|

市场调查报告书

商品编码

1822583

摩托车顶箱市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Motorcycle Top-box Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

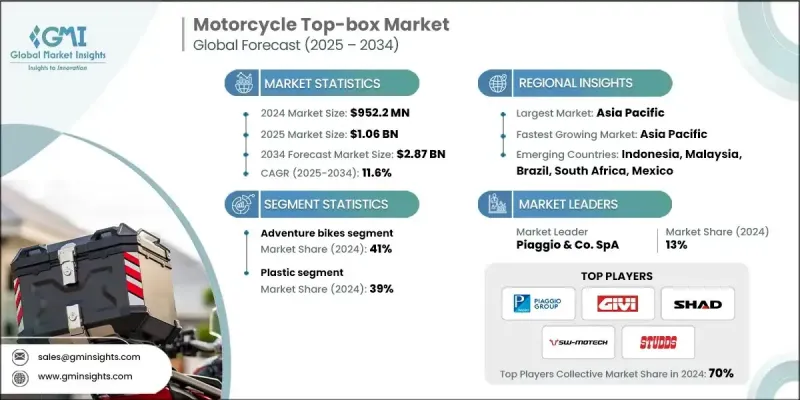

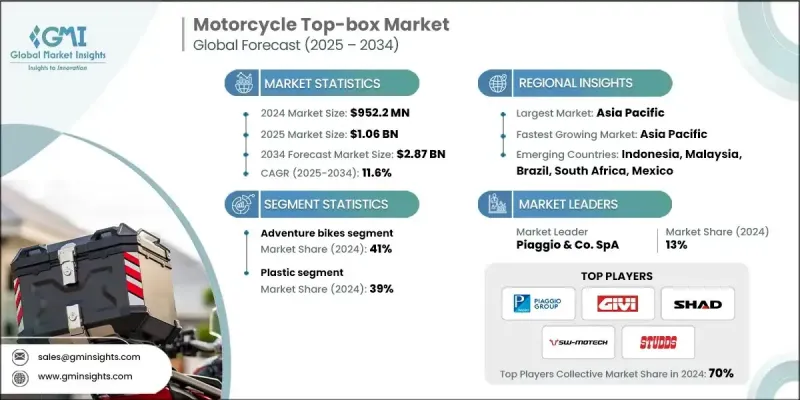

2024 年全球摩托车顶箱市场价值为 9.522 亿美元,预计到 2034 年将以 11.6% 的复合年增长率增长至 28.7 亿美元。

随着摩托车广泛用于休閒和日常通勤,骑士们越来越重视实用安全的收纳方案。如果没有专门的隔层,携带头盔、包包、杂货、笔记型电脑或工作文件等必需品可能会很困难。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.522亿美元 |

| 预测值 | 28.7亿美元 |

| 复合年增长率 | 11.6% |

探险自行车的普及率不断上升

2024年,探险摩托车细分市场保持强劲成长,因为骑乘者寻求能够同时应对公路和越野路况的多功能摩托车。专为该细分市场设计的顶箱注重耐用性、防水性和充足的储物空间,以容纳长途旅行装备。骑乘者青睐那些配备强化锁定係统和坚固结构的车型,这些车型能够抵御恶劣环境。探险旅行的日益普及,加上爱好者可支配收入的增加,正在推动对高端多功能顶箱的需求。

塑胶将获得发展动力

2024年,摩托车顶箱市场的塑胶部分凭藉其轻量、经济高效和用途广泛的特性,占据了显着的市场份额。 ABS和聚丙烯等耐衝击塑胶不仅耐用,还能帮助製造商设计出符合空气动力学的造型和色彩鲜艳的饰面,吸引註重时尚的骑士。塑胶顶箱具有耐候性和耐腐蚀性,是日常通勤者和休閒骑乘者的理想选择。随着对经济实惠且可靠的储存解决方案的需求不断增长,各公司正在透过引入抗紫外线涂层和增强结构来创新,以延长产品使用寿命。塑胶部分在功能性和美观性之间的平衡仍然是市场扩张的重要驱动力。

