capabilities and service networks, especially in high-growth markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Raw material availability & sourcing analysis

- 3.1.1.2 Manufacturing capacity assessment

- 3.1.1.3 Supply chain resilience & risk factors

- 3.1.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of synchronous generator

- 3.8 Emerging opportunities & trends

- 3.9 Digital transformation with IoT technologies

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Prime Mover, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Gas turbine

- 5.3 Steam turbine

- 5.4 Reciprocating engine

- 5.5 Others

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 ≤ 5 MVA

- 7.3 > 5 MVA - 15 MVA

- 7.4 > 15 MVA - 30 MVA

- 7.5 > 30 MVA - 50 MVA

- 7.6 > 50 MVA

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Industrial

- 8.3 Utility

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Russia

- 9.3.4 UK

- 9.3.5 Italy

- 9.3.6 Spain

- 9.3.7 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.4.6 New Zealand

- 9.4.7 Malaysia

- 9.4.8 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Egypt

- 9.5.5 South Africa

- 9.5.6 Nigeria

- 9.5.7 Turkey

- 9.5.8 Jordan

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Peru

- 9.6.3 Chile

- 9.6.4 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Alconza

- 10.3 ANDRITZ

- 10.4 Ansaldo Energia

- 10.5 CG Power & Industrial Solutions

- 10.6 Elin Motoren

- 10.7 EvoTec Power Generation

- 10.8 GE Vernova

- 10.9 Ingeteam

- 10.10 Jeumont Electric

- 10.11 Koncar

- 10.12 Marelli Motori

- 10.13 Mecc Alte

- 10.14 Meidensha Corporation

- 10.15 MENZEL ELEKTROMOTOREN

- 10.16 Nidec

- 10.17 PARTZSCH Group

- 10.18 POWERTEC GENERATOR SYSTEM

- 10.19 Schneider Electric

- 10.20 Siemens Energy

- 10.21 TD Power Systems

- 10.22 TMEIC

- 10.23 WEG

- 10.24 Wolong Electric Group