|

市场调查报告书

商品编码

1822573

挤出机市场机会、成长动力、产业趋势分析及2025-2034年预测Extruder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

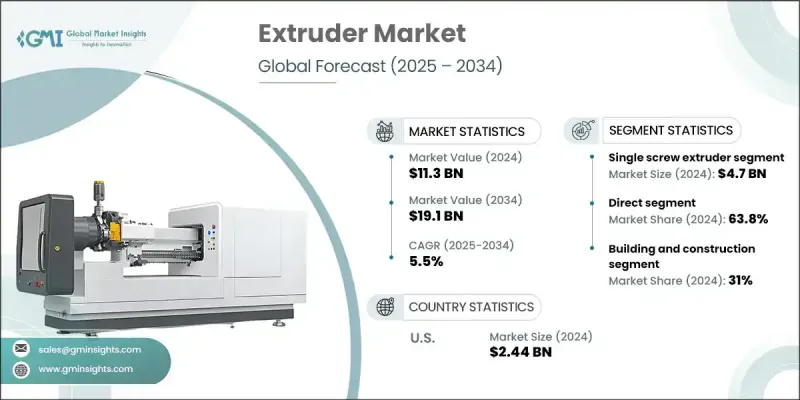

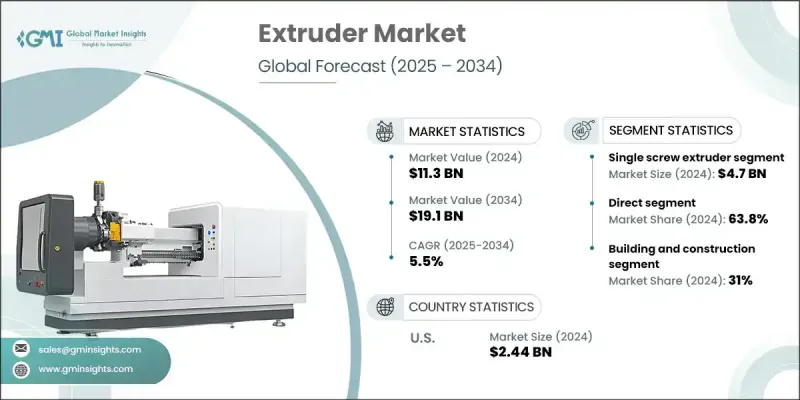

2024 年全球挤出机市场价值为 113 亿美元,预计到 2034 年将以 5.5% 的复合年增长率增长至 191 亿美元。

受消费者对永续和便利解决方案的偏好上升的推动,包装行业对挤出系统的需求不断增长,推动了市场成长。食品、医药和消费品等行业对塑胶薄膜、片材和软包装的使用日益增多,加速了挤出机的普及。人们对更长的保质期、更高的安全性和创新的包装形式的期望不断提高,推动了对先进机械的需求。随着永续性议题日益突出,各行各业正在采用环保工艺和材料,这一趋势也鼓励对减少能源使用和材料浪费的挤出技术进行投资。市场参与者优先考虑能够提高一致性、降低营运成本和提供高品质产出的升级。此外,工业4.0技术与自动化的整合正在进一步实现生产流程的现代化并提高效率。节能设计、改进的螺桿和机筒系统以及智慧控制等创新正在重塑製造业并提高各行各业的获利能力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 113亿美元 |

| 预测值 | 191亿美元 |

| 复合年增长率 | 5.5% |

单螺桿挤出机市场在2024年创造了47亿美元的产值,预计到2034年将以5.2%的复合年增长率成长。由于单螺桿挤出机在加工不同类型热塑性塑胶方面的多功能性,以及在板材、管材和薄膜生产上的高效性,其需求依然强劲。製造商继续青睐单螺桿机型,因为它们可靠性高、维护成本低且经济高效。这些特性使其能够在不影响性能的情况下持续运行,适用于小型和大型工业应用,在这些应用中,简便性和耐用性对日常生产至关重要。

直销市场在2024年占了63.8%的市场份额,预计到2034年将以5.6%的复合年增长率成长。许多製造商和大型终端用户更倾向于直接交易,因为这能让他们获得量身定制的支援、详细的客製化选项以及更快的安装和技术服务回应时间。此管道为挤出机生产商提供了建立长期客户关係的机会,同时提供符合精确生产需求的个人化解决方案。随着生产复杂性的增加,对客製化机械和实际支援的需求使得直销方式成为市场扩张的关键部分。

