|

市场调查报告书

商品编码

1822568

电池模拟软体市场机会、成长动力、产业趋势分析及2025-2034年预测Battery Simulation Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

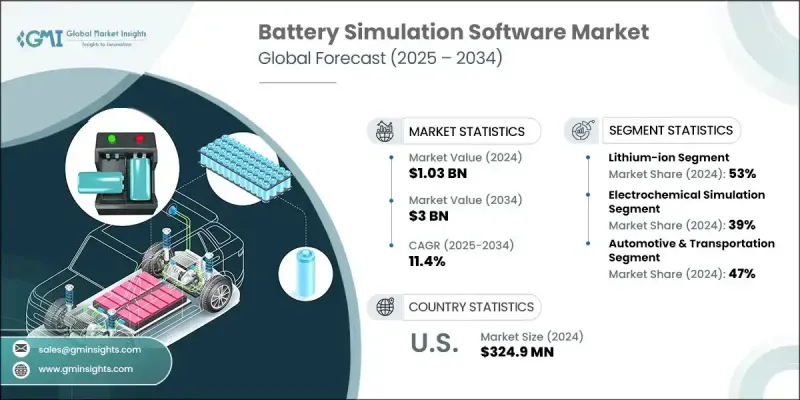

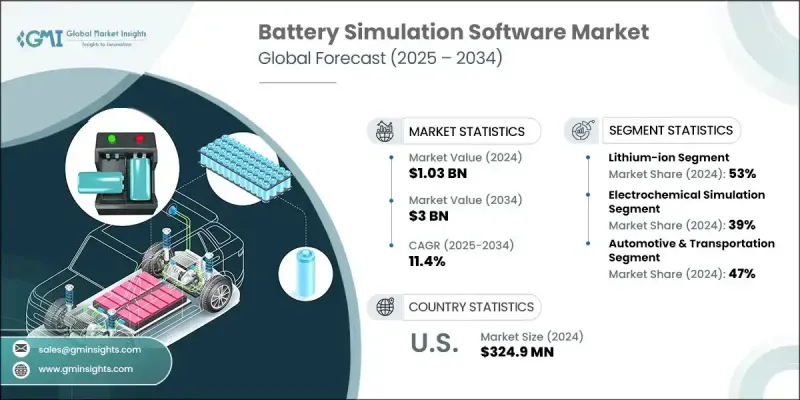

2024 年全球电池模拟软体市场价值为 10.3 亿美元,预计将以 11.4% 的复合年增长率成长,到 2034 年达到 30 亿美元。

这一成长反映出,为了因应电动车和电网规模储能需求的激增,人们正更广泛地寻求更智慧、更具成本效益和更节能的电池系统。模拟软体提供了强大的工具集,可模拟电池行为、简化设计并优化效能,同时最大限度地减少昂贵的实体原型製作。汽车製造商和能源解决方案供应商越来越多地利用模拟来提高电池安全性、延长续航里程并符合不断发展的储能法规。随着再生能源被纳入国家电网,需要可靠的储能係统来支援负载平衡、降低尖峰压力并稳定供应。电池模拟平台对于实现这些目标至关重要,尤其是在电网营运商和公用事业供应商扩大智慧能源基础设施规模的情况下。新冠疫情等疫情导致实验室访问受限和出行限制,迫使企业转向远端设计和虚拟测试,从而加速了数位化工程的转型。如今,企业依靠混合云端环境、数位孪生系统和经过验证的虚拟模型来推进电池技术开发并缩短创新週期。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 10.3亿美元 |

| 预测值 | 30亿美元 |

| 复合年增长率 | 11.4% |

锂离子电池市场在2024年占据了53%的市场份额,预计到2034年将维持11%的复合年增长率。锂离子电池凭藉其高能量密度、长循环寿命和高效的性能特点,仍然是电动车、电网能源系统和行动电子设备最主要的选择。模拟软体使开发人员能够透过对热行为、电化学反应和充放电循环进行预测建模来改进锂离子电池的设计。这些工具在提高电池寿命和系统可靠性方面也发挥着至关重要的作用。随着电动车和清洁能源产业的不断扩张,模拟为创新提供了必要的基础,确保这些电池满足日益严格的性能和安全基准。

