|

市场调查报告书

商品编码

1801943

硬式内视镜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Rigid Endoscopes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

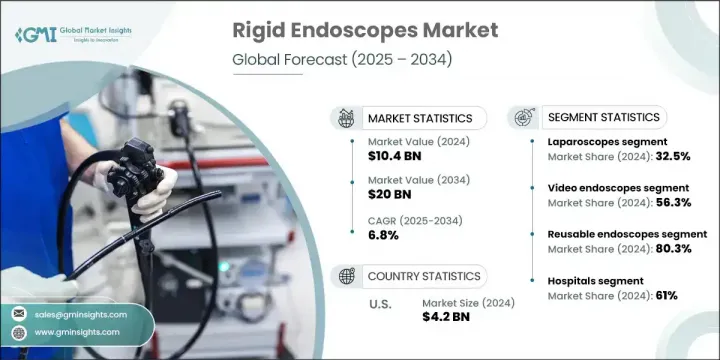

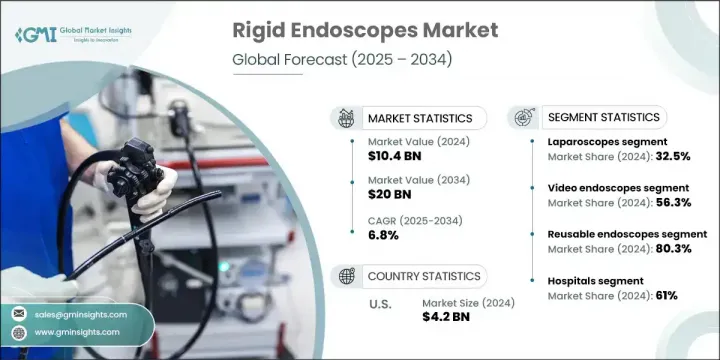

2024 年全球硬性内视镜市场规模达 104 亿美元,预计到 2034 年将以 6.8% 的复合年增长率成长至 200 亿美元。市场扩张的主要驱动力是慢性病发病率上升和全球人口老化。硬式内视镜对于执行微创手术至关重要,有助于诊断和治疗各种疾病,包括呼吸系统併发症、消化系统疾病和耳鼻喉疾病。这些设备可提供清晰的影像,广泛应用于涉及腹腔、关节、生殖系统和膀胱的手术。由于恢復速度更快、併发症更少、住院时间更短,患者对微创技术的偏好日益增加,这对刺激需求发挥至关重要的作用。此外,高清影像和手术导航工具的不断进步进一步巩固了其在门诊和住院护理中的应用。

2024 年,腹腔镜类别的份额将达到 32.5%,这得益于胆囊切除术、疝气修补术和妇科手术等可最大程度减轻术后疼痛并缩短住院时间的手术的日益普及。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 104亿美元 |

| 预测值 | 200亿美元 |

| 复合年增长率 | 6.8% |

2024年,视讯内视镜市场占据56.3%的市场份额,这得益于其提供即时高清可视化的能力,从而提高了手术精度和临床记录能力。这些工具还能促进手术过程中的团队合作,因此在外科部门备受青睐。

2024年,美国硬式内视镜市场规模达42亿美元,这得益于强大的医疗基础设施和微创手术技术的广泛应用。完善的报销框架、日益增长的老龄人口以及早期诊断筛检的普及,持续支撑着该地区硬性内视镜市场的需求。不断增长的手术量、先进的影像创新以及全国对门诊手术的重视,共同支撑着这一增长势头。美国领先的製造商和医疗技术创新者也正在向内视镜研发和自动化领域投入大量资金。

影响硬式内视镜市场格局的顶级参与者包括 Stryker、Olympus Corporation、Richard Wolf、Karl Storz、Smith & Nephew、Fujifilm、Scholly Fiberoptic、Arthrex、PENTAX Medical、ConMed、B. Braun、Henke-Sass、Wolf、Cook Medical、XION GmbH、Boston Scient 和 Am硬性内视镜市场公司采用的关键策略包括透过人工智慧辅助成像、人体工学仪器设计和整合视讯系统来推进产品创新,以提高手术精度。合併、策略合作和收购是扩大产品组合和进入尚未开发的地理区域的常见方式。参与者正在大力投资研发,以增强微创平台并探索机器人内视镜技术。许多公司也正在加强售后服务网络并参与医生培训计划以推动采用。与外科中心和机构的合作支持早期临床采用并提高全球市场渗透率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率不断上升

