|

市场调查报告书

商品编码

1801944

生物医学冰箱及冷冻机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Biomedical Refrigerators and Freezers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

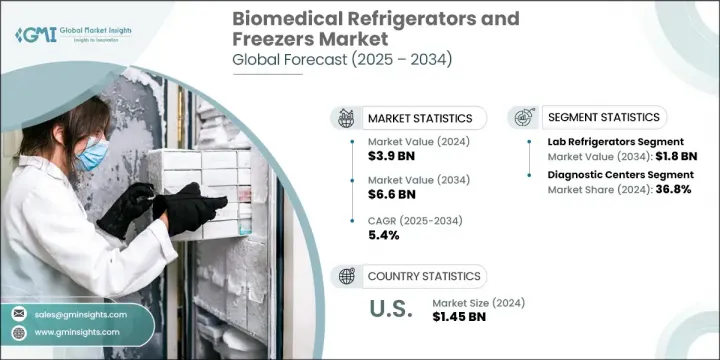

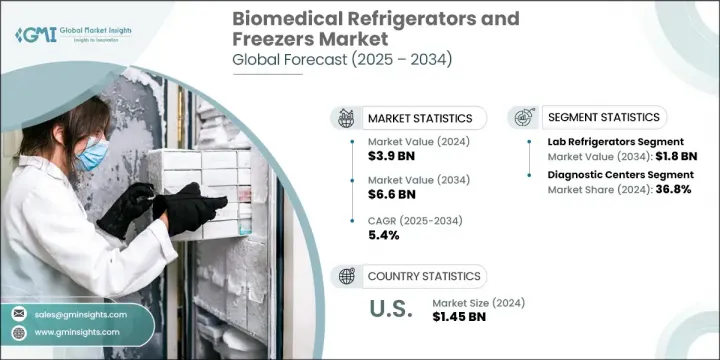

2024年,全球生物医学冰箱和冷冻柜市场规模达39亿美元,预计到2034年将以5.4%的复合年增长率成长,达到66亿美元。市场成长主要得益于技术创新、生物製药业蓬勃发展、器官移植活动增加以及政府加强对研究和临床试验的资助力度。这些驱动因素共同推动了已开发地区和发展中地区的强劲需求。生物医学冰箱和冷冻柜是医疗保健、製药和研究环境中的关键储存解决方案。这些系统旨在保持精确的温度控制,以维护药物、疫苗、生物样本和实验室试剂的完整性和稳定性。

全球器官移植需求的成长进一步凸显了这些系统的重要性,因为它们有助于在移植前保存捐赠的器官和组织。确保这些敏感材料的品质直接影响患者的治疗效果和科学研究的成功。随着医学进步,尤其是生物技术领域的进步,对可靠冷藏系统的需求日益凸显。生物医学冷藏设备在实验室、诊断中心和医疗机构中,在维护法规合规性、营运效率和产品安全方面,始终发挥着至关重要的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 66亿美元 |

| 复合年增长率 | 5.4% |

实验室冰箱细分市场在2024年创收11亿美元,预计2034年将达到18亿美元,复合年增长率为5.7%。此细分市场受益于实验室环境对精确温控解决方案日益增长的需求。科研活动的扩展和药品开发的增加,推动实验室采用先进的冷冻设备。这些系统通常在2°C至8°C之间运行,为安全储存试剂、样品以及对测试和开发过程至关重要的化合物等温度敏感材料提供了可靠的选择。

2024年,诊断中心的市占率最高,达36.8%。这些机构严重依赖生物医学冷藏设备来处理日益增长的诊断测试和生物样本。随着预防性医疗保健越来越受到重视,以及人们对早期疾病检测的认识不断提高,对可靠样本储存的需求也日益增长。生物医学製冷系统可确保在整个检测週期中保持样本质量,从而支持这些中心的效率和诊断准确性。

2024年,美国生物医学冰箱和冷冻机市场产值达14.5亿美元。多种因素加速了这一成长,包括生命科学领域的投资增加、製药和生物技术生产设施的扩建,以及监管机构更严格的品质控制要求。个人化医疗、疫苗研究和基因组学等领域的活跃度不断提升,推动了对先进实验室设备的需求。这大大促进了全美研发机构和商业医疗机构对高性能冷冻系统的需求。

推动全球生物医学冰箱和冷冻机市场发展的关键参与者包括 NuAire、PHC Corporation、BINDER、Aegis Scientific、Eppendorf、Lab Research Products、Thermo Fisher Scientific、Azbil Corporation、Stirling Ultracold、Helmer Scientific、So-Low Environmental Equipment、PowerOS Products.生物医学冰箱和冷冻机市场的领先製造商正优先考虑产品创新、全球扩张和先进的温度控制技术,以巩固其市场地位。各公司正大力投资研发节能、环保且支援物联网的冷冻设备,提供远端监控和温度追踪功能。为了扩大全球影响力,关键参与者正在扩大分销网络,并与医疗保健提供者和研究机构建立策略合作伙伴关係。一些公司也利用自动化和人工智慧来提高设备效能、最大限度地减少停机时间并满足法规遵循要求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 政府对研究活动和临床试验的支持不断增加