区域洞察

亚太地区将成为推动力市场

预计到2034年,亚太地区摩托车顶箱市场将迎来大幅成长,这得益于该地区城镇人口的不断增长和摩托车保有量的不断攀升。在印度、中国和东南亚等国家,摩托车已成为数百万人必不可少的交通工具,这推动了对实用储物配件的需求。本地製造商和国际企业正在投资扩大分销网络,提供价格具竞争力的车型,以满足不同消费者的偏好。该地区电商平台的蓬勃发展进一步提升了摩托车的可近性,从而加快了市场渗透速度。

摩托车顶箱市场的主要参与者有 Touratech、SHAD、Kappa、Hepco & Becker、BMW Motorrad、SW-Motech、Acerbis Italia、Piaggio & Co.、GIVI 和 STUDDS Accessories。

摩托车顶箱市场的公司正专注于产品创新、拓展分销管道并提升品牌知名度,以巩固其市场地位。许多公司正在投资研发,以开发轻便、耐用、防风雨且具有先进安全功能的顶箱,以满足高端和中端市场的需求。与摩托车製造商的策略合作促成了OEM合作关係,确保了相容性和整合设计。为了吸引不断增长的线上消费者群体,各大品牌正在增强其电商能力,提供详细的产品讯息,并改善售后服务。

目录

第一章:方法论

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- GMI 专有 AI 系统

- 人工智慧驱动的研究增强

- 来源一致性协议

- 人工智慧准确度指标

- 预测模型

- 初步研究和验证

- 市场估计的主要趋势

- 量化市场影响分析

- 生长参数对预测的数学影响

- 情境分析框架

- 一些主要来源(但不限于)

- 资料探勘来源

- 次要

- 付费来源

- 公共资源

- 来源(按地区)

- 次要

- 研究路径和信心评分

- 研究路径组成部分:

- 评分组件

- 研究透明度附录

- 来源归因框架

- 品质保证指标

- 我们对信任的承诺

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 城市地区摩托车保有量不断上升

- 摩托车旅行和探险活动的成长

- 电子商务与物流业扩张

- 材料和设计的进步

- 智慧功能集成

- 不断成长的电动自行车市场

- 产业陷阱与挑战

- 跨模型的相容性问题

- 盗窃和破坏问题

- 市场机会

- 可客製化和模组化设计

- 环保及再生材料产品

- 与乘客应用程式和导航集成

- 新兴市场的成长

- 成长动力

- 成长潜力分析

- 专利分析

- 监管格局

- 联合国欧洲经委会法规合规框架

- 欧盟型式认证系统分析

- 区域安全标准比较

- 市场认证要求

- 技术和创新格局

- 材料技术演变与路线图

- 先进铝合金开发

- 高性能塑胶创新(ABS、聚碳酸酯)

- 碳纤维复合材料的进展

- 混合材料解决方案及应用

- 智慧材料整合潜力

- 製造工艺创新

- 注塑技术的进步

- 3D列印应用与可扩充性

- 自动化组装系统实施

- 品质控制和测试创新

- 智慧技术整合框架

- GPS 追踪系统和精度指标

- 电子锁机制安全性分析

- 行动应用程式连接和用户体验

- 防盗警报系统的有效性

- 物联网整合和资料分析

- 设计与人体工学创新

- 气动优化技术

- 快速释放机制效率

- 通用安装系统相容性

- 耐候性功能增强

- 使用者介面和可访问性改进

- 未来技术路线图(2025-2034)

- 专利态势分析与智慧财产权策略

- 研发投资趋势及分配

- 技术采用时间表和障碍

- 材料技术演变与路线图

- 解决方案框架和痛点

- 总拥有成本(TCO)分析

- 按部门分類的初始采购成本明细

- 安装和设定成本分析

- 维护和更换费用预测

- 保险费影响量化

- 转售价值考虑和折旧

- 安全和盗窃分析

- 按产品类型和地区分類的窃盗事件率

- 安全功能有效性指标

- 保险理赔分析和趋势

- 防盗技术投资报酬率评估

- 依安全等级分析回收率

- 安装复杂性与时间分析

- 按产品分類的安装复杂度指数 (ICI)

