|

市场调查报告书

商品编码

1822546

眼科雷射器市场机会、成长动力、产业趋势分析及2025-2034年预测Ophthalmic Lasers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

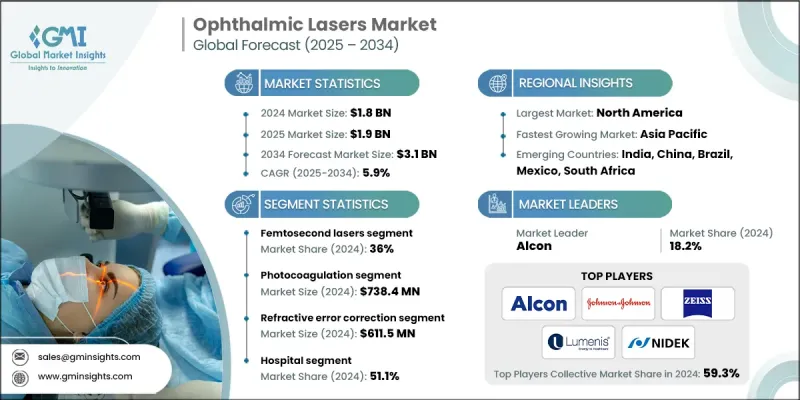

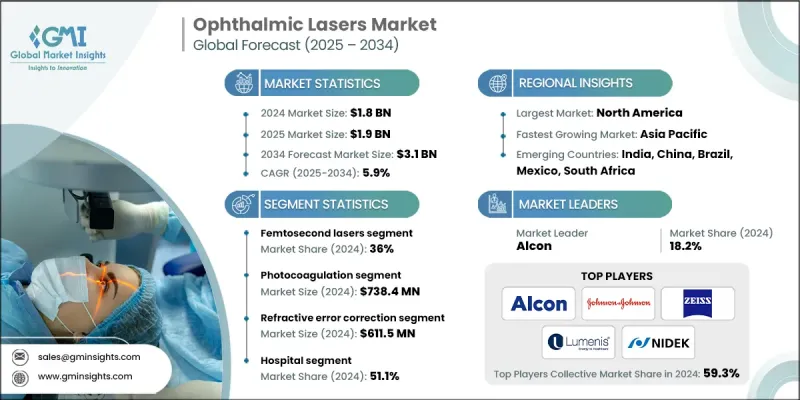

根据 Global Market Insights, Inc. 发布的最新报告,2024 年全球眼科雷射器市场价值为 18 亿美元,预计将从 2025 年的 19 亿美元增长到 2034 年的 31 亿美元,复合年增长率为 5.9%。随着视力障碍发病率的上升、人口老化以及眼科手术雷射系统的技术进步,该市场正在经历显着增长。

眼科雷射已成为治疗青光眼、糖尿病视网膜病变、老年性黄斑部病变 (AMD) 和屈光不正等疾病的关键。眼科雷射是一种微创器械,能够提供精准有效的手术治疗,因此预计未来几年其应用将日益广泛。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 31亿美元 |

| 复合年增长率 | 5.9% |

关键驱动因素:

1.眼部疾病发生率上升:白内障、糖尿病视网膜病变和青光眼的发生率不断上升,对雷射治疗的需求不断增加。

2.屈光手术的兴起:年轻一代对 LASIK 和 SMILE 手术的兴趣日益浓厚,推动了飞秒和准分子雷射的使用。

3.提高雷射的精度和安全性:新型眼科雷射具有更强的控制力、更少的热损伤和更好的术后效果,因此越来越受到眼科医生的青睐。

4.人口老化:与年龄相关的眼部疾病在世界范围内呈上升趋势,尤其是在高收入和中等收入国家。

关键参与者:

- 爱尔康、强生、蔡司、LUMENIS 和 NIDEK 是其中的一些主要参与者,共占了整个市场的 59.3%。

- 2024 年,爱尔康占据了眼科雷射市场 18.2% 的份额。

主要挑战:

- 设备成本高:眼科雷射价格昂贵,阻碍了其在低收入医疗机构的普及。

- 严格的监管审批:各个市场的设备审批延迟可能会限制发布时间表。

- 熟练专业人员短缺:使用复杂的雷射系统需要专门的培训,这在农村和欠发达地区仍然是一个问题。

按产品类型 - 飞秒雷射占据市场主导地位

飞秒雷射器凭藉其精准度、微创性以及在屈光手术和白内障手术中的卓越疗效,在2024年引领了产品类别。随着全球患者对视力矫正的兴趣日益浓厚,飞秒雷射在LASIK、SMILE和角膜切开术中的应用也正在迅速增长。

