|

市场调查报告书

商品编码

1822537

农业感测器市场机会、成长动力、产业趋势分析及2025-2034年预测Agriculture Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

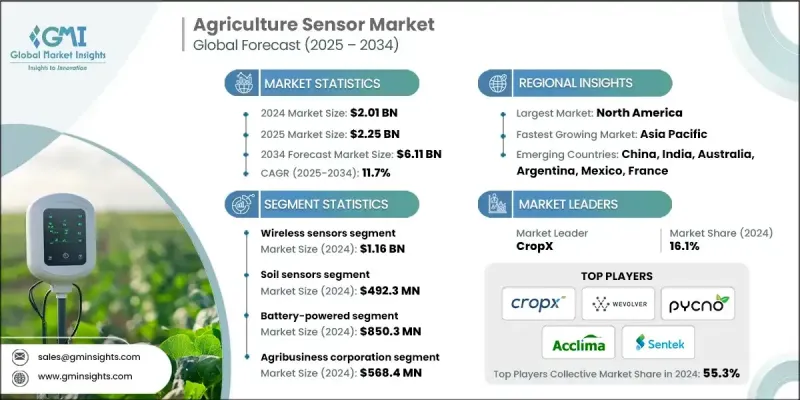

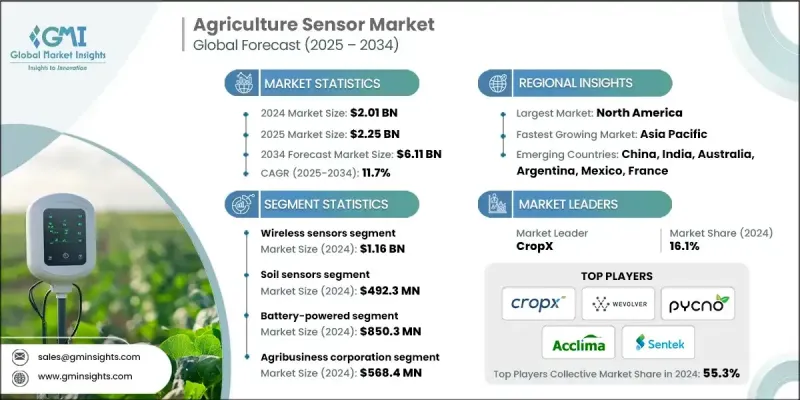

2024 年全球农业感测器市场价值为 20.1 亿美元,预计到 2034 年将以 11.7% 的复合年增长率增长至 61.1 亿美元。

精准农业正从千篇一律的田间作业转向因地制宜的作物管理,从而彻底改变传统农业。随着全球粮食需求的成长和可耕地的日益紧缺,农民面临越来越大的压力,需要用更少的资源生产更多的产品。这促使数据驱动技术的广泛应用,从而实现更智慧的决策。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 20.1亿美元 |

| 预测值 | 61.1亿美元 |

| 复合年增长率 | 11.7% |

无线感测器的采用率不断上升

无线感测器市场在2024年占据了显着的份额,这得益于其易于部署,并且无需大量布线基础设施即可支援即时资料收集。这些感测器使农民能够远端监测环境条件、作物状况和灌溉系统,从而帮助他们做出更快、更明智的决策。随着精准农业和物联网整合的兴起,无论是大型商业农场还是小规模农户,对无线解决方案的需求都很高。

土壤感测器需求不断增长

2024年,土壤感测器市场占据了相当大的份额,这得益于其对土壤湿度、温度、盐分和养分含量的重要洞察。农民依靠这些感测器来调整灌溉计划,防止过度施肥,并提高作物的整体产量。随着节水和永续发展成为全球农业的首要任务,土壤感测器在已开发市场和新兴市场都越来越受欢迎。这些工具在面临干旱或土壤退化的地区尤其重要。

电池供电感测器将获得发展

2024年,电池供电感测器市场占据了可持续的份额,这得益于其无与伦比的现场灵活性和可扩展性,使其成为大面积、偏远或难以到达的农业区域的理想选择。它们的自主运作减少了对固定电源的需求,而在许多农业环境中,固定电源成本高且不切实际。这些感测器广泛用于监测天气、土壤和作物状况,并且通常采用节能组件设计以延长电池寿命。

区域洞察

北美将成为推动力地区

2024年,北美农业感测器市场创造了可观的收入。高度的机械化、庞大的农场规模以及对农业技术的强劲投资,使该地区在精准农业实践方面处于领先地位。美国和加拿大的农民越来越多地利用基于感测器的技术来监测土壤状况、优化灌溉并实现作物管理自动化。

