|

市场调查报告书

商品编码

1822539

安全数位卡市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Secure Digital Card Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球安全数位卡市场价值为 103 亿美元,预计将以 4.7% 的复合年增长率成长,到 2034 年达到 163 亿美元。

消费性电子产品对紧凑型大容量储存的需求日益增长,以及物联网和嵌入式系统的快速应用,推动了需求的激增。随着边缘运算的发展和人工智慧在设备层面的集成,SD 卡已成为实现本地资料储存和缓衝的关键。这在自动驾驶、智慧基础设施和监控等领域尤其重要。随着边缘人工智慧的兴起,尤其是在北美和亚太地区,SD 卡的整合预计将进一步深化。能够耐受极端环境的加固型 SD 卡在汽车、工业自动化和国防等领域正日益受到青睐。这些应用需要耐用、抗震的储存设备,即使在严苛的操作条件下也能支援数位化工作流程。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 103亿美元 |

| 预测值 | 163亿美元 |

| 复合年增长率 | 4.7% |

2024年,micro SD卡市场占有79%的市占率。其主导地位主要归功于无人机、智慧型手机和运动相机等小型设备的广泛采用。随着行动装置功能越来越强大,以及创作高解析度内容的创作者数量不断增长,UHS-I和UHS-II等microSD卡因其高耐用性和快速传输速度而越来越受到青睐。预计製造商将围绕设备耐用性、资料传输速度以及与高端设备的兼容性加强产品行销。

预计到2034年,线上分销领域将创造68亿美元的市场规模。消费者更青睐数位平台,因为它们便捷、产品多样且易于比较。亚洲和北美的数位市场正透过精准行销、搜寻引擎优化策略、限时抢购和个人化购物体验加速线上SD卡的销售。为了保持竞争力,品牌需要采用专注于直接面向消费者的精准广告策略,并提升其在电商平台上的曝光度。

2024年,北美安全数位卡市场占据31.1%的市场份额,预计到2034年将以4.7%的复合年增长率成长。该地区的成长得益于消费性电子产品使用量的不断增长、视讯监控系统的日益普及以及影像领域内容创作者和专业人士日益增长的需求。为了抢占市场份额,SD卡製造商专注于开发专为物联网生态系统量身定制的高度安全的工业级储存解决方案,并与区域原始设备製造商(OEM)和系统整合商保持合作。

全球安全数位卡市场的领导企业包括美光科技、雷克沙媒体、威刚科技、Nextorage、铠侠、松下和金士顿科技。为了巩固其在竞争激烈的安全数位卡行业中的地位,各公司正致力于透过适用于商业和工业用例的坚固耐用、高速和高容量的卡片来丰富其产品线。与智慧型手机品牌、相机製造商和原始设备製造商 (OEM) 建立策略联盟有助于将 SD 卡相容性嵌入到下一代设备中。企业也利用人工智慧驱动的消费者行为分析来微调其行销和分销策略。透过投资在地化製造、扩展直接面向消费者的管道以及推广环保产品设计,这些公司旨在增强全球影响力和客户保留率。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 消费性电子产品对大容量储存的需求不断增加

- 数位影像设备和高画质内容的普及率不断提高

- 物联网设备和嵌入式系统的扩展

- 监控和安全应用的成长

- 游戏机和便携式设备日益普及

- 产业陷阱与挑战

- 预算快闪记忆体的资料传输速度有限

- 大容量驱动器的热管理挑战

- 市场机会

- 资料中心和云端运算的扩展

- 采用电动和自动驾驶汽车

- 企业从 HDD 过渡到 SSD

- 5G 部署提升行动与网路效能

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- SD 卡

- 迷你 SD 卡

- Micro SD 卡

第六章:市场估计与预测:按产能,2021 - 2034 年

- 主要趋势

- SDSC(最高 2GB)

- SDHC(2GB - 32GB)

- SDXC(32GB - 2TB)

