|

市场调查报告书

商品编码

1801945

人工智慧伺服器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测AI Server Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

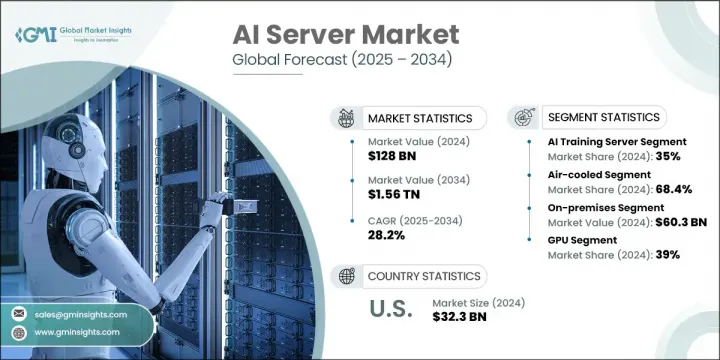

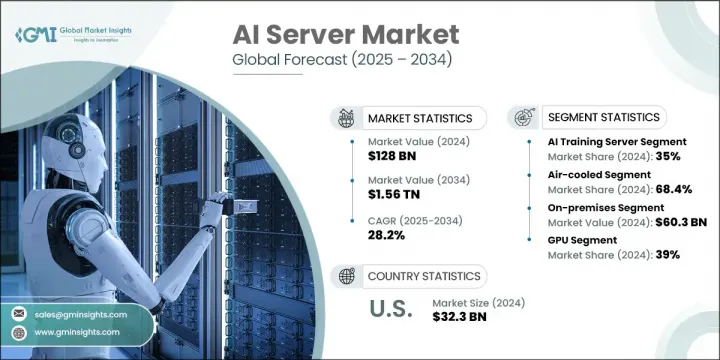

2024 年全球人工智慧伺服器市场规模达 1,280 亿美元,预计到 2034 年将以 28.2% 的复合年增长率成长,达到 1.56 兆美元。推动这一成长的主要因素是各行各业对人工智慧技术的快速应用,以及对强大伺服器日益增长的需求,以支援日益复杂的人工智慧驱动型工作负载。随着人工智慧持续改变製造业、金融业和医疗保健业等产业,对高效能运算基础设施的需求也随之激增。混合环境、边缘部署和即时资料处理的兴起进一步支撑了人工智慧伺服器需求的上升趋势。企业对生成式人工智慧、预测分析和营运自动化的日益关注,正促使企业大力投资人工智慧优化型基础设施,从而推动该领域的收入成长和技术创新。

北美在人工智慧伺服器部署方面依然处于领先地位,这得益于成熟的云端服务供应商和人工智慧半导体公司生态系统的支援。该地区受益于强大的机构投资和政府支持的人工智慧项目,从而实现了持续创新。边缘人工智慧运算已成为市场变革的趋势,尤其是在医疗保健、智慧工业和自动化系统等资料密集型垂直领域。这些用例需要紧凑、节能的伺服器,并配备专用的人工智慧加速器来进行现场资料处理,从而消除对集中式云端网路的过度依赖。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1280亿美元 |

| 预测值 | 1.56兆美元 |

| 复合年增长率 | 28.2% |

2024年,人工智慧训练伺服器市场占据35%的市场份额,预计2025年至2034年期间的复合年增长率将达到26%。随着越来越多的企业采用先进的机器学习、电脑视觉和生成式人工智慧系统,该市场正蓬勃发展。这些配备人工智慧专用处理器和GPU的高效能伺服器对于处理大量资料集和复杂的训练模型至关重要。随着人工智慧训练成为创新和竞争策略不可或缺的一部分,企业和研究机构的支出增加正在增强该市场的成长速度。

风冷式AI伺服器市场在2024年占了68.4%的市场份额,预计到2034年将以27%的复合年增长率成长。由于安装简单、成本低且维护要求更简单,这类系统将继续占据主导地位。气流管理、热控制和机箱设计方面的技术进步使这些伺服器能够支援更密集的AI工作负载,使其成为部署在边缘环境或基础设施资源有限的企业设施中的理想选择。

2024年,美国人工智慧伺服器市场规模达323亿美元,占80%的市场。人工智慧驱动的机器人技术和自动化技术在製造环境中的整合对市场成长产生了巨大影响。随着下一代伺服器的生产日益复杂,製造商正在利用自动化来简化营运流程、提高准确性并降低人力成本。对可扩展、高效人工智慧基础设施的追求正在重塑工厂车间,凸显了智慧机器在建构推动人工智慧发展的系统中所发挥的作用。