电化学模拟领域在2024年占据了39%的市场份额,预计2025年至2034年的复合年增长率将达到11%。该领域因其能够在分子层面模拟电池化学和内部过程而脱颖而出。它使製造商能够在物理试验之前评估离子动力学、充电行为和反应机制,从而加快开发速度并提高成本效益。电化学建模对于改进电池结构、优化电极材料和调整电解质成分至关重要。这种模拟类型有助于深入了解电池在各种工作条件下的性能,这对于安全性和耐用性至关重要的应用(例如电动车和航太系统)至关重要。

2024年,美国电池模拟软体产业占85%的市场份额,产值达3.249亿美元。美国电池模拟产业受益于其成熟的技术生态系统、先进的运算基础设施以及为模拟工作负载提供可扩展环境的云端服务供应商的强大影响力。对多物理场、高保真模拟模型的需求正在成长,尤其是在电动车製造商、航太公司和清洁能源新创公司。美国在研发投资和数位工程转型方面也处于领先地位,使企业能够透过基于云端的建模平台降低实体原型製作成本并缩短产品上市时间。

全球电池模拟软体产业的知名企业包括达梭、ESI、西门子、COMSOL、AVL List、MathWorks、Autodesk、Ansys 和 Altair Engineering。为了巩固市场地位,电池模拟软体领域的公司将创新、协作和云端整合放在首位。各公司正透过投资适应实际电池使用条件的 AI 增强建模工具来提高模拟精度。许多企业正在与原始设备製造商 (OEM)、电池开发商和学术机构建立合作伙伴关係,以开发专有演算法并共同开发行业特定的应用程式。他们非常注重提供混合部署选项(基于云端和本地),以满足不同 IP 敏感度等级的需求。领先的供应商还在改进使用者介面、减少模拟运行时间并支援多物理环境,以吸引更多企业用户。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 电动车(EV)的普及率不断上升

- 增加对再生能源储存的投资

- 电池化学技术进步

- 人工智慧与云端运算在模拟中的融合

- 产业陷阱与挑战

- 初始投资高且软体复杂

- 数据可用性和模型准确性挑战

- 市场机会

- 新兴市场的扩张

- 与电池製造商和原始设备製造商合作

- 与数位孪生和物联网技术的集成

- 下一代电池的客製化

- 成长动力

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利分析

- 定价趋势与经济分析

- 用例

- 单元级设计与最佳化

- 模组和包级集成

- 系统级性能和集成

- 生命週期和退化分析

- 最佳情况

- 投资前景和资金分析

- 全球电池产业投资趋势

- 模拟软体投资与研发支出

- 区域投资模式和政府支持

- 技术转移和商业化

- 成本效益分析

- 软体实施成本结构

- 营运效益和价值创造

- 策略利益和竞争优势

- 投资报酬率分析和回报评估

- 永续性和环境影响分析

- 生命週期评估与环境建模

- 永续设计与最佳化

- 环境合规与报告

- 绿色科技与创新

- 未来技术路线图与创新时间表

- 模拟技术演进(2024-2034)

- 电池技术整合与改造

- 技术融合与平台演进

- 市场演变与颠覆情景

- 品质保证和验证框架

- 模型验证和确认

- 软体品质保证

- 法规遵从性和文檔

- 持续改进和创新

- 技术整合和工作流程优化

- CAD 和设计工具集成

- PLM 和资料管理集成

- 製造和测试集成

- 数位孪生和物联网集成

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依电池类型,2021 - 2034

- 主要趋势

- 锂离子

- 铅酸电池

- 固态

- 其他的

第六章:市场估计与预测:透过模拟,2021 - 2034

- 主要趋势

- 电化学模拟

- 热模拟

- 结构和机械模拟

- 电气和电路模拟

- 其他的

第七章:市场估计与预测:依部署模式,2021 - 2034

- 主要趋势

- 本地部署

- 云

- 杂交种

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 汽车与运输

- 消费性电子产品

- 储能係统

- 工业设备

第九章:市场估计与预测:依企业划分,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- OEM

- 电池製造商

- 研究与开发组织

- 大学和学术机构

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- 全球参与者

- Ansys

- Siemens

- Altair Engineering

- MathWorks

- Dassault Systemes

- AVL List GmbH

- ESI Group

- Ricardo

- Intertek Group

- Hexagon

- Synopsys

- COMSOL

- dSPACE

- Gamma Technologies

- 区域参与者

- OpenCFD

- TWAICE Technologies GmbH

- Batemo

- Maplesoft

- ThermoAnalytics

- Shenzhen Finite Element Technology

- Suzhou Yilaikede Technology

- Mid-Atlantic Power Specialists

- UK Battery Industrialization Centre

- 新兴玩家

- Battery Design LLC

- BATEMO GmbH

- Keysight Technologies

- Gamma Technologies

- AVL List GmbH

- Cadmus Group

- Electrochemical Engine Simulation

The Global Battery Simulation Software Market was valued at USD 1.03 billion in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 3 billion by 2034.