2024年,美国挤出机市场规模达24.4亿美元,预计到2034年复合年增长率为5.2%。美国的成长主要得益于其成熟的製造业基础设施以及建筑、汽车、消费品和包装等关键产业日益增长的需求。美国企业也在大力投资技术升级和生产线自动化整合。美国对永续性和回收的高度重视,正在推动人们青睐支持环保材料的挤出过程。全球知名挤出机生产商的涌现以及持续的创新努力,进一步巩固了美国在全球市场中的关键地位。

全球挤出机市场的知名公司包括 Milacron、Kabra Extrusion Technik Ltd、Hosokawa Alpine American, Inc.、Coperion GmbH、Reading Bakery Systems、Cowell Extrusion Machinery Co., Ltd.、Entek、Anderson Feed Technology、Bausano & FiglibA、Leistritz、BRchinER GGykz、BRchinER GGansano & Machine、R&B Plastics Machinery, LLC、BC Extrusion Holding GmbH、Davis-Standard、Everplast、Clextral、KraussMaffei Berstorff 和 Presezzi Extrusion SpA。为了巩固市场地位,挤出机行业的公司正在强调创新、营运效率和以客户为中心的方法。许多公司正在透过引入符合永续发展目标的节能机器和智慧控制系统来扩展其产品组合。策略合作伙伴关係和收购也帮助製造商拓宽地域范围并进入新的应用领域。领先的企业正在加大研发投入,以开发更通用的挤出技术并提升材料处理能力。客製化是另一个重点,使企业能够满足食品加工、塑胶和建筑等行业的独特需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 包装产业需求不断成长

- 建筑业的扩张

- 技术进步

- 汽车产业的成长

- 产业陷阱与挑战

- 初期投资成本高

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按挤出机类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依挤出机类型,2021 - 2034

- 主要趋势

- 单螺桿挤出机

- 双螺桿挤出机

- 三螺桿挤出机

第六章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 铝

- 黄铜

- 铜

- 铅和锡

- 镁

- 钢

- 其他(锌、钛)

第七章:市场估计与预测:依营运模式,2021 - 2034 年

- 主要趋势

- 自动的

- 半自动

- 手动的

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 食物

- 药物载体

- 生物质煤球

- 纺织品

第九章:市场估计与预测:依最终用途产业,2021 - 2034 年

- 主要趋势

- 建筑和施工

- 运输

- 消费品

- 製药

- 其他的

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十二章:公司简介

- Anderson Feed Technology

- Bausano & Figli SpA

- BC Extrusion Holding GmbH

- BREYER GmbH Maschinenfabrik

- Clextral

- Coperion GmbH

- Cowell Extrusion Machinery Co., Ltd.

- Davis-Standard

- Entek

- Everplast

- EXTRUDEX Kunststoffmaschinen GmbH

- Hosokawa Alpine American, Inc.

- Kabra Extrusion Technik Ltd

- KraussMaffei Berstorff

- Leistritz

- Milacron

- Presezzi Extrusion SpA

- R&B Plastics Machinery, LLC

- Reading Bakery Systems

- Shibaura Machine

The Global Extruder Market was valued at USD 11.3 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 19.1 billion by 2034.

Market growth is being supported by the increasing demand for extrusion systems in the packaging sector, driven by the rise in consumer preference for sustainable and convenient solutions. The growing use of plastic films, sheets, and flexible packaging across industries such as food, pharmaceuticals, and consumer goods is accelerating the adoption of extruders. Evolving expectations for longer shelf life, better safety, and innovative packaging formats have pushed the need for advanced machinery. As sustainability concerns become more prominent, industries are adopting eco-friendly processes and materials, and this trend is also encouraging investments in extrusion technologies that reduce energy use and material waste. Market players are prioritizing upgrades that enhance consistency, reduce operational costs, and deliver high-quality output. Alongside this, the integration of Industry 4.0 technologies and automation is further modernizing production workflows and driving efficiency. Energy-efficient designs, improved screw and barrel systems, and smart controls are among the innovations that are reshaping manufacturing and improving profitability across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.3 Billion |

| Forecast Value | $19.1 Billion |

| CAGR | 5.5% |

The single screw extruders segment generated USD 4.7 billion in 2024 and is expected to grow at a CAGR of 5.2% through 2034. These systems remain in high demand due to their versatility in processing different types of thermoplastics and their effectiveness in the production of sheets, pipes, and films. Manufacturers continue to favor single screw models for their reliability, reduced maintenance, and cost-efficiency. These features allow for continuous operation without compromising performance, making them suitable for both small- and large-scale industrial applications where simplicity and durability are critical to daily production.

