|

市场调查报告书

商品编码

1822542

汽车区块链技术市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Blockchain Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

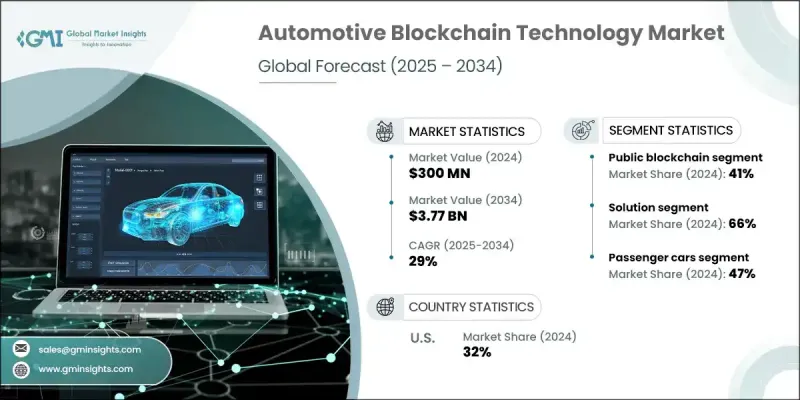

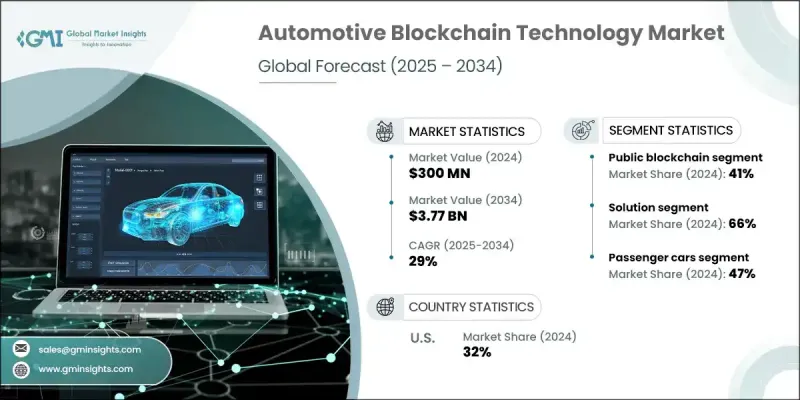

2024 年全球汽车区块链技术市场价值为 3 亿美元,预计到 2034 年将以 29% 的复合年增长率增长至 37.7 亿美元。

随着汽车互联互通和软体驱动程度的不断提升,汽车製造商在资料完整性、网路安全和即时通讯方面面临日益增长的担忧。区块链提供了一个去中心化的防篡改系统,可以安全地追踪和验证车辆生命週期内的资料,涵盖从製造、零件采购到软体更新和所有权转移的各个环节。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3亿美元 |

| 预测值 | 37.7亿美元 |

| 复合年增长率 | 29% |

公共区块链日益普及

预计到2034年,公共区块链领域将凭藉其无与伦比的透明度和去中心化架构获得强劲发展。公共区块链允许汽车製造商、监管机构、供应商和最终用户等多个利益相关者即时存取和验证资料,而无需依赖中央机构。这种模式对于车辆历史记录、所有权记录和共享出行应用尤其有用。

解决方案的采用率不断上升

2024年,汽车区块链技术市场的解决方案部分占据了相当大的份额。汽车製造商和车队营运商越来越多地投资端到端区块链平台,这些平台提供从智慧合约执行到供应链管理和资料认证的全套服务。这些解决方案可以降低营运成本,提高透明度,并帮助企业打造面向未来的数位基础设施。

乘用车将获得发展动力

由于数位技术在现代汽车中的快速融合,乘用车市场在2024年占据了相当大的份额。随着消费者对更智慧、更安全、更互联的驾驶体验的需求,汽车製造商正在利用区块链来确保无线 (OTA) 更新的安全、车辆身分管理以及资料货币化模式。从叫车到订阅模式,区块链确保与汽车相关的每项交易和资料点都是安全且可追溯的。