塑造全球人工智慧伺服器市场的主要公司包括微软、戴尔、富士通、英伟达、IBM、超微电脑和惠普企业。为了巩固更强大的市场地位,人工智慧伺服器领域的公司正专注于多管齐下的策略。这包括扩展其人工智慧伺服器产品组合以满足训练和推理应用的需求,以及开发节能冷却解决方案。领先的公司正在与人工智慧软体供应商和半导体生产商合作,以提供全面优化的系统。一些参与者正在增加对本地化製造和自动化的投资,以满足不断增长的区域需求,同时降低供应链风险。云端整合、可扩展设计和快速部署能力仍然是产品创新策略的核心,同时策略联盟可以渗透到医疗保健、金融和自治系统等高成长垂直领域。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 硬体提供者

- 最终用途

- 成本结构

- 利润率

- 每个阶段的增值

- 影响供应链的因素

- 破坏者

- 供应商格局

- 技术与创新格局

- 现有技术

- GPU和AI加速器的演变

- 液体冷却系统和先进的热管理

- 高频宽记忆体 (HBM) 和先进的记忆体技术

- Power edge AI与分散式运算

- 新兴技术

- 量子计算集成

- 神经形态计算与脑启发处理器

- 光子计算和光互连

- AI专用晶片和客製化ASIC

- 创新生态系和伙伴关係

- 技术合作策略

- 创新加速机制

- 现有技术

- 专利分析

- 定价分析

- 成本结构分析

- 重要新闻和倡议

- 监管格局

- 2020-2024 年 AI 伺服器趋势

- 按冷却方式分類的成本结构

- AI伺服器的平均寿命

- 2020 年至 2024 年 CSP 和 OEM 的伺服器采购量

- 2020 年至 2024 年 CSP 和 OEM 的区域 AI 伺服器部署情况

- AI 伺服器产品整合:内部整合 vs. 外包,2020-2024 年

- 伺服器功耗

- 维护成本: OEM与第三方

- 组件故障率

- AI伺服器市场案例研究

- 微软的 Azure AI 基础架构转型

- 谷歌基于TPU的客製化硅片战略

- 特斯拉的全自动驾驶人工智慧训练基础设施

- 未来展望与建议

- 市场转型与成长轨迹

- 战略基础设施建议

- 监管合规和永续性框架

- 长期成功策略和生态系统发展

- 衝击力

- 成长动力

- 企业人工智慧采用率激增,投资报酬率已得到证实

- 大规模云端基础设施扩张与投资

- 边缘运算的成长和即时处理需求

- 人工智慧工作负载的高效能运算需求

- 产业陷阱与挑战

- 天文数字的基础设施成本和电力消耗

- 关键技能短缺和技术复杂性

- 监理合规性和资料主权要求

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按伺服器,2021 - 2034 年

- 主要趋势

- 人工智慧资料

- 人工智慧训练

- 人工智慧推理

- 其他的

第六章:市场估计与预测:按硬件,2021 - 2034 年

- 主要趋势

- 专用积体电路(ASIC)

- FPGA

- 图形处理器

- 其他的

第七章:市场估计与预测:按冷却技术,2021 - 2034 年

- 主要趋势

- 风冷

- 被动空气冷却

- 主动空气冷却

- 精密空调

- 遏止解决方案

- 液冷

- 直接晶片

- 浸入式冷却

- 单相

- 两相

- 混合冷却系统

第八章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

- 杂交种

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- IT与电信

- 交通运输和汽车

- 金融服务业

- 零售与电子商务

- 医疗保健和製药

- 工业自动化

- 其他的

第十章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- OEM

- 云端服务提供者 (CSP)

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- 全球参与者

- Advanced Micro Devices

- Intel

- NVIDIA

- Cisco Systems

- Server system manufacturers

- Dell

- Hewlett Packard Enterprise

- Huawei

- Inspur

- International Business Machines

- Lenovo

- Super Micro Computer

- Hyperscale and cloud providers

- Amazon Web Services

- Microsoft

- Oracle

- 新兴和区域参与者

- Foxconn (Hon Hai)

