|

市场调查报告书

商品编码

1822554

军用防护眼镜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Military Protective Eyewear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

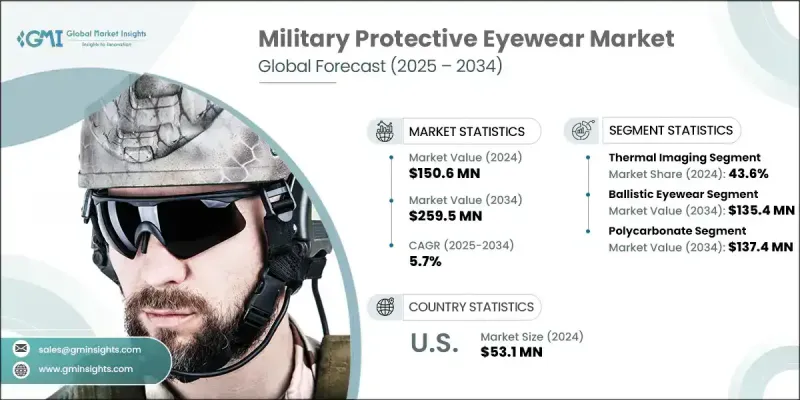

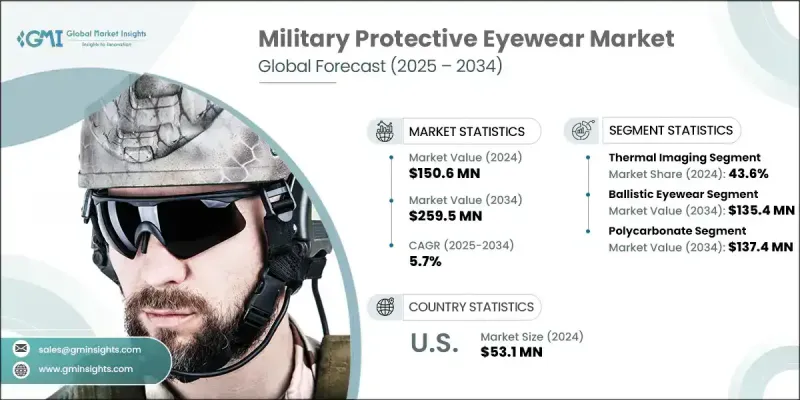

2024 年全球军用防护眼镜市场价值为 1.506 亿美元,预计到 2034 年将以 5.7% 的复合年增长率增长至 2.595 亿美元。

各国军事预算的不断成长,以及扩增实境等智慧技术日益融入作战系统,是推动市场需求的关键因素。军事组织越来越重视士兵安全和战备状态,从而更加重视先进眼镜。采购模式正朝着长期合作伙伴关係发展,优先考虑防护眼镜系统的生命週期成本效益、持续性能和持续研发。武装部队正在与私人科技开发商合作,透过联合专案推动创新,尤其是在下一代战术光学元件领域。人们对积层製造和快速成型技术的兴趣也日益浓厚,这些技术能够在移动野外环境中按需生产眼镜零件。这些进步正在重塑物流战略,预计到未来十年将成为未来作战的核心,尤其是在特种部队中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.506亿美元 |

| 预测值 | 2.595亿美元 |

| 复合年增长率 | 5.7% |

2024年,热成像系统占了43.6%的市场。在夜间任务、侦察和目标追踪等需要在弱光或遮蔽条件下保持可见性的行动中,热光学的应用日益增加。为了减小组件的尺寸和重量,开发人员正在研发可与头盔和支援AR的头饰整合的紧凑型热成像模组。製造商被鼓励创新轻量化的热成像装置,以保持低功耗并与平视显示器无缝合作。这些增强型系统正成为精英作战部队的必备工具,他们需要高效的、技术驱动的现场视野,同时又不影响长时间任务中的舒适度或电池性能。

2034年,防弹眼镜市场规模将达到1.354亿美元。由于在现役战区中,人们日益频繁地接触高速威胁、爆炸碎片和敌方弹,该市场的需求正在成长。更轻的镜框设计、模组化的佩戴方式以及升级的抗衝击镜片,都提升了产品的吸引力。符合最新的军事和安全认证标准,有助于推动产品在全球国防部队的部署。 MIL-PRF和ANSI Z87.1+等标准的广泛实施正在各国防机构加速推进。为了保持竞争优势,该领域的公司越来越注重开发可更换镜片平台,并努力实现高等级的抗衝击合规性,以赢得多年的政府供应合约。