农业感测器市场的主要参与者有 Libelium Comunicaciones Distribuidas SL、Acuity Agriculture、Pycno、Caipos GmbH、dol-sensors A/S、Monnit Corporation、Wevolver、长沙卓科联科技有限公司、Bosch Sensortec、Sensoterra、CropX Inc.、Auroras (AsorX Inc., Deuroras、Suroras、C.A.S. Ltd.、Texas Instruments Incorporated、AquaSpy Inc.、Sentek Ltd、Lindsay Corporation、湖南日卡电子科技有限公司、Acclima Inc.、Decagon Devices (METER Group)、AgSmarts Inc.、OMRON Electronic Components、Teralytic、Honde Technology Co., Ltd.。

为了巩固自身地位,农业感测器市场中的公司正专注于产品创新、价格实惠和资料整合。许多公司正在投资研发,以开发能够同时追踪多个变数并最大程度降低能耗的多功能感测器。与农业科技新创公司、灌溉系统製造商和农业软体供应商建立策略合作伙伴关係,有助于公司提供端到端解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 精准农业和智慧农业的采用率不断提高

- 政府补贴和政策推动数位农业

- 对永续农业实践的需求日益增长

- 物联网、人工智慧和无线连接在农村地区的扩展

- 全球粮食需求不断成长,可耕地面积却不断减少

- 产业陷阱与挑战

- 前期成本高,小农户无力负担

- 农村经济的数位基础设施和资料素养有限

- 市场机会

- 与人工智慧、巨量资料和农场管理软体的集成

- 垂直农业和受控环境农业的成长

- 农业无人机和机器人应用的扩展

- 低成本、太阳能和无线感测器的开发

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 关键参与者的竞争基准化分析

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理分布比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按感测器类型,2021 - 2034

- 主要趋势

- 土壤感测器

- 水感测器

- 气候/天气感测器

- 位置感测器

- 光学感测器

- 机械感测器

- 生物感测器

- 其他专用感测器

第六章:市场估计与预测:依连结性,2021 - 2034 年

- 主要趋势

- 有线感应器

- 无线感测器

第七章:市场估计与预测:按电源,2021 - 2034

- 主要趋势

- 电池供电

- 太阳能供电

- 杂交种

第 8 章:市场估计与预测:按最终用途,2021-2034 年

- 主要趋势

- 农民/个体种植者

- 农业合作社

- 研究机构和大学

- 农业综合企业

- 政府和公共机构

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Acclima Inc.

- Acuity Agriculture

- Agsmarts Inc.

- Aker Technology Co., Ltd.

- AquaSpy Inc.

- Auroras (Auroras srl)

- Bosch Sensortec

- Caipos GmbH

- Changsha Zoko Link Technology Co., Ltd.

- CropX Inc.

- Decagon Devices (METER Group)

- dol-sensors A/S

- Honde Technology Co., Ltd.

- Hunan Rika Electronic Tech Co., Ltd.

- John Deere

- Libelium Comunicaciones Distribuidas SL

- Lindsay Corporation

- Monnit Corporation

- OMRON Electronic Components

- Pycno

- Sensaphone

- Sensoterra

- Sentek Ltd

- Teralytic

- Texas Instruments Incorporated

- Vegetronix Inc.

- Wevolver

The Global Agriculture Sensor Market was valued at USD 2.01 billion in 2024 and is estimated to grow at a CAGR of 11.7% to reach USD 6.11 billion by 2034.

Precision farming is transforming traditional agriculture by shifting from uniform field practices to site-specific crop management. As global food demand rises and arable land becomes more limited, farmers are under increasing pressure to produce more with fewer resources. This has led to the widespread adoption of data-driven technologies, enabling smarter decision-making.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.01 Billion |

| Forecast Value | $6.11 Billion |

| CAGR | 11.7% |

Rising Adoption of Wireless Sensors

The wireless sensors segment held a notable share in 2024, driven by its ease of deployment and ability to support real-time data collection without the need for extensive cabling infrastructure. These sensors enable farmers to monitor environmental conditions, crop status, and irrigation systems remotely, helping them make faster and more informed decisions. With the rise of precision farming and IoT integration, wireless solutions are in high demand across both large-scale commercial farms and smallholder operations.

Growing Demand in Soil Sensors

The soil sensors segment generated a significant share in 2024, driven by vital insights into soil moisture, temperature, salinity, and nutrient content. Farmers rely on these sensors to fine-tune irrigation schedules, prevent over-fertilization, and enhance overall crop productivity. As water conservation and sustainability become top priorities across global agriculture, soil sensors are gaining traction in both developed and emerging markets. These tools are especially valuable in regions facing drought or soil degradation.