依技术分类-光凝术被广泛采用

光凝固术领域在2024年保持强劲成长,尤其得益于其在糖尿病视网膜病变和视网膜静脉阻塞治疗的应用日益增多。该技术因其能够长期稳定危及视力的疾病而受到视网膜专家的青睐。

按应用 - 屈光不正矫正仍是焦点

2024 年,屈光不正矫正占据了市场主导地位。对眼镜和隐形眼镜的永久性视力矫正解决方案的需求不断增长,推动了对雷射辅助手术的需求,尤其是在城市地区。

按最终用途划分-医院占最大份额

2024年,医院在终端使用领域占据主导地位。医院设施配备综合眼科护理单位、合格的外科医生和高科技雷射设备。它们还提供报销福利,并有能力进行选择性和紧急眼科手术。

2024年,北美成为全球眼科雷射市场的最大参与者,这得益于先进眼科手术的广泛应用、较高的近视和白内障发病率以及知名企业的涌现。美国在技术应用、报销方案以及拥有先进雷射治疗的门诊手术设施方面仍处于领先地位。

顶尖企业正在探索并执行新的研发、策略合作伙伴关係和新品发布,以提升竞争优势。例如,爱尔康近期推出了用于白内障和角膜手术的新一代飞秒雷射产品组合。蔡司和强生则专注于人工智慧导引的雷射平台,以提高手术精准度。另一方面,科医人(Lumenis)和格劳科斯(Glaukos)则致力于与眼科诊所和医院合作,以更好地支持其分销管道。博士伦(BAUSCH + LOMB)和尼德克(NIDEK)则透过探索本地生产和培训眼科医生,实施专注于新兴市场的成长策略。这将进一步拓展全球影响力,同时也将推动技术进步并改善病患照护效果。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 眼部疾病盛行率不断上升

- 微创眼科手术的需求不断增长

- 雷射系统的技术进步

- 已开发市场的报销状况改善

- 产业陷阱与挑战

- 眼科雷射系统成本高

- 术后併发症和副作用的风险

- 市场机会

- 亚太、拉丁美洲和中东和非洲地区的新兴市场

- 用于外展计划的便携式紧凑型雷射平台

- 成长动力

- 成长潜力分析

- 监管格局

- 报销场景

- 技术格局

- 当前的技术趋势

- 新兴技术

- 2024 年按产品类型分類的定价分析

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲和中东和非洲

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品类型发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 飞秒雷射

- 二极体雷射

- 准分子雷射

- Nd:YAG雷射

- 其他产品类型

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 光凝固

- 光破坏

- 消融

- 其他技术

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 屈光不正矫正

- 白内障手术

- 糖尿病视网膜病变

- 青光眼

- 其他应用

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 眼科诊所

- 门诊手术中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- Alcon

- BAUSCH + LOMB

- Johnson & Johnson

- LUMENIS

- NIDEK

- ZEISS

- 区域参与者

- LIGHTMED

- LUMIBIRD MEDICAL

- Meridian Medical

- TOPCON Healthcare

- 新兴玩家

- ARC LASER

- Glaukos

- IRIDEX

- Ziemer Ophthalmology

The global ophthalmic lasers market was valued at USD 1.8 billion in 2024 and is projected to grow from USD 1.9 billion in 2025 to USD 3.1 billion by 2034, at a CAGR of 5.9%, according to the latest report published by Global Market Insights, Inc. The market is experiencing significant growth with the growing incidence of vision disorders, the aging population, and technological advancements in laser systems for eye procedures.

Ophthalmic lasers have emerged as vital for the treatment of diseases like glaucoma, diabetic retinopathy, age-related macular degeneration (AMD), and refractive errors. Ophthalmic lasers are minimally invasive instruments that deliver precise and effective surgical treatments, and therefore are expected to show increased uptake over the next few years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 5.9% |

Key Drivers:

1. Rising incidences of eye diseases: Increasing numbers of cataracts, diabetic retinopathy, and glaucoma are favoring the demand for laser-based treatments.

2. Rise in refractive surgeries: Increased interest in LASIK and SMILE surgeries among young generations is driving the usage of femtosecond and excimer lasers.