- 按产品类型分類的平均安装时间

- 专业安装与DIY安装的成功率

- 常见安装挑战资料库

- 服务网路可用性映射

- 工具需求分析与成本影响

- 总拥有成本(TCO)分析

- 永续性和环境方面

- 环境影响评估

- 依材料类型分析碳足迹

- 可回收性和报废管理

- 永续生产实践评估

- 循环经济整合策略

- 用水量和废弃物管理指标

- ESG合规框架

- 企业永续性评级(按公司)

- 供应链透明度指标

- 社会影响评估和社区关係

- 治理与道德标准比较

- 利害关係人参与有效性

- 环境影响评估

- 客户体验分析

- 客户满意度基准测试

- 购买决策历程图

- 品牌忠诚度与转换行为

- 耐候效能资料库

- 气动衝击综合测量

- 负载能力与利用模式分析

- 品质标准和测试协议

- 数位转型与电子商务的影响

- 数位行销成效分析

- 社群媒体影响力指标与投资报酬率

- 线上评论对销售的影响评估

- 网红行销的有效性和影响力

- 内容行销绩效与参与度

- 搜寻引擎优化影响分析

- 电商平台绩效分析

- 特定平台的销售分析与趋势

- 转换率优化策略

- 按平台分析客户获取成本

- 数位客户体验指标及改进

- 移动商务趋势和表现

- 数位客户旅程优化

- 全通路体验整合

- 数位接触点有效性分析

- 客户资料分析与个人化

- 数位客户服务和支援指标

- 数位行销成效分析

- 季节性需求和库存分析

- 按地区分析季节性需求模式

- 月度销售变化分析及趋势

- 天气影响相关性和预测

- 旅游季节调整与优化

- 节庆和活动影响分析

- 库存规划和最佳化策略

- 需求预测模型与准确性

- 按地区和产品优化安全库存

- 供应链同步策略

- 季节性库存投资分析

- 区域气候影响评估

- 天气模式分析与市场影响

- 季节性产品组合优化

- 区域存储和仓储要求

- 按地区分析季节性需求模式

- 波特的分析

- PESTEL分析

- 战略展望

- 电动摩托车革命影响分析

- 市场转型时间表和影响

- 技术适应要求和策略

- 新的市场机会与收入来源

- 传统市场颠覆评估

- 自动驾驶摩托车技术的影响

- 技术开发时间表和准备情况

- 市场混乱的潜力与影响

- 地缘政治影响评估与缓解

- 贸易政策影响及因应策略

- 市场进入风险评估与缓解

- 供应链弹性和适应性

- 策略合作机会和模式

- 技术合作策略与优势

- 市场拓展合作机会

- 价值链整合与优化

- 电动摩托车革命影响分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按摩托车,2021 - 2034 年

- 主要趋势

- 探险自行车

- 巡洋舰摩托车

- 旅行摩托车

- 运动自行车

- 越野车

- 其他(Enduro、Cafe Racer 等)

第六章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 塑胶

- 铝

- 玻璃纤维

- 其他(软尾包等)

第七章:市场估计与预测:按安装情况,2021 - 2034

- 主要趋势

- 单锁

- Monokey

第八章:市场估计与预测:依储存容量,2021 - 2034

- 主要趋势

- 小型(10-20公升)

- 中号(21-40L)

- 大号(41-60公升)

- 特大号(60L以上)

第九章:市场估计与预测:按配销通路,2021 - 2034

- 主要趋势

- OEM

- 售后市场

- 在线的

- 离线

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 印尼

- 菲律宾

- 泰国

- 韩国

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- 全球参与者

- GIVI

- Hepco & Becker

- SW-MOTECH

- SHAD

- Kappa

- Acerbis

- 区域参与者

- Nelson-Rigg

- Kriega

- Oxford Products

- Touratech

- Giant Loop

- Wolfman Luggage

- Ortlieb Sportartikel

- Bagster

- Ventura Bike-Pack

- Motodry

- 新兴参与者/颠覆者

- Mosko Moto

- Enduristan

- ROK Straps

- Tusk

- Twisted Throttle

- Bumot

- Happy Trails Products

- Wolfpack Luggage

- Rigg Gear

The Global Motorcycle Top-box Market was valued at USD 952.2 million in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 2.87 billion by 2034.

