|

市场调查报告书

商品编码

1822551

婴儿孵化器市场机会、成长动力、产业趋势分析及2025-2034年预测Infant Incubator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

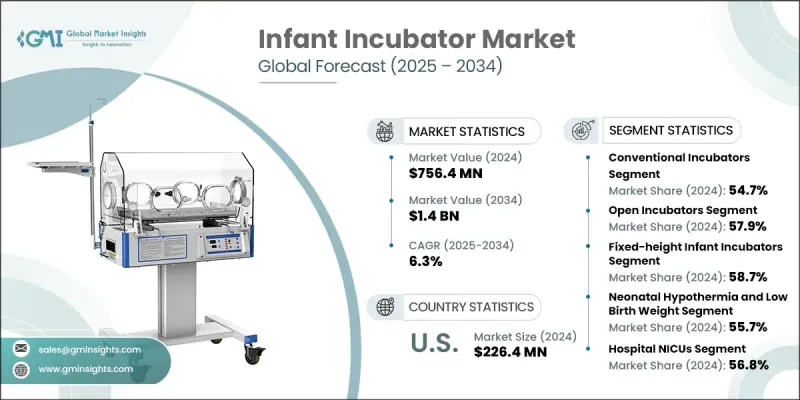

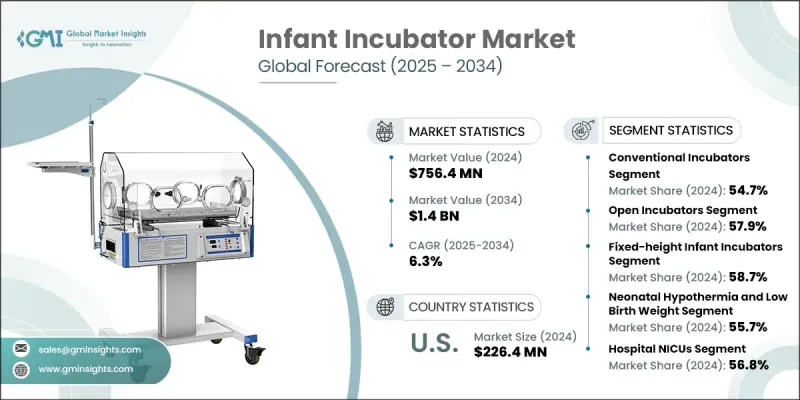

2024 年全球婴儿孵化器市场价值为 7.564 亿美元,预计将以 6.3% 的复合年增长率成长,到 2034 年达到 14 亿美元。

早产率上升、降低新生儿死亡率的措施不断加强以及新生儿护理技术的稳定进步,共同推动市场的成长。此外,已开发国家和发展中国家新生儿加护病房的扩建和现代化建设,也显着提升了对高性能婴儿培养箱的需求。这些培养箱为脆弱的新生儿提供了一个精心调控的环境,帮助他们发育和康復,在保护其免受外界干扰的同时,确保温度、湿度和氧气水平达到最佳控制。随着各国政府和卫生组织持续投资新生儿健康基础设施,包含远端监控和物联网连接等功能的先进模式正在加速普及。医疗保健系统的持续升级,尤其是在新兴地区,加上人们对婴儿健康需求的认识不断提高,以及更先进护理设备的普及,预计将在未来几年推动市场向前发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.564亿美元 |

| 预测值 | 14亿美元 |

| 复合年增长率 | 6.3% |

2024年,传统恆温箱市场占54.7%的份额。这些系统因其可靠性、有效性以及与新技术相比相对较低的成本,仍在新生儿加护病房(NICU)广泛使用。无论资源丰富或匮乏,医院都仍然严重依赖传统恆温箱,以确保为早产儿提供一个稳定且支持性的环境。它们能够维持新生儿生存所必需的稳定环境条件,使其成为妇产科医院重症监护的重要组成部分。因此,预计它们将在整个预测期内占据市场主导地位,尤其是在预算有限、无法采用更先进恆温箱的医疗机构。