The direct sales segment held a 63.8% share in 2024 and is anticipated to grow at a 5.6% CAGR through 2034. Many manufacturers and large-scale end use prefer to engage in direct transactions, as it gives them access to tailored support, detailed customization options, and faster response times for installation and technical servicing. This channel offers extruder producers an opportunity to build long-term client relationships while delivering personalized solutions that match exact production demands. As production complexity increases, the need for customized machinery and hands-on support has made the direct sales approach a critical part of market expansion.

U.S. Extruder Market generated USD 2.44 billion in 2024, with a 5.2% CAGR through 2034. Growth in the U.S. is largely backed by its mature manufacturing infrastructure and increasing demand from key sectors such as construction, automotive, consumer goods, and packaging. U.S.-based companies are also investing heavily in upgrading technologies and integrating automation across production lines. The country's strong focus on sustainability and recycling is fostering a preference for extrusion processes that support eco-friendly materials. The presence of globally recognized extruder producers and ongoing innovation efforts further position the U.S. as a key player in the global market.

Prominent companies in the Global Extruder Market include Milacron, Kabra Extrusion Technik Ltd, Hosokawa Alpine American, Inc., Coperion GmbH, Reading Bakery Systems, Cowell Extrusion Machinery Co., Ltd., Entek, Anderson Feed Technology, Bausano & Figli S.p.A., Leistritz, BREYER GmbH Maschinenfabrik, EXTRUDEX Kunststoffmaschinen GmbH, Shibaura Machine, R&B Plastics Machinery, LLC, BC Extrusion Holding GmbH, Davis-Standard, Everplast, Clextral, KraussMaffei Berstorff, and Presezzi Extrusion S.p.A. To strengthen their market position, companies in the extruder industry are emphasizing innovation, operational efficiency, and customer-centric approaches. Many are expanding their product portfolios by introducing energy-efficient machines and smart control systems that align with sustainability goals. Strategic partnerships and acquisitions are also helping manufacturers broaden geographic reach and enter new application areas. Leading players are investing in R&D to develop more versatile extrusion technologies and improve material handling capabilities. Customization is another major focus, allowing companies to meet the unique needs of industries such as food processing, plastics, and construction.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Extruder type

- 2.2.3 Material

- 2.2.4 Mode of operation

- 2.2.5 Application

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in packaging industry

- 3.2.1.2 Expansion of construction sector

- 3.2.1.3 Technological advancements

- 3.2.1.4 Growth in automotive industry

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Fluctuating raw material prices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Extruder type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Extruder Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single screw extruder

- 5.3 Twin screw extruder

- 5.4 Three screw extruders

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Aluminum

- 6.3 Brass

- 6.4 Copper

- 6.5 Lead & tin

- 6.6 Magnesium

- 6.7 Steel

- 6.8 Other (Zinc, Titanium)

Chapter 7 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

- 7.4 Manual

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food

- 8.3 Drug carriers

- 8.4 Biomass briquettes

- 8.5 Textiles

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Building and construction

- 9.3 Transportation

- 9.4 Consumer goods

- 9.5 Pharmaceutical

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Anderson Feed Technology

- 12.2 Bausano & Figli S.p.A

- 12.3 BC Extrusion Holding GmbH

- 12.4 BREYER GmbH Maschinenfabrik

- 12.5 Clextral

- 12.6 Coperion GmbH

- 12.7 Cowell Extrusion Machinery Co., Ltd.

- 12.8 Davis-Standard

- 12.9 Entek

- 12.10 Everplast

- 12.11 EXTRUDEX Kunststoffmaschinen GmbH

- 12.12 Hosokawa Alpine American, Inc.

- 12.13 Kabra Extrusion Technik Ltd

- 12.14 KraussMaffei Berstorff

- 12.15 Leistritz

- 12.16 Milacron

- 12.17 Presezzi Extrusion S.p.A

- 12.18 R&B Plastics Machinery, LLC

- 12.19 Reading Bakery Systems

- 12.20 Shibaura Machine