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 离线

第 8 章:市场估计与预测:按最终用途应用,2021 - 2034 年

- 主要趋势

- 消费性电子产品

- 智慧型手机和平板电脑

- 笔记型电脑和桌上型电脑

- 数位相机

- 穿戴式装置

- 其他的

- 汽车

- 资讯娱乐系统

- 行车记录器和 ADAS资料存储

- 其他的

- 工业的

- 工业物联网系统

- 工厂自动化与机器人技术

- 其他的

- 卫生保健

- 零售

- 军事与国防

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球关键参与者

- SanDisk

- Samsung Electronics

- Sony

- Micron Technology

- 区域关键参与者

- 北美洲

- Lexar Media

- Patriot Memory

- PNY Technologies

- 欧洲

- Verbatim

- Kingston Technology

- Nextorage

- 亚太地区

- Kioxia

- Toshiba

- Transcend Information

- Panasonic

- 北美洲

- 利基市场参与者/颠覆者

- Adata Technology

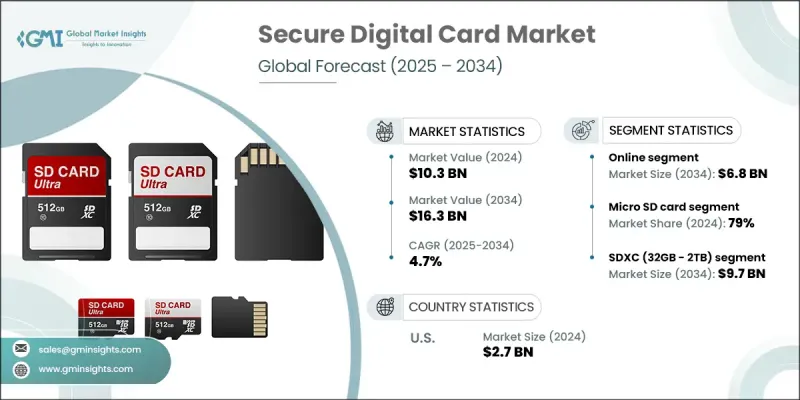

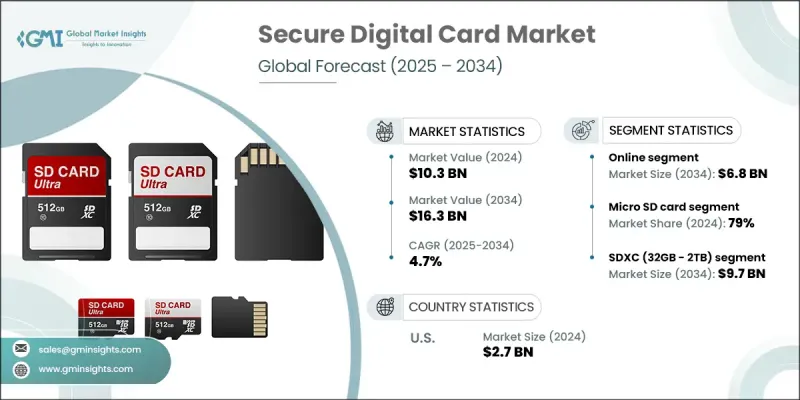

The Global Secure Digital Card Market was valued at USD 10.3 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 16.3 billion by 2034.

The surge in demand is driven by the rising need for compact, high-capacity storage across consumer electronics and the rapidly growing use of IoT and embedded systems. With the evolution of edge computing and the integration of AI at the device level, SD cards have become critical for enabling local data storage and buffering. This is particularly important in sectors like autonomous mobility, smart infrastructure, and surveillance. As edge AI gains traction, especially across North America and the Asia-Pacific region, SD card integration is expected to deepen. Ruggedized SD cards that endure extreme environments are gaining significant traction in sectors like automotive, industrial automation, and defense. These applications demand durable, shock-resistant storage that supports digital workflows even under challenging operational conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.3 Billion |

| Forecast Value | $16.3 Billion |

| CAGR | 4.7% |

In 2024, the micro SD card segment held a 79% share. Its dominance is largely due to high adoption in compact devices such as drones, smartphones, and action cameras. As mobile devices become more powerful and the number of creators producing high-resolution content grows, microSD variants like UHS-I and UHS-II are increasingly preferred for their high durability and fast transfer speeds. Manufacturers are expected to strengthen product marketing around device endurance, data speed, and compatibility with advanced devices.

