|

市场调查报告书

商品编码

1822593

卫星 NTN 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Satellite NTN Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

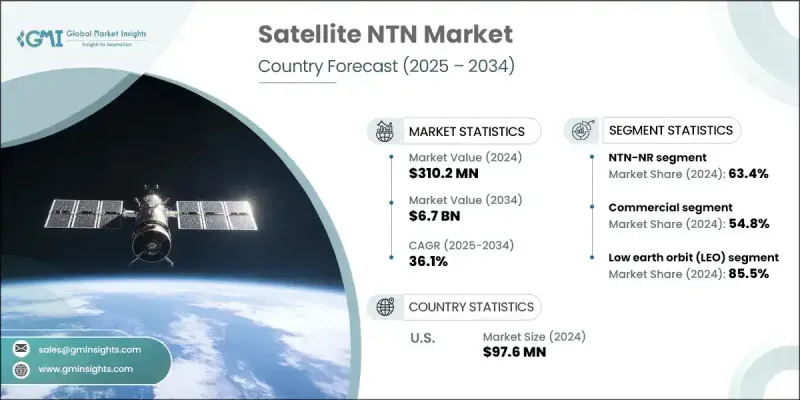

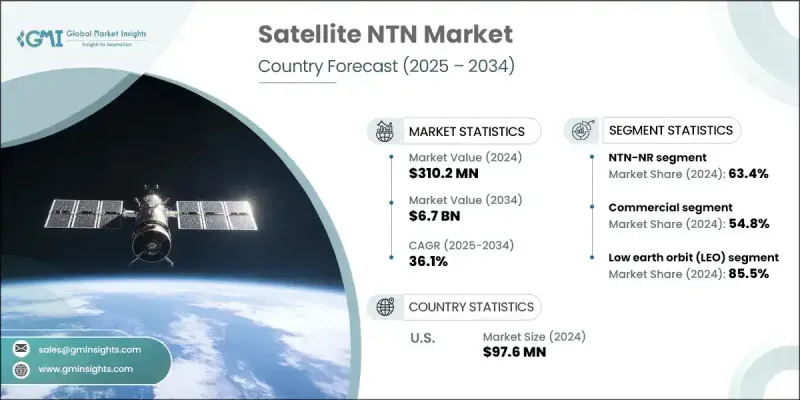

2024 年全球卫星 NTN 市值为 3.102 亿美元,预计到 2034 年将以 36.1% 的复合年增长率增长至 67 亿美元。

这一显着成长主要得益于全球对高速宽频连线日益增长的需求,尤其是在服务不足的地区。持续部署的包含NTN基础设施的5G网路在市场扩张中发挥关键作用。 NTN与3GPP Release 17及更高版本的集成,在地面和卫星网路之间建立了更无缝的连接,改善了农村和偏远地区的覆盖范围。对低地球轨道(LEO)卫星系统的投资正在激增,各大公司大幅扩充其卫星群,以填补全球连结缺口。随着电信业者寻求更具弹性和可扩展性的基础设施,基于卫星的NTN解决方案正在部署以加强地面系统,特别是在网路基础设施稀疏的地区。在各国透过卫星服务和支持地面设施缩小数位落差的努力的支持下,巴西、南非和印度等新兴经济体正在迅速采用这些技术。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.102亿美元 |

| 预测值 | 67亿美元 |

| 复合年增长率 | 36.1% |

NTN-NR 技术由于相容 5G 标准,在 2024 年占据了 63.4% 的市场份额,为行动和物联网应用提供了高资料吞吐量和超低延迟。政府对 5G NTN 部署的支援不断增加,电信业者也加强了投资力度,进一步加速了这一领域的发展动能。 NTN-NR 系统的整合正在带来更流畅的用户体验,并推动动物联网、物流和行动领域的创新。

受宽频存取、数位内容交付和企业物联网解决方案需求不断增长的推动,商业应用领域在2024年占据了54.8%的份额。随着数位转型成为企业的策略重点,各企业纷纷投资卫星NTN,以提高网路的连续性、速度和可扩展性。从媒体到物流,再到云端服务,商业用户纷纷转向这些解决方案,以获得跨地域的可靠覆盖。

2024年,北美卫星NTN市场占据35.1%的市场份额,这得益于5G NTN的早期采用、成熟的卫星基础设施以及对低地球轨道(LEO)系统的大量投资。核心技术公司的聚集、强大的用户群,以及强有力的监管和资金支持,将继续推动北美地区保持领先地位。有意在该地区扩张规模的企业应专注于与当地电信业者和公共部门机构合作,将卫星覆盖范围扩展到服务不足的农村地区,特别是利用低延迟解决方案和宽频补贴。