As motorcycles are widely used for leisure and daily commuting, riders are placing greater importance on practical and secure storage solutions. Carrying essentials such as helmets, bags, groceries, laptops, or work-related documents can be challenging without dedicated compartments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $952.2 Million |

| Forecast Value | $2.87 Billion |

| CAGR | 11.6% |

Rising Adoption of Adventure Bikes

The adventure bikes segment held robust growth in 2024 as riders sought versatile motorcycles capable of handling both on-road and off-road conditions. Top-boxes designed for this segment emphasized durability, water resistance, and ample storage capacity to accommodate long-distance touring gear. Riders favor models with reinforced locking systems and rugged construction that withstand harsh environments. The rising popularity of adventure touring, combined with increased disposable income among enthusiasts, is driving demand for premium, multifunctional top-boxes.

Plastic to Gain Traction

The plastic segment in the motorcycle top-box market generated a notable share in 2024 owing to its lightweight, cost-effective, and versatile properties. High-impact plastics such as ABS and polypropylene provide durability while enabling manufacturers to design aerodynamic shapes and vibrant finishes that appeal to style-conscious riders. Plastic top-boxes offer resistance against weather elements and corrosion, making them ideal for daily commuters and casual riders alike. As demand grows for affordable yet reliable storage solutions, companies are innovating by incorporating UV-resistant coatings and reinforced structures to extend product lifespan. The plastic segment's balance of functionality and aesthetics continues to be a significant driver of market expansion.

Regional Insights

Asia Pacific to Emerge as a Propelling Market

Asia Pacific motorcycle top-box market is expected to witness substantial growth through 2034, propelled by the region's expanding urban populations and rising motorcycle ownership. In countries such as India, China, and Southeast Asia, motorcycles serve as essential transportation for millions, fueling demand for practical storage accessories. Local manufacturers and international players are investing in expanding distribution networks, offering competitively priced models tailored to diverse consumer preferences. The growth of e-commerce platforms in the region further enhances accessibility, enabling faster market penetration.

Major players in the motorcycle top-box market are Touratech, SHAD, Kappa, Hepco & Becker, BMW Motorrad, SW-Motech, Acerbis Italia, Piaggio & Co., GIVI, and STUDDS Accessories.

Companies in the motorcycle top-box market are focusing on product innovation, expanding distribution channels, and strengthening brand visibility to solidify their market presence. Many are investing in R&D to develop lightweight, durable, and weather-resistant top-boxes with advanced security features, catering to both premium and budget segments. Strategic collaborations with motorcycle manufacturers allow for OEM partnerships, ensuring compatibility and integrated design. To capture the growing online consumer base, brands are enhancing their e-commerce capabilities, providing detailed product information, and improving after-sales service.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Motorcycle

- 2.2.3 Material

- 2.2.4 Mounting

- 2.2.5 Storage capacity

- 2.2.6 Distribution channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising motorcycle ownership in urban areas

- 3.2.1.2 Growth of motorcycle touring and adventure

- 3.2.1.3 E-commerce and logistics sector expansion

- 3.2.1.4 Advancements in material & design

- 3.2.1.5 Integration of smart features

- 3.2.1.6 Growing electric bike market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Compatibility issues across models

- 3.2.2.2 Theft & vandalism concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Customizable and modular designs

- 3.2.3.2 Eco-friendly and recycled material products

- 3.2.3.3 Integration with rider apps and navigation

- 3.2.3.4 Growth in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.5.1 UN ECE regulations compliance framework

- 3.5.2 EU type-approval systems analysis

- 3.5.3 Regional safety standards comparison

- 3.5.4 Certification requirements by market

- 3.6 Technology and innovation landscape

- 3.6.1 Material technology evolution and roadmap

- 3.6.1.1 Advanced aluminum alloys development

- 3.6.1.2 High-performance plastics innovation (ABS, polycarbonate)