- 技术进步

- 微创手术的采用率不断上升

- 不断增强的健康意识和对早期诊断的需求

- 产业陷阱与挑战

- 设备成本高

- 患者不适和手术限制的风险

- 市场机会

- 门诊及流动手术中心(ASC)的扩建

- 医疗基础设施不断改善的新兴市场

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前的技术趋势

- 新兴技术

- 报销场景

- 2024年定价分析

- 未来市场趋势

- 市场进入策略

- 管道分析

- 差距分析

- 波特的分析

- PESTEL分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 腹腔镜

- 关节镜

- 膀胱镜

- 耳鼻喉内视镜

- 支气管镜

- 输尿管镜

- 子宫腔镜

- 其他产品类型

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 传统内视镜

- 视讯内视镜

- 光纤内视镜

第七章:市场估计与预测:按可用性,2021 - 2034 年

- 主要趋势

- 可重复使用的内视镜

- 免洗内视镜

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Ambu

- Arthrex

- B. Braun

- Boston Scientific

- ConMed

- Cook

- Fujifilm

- Henke-Sass Wolf

- Olympus

- PENTAX Medical

- Richard Wolf

- Scholly Fiberoptic

- Smith & Nephew

- Storz

- Stryker

- XION medical

The Global Rigid Endoscopes Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 20 billion by 2034. Market expansion is largely driven by the rising incidence of chronic health issues and an aging global population. Rigid endoscopes are essential for performing minimally invasive procedures that aid in diagnosing and treating a wide range of conditions, including respiratory complications, digestive system ailments, and ENT disorders. These devices deliver crystal-clear imaging and are widely applied in surgeries involving the abdominal cavity, joints, reproductive system, and urinary bladder. Increasing patient preference for minimally invasive techniques-because of faster recovery, fewer complications, and lower hospitalization times-is playing a vital role in boosting demand. Additionally, ongoing advancements in high-definition imaging and surgical navigation tools further reinforce their adoption in both outpatient and inpatient care.

The laparoscopes category held 32.5% share in 2024, fueled by the expanding popularity of procedures like gallbladder removal, hernia repair, and gynecological surgeries that minimize post-operative pain and shorten hospital stays.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $20 Billion |

| CAGR | 6.8% |

The video endoscopes segment held 56.3% share in 2024, driven by their ability to deliver real-time, high-definition visualization, which enhances surgical precision and clinical documentation. These tools also facilitate team collaboration during operations, making them highly preferred across surgical departments.

U.S. Rigid Endoscopes Market generated USD 4.2 billion in 2024, supported by robust healthcare infrastructure and wide-scale adoption of minimally invasive surgical techniques. Strong reimbursement frameworks, a growing elderly population, and an uptick in early diagnostic screenings continue to bolster regional demand. Rising surgical volumes, advanced imaging innovations, and a focus on outpatient procedures across the country are sustaining this momentum. Leading manufacturers and medtech innovators in the U.S. are also channeling substantial investments into endoscopic R&D and automation.

Top players shaping the Rigid Endoscopes Market landscape include Stryker, Olympus Corporation, Richard Wolf, Karl Storz, Smith & Nephew, Fujifilm, Scholly Fiberoptic, Arthrex, PENTAX Medical, ConMed, B. Braun, Henke-Sass, Wolf, Cook Medical, XION GmbH, Boston Scientific, and Ambu A/S. Key strategies adopted by companies in the rigid endoscopes market include advancing product innovation through AI-assisted imaging, ergonomic instrument design, and integrated video systems to improve surgical precision. Mergers, strategic partnerships, and acquisitions are common to expand product portfolios and enter untapped geographic areas. Players are heavily investing in R&D to enhance minimally invasive platforms and explore robotic endoscopic technologies. Many are also strengthening after-sales service networks and engaging in physician training programs to drive adoption. Collaborations with surgical centers and institutions support early clinical adoption and increase market penetration globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Technology trends

- 2.2.3 Usability trends

- 2.2.4 End use trends

- 2.2.5 Region trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic conditions

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rising adoption of minimally invasive surgeries

- 3.2.1.4 Increasing health awareness and demand for early-stage diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High device cost

- 3.2.2.2 Risk of patient discomfort and procedural limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and ambulatory surgical centers (ASCs)

- 3.2.3.2 Emerging markets with improving healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis, 2024

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East and Africa

- 3.8 Future market trends

- 3.9 Go-to-market strategy

- 3.10 Pipeline analysis

- 3.11 Gap analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Laparoscopes

- 5.3 Arthroscopes

- 5.4 Cystoscopes

- 5.5 ENT endoscopes

- 5.6 Bronchoscopes

- 5.7 Ureteroscopes

- 5.8 Hysteroscopes

- 5.9 Other product types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Conventional endoscopes

- 6.3 Video endoscopes

- 6.4 Fiber-optic endoscopes

Chapter 7 Market Estimates and Forecast, By Usability, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 Reusable endoscopes

- 7.3 Disposable endoscopes

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ambu

- 10.2 Arthrex

- 10.3 B. Braun

- 10.4 Boston Scientific

- 10.5 ConMed

- 10.6 Cook

- 10.7 Fujifilm

- 10.8 Henke-Sass Wolf

- 10.9 Olympus

- 10.10 PENTAX Medical

- 10.11 Richard Wolf

- 10.12 Scholly Fiberoptic

- 10.13 Smith & Nephew

- 10.14 Storz

- 10.15 Stryker

- 10.16 XION medical