The online distribution segment is projected to generate USD 6.8 billion by 2034. Consumers prefer digital platforms for their convenience, product variety, and ease of comparison. Digital marketplaces in Asia and North America are accelerating online SD card sales through targeted marketing, SEO strategies, flash deals, and personalized shopping experiences. To stay competitive, brands need to adopt precision advertising techniques focused on direct-to-consumer outreach and enhance their visibility across e-commerce platforms.

North America Secure Digital Card Market held 31.1% share in 2024 and is forecasted to grow at a CAGR of 4.7% through 2034. Growth in this region is supported by expanding consumer electronics usage, rising adoption of video surveillance systems, and increased demand from content creators and professionals in the imaging space. To capture market share, SD card makers focus on developing highly secure, industrial-grade storage solutions tailored for IoT ecosystems and align with regional OEMs and system integrators.

Leading players in the Global Secure Digital Card Market include Micron Technology, Lexar Media, Adata Technology, Nextorage, Kioxia, Panasonic, and Kingston Technology. To solidify their position in the competitive secure digital card industry, companies are focusing on diversifying their product lines with rugged, high-speed, and high-capacity cards suitable for both commercial and industrial use cases. Strategic alliances with smartphone brands, camera manufacturers, and OEMs help in embedding SD card compatibility into next-gen devices. Firms are also leveraging AI-driven consumer behavior analytics to fine-tune their marketing and distribution strategies. By investing in localized manufacturing, expanding direct-to-consumer channels, and promoting eco-friendly product designs, these companies aim to enhance both global reach and customer retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Capacity trends

- 2.2.3 Distribution channel trends

- 2.2.4 End use application trends

- 2.2.5 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for high-capacity storage in consumer electronics

- 3.2.1.2 Growing adoption of digital imaging devices and HD content

- 3.2.1.3 Expansion of IoT devices and embedded systems

- 3.2.1.4 Growth in surveillance and security applications

- 3.2.1.5 Rising popularity of gaming consoles and portable devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited data transfer speeds in budget flash storage

- 3.2.2.2 Thermal management challenges in high-capacity drives

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of data centers and cloud computing

- 3.2.3.2 Adoption of electric and autonomous vehicles

- 3.2.3.3 Transition from HDD to SSD in enterprises

- 3.2.3.4 5G rollouts enhancing mobile and network performance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion & Thousand Units)

- 5.1 Key trends

- 5.2 SD card

- 5.3 Mini SD card

- 5.4 Micro SD card

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion & Thousand Units)

- 6.1 Key trends

- 6.2 SDSC (Up to 2GB)

- 6.3 SDHC (2GB - 32GB)

- 6.4 SDXC (32GB - 2TB)

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion & Thousand Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates and Forecast, By End Use Application, 2021 - 2034 (USD Billion & Thousand Units)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.2.1 Smartphone & tablets

- 8.2.2 Laptops & computers

- 8.2.3 Digital cameras

- 8.2.4 Wearable devices

- 8.2.5 Others

- 8.3 Automotive

- 8.3.1 Infotainment system

- 8.3.2 Dashcams and ADAS data storage

- 8.3.3 Others

- 8.4 Industrial

- 8.4.1 Industrial IoT systems

- 8.4.2 Factory automation and robotics

- 8.4.3 Others

- 8.5 Healthcare

- 8.6 Retail

- 8.7 Military & Defense

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 SanDisk

- 10.1.2 Samsung Electronics

- 10.1.3 Sony

- 10.1.4 Micron Technology

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Lexar Media

- 10.2.1.2 Patriot Memory

- 10.2.1.3 PNY Technologies

- 10.2.2 Europe

- 10.2.2.1 Verbatim

- 10.2.2.2 Kingston Technology

- 10.2.2.3 Nextorage

- 10.2.3 APAC

- 10.2.3.1 Kioxia

- 10.2.3.2 Toshiba

- 10.2.3.3 Transcend Information

- 10.2.3.4 Panasonic

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Adata Technology