- 3.6.1.3 Carbon fiber composites advancement

- 3.6.1.4 Hybrid material solutions and applications

- 3.6.1.5 Smart materials integration potential

- 3.6.2 Manufacturing process innovations

- 3.6.2.1 Injection molding technology advancements

- 3.6.2.2 3D printing applications and scalability

- 3.6.2.3 Automated assembly systems implementation

- 3.6.2.4 Quality control and testing innovations

- 3.6.3 Smart technology integration framework

- 3.6.3.1 GPS tracking systems and accuracy metrics

- 3.6.3.2 Electronic locking mechanisms security analysis

- 3.6.3.3 Mobile app connectivity and user experience

- 3.6.3.4 Anti-theft alert systems effectiveness

- 3.6.3.5 IoT integration and data analytics

- 3.6.4 Design and ergonomics innovations

- 3.6.4.1 Aerodynamic optimization techniques

- 3.6.4.2 Quick-release mechanisms efficiency

- 3.6.4.3 Universal mounting systems compatibility

- 3.6.4.4 Weather resistance feature enhancement

- 3.6.4.5 User interface and accessibility improvements

- 3.6.5 Future technology roadmap (2025-2034)

- 3.6.5.1 Patent landscape analysis and IP strategy

- 3.6.5.2 R&D investment trends and allocation

- 3.6.5.3 Technology adoption timeline and barriers

- 3.6.1 Material technology evolution and roadmap

- 3.7 Solution framework & pain points

- 3.7.1 Total cost of ownership (TCO) analysis

- 3.7.1.1 Initial purchase cost breakdown by segment

- 3.7.1.2 Installation and setup cost analysis

- 3.7.1.3 Maintenance and replacement expense projections

- 3.7.1.4 Insurance premium impact quantification

- 3.7.1.5 Resale value considerations and depreciation

- 3.7.2 Security and theft analytics

- 3.7.2.1 Theft incident rates by product type and region

- 3.7.2.2 Security feature effectiveness metrics

- 3.7.2.3 Insurance claim analysis and trends

- 3.7.2.4 Anti-theft technology ROI assessment

- 3.7.2.5 Recovery rate analysis by security level

- 3.7.3 Installation complexity and time analysis

- 3.7.3.1 Installation complexity index (ICI) by product

- 3.7.3.2 Average installation time by product type

- 3.7.3.3 Professional vs. DIY installation success rates

- 3.7.3.4 Common installation challenges database

- 3.7.3.5 Service network availability mapping

- 3.7.3.6 Tool requirement analysis and cost impact

- 3.7.1 Total cost of ownership (TCO) analysis

- 3.8 Sustainability and environmental aspects

- 3.8.1 Environmental impact assessment

- 3.8.1.1 Carbon footprint analysis by material type

- 3.8.1.2 Recyclability and end-of-life management

- 3.8.1.3 Sustainable manufacturing practices evaluation

- 3.8.1.4 Circular economy integration strategies

- 3.8.1.5 Water usage and waste management metrics

- 3.8.2 Esg compliance framework

- 3.8.2.1 Corporate sustainability ratings by company

- 3.8.2.2 Supply chain transparency metrics

- 3.8.2.3 Social impact assessment and community relations

- 3.8.2.4 Governance and ethics standards comparison

- 3.8.2.5 Stakeholder engagement effectiveness

- 3.8.1 Environmental impact assessment

- 3.9 Customer experience analytics

- 3.9.1 Customer satisfaction benchmarking

- 3.9.2 Purchase decision journey mapping

- 3.9.3 Brand loyalty and switching behavior

- 3.10 Weather resistance performance database

- 3.10.1 Aerodynamic impact comprehensive measurements

- 3.10.2 Load capacity and utilization pattern analysis

- 3.10.3 Quality standards and testing protocols

- 3.11 Digital transformation and e-commerce impact

- 3.11.1 Digital marketing effectiveness analysis

- 3.11.1.1 Social media influence metrics and ROI

- 3.11.1.2 Online review impact assessment on sales

- 3.11.1.3 Influencer marketing effectiveness and reach

- 3.11.1.4 Content marketing performance and engagement

- 3.11.1.5 Search engine optimization impact analysis

- 3.11.2 E-commerce platform performance analysis

- 3.11.2.1 Platform-specific sales analytics and trends

- 3.11.2.2 Conversion rate optimization strategies

- 3.11.2.3 Customer acquisition cost analysis by platform