This growth reflects a broader push toward smarter, cost-effective, and energy-efficient battery systems in response to surging demand for electric vehicles and grid-scale energy storage. Simulation software offers a powerful toolset to model battery behavior, streamline design, and optimize performance while minimizing costly physical prototyping. Automakers and energy solution providers are increasingly leveraging simulation to enhance battery safety, extend range, and align with evolving energy storage regulations. With renewable energy sources being added to national grids, there's a need for dependable storage that supports load balancing, reduces peak pressure, and stabilizes supply. Battery simulation platforms are emerging as essential to meeting these goals, especially as grid operators and utility providers scale up smart energy infrastructure. The transition to digital engineering has been accelerated by disruptions like the COVID-19 pandemic, where limited access to labs and travel restrictions drove enterprises toward remote design and virtual testing. Companies now rely on hybrid cloud environments, digital twin systems, and validated virtual models to advance battery technology development and shorten innovation cycles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.03 Billion |

| Forecast Value | $3 Billion |

| CAGR | 11.4% |

The lithium-ion battery segment held 53% share in 2024 and is projected to maintain a CAGR of 11% through 2034. Lithium-ion batteries remain the most prominent choice for electric vehicles, grid energy systems, and mobile electronics due to their high energy density, long cycle life, and efficient performance characteristics. Simulation software enables developers to improve lithium-ion battery design through predictive modeling of thermal behavior, electrochemical reactions, and charge-discharge cycles. These tools also play a vital role in improving battery longevity and system reliability. As electric mobility and clean energy sectors continue to scale, simulation provides a necessary foundation for innovation, ensuring these batteries meet increasingly rigorous performance and safety benchmarks.

The electrochemical simulation segment captured 39% share in 2024 and is anticipated to grow at a CAGR of 11% from 2025 to 2034. This segment stands out due to its capacity to simulate battery chemistry and internal processes at the molecular level. It allows manufacturers to evaluate ion dynamics, charging behavior, and reaction mechanisms before physical trials, making development faster and more cost-effective. Electrochemical modeling is essential for refining battery architecture, optimizing electrode materials, and tailoring electrolyte composition. This simulation type supports deeper insights into performance under variable operating conditions, which is crucial for applications where safety and durability are mission-critical, including electric vehicles and aerospace systems.

United States Battery Simulation Software Industry held an 85% share in 2024, generating USD 324.9 million. The country's battery simulation sector benefits from its mature tech ecosystem, access to advanced computing infrastructure, and a strong presence of cloud service providers offering scalable environments for simulation workloads. The demand for multi-physics, high-fidelity simulation models is growing, particularly among EV manufacturers, aerospace companies, and clean energy startups. The US also leads in R&D investment and digital engineering transformation, enabling companies to reduce physical prototyping costs and shorten time-to-market through cloud-enabled modeling platforms.

Notable players in the Global Battery Simulation Software Industry include Dassault, ESI, Siemens, COMSOL, AVL List, MathWorks, Autodesk, Ansys, and Altair Engineering. To solidify their market position, companies in the battery simulation software sector are prioritizing innovation, collaboration, and cloud integration. Firms are advancing simulation accuracy by investing in AI-enhanced modeling tools that adapt to real-world battery usage conditions. Many players are forming partnerships with OEMs, battery developers, and academic institutions to develop proprietary algorithms and co-develop industry-specific applications. There's a strong focus on offering hybrid deployment options-cloud-based and on-premises-catering to varying IP sensitivity levels. Leading providers are also improving user interfaces, reducing simulation runtimes, and supporting multi-physics environments to attract more enterprise users.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Battery Type

