|

市场调查报告书

商品编码

1822582

纸箱封口机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Carton Sealers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

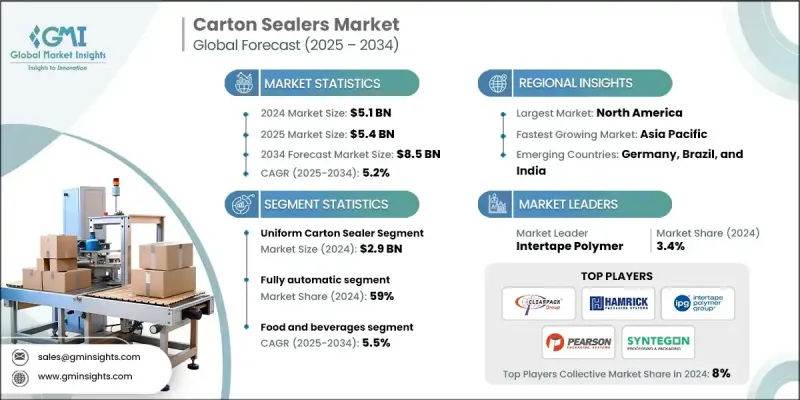

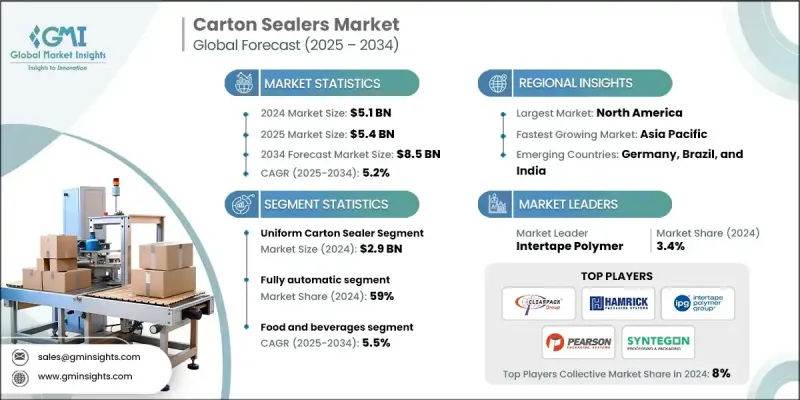

2024 年全球纸箱封口机市场价值为 51 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 85 亿美元。

随着线上购物不断重塑物流中心,企业正在大力投资纸箱密封技术,以提高速度、一致性和保护性。这种向自动化的转变确保了发货的准确性,并最大限度地减少了货物损坏。此外,经济高效、灵活的包装解决方案对零售商和第三方物流公司来说越来越重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 51亿美元 |

| 预测值 | 85亿美元 |

| 复合年增长率 | 5.2% |

统一纸箱封口机的采用率不断上升

2024年,统一封箱机市场占据最大份额,这得益于其高效性以及对大批量标准化包装作业的适用性。这些机器旨在封接相同尺寸和形状的纸箱,非常适合食品饮料、电子产品和药品等包装要求一致的行业。统一封箱机封箱速度快,人工成本低,性能可靠,有助于提高产量并最大限度地减少停机时间。

全自动纸箱封口机将获得发展动力

2024年,全自动封箱机市场占据了相当大的份额,各行各业的製造商都在寻求最大限度地提高效率、减少对劳动力的依赖,并提高包装的一致性。这些机器能够自动适应不同的纸箱尺寸,无需人工干预即可完成封箱,并与传送带系统和智慧包装线无缝整合。它们在高速、大规模的营运中尤其有价值,例如电商仓库、物流中心和快速消费品生产部门,这些部门可以最大限度地减少停机时间和人为错误。

在食品和饮料行业日益普及

2024年,食品和饮料产业实现了显着成长,这得益于对卫生、安全、防篡改包装日益增长的需求。随着消费者对包装食品、即食食品和饮料的需求不断增长,製造商面临确保纸盒安全高效密封的压力,以维护整个供应链中的产品完整性。纸盒封口机有助于食品加工厂实现包装的自动化和标准化,确保密封效果始终如一,防止污染、潮湿和变质。

区域洞察

北美将成为利润丰厚的地区

2024年,北美纸箱封口机市场收入可观,这得益于先进的製造业基础设施、电商巨头的强势布局以及对自动化包装解决方案的旺盛需求。在美国,纸箱封口机正广泛应用于食品饮料、製药、物流和消费品等行业,这主要得益于提升营运效率和满足严格监管标准的需求。此外,劳动力短缺和工资上涨也促使製造商投资自动化生产线末端包装系统。

纸箱封口机市场的主要参与者有 Clearpack、Signode、Jacob White、3M、Intertape Polymer、Wayne Automation、INSITE Packaging Automation、Combi、Hamrick、Massman、Lantech、Syntegon、Rapid Packaging、Allpack 和 Pearson Packaging Systems。

纸箱封口机市场的领导者正专注于技术创新、策略合作伙伴关係和永续发展计划,以增强其市场影响力。许多公司正在投资研发,以开发配备智慧感测器、即时监控和自动尺寸调整功能的高速智慧封口系统。 3M 和 Lantech 等公司正在增强产品线,以满足日益增长的自动化和客製化需求。与电商和物流公司的策略合作有助于扩大客户群,而收购则增强了区域覆盖范围和能力。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按机器类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依机器类型,2021 - 2034 年