区域洞察

北美将成为利润丰厚的地区

2024年,北美汽车区块链技术市场创造了可观的收入,这得益于其强大的数位基础设施、高额的研发支出以及强大的产业合作伙伴关係。美国主机厂和科技巨头正引领这一趋势,在数位车辆所有权、电动车电池追踪和自动驾驶汽车资料验证等领域开展试点计画。该地区还受益于对区块链创新的监管开放,这使得汽车公司能够以更少的门槛扩展新的解决方案。

汽车区块链技术市场的主要参与者包括 MOBI、亚马逊、SAP SE、Tech Mahindra Limited、IBM Corporation、BigchainDB GmbH、微软公司、甲骨文公司、R3、埃森哲公司。

汽车区块链技术市场的领导者正在寻求策略合作、试点项目和产品创新,以巩固其市场地位。各公司正在向汽车原始设备製造商提供区块链即服务 (BaaS) 平台,以实现更快、更安全的部署。 R3 和 BigchainDB 等公司正专注于开发针对供应链、资料安全和智慧合约应用的可客製化区块链协议。同时,由汽车製造商和科技公司组成的联盟 MOBI 正在建立行业标准,以促进互通性。

目录

第一章:方法论

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- GMI 专有 AI 系统

- 人工智慧驱动的研究增强

- 来源一致性协议

- 人工智慧准确度指标

- 预测模型

- 初步研究和验证

- 市场估计的主要趋势

- 量化市场影响分析

- 生长参数对预测的数学影响

- 情境分析框架

- 一些主要来源(但不限于)

- 资料探勘来源

- 次要

- 付费来源

- 公共资源

- 来源(按地区)

- 次要

- 研究路径和信心评分

- 研究路径组成部分:

- 评分组件

- 研究透明度附录

- 来源归因框架

- 品质保证指标

- 我们对信任的承诺

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对供应链透明度和可追溯性的需求不断增加

- 连网和自动驾驶汽车的普及率不断上升

- 对防诈欺和安全交易的需求日益增长

- 移动即服务 (MaaS) 和共享汽车平台的扩展

- 产业陷阱与挑战

- 区块链系统实施与整合成本高

- 汽车网路缺乏标准化和互通性

- 市场机会

- 区块链与物联网和人工智慧的集成,实现预测性维护

- 车辆所有权转移和数位身分解决方案的应用

- 透过智慧出行计画拓展新兴市场

- 中小企业和二/三级供应商整合

- 成长动力

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利分析

- 定价趋势与经济分析

- 用例

- 最佳情况

- 投资前景和资金分析

- 全球汽车科技投资趋势

- 区块链技术在汽车领域的投资

- 区域投资模式和政府支持

- 企业投资与併购活动

- 成本效益分析

- 实施成本结构和投资要求

- 营运效益和效率提升

- 财务效益和成本降低

- 策略利益和竞争优势

- 车辆身分和生命週期管理

- 自动驾驶汽车和资料管理

- 感测器资料完整性和验证

- 机器学习模型管理

- 责任和事故调查

- 数据货币化和共享

- 行动服务和支付集成

- 共乘和汽车共享平台

- 电动车充电与能源管理

- 智慧城市整合和基础设施

- 保险与风险管理

- 网路安全与资料保护框架

- 汽车网路安全与区块链集成

- 区块链安全和威胁评估

- 资料隐私和合规性管理

- 事件回应和业务连续性

- 永续性和环境影响分析

- 碳足迹追踪和报告

- 循环经济和材料可追溯性

- 环境合规与报告

- 绿色科技与创新

- 未来技术路线图与创新时间表

- 区块链技术演进(2024-2034)

- 汽车技术整合时间表

- 产业转型与融合场景

- 市场演变与中断评估

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依类型,2021 - 2034

- 主要趋势

- 公共区块链

- 私有区块链

- 混合区块链

第六章:市场估计与预测:依组件,2021 - 2034

- 主要趋势

- 解决方案

- 服务

第七章:市场估计与预测:依车型,2021 - 2034

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 多功能乘用车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