- 2.2.3 Simulation

- 2.2.4 Application

- 2.2.5 Enterprises

- 2.2.6 Deployment mode

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of electric vehicles (EVs)

- 3.2.1.2 Increasing investment in renewable energy storage

- 3.2.1.3 Technological advancements in battery chemistry

- 3.2.1.4 Integration of AI and cloud computing in simulation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment and software complexity

- 3.2.2.2 Data availability and model accuracy challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Collaboration with battery manufacturers and OEMs

- 3.2.3.3 Integration with digital twin and IoT technologies

- 3.2.3.4 Customization for next-generation batteries

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Pricing trends and economic analysis

- 3.9 Use cases

- 3.9.1 Cell-level design and optimization

- 3.9.2 Module and pack-level integration

- 3.9.3 System-level performance and integration

- 3.9.4 Lifecycle and degradation analysis

- 3.10 Best-case scenario

- 3.11 Investment landscape and funding analysis

- 3.11.1 Global battery industry investment trends

- 3.11.2 Simulation software investment and R&D spending

- 3.11.3 Regional investment patterns and government support

- 3.11.4 Technology transfer and commercialization

- 3.12 Cost-benefit analysis

- 3.12.1 Software implementation cost structure

- 3.12.2 Operational benefits and value creation

- 3.12.3 Strategic benefits and competitive advantage

- 3.12.4 ROI analysis and payback assessment

- 3.13 Sustainability and environmental impact analysis

- 3.13.1 Lifecycle assessment and environmental modeling

- 3.13.2 Sustainable design and optimization

- 3.13.3 Environmental compliance and reporting

- 3.13.4 Green technology and innovation

- 3.14 Future technology roadmap and innovation timeline

- 3.14.1 Simulation technology evolution (2024-2034)

- 3.14.2 Battery technology integration and adaptation

- 3.14.3 Technology convergence and platform evolution

- 3.14.4 Market evolution and disruption scenarios

- 3.15 Quality assurance and validation framework

- 3.15.1 Model validation and verification

- 3.15.2 Software quality assurance

- 3.15.3 Regulatory compliance and documentation

- 3.15.4 Continuous improvement and innovation

- 3.16 Technology integration and workflow optimization

- 3.16.1 CAD and design tool integration

- 3.16.2 PLM and data management integration

- 3.16.3 Manufacturing and testing integration

- 3.16.4 Digital twin and IOT integration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Battery type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Lithium-Ion

- 5.3 Lead-Acid

- 5.4 Solid-State

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Simulation, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Electrochemical simulation

- 6.3 Thermal simulation

- 6.4 Structural & mechanical simulation

- 6.5 Electrical & circuit simulation

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 On-Premise

- 7.3 Cloud

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Automotive & transportation

- 8.3 Consumer electronics

- 8.4 Energy storage systems

- 8.5 Industrial equipment

Chapter 9 Market Estimates & Forecast, By Enterprises, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 SME

- 9.3 Large Enterprises

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Battery manufacturers

- 10.4 Research & development organizations

- 10.5 Universities & academic institutions

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Ansys

- 12.1.2 Siemens

- 12.1.3 Altair Engineering

- 12.1.4 MathWorks

- 12.1.5 Dassault Systemes

- 12.1.6 AVL List GmbH

- 12.1.7 ESI Group

- 12.1.8 Ricardo

- 12.1.9 Intertek Group

- 12.1.10 Hexagon

- 12.1.11 Synopsys

- 12.1.12 COMSOL

- 12.1.13 dSPACE

- 12.1.14 Gamma Technologies

- 12.2 Regional Players

- 12.2.1 OpenCFD

- 12.2.2 TWAICE Technologies GmbH

- 12.2.3 Batemo

- 12.2.4 Maplesoft

- 12.2.5 ThermoAnalytics

- 12.2.6 Shenzhen Finite Element Technology

- 12.2.7 Suzhou Yilaikede Technology

- 12.2.8 Mid-Atlantic Power Specialists

- 12.2.9 UK Battery Industrialization Centre

- 12.3 Emerging Players

- 12.3.1 Battery Design LLC

- 12.3.2 BATEMO GmbH

- 12.3.3 Keysight Technologies

- 12.3.4 Gamma Technologies

- 12.3.5 AVL List GmbH

- 12.3.6 Cadmus Group

- 12.3.7 Electrochemical Engine Simulation