Battery-Powered Sensors to Gain Traction

The battery-powered sensors segment held a sustainable share in 2024, backed by unmatched flexibility and scalability in the field, making them ideal for use in large, remote, or hard-to-reach agricultural areas. Their autonomous operation reduces the need for fixed power sources, which can be costly and impractical in many farming environments. These sensors are widely used in monitoring weather, soil, and crop conditions, and are often designed with energy-efficient components to extend battery life.

Regional Insights

North America to Emerge as a Propelling Region

North America agriculture sensor market generated significant revenues in 2024. High levels of mechanization, large farm sizes, and strong investment in agri-tech have made the region a leader in adopting precision farming practices. Farmers in the United States and Canada are increasingly integrating sensor-based technologies to monitor soil conditions, optimize irrigation, and automate crop management.

Major players in the agriculture sensor market are Libelium Comunicaciones Distribuidas SL, Acuity Agriculture, Pycno, Caipos GmbH, dol-sensors A/S, Monnit Corporation, Wevolver, Changsha Zoko Link Technology Co., Ltd., Bosch Sensortec, Sensoterra, CropX Inc., Auroras (Auroras s.r.l.), Sensaphone, John Deere, Aker Technology Co., Ltd., Texas Instruments Incorporated, AquaSpy Inc., Sentek Ltd, Lindsay Corporation, Hunan Rika Electronic Tech Co., Ltd., Acclima Inc., Decagon Devices (METER Group), AgSmarts Inc., OMRON Electronic Components, Teralytic, Honde Technology Co., Ltd.

To strengthen their position, companies in the agriculture sensor market are focusing on product innovation, affordability, and data integration. Many are investing in R&D to develop multi-functional sensors that can track multiple variables simultaneously while minimizing energy consumption. Strategic partnerships with agri-tech startups, irrigation system manufacturers, and agri-software providers are helping companies offer end-to-end solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1. Sensor Type

- 2.2.2 Connectivity

- 2.2.3 Power Source

- 2.2.4 end use

- 2.2.5 North America

- 2.2.6 Europe

- 2.2.7 Asia Pacific

- 2.2.8 Latin America

- 2.2.9 Middle East & Africa

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of precision agriculture and smart farming

- 3.2.1.2 Government subsidies & policies promoting digital agriculture

- 3.2.1.3 Growing need for sustainable farming practices

- 3.2.1.4 Expansion of IoT, AI, and wireless connectivity in rural areas

- 3.2.1.5 Rising global food demand with shrinking arable land

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront costs and lack of affordability for smallholder farmers

- 3.2.2.2 Limited digital infrastructure and data literacy in rural economies

- 3.2.3 Market Opportunities

- 3.2.3.1 Integration with AI, big data, and farm management software

- 3.2.3.2 Growth of vertical farming and controlled-environment agriculture

- 3.2.3.3 Expansion of agricultural drone and robotics applications

- 3.2.3.4 Development of low-cost, solar-powered and wireless sensors

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Sensor Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Soil sensors

- 5.3 Water sensors

- 5.4 Climate/weather sensors

- 5.5 Location sensors

- 5.6 Optical sensors

- 5.7 Mechanical sensors

- 5.8 Biosensors

- 5.9 Other specialized sensors

Chapter 6 Market estimates & forecast, By Connectivity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Wired sensors

- 6.3 Wireless sensors

Chapter 7 Market estimates & forecast, By Power Source, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Battery-powered

- 7.3 Solar-powered

- 7.4 Hybrid

Chapter 8 Market estimates & forecast, By End Use, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Farmers/individual growers

- 8.3 Agricultural cooperatives

- 8.4 Research institutes & universities

- 8.5 Agribusiness corporations

- 8.6 Government & public agencies

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East & Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profile

- 10.1 Acclima Inc.

- 10.2 Acuity Agriculture

- 10.3 Agsmarts Inc.

- 10.4 Aker Technology Co., Ltd.

- 10.5 AquaSpy Inc.

- 10.6 Auroras (Auroras s.r.l.)

- 10.7 Bosch Sensortec

- 10.8 Caipos GmbH

- 10.9 Changsha Zoko Link Technology Co., Ltd.

- 10.10 CropX Inc.

- 10.11 Decagon Devices (METER Group)

- 10.12 dol-sensors A/S

- 10.13 Honde Technology Co., Ltd.

- 10.14 Hunan Rika Electronic Tech Co., Ltd.

- 10.15 John Deere

- 10.16 Libelium Comunicaciones Distribuidas SL

- 10.17 Lindsay Corporation

- 10.18 Monnit Corporation

- 10.19 OMRON Electronic Components

- 10.20 Pycno

- 10.21 Sensaphone

- 10.22 Sensoterra

- 10.23 Sentek Ltd

- 10.24 Teralytic

- 10.25 Texas Instruments Incorporated

- 10.26 Vegetronix Inc.

- 10.27 Wevolver