3. Improved precision and safety of lasers: New ophthalmic lasers provide enhanced control, less thermal damage, and better post-op results, thus gaining traction among ophthalmologists.

4. Aging population: Age-related eye conditions are on the rise worldwide, particularly in high-income and middle-income nations.

Key Players:

- Alcon, Johnson & Johnson, ZEISS, LUMENIS, and NIDEK are some of the key players, together commanding 59.3% of the overall market.

- Alcon captured an 18.2% share of the ophthalmic lasers market in 2024.

Key Challenges:

- High cost of equipment: Ophthalmic lasers are expensive, which hinders their penetration in low-income healthcare facilities.

- Strict regulatory approvals: Device approval delays in various markets may limit launch schedules.

- Scarcity of skilled professionals: Specialized training is needed for the use of sophisticated laser systems, which is still an issue in rural and underdeveloped regions.

By Product Type - Femtosecond Lasers Dominate the Market

Femtosecond lasers led the product category in 2024 with their precision, minimal invasiveness, and efficacy in refractive and cataract surgeries. Their use in LASIK, SMILE, and corneal incisions is increasing rapidly due to the increasing patient interest in vision correction continues to rise worldwide.

By Technology - Photocoagulation witnessed widespread Adoption

The photocoagulation segment sustained a strong position in 2024, particularly because of the increasing usage in the treatment of diabetic retinopathy and retinal vein occlusions. The technology is preferred among retinal specialists as it offers long-term stabilization of vision-threatening disease.

By Application - Refractive Error Correction Remains in Focus

Refractive error correction dominated the market in 2024. Growing demand for permanent vision correction solutions to glasses and contact lenses is propelling the demand for laser-assisted procedures, especially in urban areas.

By End Use - Hospitals Captured the Biggest Share

Hospitals dominated the end-use segment in 2024. Hospital facilities have integrated eye care units, qualified surgeons, and high-tech laser equipment. They also offer reimbursement benefits and have the capacity to treat both elective and emergency ophthalmic surgeries.

North America was the biggest player in the global ophthalmic lasers market in 2024, driven by extensive use of advanced ophthalmic surgeries, high myopia and cataract rates, and the presence of prominent players. The U.S. remains at the forefront in terms of technology adoption, reimbursement schemes, and outpatient surgical facilities with sophisticated laser-based treatments.

Top players are exploring and executing new research and development, strategic partnerships, and new launches for competitive advantage. As an example, Alcon has recently built its portfolio with next-generation femtosecond lasers for cataract and corneal surgery. ZEISS and Johnson & Johnson are focused on artificial intelligence-guided laser platforms to improve surgical precision. Conversely, Lumenis and Glaukos aim to partner with eye clinics and hospitals to better support their distribution channels. BAUSCH + LOMB and NIDEK implement growth strategies focused on emerging markets by exploring local production and also training ophthalmologists. This will further global reach but also advance technology and improve patient care outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of eye disorders

- 3.2.1.2 Growing demand for minimally invasive ophthalmic surgeries

- 3.2.1.3 Technological advancements in laser systems

- 3.2.1.4 Improved reimbursement landscape in developed markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of ophthalmic laser systems

- 3.2.2.2 Risk of postoperative complications and side effects

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets in Asia-Pacific, Latin America, and MEA

- 3.2.3.2 Portable and compact laser platforms for outreach programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis, By product type, 2024

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LATAM and MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Femtosecond lasers

- 5.3 Diode lasers

- 5.4 Excimer lasers

- 5.5 Nd:YAG lasers

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Photocoagulation

- 6.3 Photodisruption

- 6.4 Ablation

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Refractive error correction

- 7.3 Cataract surgery

- 7.4 Diabetic retinopathy

- 7.5 Glaucoma

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ophthalmic clinics

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Alcon

- 10.1.2 BAUSCH + LOMB

- 10.1.3 Johnson & Johnson

- 10.1.4 LUMENIS

- 10.1.5 NIDEK

- 10.1.6 ZEISS

- 10.2 Regional Players

- 10.2.1 LIGHTMED

- 10.2.2 LUMIBIRD MEDICAL

- 10.2.3 Meridian Medical

- 10.2.4 TOPCON Healthcare

- 10.3 Emerging Players

- 10.3.1 A.R.C. LASER

- 10.3.2 Glaukos

- 10.3.3 IRIDEX

- 10.3.4 Ziemer Ophthalmology