2024年,北美军用防护眼镜市场占据42.4%的市场份额,预计到2034年将以6.7%的复合年增长率成长。强大的国防支出文化、强大的创新生态系统以及防护装备领域的早期技术应用,使该地区保持了领先地位。国防现代化计画和不断变化的战场需求正在推动先进防护光学元件的采购,包括抗雷射、防弹级和整合式扩增实境(AR)的眼镜。该地区对作战人员生存能力的关注,加上广泛的研发支持,正在为下一代眼镜奠定基础,该眼镜能够在各种环境条件下增强态势感知、即时瞄准和威胁缓解能力。

塑造全球军用防护眼镜市场格局的关键参与者包括霍尼韦尔、奥克利、Wiley X、3M 和 Revision Military。军用防护眼镜市场的领先公司正专注于多方面策略,以巩固其市场地位。他们优先考虑研发投入,设计轻量化、模组化的系统,增强其弹道和光学性能,以满足不断发展的军事行动的特定需求。一些公司正在遵守政府采购协议和认证,以确保获得高价值的长期国防合约。与技术合作伙伴的策略合作也使得扩增实境、热成像和抬头显示系统能够整合到眼镜中。各公司正在透过建立供应链中心和区域製造部门来扩大其在高支出地区的业务,以确保持续交付。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 全球国防开支不断上升

- 军事现代化和装备升级

- 扩增实境与智慧眼镜系统的集成

- 采用轻量化和人体工学设计

- 执法和准军事部队的采购量不断增加

- 产业陷阱与挑战

- 高级防护眼镜成本高

- 发展中国家的预算限制

- 市场机会

- 融入士兵现代化计划

- 执法和国土安全的需求不断增长

- 材料科学与镜头技术的进步

- 更加重视雷射和辐射眼部保护

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 国防预算分析

- 全球国防开支趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 重点国防现代化项目

- 预算预测(2025-2034)

- 对产业成长的影响

- 各国国防预算

- 供应链弹性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 合併、收购和策略伙伴关係格局

- 风险评估与管理

- 主要合约授予(2021-2024)

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 防弹眼镜

- 雷射防护眼镜

- 化学和生物防护眼镜

- 夜视相容眼镜

- 标准防护眼镜

- 其他的

第六章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 石英

- 聚碳酸酯

- 玻璃纤维

- 蓝宝石

- 其他的

第七章:市场估计与预测:按技术分类,2021 - 2034 年

- 主要趋势

- 热成像

- 影像增强器

第 8 章:市场估计与预测:按最终用途应用,2021 - 2034 年

- 主要趋势

- 炮手瞄准具

- 海军追踪器

- 驾驶视线

- 步兵武器瞄准具

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球关键参与者

- 3M

- Honeywell International

- Oakley

- Revision Military

- Wiley X

- 区域关键参与者

- 北美洲

- ESS Eyewear

- Gentex

- Smith Optics

- 欧洲

- BAE Systems

- Bolle Safety

- Thales

- 亚太地区

- Bharat Electronics

- Day Sun Industrial

- Univet Optical Technologies

- 北美洲

- 利基市场参与者/颠覆者

- Elbit Systems

- Kentek

- Meopta

- NoIR Laser

- Philips Safety Products

- Uvex Safety Group

The Global Military Protective Eyewear Market was valued at USD 150.6 million in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 259.5 million by 2034.

Rising military budgets across nations and increasing integration of smart technologies such as augmented reality into combat systems are key factors driving market demand. Military organizations are placing higher importance on soldier safety and operational readiness, leading to increased focus on advanced eyewear. Procurement patterns are evolving toward long-term partnerships that prioritize lifecycle cost-efficiency, sustained performance, and continuous R&D in protective eyewear systems. Armed forces are collaborating with private tech developers to advance innovations via joint programs, especially for next-gen tactical optics. There's also a rising interest in additive manufacturing and rapid prototyping techniques, enabling on-demand creation of eyewear parts in mobile field environments. These advancements are reshaping logistics strategies and are expected to become central to future operations, particularly among special forces, by the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $150.6 Million |

| Forecast Value | $259.5 Million |

| CAGR | 5.7% |

The thermal imaging systems held a 43.6% share in 2024. The adoption of thermal optics is rising in operations requiring visibility in low-light or obscured conditions, such as night missions, reconnaissance, and target tracking. With a push to reduce the size and weight of components, developers are working on compact thermal modules that integrate with helmets and AR-enabled headgear. Manufacturers are encouraged to innovate lightweight thermal units that maintain low power consumption and work seamlessly with heads-up displays. These enhanced systems are becoming essential tools for elite combat units who require efficient, tech-enabled field vision without compromising comfort or battery performance during extended missions.