2024年,开放式恆温箱市场占有57.9%的份额。开放式恆温箱以其便捷易用、价格实惠且相容于多种监测设备而闻名,在许多临床环境中仍然是首选。这些设备通常被称为辐射加温器,利用顶部热量来维持婴儿体温,同时方便婴儿进行紧急干预或常规护理。虽然开放式恆温箱缺乏封闭式系统那样的全面环境控制,但其开放式设计使护理人员能够快速回应医疗需求。这使得它们特别适用于需要便捷通道的高风险病例。开放式恆温箱在医院中的受欢迎程度也得益于其较低的维护要求以及在产后即时护理中经过验证的临床效果。

2024年,美国婴儿培养箱市场规模达到2.264亿美元,其成长动力源自于新生儿照护投资的增加、保险支持以及早产病例的上升。这项成长得益于先进的医疗基础设施、持续成长的研发活动,以及将创新婴儿护理技术融入新生儿加护病房(NICU)环境的广泛推动。该地区还受益于健全的监管框架和强大的报销网络,这些因素正在推动公立和私立医院加快采用更智慧、更安全的培养箱系统。

活跃于婴儿培养箱市场的主要公司包括 GE HealthCare、Dragerwerk、Koninklijke Philips、Stryker、Natus Medical 和 Inspiration Healthcare Group。婴儿培养箱市场的公司专注于创新、合规和合作伙伴关係,以加强其全球影响力。许多公司正在投资研究,设计配备智慧感测器、即时监控和基于物联网的连接功能的培养箱,以满足现代新生儿重症监护室 (NICU) 不断变化的需求。与医院和医疗保健系统的策略合作有助于製造商根据特定的临床需求量身定制产品,而与当地分销商的合作则使其更容易进入新兴地区。各公司也正在努力满足国际安全和性能认证,以提高信任度和采用率。产品组合扩展到包括运输培养箱、混合系统和全数位化平台,使参与者能够应对多种护理环境。成本效益、病患安全和临床结果仍然是保持市场领先地位的关键关注领域。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球早产数量不断增加

- 政府加强新生儿护理力度

- 新生儿护理的技术进步

- 产业陷阱与挑战

- 先进孵化器成本高

- 服务和维护挑战

- 市场机会

- 混合孵化器的采用日益增多

- 关注新兴经济体的新生儿健康

- 成长动力

- 成长潜力分析

- 监管格局

- 技术进步

- 当前的技术趋势

- 新兴技术

- 供应链分析

- 报销场景

- 2024年定价分析

- 北美洲

- 欧洲

- 亚太地区

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 常规孵化器

- 混合孵化器

- 运输孵化器

第六章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 开放式(辐射加热器)

- 关闭

第七章:市场估计与预测:按模式,2021 - 2034

- 主要趋势

- 固定高度婴儿培养箱

- 高度可调的婴儿培养箱

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 新生儿体温过低和低出生体重

- 黄疸

- 其他应用

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 医院新生儿加护病房

- 产妇护理中心

- 紧急医疗服务

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Dragerwerk

- GE HealthCare

- Inspiration Healthcare Group

- Koninklijke Philips

- Natus Medical

- Stryker

- 区域参与者

- Atom Medical

- Avante Health Solutions

- Bistos

- Fanem

- International Biomedical

- MEDICOR Elektronika

- 新兴企业

- JW Pharmaceutical

- Narang Medical

- NOVOS

The Global Infant Incubator Market was valued at USD 756.4 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 1.4 billion by 2034.