- 两轮车

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 供应链管理

- 车辆身分和生命週期管理

- 自动驾驶汽车资料管理

- 旅行服务和支付

- 其他的

第九章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 原始设备製造商

- 车辆所有者

- 出行即服务提供者

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 奈及利亚

第十二章:公司简介

- 全球参与者

- Amazon

- BMW Group

- ConsenSys

- Ford Motor

- General Motors

- Hyperledger Foundation

- Hyundai Motor

- IBM

- Mercedes-Benz

- Microsoft

- Oracle

- R3

- Renault-Nissan-Mitsubishi Alliance

- SAP

- Toyota Motor

- Volkswagen

- 区域参与者

- MOBI

- VeChain

- OriginTrail

- Chronicled

- Ambrosus

- Provenance

- Everledger

- 新兴玩家

- CarVertical

- AutoBlock

The Global Automotive Blockchain Technology Market was valued at USD 300 million in 2024 and is estimated to grow at a CAGR of 29% to reach USD 3.77 billion by 2034.

As vehicles become increasingly connected and software-driven, automakers are facing growing concerns around data integrity, cybersecurity, and real-time communication. Blockchain offers a decentralized, tamper-proof system to securely track and verify data across a vehicle's lifecycle from manufacturing and parts sourcing to software updates and ownership transfers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $300 Million |

| Forecast Value | $3.77 Billion |

| CAGR | 29% |

Increasing Prevalence of Public Blockchain

The public blockchain segment is expected to gain strong traction through 2034 driven by its unmatched transparency and decentralized structure. Public blockchains allow multiple stakeholders including automakers, regulators, suppliers, and end use to access and verify data in real-time, without relying on a central authority. This model is particularly useful for vehicle history tracking, ownership records, and shared mobility applications.

Rising Adoption of Solutions

The solutions segment from the automotive blockchain technology market held sizeable share in 2024. Automakers and fleet operators are increasingly investing in end-to-end blockchain platforms that offer a complete suite of services from smart contract execution to supply chain management and data authentication. These solutions reduce operational overhead, enhance transparency, and help companies to future-proof their digital infrastructure.

Passenger Cars to Gain Traction

The passenger cars segment held substantial share in 2024, owing to the rapid integration of digital technologies in modern vehicles. As consumers demand smarter, safer, and more connected driving experiences, automakers are leveraging blockchain to secure over-the-air (OTA) updates, manage vehicle identity, and enable data monetization models. From ride-hailing to subscription models, blockchain ensures that every transaction and data point tied to a car is secure and traceable.

Regional Insights

North America to Emerge as a Lucrative Region

North America automotive blockchain technology market generated significant revenues in 2024, driven by a robust digital infrastructure, high R&D spending, and strong industry partnerships. U.S. based OEMs and technology giants are leading the charge with pilot projects in digital vehicle titles, EV battery tracking, and autonomous vehicle data verification. The region also benefits from regulatory openness to blockchain innovation, allowing automotive companies to scale new solutions with fewer barriers.

Major players involved in the automotive blockchain technology market include MOBI, Amazon, SAP SE, Tech Mahindra Limited, IBM Corporation, BigchainDB GmbH, Microsoft Corporation, Oracle Corporation, R3, Accenture plc.

Leading players in the automotive blockchain technology market are pursuing strategic collaborations, pilot programs, and product innovation to strengthen their market position. Companies are offering blockchain-as-a-service (BaaS) platforms to automotive OEMs, enabling faster and more secure deployment. Firms such as R3 and BigchainDB are focusing on developing customizable blockchain protocols tailored for supply chain, data security, and smart contract applications. Meanwhile, MOBI, a consortium of automakers and tech firms, is building industry-wide standards to promote interoperability.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 GMI proprietary AI system

- 1.1.5.1 AI-Powered research enhancement

- 1.1.5.2 Source consistency protocol

- 1.1.5.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Component

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 Organization Size

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for supply chain transparency and traceability

- 3.2.1.2 Rising adoption of connected and autonomous vehicles

- 3.2.1.3 Growing need for fraud prevention and secure transactions

- 3.2.1.4 Expansion of mobility-as-a-service (MaaS) and shared vehicle platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and integration costs for blockchain systems