影响全球卫星 NTN 市场的关键公司包括洛克希德马丁、OneWeb、L3Harris Technologies、Teledyne Technologies、Viasat Inc.、爱立信、SES SA、太空探索技术公司 (SpaceX)、SWISSto12 和 Telesat。为了保持在卫星 NTN 产业的竞争优势,各公司正在与电信营运商和政府建立战略合作关係,以扩大 5G NTN 覆盖范围。领先的参与者正在扩展其 LEO 卫星星座,以向偏远和城市市场提供低延迟、高吞吐量的服务。他们还投资于下一代地面基础设施、边缘整合和自适应波形技术,以满足不断变化的资料需求。对研发、可扩展平台解决方案和基于云端的连接服务的重视正在帮助品牌满足企业需求和新兴的物联网用例。战略性的政府合作伙伴关係支持在服务欠缺地区部署基础设施。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 全球对宽频连线的需求不断增长

- 扩展采用NTN技术的5G网络

- 低地球轨道(LEO)卫星星座的投资不断增加

- 物联网和机器对机器 (M2M) 应用的采用率不断上升

- 政府措施支持国防和公共安全卫星通信

- 产业陷阱与挑战

- 高资本支出和营运成本

- 监管挑战和复杂的频谱分配

- 市场机会

- 融合地面和非地面通讯的混合网路发展

- 不断增长的数位基础设施需求

- 机载处理和天线系统的技术进步

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规要求

- 专利和智慧财产权分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- NTN天然橡胶

- NTN-物联网

第六章:市场估计与预测:按组件,2021 - 2034

- 主要趋势

- 硬体

- 射频前端

- 天线

- 板载处理器单元

- 其他的

- 软体

第七章:市场估计与预测:按轨道类型,2021 - 2034 年

- 主要趋势

- 低地球轨道(LEO)

- 中地球轨道(MEO)

- 地球静止轨道(GEO)

第八章:市场估计与预测:按频率,2021 - 2034 年

- 主要趋势

- L波段

- S波段

- C波段

- Ku波段

- Ka波段

- HF/VHF/UHF频段

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 宽频网路存取

- 直接到装置 (D2D) 连接

- 回程和网路扩展

- 物联网/M2M 连接

- 其他的

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 商业的

- 电信及网际网路服务

- 媒体与广播

- 企业和消费者物联网

- 能源和公用事业

- 运输与物流

- 其他的

- 防御

- C4 ISR

- 军事通信

- 战场机动性和战术网络

- 监视和侦察卫星

- 其他的

- 政府

- 公共安全与紧急应变

- 太空研究与探索

- 环境监测

- 基础设施管理

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- 全球关键参与者

- Space Exploration Technologies Corp. (SpaceX)

- OneWeb

- SES SA

- Viasat Inc.

- Telesat

- 区域关键参与者

- 北美洲

- Intelsat General Communications

- Lockheed Martin

- L3Harris Technologies

- Qorvo, Inc.

- Qualcomm Technologies Inc.

- 欧洲

- Airbus

- Thales Alenia Space

- SWISSto12

- OQ Technology

- 亚太地区

- Huawei Technologies Co., Ltd.

- MediaTek Inc.

- NEC Corporation

- Nokia Corporation

- 北美洲

- 利基市场参与者/颠覆者

- AST SpaceMobile

- Teledyne Technologies

- Ericsson

- Filtronic Plc

- ZTE Corporation

The Global Satellite NTN Market was valued at USD 310.2 million in 2024 and is estimated to grow at a CAGR of 36.1% to reach USD 6.7 billion by 2034.

This remarkable growth is largely driven by the rising global demand for high-speed broadband connectivity, especially in underserved regions. The continued rollout of 5G networks incorporating NTN infrastructure is playing a key role in market expansion. Integration of NTN into 3GPP's Release 17 and beyond has created a more seamless link between terrestrial and satellite networks, improving coverage in rural and hard-to-reach areas. Investment in low Earth orbit (LEO) satellite systems is surging, with companies significantly expanding their satellite fleets to fill connectivity gaps worldwide. As telecom providers look for more resilient and scalable infrastructure, satellite-based NTN solutions are being deployed to strengthen terrestrial systems-particularly in regions where network infrastructure is sparse. Emerging economies like Brazil, South Africa, and India are rapidly adopting these technologies, backed by national efforts to close the digital divide through satellite services and supporting ground installations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $310.2 Million |

| Forecast Value | $6.7 Billion |

| CAGR | 36.1% |

The NTN-NR technology held a 63.4% share in 2024 due to its compatibility with 5G standards, offering high data throughput and ultra-low latency for mobile and IoT applications. Increasing government support and telecom operator investment in 5G NTN rollouts are further accelerating the momentum of this segment. The integration of NTN-NR systems is enabling smoother user experiences and driving innovation across IoT, logistics, and mobile sectors.

The commercial application segment held 54.8% share in 2024, propelled by growing demand for broadband access, digital content delivery, and enterprise IoT solutions. As digital transformation becomes a strategic priority for businesses, organizations are investing in satellite NTN to improve network continuity, speed, and scalability. From media to logistics and cloud-based services, commercial users are turning to these solutions for dependable coverage across diverse geographies.