- Fujitsu

- Inventec

- Quanta Computer

- Wistron

The Global AI Server Market was valued at USD 128 billion in 2024 and is estimated to grow at a CAGR of 28.2% to reach USD 1.56 trillion by 2034. This surge is being fueled by the rapid adoption of AI technologies across various industries and the growing requirement for robust servers to support increasingly complex AI-driven workloads. As AI continues to transform sectors such as manufacturing, finance, and healthcare, demand for high-performance computing infrastructure is surging. The rise of hybrid environments, edge deployments, and real-time data processing further supports the upward trajectory of AI server demand. Enhanced focus on generative AI, predictive analytics, and automation in enterprise operations is pushing organizations to invest heavily in AI-optimized infrastructure, driving both revenue and technological innovation in this space.

North America remains the front runner in AI server deployment, supported by an established ecosystem of cloud providers and AI semiconductor firms. The region benefits from strong institutional investments and government-backed AI initiatives, enabling sustained innovation. Edge AI computing has emerged as a transformative trend in the market, especially in data-intensive verticals such as healthcare, smart industry, and automated systems. These use cases require compact, power-efficient servers with specialized AI accelerators for on-site data processing, eliminating the need to rely heavily on centralized cloud networks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $128 Billion |

| Forecast Value | $1.56 Trillion |

| CAGR | 28.2% |

The AI training servers segment held 35% share in 2024 and is projected to grow at a CAGR of 26% between 2025 and 2034. The segment is gaining momentum as more organizations adopt advanced machine learning, computer vision, and generative AI systems. These high-performance servers, equipped with AI-specific processors and GPUs, are crucial for handling large datasets and complex training models. Increased spending from enterprises and research institutions is reinforcing the growth of this segment, as AI training becomes integral to innovation and competitive strategy.

The air-cooled AI servers segment held 68.4% share in 2024 and is expected to grow at a 27% CAGR through 2034. These systems continue to dominate due to their straightforward installation, lower costs, and simpler maintenance requirements. Technological advancements in airflow management, thermal control, and chassis design have allowed these servers to support more dense AI workloads, making them ideal for deployment in edge environments or enterprise facilities with limited infrastructure resources.

United States AI Server Market generated USD 32.3 billion in 2024 and held 80% share. Growth is strongly influenced by the integration of AI-driven robotics and automation in manufacturing environments. As production of next-generation servers becomes increasingly complex, manufacturers are leveraging automation to streamline operations, improve accuracy, and cut down on labor costs. The push for scalable, high-efficiency AI infrastructure is reshaping factory floors, emphasizing the role of intelligent machines in building the very systems that drive AI forward.

The major companies shaping the Global AI Server Market include Microsoft, Dell, Fujitsu, Nvidia, IBM, Super Micro Computer, and Hewlett Packard Enterprise. To secure stronger market positions, companies in the AI server space are focusing on multi-pronged strategies. This includes expanding their AI server portfolios to cater to both training and inference applications and developing energy-efficient cooling solutions. Leading firms are collaborating with AI software vendors and semiconductor producers to deliver fully optimized systems. Several players are increasing investments in localized manufacturing and automation to meet rising regional demand while reducing supply chain risk. Cloud integration, scalable design, and rapid deployment capabilities remain central to product innovation strategies, along with strategic alliances to penetrate high-growth verticals such as healthcare, finance, and autonomous systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Data mining sources

- 1.2.1 Global

- 1.2.2 Regional/Country

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Type

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Hardware providers

- 3.1.1.4 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.2.1 Current technologies