- 3.11.2.4 Digital customer experience metrics and improvement

- 3.11.2.5 Mobile commerce trends and performance

- 3.11.3 Digital customer journey optimization

- 3.11.3.1 Omnichannel experience integration

- 3.11.3.2 Digital touchpoint effectiveness analysis

- 3.11.3.3 Customer data analytics and personalization

- 3.11.3.4 Digital customer service and support metrics

- 3.11.1 Digital marketing effectiveness analysis

- 3.12 Seasonal demand and inventory analytics

- 3.12.1 Seasonal demand pattern analysis by region

- 3.12.1.1 Monthly sales variation analysis and trends

- 3.12.1.2 Weather impact correlation and forecasting

- 3.12.1.3 Tourism season alignment and optimization

- 3.12.1.4 Holiday and event impact analysis

- 3.12.2 Inventory planning and optimization strategies

- 3.12.2.1 Demand forecasting models and accuracy

- 3.12.2.2 Safety stock optimization by region and product

- 3.12.2.3 Supply chain synchronization strategies

- 3.12.2.4 Seasonal inventory investment analysis

- 3.12.3 Regional climate impact assessment

- 3.12.3.1 Weather pattern analysis and market impact

- 3.12.3.2 Seasonal product mix optimization

- 3.12.3.3 Regional storage and warehousing requirements

- 3.12.1 Seasonal demand pattern analysis by region

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Strategic outlook

- 3.15.1 Electric motorcycle revolution impact analysis

- 3.15.1.1 Market transformation timeline and implications

- 3.15.1.2 Technology adaptation requirements and strategies

- 3.15.1.3 New market opportunities and revenue streams

- 3.15.1.4 Traditional market disruption assessment

- 3.15.1.5 Autonomous motorcycle technology impact

- 3.15.1.6 Technology development timeline and readiness

- 3.15.1.7 Market disruption potential and implications

- 3.15.2 Geopolitical impact assessment and mitigation

- 3.15.2.1 Trade policy impact and response strategies

- 3.15.2.2 Market access risk assessment and mitigation

- 3.15.2.3 Supply chain resilience and adaptation

- 3.15.3 Strategic partnership opportunities and models

- 3.15.3.1 Technology partnership strategies and benefits

- 3.15.3.2 Market expansion partnership opportunities

- 3.15.3.3 Value chain integration and optimization

- 3.15.1 Electric motorcycle revolution impact analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Motorcycle, 2021 - 2034 ($Mn, Mn Units)

- 5.1 Key trends

- 5.2 Adventure bikes

- 5.3 Cruiser motorcycles

- 5.4 Touring motorcycles

- 5.5 Sport bikes

- 5.6 Dirt bikes

- 5.7 Others (Enduro, Cafe Racer etc.)

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Mn Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Aluminum

- 6.4 Fiber glass

- 6.5 Others (soft tail bags etc.)

Chapter 7 Market Estimates & Forecast, By Mounting, 2021 - 2034 ($Mn, Mn Units)

- 7.1 Key trends

- 7.2 Monolock

- 7.3 Monokey

Chapter 8 Market Estimates & Forecast, By Storage Capacity, 2021 - 2034 ($Mn, Mn Units)

- 8.1 Key trends

- 8.2 Small (10-20L)

- 8.3 Medium (21-40L)

- 8.4 Large (41-60L)

- 8.5 Extra-large (above 60L)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Mn Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

- 9.3.1 Online

- 9.3.2 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Mn Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Indonesia

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 South Korea

- 10.4.9 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 GIVI

- 11.1.2 Hepco & Becker

- 11.1.3 SW-MOTECH

- 11.1.4 SHAD

- 11.1.5 Kappa

- 11.1.6 Acerbis

- 11.2 Regional Players

- 11.2.1 Nelson-Rigg

- 11.2.2 Kriega

- 11.2.3 Oxford Products

- 11.2.4 Touratech

- 11.2.5 Giant Loop

- 11.2.6 Wolfman Luggage

- 11.2.7 Ortlieb Sportartikel

- 11.2.8 Bagster

- 11.2.9 Ventura Bike-Pack

- 11.2.10 Motodry

- 11.3 Emerging Players / Disruptors

- 11.3.1 Mosko Moto

- 11.3.2 Enduristan

- 11.3.3 ROK Straps

- 11.3.4 Tusk

- 11.3.5 Twisted Throttle

- 11.3.6 Bumot

- 11.3.7 Happy Trails Products

- 11.3.8 Wolfpack Luggage

- 11.3.9 Rigg Gear