North America Satellite NTN Market held a 35.1% share in 2024, supported by early 5G NTN adoption, an established satellite infrastructure, and substantial investments in LEO systems. The presence of key technology companies and a robust user base, along with strong regulatory and funding support, continues to drive regional leadership. Businesses aiming to scale in this region should focus on partnerships with local telecom carriers and public-sector agencies to extend satellite coverage to underserved rural zones, particularly by leveraging low-latency solutions and broadband grants.

Key companies shaping the Global Satellite NTN Market include Lockheed Martin, OneWeb, L3Harris Technologies, Teledyne Technologies, Viasat Inc., Ericsson, SES S.A., Space Exploration Technologies Corp. (SpaceX), SWISSto12, and Telesat. To maintain a competitive edge in the satellite NTN industry, companies are pursuing strategic collaborations with telecom carriers and governments to scale 5G NTN coverage. Leading players are expanding their LEO satellite constellations to deliver low-latency, high-throughput services across remote and urban markets. They are also investing in next-gen ground infrastructure, edge integration, and adaptive waveform technology to meet evolving data needs. Emphasis on R&D, scalable platform solutions, and cloud-based connectivity services is helping brands cater to enterprise demand and emerging IoT use cases. The strategic government partnerships support infrastructure deployment in underserved areas.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Component trends

- 2.2.3 Orbit type trends

- 2.2.4 Frequency trends

- 2.2.5 Application trends

- 2.2.6 end use trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global demand for broadband connectivity

- 3.2.1.2 Expansion of 5G networks incorporating NTN technology

- 3.2.1.3 Growing investments in Low Earth Orbit (LEO) satellite constellations

- 3.2.1.4 Rising adoption of IoT and Machine-to-Machine (M2M) applications

- 3.2.1.5 Government initiatives supporting satellite communications for defense and public safety

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital expenditure and operational costs

- 3.2.2.2 Regulatory challenges and complex spectrum allocation

- 3.2.3 Market opportunities

- 3.2.3.1 Development of hybrid networks integrating terrestrial and non-terrestrial communication

- 3.2.3.2 Growing digital infrastructure needs

- 3.2.3.3 Technological advancements in onboard processing and antenna systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing Strategies

- 3.10 Emerging Business Models

- 3.11 Compliance Requirements

- 3.12 Patent and IP analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 NTN-NR

- 5.3 NTN-IoT

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 RF front end

- 6.2.2 Antenna

- 6.2.3 Onboard processor unit

- 6.2.4 Others

- 6.3 Software

Chapter 7 Market Estimates and Forecast, By Orbit Type, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Low earth orbit (LEO)

- 7.3 Medium earth orbit (MEO)

- 7.4 Geostationary orbit (GEO)

Chapter 8 Market Estimates and Forecast, By Frequency, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 L-band

- 8.3 S-band

- 8.4 C-band

- 8.5 Ku-band

- 8.6 Ka-band

- 8.7 HF/VHF/UHF-bands

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Broadband internet access

- 9.3 Direct-to-Device (D2D) connectivity

- 9.4 Backhaul and network extension

- 9.5 IoT/M2M connectivity

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 10.1 Commercial

- 10.1.1 Telecommunications & internet service

- 10.1.2 Media & broadcasting

- 10.1.3 Enterprise & consumer IoT

- 10.1.4 Energy & utilities

- 10.1.5 Transportation & logistics

- 10.1.6 Others

- 10.2 Defense

- 10.2.1. C4 ISR

- 10.2.2 Military communications

- 10.2.3 Battlefield mobility & tactical networks

- 10.2.4 Surveillance & reconnaissance satellites

- 10.2.5 Others

- 10.3 Government

- 10.3.1 Public safety & emergency response

- 10.3.2 Space research & exploration

- 10.3.3 Environmental monitoring

- 10.3.4 Infrastructure management

- 10.3.5 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Key Players

- 12.1.1 Space Exploration Technologies Corp. (SpaceX)

- 12.1.2 OneWeb

- 12.1.3 SES S.A.

- 12.1.4 Viasat Inc.

- 12.1.5 Telesat

- 12.2 Regional Key Players

- 12.2.1 North America

- 12.2.1.1 Intelsat General Communications

- 12.2.1.2 Lockheed Martin

- 12.2.1.3 L3Harris Technologies

- 12.2.1.4 Qorvo, Inc.

- 12.2.1.5 Qualcomm Technologies Inc.

- 12.2.2 Europe

- 12.2.2.1 Airbus

- 12.2.2.2 Thales Alenia Space

- 12.2.2.3 SWISSto12

- 12.2.2.4 OQ Technology

- 12.2.3 Asia Pacific

- 12.2.3.1 Huawei Technologies Co., Ltd.

- 12.2.3.2 MediaTek Inc.

- 12.2.3.3 NEC Corporation

- 12.2.3.4 Nokia Corporation

- 12.2.1 North America

- 12.3 Niche Players / Disruptors

- 12.3.1 AST SpaceMobile

- 12.3.2 Teledyne Technologies

- 12.3.3 Ericsson

- 12.3.4 Filtronic Plc

- 12.3.5 ZTE Corporation