Market growth is being propelled by a rise in premature births, increasing efforts to lower neonatal mortality rates, and steady progress in neonatal care technologies. Additionally, the expansion and modernization of neonatal intensive care units across developed and developing countries is significantly boosting demand for high-performance infant incubators. These incubators provide a carefully regulated environment to support the development and recovery of vulnerable newborns, offering protection from external disturbances while ensuring optimal control of temperature, humidity, and oxygen levels. As governments and health organizations continue to invest in neonatal health infrastructure, the adoption of advanced models that include features like remote monitoring and IoT connectivity is accelerating. Ongoing upgrades to healthcare systems, particularly in emerging regions, combined with rising awareness of infant health needs and the availability of more advanced care devices, are expected to push the market forward over the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $756.4 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 6.3% |

In 2024, the conventional incubators segment accounted for a 54.7% share. These systems remain widely used across NICUs for their reliability, effectiveness, and relatively lower cost when compared with newer technologies. Hospitals in both high- and low-resource settings continue to depend heavily on conventional models to ensure a stable, supportive environment for premature infants. Their ability to maintain consistent environmental conditions essential for neonatal survival has made them an integral part of critical care in maternity hospitals. As a result, they are expected to hold a dominant share of the market throughout the forecast period, particularly in facilities where budget constraints limit the adoption of more advanced models.

The open incubators segment held a 57.9% share in 2024. Known for their ease of access, affordability, and compatibility with multiple monitoring devices, open incubators remain a top choice in many clinical environments. These devices, often referred to as radiant warmers, use overhead heat to maintain infant body temperature while keeping the baby accessible for emergency intervention or routine care. Though they lack the full environmental control of closed systems, their open design allows caregivers to respond quickly to medical needs. This makes them particularly suitable for high-acuity cases where access is critical. Their popularity across hospitals is also supported by their lower maintenance requirements and proven clinical performance in immediate postnatal care.

United States Infant Incubator Market reached USD 226.4 million in 2024, with growth driven by increasing neonatal care investments, insurance support, and rising cases of preterm births. This progress is supported by a combination of advanced healthcare infrastructure, growing R&D activities, and a widespread push toward integrating innovative infant care technologies into NICU environments. The region also benefits from a robust regulatory framework and strong reimbursement networks, which are encouraging the faster adoption of smarter, safer incubator systems across both public and private hospitals.

Key companies active in the Infant Incubator Market include GE HealthCare, Dragerwerk, Koninklijke Philips, Stryker, Natus Medical, and Inspiration Healthcare Group. Companies in the infant incubator market are focusing on innovation, compliance, and partnerships to strengthen their global reach. Many are investing in research to design incubators equipped with smart sensors, real-time monitoring, and IoT-based connectivity to meet the evolving demands of modern NICUs. Strategic collaborations with hospitals and healthcare systems help manufacturers tailor their products for specific clinical needs, while partnerships with local distributors allow easier entry into emerging regions. Firms are also working to meet international safety and performance certifications to improve trust and adoption. Expansion of product portfolios to include transport incubators, hybrid systems, and fully digitized platforms enables players to address multiple care environments. Cost-efficiency, patient safety, and clinical outcomes remain key focus areas to maintain market leadership.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Type trends

- 2.2.4 Modality trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of preterm births globally

- 3.2.1.2 Rising government initiatives for neonatal care

- 3.2.1.3 Technological advancements in neonatal care

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced incubators

- 3.2.2.2 Service and maintenance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption of hybrid incubators

- 3.2.3.2 Focus on neonatal health in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Conventional incubator

- 5.3 Hybrid incubator

- 5.4 Transport incubator

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Open (radiant warmers)

- 6.3 Closed

Chapter 7 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Fixed-height infant incubators

- 7.3 Height-adjustable infant incubators

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Neonatal hypothermia and low birth weight

- 8.3 Jaundice

- 8.4 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital NICU

- 9.3 Maternity care centers

- 9.4 Emergency medical services

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Dragerwerk

- 11.1.2 GE HealthCare

- 11.1.3 Inspiration Healthcare Group

- 11.1.4 Koninklijke Philips

- 11.1.5 Natus Medical

- 11.1.6 Stryker

- 11.2 Regional players

- 11.2.1 Atom Medical

- 11.2.2 Avante Health Solutions

- 11.2.3 Bistos

- 11.2.4 Fanem

- 11.2.5 International Biomedical

- 11.2.6 MEDICOR Elektronika

- 11.3 Emerging players

- 11.3.1 JW Pharmaceutical

- 11.3.2 Narang Medical

- 11.3.3 NOVOS