- 3.2.1.1 GPU and AI accelerator evolution

- 3.2.1.2 Liquid cooling system and advanced thermal management

- 3.2.1.3 High-bandwidth memory (HBM) and advanced memory technology

- 3.2.1.4 Power edge AI and distributed computing

- 3.2.2 Emerging technologies

- 3.2.2.1 Quantum computing integration

- 3.2.2.2 Neuromorphic computing and brain-inspired processor

- 3.2.2.3 Photonic computing and optical interconnects

- 3.2.2.4 AI-Specific Silicon and Custom ASICs

- 3.2.3 Innovation ecosystem and partnerships

- 3.2.3.1 Technology partnership strategy

- 3.2.3.2 Innovation acceleration mechanisms

- 3.2.1 Current technologies

- 3.3 Patent analysis

- 3.4 Pricing analysis

- 3.5 Cost structure analysis

- 3.6 Key news and initiatives

- 3.7 Regulatory landscape

- 3.8 AI server trends, 2020-2024

- 3.9 Cost structure breakdown by cooling

- 3.10 Average lifespan of AI servers

- 3.11 Server procurement volume by CSPs and OEMs, 2020-2024

- 3.12 Regional AI server deployment by CSPs and OEMs, 2020-2024

- 3.13 AI server product integration: In-house vs outsourced, 2020-2024

- 3.14 Power consumption by server

- 3.15 Maintenance cost: OEM vs. third party

- 3.16 Failure rate by component

- 3.17 AI server market case studies

- 3.17.1 Microsoft's Azure AI infrastructure transformation

- 3.17.2 Google's TPU-based custom silicon strategy

- 3.17.3 Tesla's AI training infrastructure for full self-driving

- 3.18 Future outlook and recommendations

- 3.18.1 Market transformation and growth trajectory

- 3.18.2 Strategic infrastructure recommendations

- 3.18.3 Regulatory compliance and sustainability framework

- 3.18.4 Long-term success strategies and ecosystem development

- 3.19 Impact forces

- 3.19.1 Growth drivers

- 3.19.1.1 Explosive enterprise AI adoption and proven return on investment

- 3.19.1.2 Massive cloud infrastructure expansion and investment

- 3.19.1.3 Edge computing growth and real-time processing demands

- 3.19.1.4 High-performance computing requirements for AI workloads

- 3.19.2 Industry pitfalls & challenges

- 3.19.2.1 Astronomical infrastructure costs and power consumption

- 3.19.2.2 Critical skills shortage and technical complexity

- 3.19.3 Regulatory compliance and data sovereignty requirements

- 3.19.1 Growth drivers

- 3.20 Growth potential analysis

- 3.21 Porter's analysis

- 3.22 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Server, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 AI data

- 5.3 AI training

- 5.4 AI inference

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Hardware, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 ASIC

- 6.3 FPGA

- 6.4 GPU

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Cooling Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Air-cooled

- 7.2.1 Passive air cooling

- 7.2.2 Active air cooling

- 7.2.3 Precision air conditioning

- 7.2.4 Containment solutions

- 7.3 Liquid-cooled

- 7.3.1 Direct-to-chip

- 7.3.2 Immersion cooling

- 7.3.3 Single-phase

- 7.3.4 Two-phase

- 7.4 Hybrid cooling systems

Chapter 8 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud-based

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 IT & telecommunications

- 9.3 Transportation and automotive

- 9.4 BFSI

- 9.5 Retail and e-commerce

- 9.6 Healthcare and Pharmaceutical

- 9.7 Industrial Automation

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Cloud Service Provider (CSP)

- 10.4 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 North America

- 11.1.1 US

- 11.1.2 Canada

- 11.2 Europe

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Italy

- 11.2.5 Spain

- 11.2.6 Belgium

- 11.2.7 Netherlands

- 11.2.8 Sweden

- 11.3 Asia Pacific

- 11.3.1 China

- 11.3.2 India

- 11.3.3 Japan

- 11.3.4 Australia

- 11.3.5 Singapore

- 11.3.6 South Korea

- 11.3.7 Vietnam

- 11.3.8 Indonesia

- 11.4 Latin America

- 11.4.1 Brazil

- 11.4.2 Mexico

- 11.4.3 Argentina

- 11.5 MEA

- 11.5.1 South Africa

- 11.5.2 Saudi Arabia

- 11.5.3 UAE

Chapter 12 Company Profiles

- 12.1 Global players

- 12.1.1 Advanced Micro Devices

- 12.1.2 Intel

- 12.1.3 NVIDIA

- 12.1.4 Cisco Systems

- 12.2 Server system manufacturers

- 12.2.1 Dell

- 12.2.2 Hewlett Packard Enterprise

- 12.2.3 Huawei

- 12.2.4 Inspur

- 12.2.5 International Business Machines

- 12.2.6 Lenovo

- 12.2.7 Super Micro Computer

- 12.3 Hyperscale and cloud providers

- 12.3.1 Amazon Web Services

- 12.3.2 Google

- 12.3.3 Microsoft

- 12.3.4 Oracle

- 12.4 Emerging and regional players

- 12.4.1 Foxconn (Hon Hai)

- 12.4.2 Fujitsu

- 12.4.3 Inventec

- 12.4.4 Quanta Computer

- 12.4.5 Wistron