The ballistic protective eyewear segment will reach USD 135.4 million by 2034. This segment is witnessing higher uptake due to escalating exposure to high-velocity threats, blast debris, and hostile projectiles in active combat zones. Lighter frame designs, modular fit options, and upgraded lenses with high-impact resistance are all contributing to product appeal. Compliance with updated military and safety certification standards is helping drive product deployment across global defense forces. Widespread implementation of standards like MIL-PRF and ANSI Z87.1+ is accelerating across defense agencies. To retain a competitive edge, companies in this segment are increasingly focused on developing interchangeable lens platforms and working toward high-grade impact compliance to win multi-year government supply contracts.

North America Military Protective Eyewear Market held 42.4% share in 2024 and is expected to grow at a CAGR of 6.7% through 2034. A strong culture of defense spending, robust innovation ecosystems, and early tech adoption in protective gear have allowed the region to maintain leadership. Defense modernization initiatives and evolving battlefield requirements are pushing procurement of advanced protective optics, including laser-resistant, ballistic-grade, and AR-integrated eyewear. The region's focus on warfighter survivability, combined with extensive R&D support, is laying the groundwork for next-gen eyewear capable of enhancing situational awareness, real-time targeting, and threat mitigation under varied environmental conditions.

Key players shaping the Global Military Protective Eyewear Market landscape include Honeywell, Oakley, Wiley X, 3M, and Revision Military. Leading companies in the military protective eyewear market are focusing on multi-faceted strategies to solidify their presence. Prioritizing R&D investment, they are designing lightweight, modular systems with enhanced ballistic and optical capabilities to meet the specific needs of evolving military operations. Several firms are aligning with government procurement protocols and certifications to secure high-value, long-term defense contracts. Strategic collaborations with tech partners are also enabling the integration of AR, thermal, and HUD systems into eyewear. Companies are expanding their footprint in high-spending regions by establishing supply chain hubs and regional manufacturing units to ensure consistent delivery

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Material trends

- 2.2.3 Technology trends

- 2.2.4 End use application trends

- 2.2.5 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global defense expenditures

- 3.2.1.2 Military modernization and equipment upgrades

- 3.2.1.3 Integration of augmented reality and smart eyewear systems

- 3.2.1.4 Adoption of lightweight and ergonomic designs

- 3.2.1.5 Rising procurement from law enforcement and paramilitary forces

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of advanced protective eyewear

- 3.2.2.2 Budget constraints in developing nations

- 3.2.3 Market opportunities

- 3.2.3.1 Integration into soldier modernization programs

- 3.2.3.2 Growing demand from law enforcement and homeland security

- 3.2.3.3 Advancements in material science and lens technology

- 3.2.3.4 Increased focus on laser and radiation eye protection

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Ballistic eyewear

- 5.3 Laser protection eyewear

- 5.4 Chemical and biological protection eyewear

- 5.5 Night vision-compatible eyewear

- 5.6 Standard protective eyewear

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Quartz

- 6.3 Polycarbonate

- 6.4 Glass Fiber

- 6.5 Sapphire

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Thermal imaging

- 7.3 Image intensifier

Chapter 8 Market Estimates and Forecast, By End Use Application, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Gunner sights

- 8.3 Naval trackers

- 8.4 Driving sights

- 8.5 Infantry weapon sight

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (Million & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 3M

- 10.1.2 Honeywell International

- 10.1.3 Oakley

- 10.1.4 Revision Military

- 10.1.5 Wiley X

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 ESS Eyewear

- 10.2.1.2 Gentex

- 10.2.1.3 Smith Optics

- 10.2.2 Europe

- 10.2.2.1 BAE Systems

- 10.2.2.2 Bolle Safety

- 10.2.2.3 Thales

- 10.2.3 APAC

- 10.2.3.1 Bharat Electronics

- 10.2.3.2 Day Sun Industrial

- 10.2.3.3 Univet Optical Technologies

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Elbit Systems

- 10.3.2 Kentek

- 10.3.3 Meopta

- 10.3.4 NoIR Laser

- 10.3.5 Philips Safety Products

- 10.3.6 Uvex Safety Group