- 生物医学冰箱和冷冻机的技术进步

- 老年人口基数不断增加

- 生物製药和器官移植的需求不断增长

- 产业陷阱与挑战

- 大量本地企业提供价格实惠的翻新设备

- 冰箱和冰柜释放的氢氟碳化物对环境造成有害影响

- 生物医学冰箱和冷冻柜的购买成本、维护成本和能源成本高

- 市场机会

- 新兴市场的扩张

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术进步

- 当前的技术趋势

- 新兴技术

- 供应链和分销分析

- 2024年定价分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 血浆冷冻机

- 血库冰箱

- 实验室冰箱

- 实验室冰柜

- 超低温冷冻机

- 速冻机

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 血库

- 药局

- 医院

- 研究实验室

- 诊断中心

- 其他最终用途

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- Aegis Scientific

- Azbil Corporation

- B Medical Systems

- BINDER

- Eppendorf

- Follett Products

- Helmer Scientific

- Lab Research Products

- Migali Scientific

- NuAire

- PHC Corporation

- Powers Scientific

- So-Low Environmental Equipment

- Stirling Ultracold

- Thermo Fisher Scientific

The Global Biomedical Refrigerators and Freezers Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 6.6 billion by 2034. Market growth is primarily fueled by technological innovations, rising biopharmaceutical development, increasing organ transplant activity, and expanded government funding for research and clinical trials. These drivers are collectively creating robust demand across both advanced and developing regions. Biomedical refrigerators and freezers are critical storage solutions in healthcare, pharmaceutical, and research environments. These systems are engineered to maintain precise temperature control to preserve the integrity and stability of medications, vaccines, biological samples, and lab reagents.

The rise in global demand for organ transplants further amplifies the importance of these systems, as they help preserve donated organs and tissues prior to transplantation. Ensuring the quality of these sensitive materials directly affects patient outcomes and scientific research success. With more focus on medical advancements, especially in biotechnological sectors, the need for reliable cold storage systems is becoming more pronounced. Biomedical cold storage equipment continues to serve as a vital link in maintaining regulatory compliance, operational efficiency, and product safety in labs, diagnostic centers, and medical facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 5.4% |

The lab refrigerators segment generated USD 1.1 billion in 2024 and is forecasted to hit USD 1.8 billion by 2034, growing at a CAGR of 5.7%. This segment benefits from the increasing demand for precise temperature-controlled solutions across laboratory environments. Expansion in research activity and increased pharmaceutical product development are driving laboratories to adopt advanced refrigeration units. These systems, which typically operate between 2°C and 8°C, offer a dependable option for safely storing temperature-sensitive materials such as reagents, samples, and chemical compounds critical to testing and development processes.

In 2024 the diagnostic centers held the highest market share at 36.8%. These facilities heavily rely on biomedical cold storage equipment to handle the growing volume of diagnostic tests and biological samples. With preventive healthcare gaining more attention and awareness rising around early disease detection, the need for reliable sample storage has grown. Biomedical refrigeration systems ensure that sample quality is maintained throughout the testing cycle, supporting efficiency and diagnostic accuracy within these centers.

United States Biomedical Refrigerators and Freezers Market generated 1.45 billion in 2024. Several factors are accelerating this growth, including greater investments in life sciences, expansion of pharmaceutical and biotech production facilities, and stricter quality control requirements from regulatory bodies. Increasing activity in areas like personalized medicine, vaccine research, and genomics is fueling the demand for state-of-the-art lab equipment. This is significantly contributing to the need for high-performance refrigeration systems in R&D institutions and commercial healthcare settings across the country.

Key players driving the Global Biomedical Refrigerators and Freezers Market include NuAire, PHC Corporation, BINDER, Aegis Scientific, Eppendorf, Lab Research Products, Thermo Fisher Scientific, Azbil Corporation, Stirling Ultracold, Helmer Scientific, So-Low Environmental Equipment, Follett Products, B Medical Systems, Powers Scientific, and Migali Scientific. Leading manufacturers in the biomedical refrigerators and freezers market are prioritizing product innovation, global expansion, and advanced temperature control technology to strengthen their market positions. Companies are heavily investing in R&D to develop energy-efficient, eco-friendly, and IoT-enabled refrigeration units that provide remote monitoring and temperature tracking. To enhance global footprint, key players are expanding distribution networks and forming strategic partnerships with healthcare providers and research institutions. Some companies are also leveraging automation and AI to improve device performance, minimize downtime, and meet regulatory compliance requirements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising government support for research activities and clinical trials

- 3.2.1.2 Technological advancements in biomedical refrigerators and freezers

- 3.2.1.3 Increasing geriatric population base

- 3.2.1.4 Increasing demand for biopharmaceuticals and organ transplantation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Presence of large number of local players providing affordable refurbished equipment

- 3.2.2.2 Release of hydrofluorocarbons from refrigerators and freezers have deleterious impact on environment

- 3.2.2.3 High purchase costs, maintenance costs and energy costs of biomedical refrigerators and freezers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain and distribution analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Plasma freezers

- 5.3 Blood bank refrigerators

- 5.4 Lab refrigerators

- 5.5 Lab freezers

- 5.6 Ultra-low temperature freezers

- 5.7 Shock freezers

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Blood banks

- 6.3 Pharmacies

- 6.4 Hospitals

- 6.5 Research labs

- 6.6 Diagnostic centers

- 6.7 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Aegis Scientific

- 8.2 Azbil Corporation

- 8.3 B Medical Systems

- 8.4 BINDER

- 8.5 Eppendorf

- 8.6 Follett Products

- 8.7 Helmer Scientific

- 8.8 Lab Research Products

- 8.9 Migali Scientific

- 8.10 NuAire

- 8.11 PHC Corporation

- 8.12 Powers Scientific

- 8.13 So-Low Environmental Equipment

- 8.14 Stirling Ultracold

- 8.15 Thermo Fisher Scientific