- 3.2.2.2 Lack of standardization and interoperability across automotive networks

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of blockchain with IoT and AI for predictive maintenance

- 3.2.3.2 Adoption in vehicle ownership transfer and digital identity solutions

- 3.2.3.3 Expansion into emerging markets with smart mobility initiatives

- 3.2.3.4 SME and tier 2/3 supplier integration

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Pricing trends and economic analysis

- 3.9 Use cases

- 3.10 Best-case scenario

- 3.11 Investment landscape and funding analysis

- 3.11.1 Global automotive technology investment trends

- 3.11.2 Blockchain technology investment in automotive

- 3.11.3 Regional investment patterns and government support

- 3.11.4 Corporate investment and M&A activity

- 3.12 Cost-benefit analysis

- 3.12.1 Implementation cost structure and investment requirements

- 3.12.2 Operational benefits and efficiency gains

- 3.12.3 Financial benefits and cost reduction

- 3.12.4 Strategic benefits and competitive advantage

- 3.13 Vehicle identity and lifecycle management

- 3.14 Autonomous vehicle and data management

- 3.14.1 Sensor data integrity and validation

- 3.14.2 Machine learning model management

- 3.14.3 Liability and accident investigation

- 3.14.4 Data monetization and sharing

- 3.15 Mobility services and payment integration

- 3.15.1 Ride-sharing and car-sharing platforms

- 3.15.2 Electric vehicle charging and energy management

- 3.15.3 Smart city integration and infrastructure

- 3.15.4 Insurance and risk management

- 3.16 Cybersecurity and data protection framework

- 3.16.1 Automotive cybersecurity and blockchain integration

- 3.16.2 Blockchain security and threat assessment

- 3.16.3 Data privacy and compliance management

- 3.16.4 Incident response and business continuity

- 3.17 Sustainability and environmental impact analysis

- 3.17.1 Carbon footprint tracking and reporting

- 3.17.2 Circular economy and material traceability

- 3.17.3 Environmental compliance and reporting

- 3.17.4 Green technology and innovation

- 3.18 Future technology roadmap and innovation timeline

- 3.18.1 Blockchain technology evolution (2024-2034)

- 3.18.2 Automotive technology integration timeline

- 3.18.3 Industry transformation and convergence scenarios

- 3.18.4 Market evolution and disruption assessment

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.1.1 Public blockchain

- 5.1.2 Private blockchain

- 5.1.3 Hybrid blockchain

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Solution

- 6.3 Services

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Hatchbacks

- 7.2.2 Sedans

- 7.2.3 SUV

- 7.2.4 MPVs

- 7.3 Commercial Vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

- 7.4 Two-Wheelers

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Supply chain management

- 8.3 Vehicle identity and lifecycle management

- 8.4 Autonomous vehicle data management

- 8.5 Mobility services and payments

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 SME

- 9.3 Large enterprises

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 OEMs

- 10.3 Vehicle owners

- 10.4 Mobility as a service provider

- 10.5 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Nigeria

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Amazon

- 12.1.2 BMW Group

- 12.1.3 ConsenSys

- 12.1.4 Ford Motor

- 12.1.5 General Motors

- 12.1.6 Hyperledger Foundation

- 12.1.7 Hyundai Motor

- 12.1.8 IBM

- 12.1.9 Mercedes-Benz

- 12.1.10 Microsoft

- 12.1.11 Oracle

- 12.1.12 R3

- 12.1.13 Renault-Nissan-Mitsubishi Alliance

- 12.1.14 SAP

- 12.1.15 Toyota Motor

- 12.1.16 Volkswagen

- 12.2 Regional Players

- 12.2.1 MOBI

- 12.2.2 VeChain

- 12.2.3 OriginTrail

- 12.2.4 Chronicled

- 12.2.5 Ambrosus

- 12.2.6 Provenance

- 12.2.7 Everledger

- 12.3 Emerging Players

- 12.3.1 CarVertical

- 12.3.2 AutoBlock