- 主要趋势

- 统一封箱机

- 随机封箱机

第六章:市场估计与预测:依营运模式,2021 - 2034 年

- 主要趋势

- 手动的

- 半自动

- 全自动

第七章:市场估计与预测:依密封法,2021 - 2034 年

- 主要趋势

- 顶部和底部

- 底部

- 顶部

- 双面

- 四边形

第 8 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 物流与仓储

- 电子商务与零售

- 其他(消费品等)

第九章:市场估计与预测:按配销通路,2021 - 2034

- 主要趋势

- 直销

- 间接销售

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 3M

- Allpack

- Clearpack

- Combi

- Hamrick

- INSITE Packaging Automation

- Intertape Polymer

- Jacob White

- Lantech

- Massman

- Pearson Packaging Systems

- Rapid Packaging

- Signode

- Syntegon

- Wayne Automation

The Global Carton Sealers Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 8.5 billion by 2034.

As online shopping continues to reshape fulfillment centers, businesses are investing heavily in carton sealing technology to boost speed, consistency, and protection. This shift toward automation ensures shipment accuracy and minimizes damaged goods. Moreover, cost-efficient, flexible packaging solutions are increasingly essential to retailers and third-party logistics companies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.5 Billion |

| CAGR | 5.2% |

Rising Adoption of Uniform Carton Sealer

The uniform carton sealer segment held the largest share in 2024, driven by its efficiency and suitability for high volume, standardized packaging operations. These machines are designed to seal cartons of the same size and shape, making them ideal for industries with consistent packaging requirements such as food & beverage, electronics, and pharmaceuticals. Uniform carton sealers offer fast sealing speeds, reduced labor costs, and reliable performance, contributing to improved throughput and minimized downtime.

Fully Automatic Carton Sealers to Gain Traction

The fully automatic carton sealers segment held a substantial share in 2024, as manufacturers across industries seek to maximize efficiency, reduce labor dependency, and improve packaging consistency. These machines automatically adjust to different carton sizes, seal boxes without manual intervention, and integrate seamlessly with conveyor systems and smart packaging lines. They are especially valuable in high-speed, large-scale operations such as e-commerce warehouses, logistics hubs, and FMCG production units, where downtime and human error are minimized.

Increasing Prevalence in Food & Beverage

The food and beverage segment held sizeable growth in 2024 driven by the growing need for hygienic, secure, and tamper-evident packaging. With rising consumer demand for packaged foods, ready-to-eat meals, and beverages, manufacturers are under pressure to ensure safe and efficient sealing of cartons to maintain product integrity throughout the supply chain. Carton sealers help automate and standardize packaging in food processing plants, ensuring consistent seals that protect against contamination, moisture, and spoilage.

Regional Insights

North America to Emerge as a Lucrative Region

North America carton sealers market generated notable revenues in 2024, fueled by the advanced manufacturing infrastructure, strong presence of e-commerce giants, and high demand for automated packaging solutions. The U.S. is witnessing widespread adoption of carton sealers across industries such as food & beverage, pharmaceuticals, logistics, and consumer goods, driven by the need to enhance operational efficiency and meet strict regulatory standards. Additionally, labor shortages and rising wages are prompting manufacturers to invest in automated end-of-line packaging systems.

Major players in the carton sealers market are Clearpack, Signode, Jacob White, 3M, Intertape Polymer, Wayne Automation, INSITE Packaging Automation, Combi, Hamrick, Massman, Lantech, Syntegon, Rapid Packaging, Allpack, Pearson Packaging Systems.

Leading companies in the carton sealers market are focusing on technological innovation, strategic partnerships, and sustainability initiatives to strengthen their presence. Many are investing in R&D to develop high-speed, intelligent sealing systems with smart sensors, real-time monitoring, and automatic size adjustments. Firms like 3M and Lantech are enhancing product lines to meet the rising demand for automation and customization. Strategic collaborations with e-commerce and logistics companies help expand their client base, while acquisitions strengthen regional reach and capabilities.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By machine type

- 2.2.3 By mode of operation

- 2.2.4 By sealing methods

- 2.2.5 By end use industry

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Uniform carton sealer

- 5.3 Random carton sealer

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Sealing Methods, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Top & bottom

- 7.3 Bottom

- 7.4 Top

- 7.5 Two-side

- 7.6 Four-edge

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Food and beverages

- 8.3 Pharmaceuticals

- 8.4 Logistics & warehousing

- 8.5 E-commerce & retail

- 8.6 Others (consumer goods etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3M

- 11.2 Allpack

- 11.3 Clearpack

- 11.4 Combi

- 11.5 Hamrick

- 11.6 INSITE Packaging Automation

- 11.7 Intertape Polymer

- 11.8 Jacob White

- 11.9 Lantech

- 11.10 Massman

- 11.11 Pearson Packaging Systems

- 11.12 Rapid Packaging

- 11.13 Signode

- 11.14 Syntegon

- 11.15 Wayne Automation