|

市场调查报告书

商品编码

1822601

汽车网路安全市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Cybersecurity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

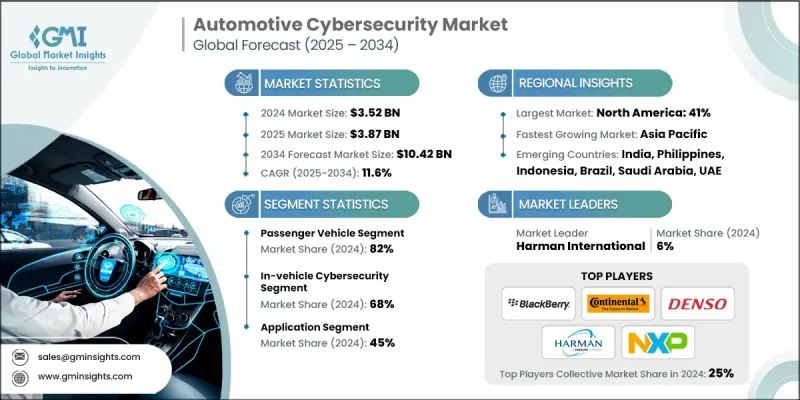

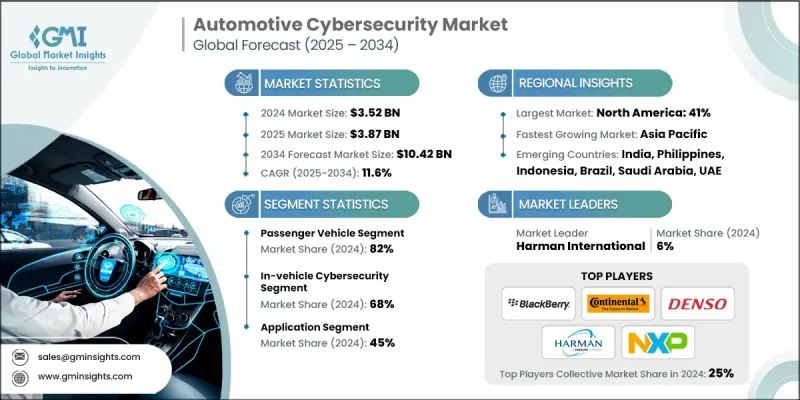

2024 年全球汽车网路安全市场规模估计为 35.2 亿美元。根据 Global Market Insights Inc. 发布的最新报告,预计该市场规模将从 2025 年的 38.7 亿美元增长到 2034 年的 104.2 亿美元,复合年增长率为 11.6%。

随着车辆透过 V2X(车联网)通讯和嵌入式资讯娱乐系统日益互联,骇客的攻击面也显着扩大。这促使汽车製造商投资强大的网路安全解决方案,以保护即时资料交换、车载网路和数位系统。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35.2亿美元 |

| 预测值 | 104.2亿美元 |

| 复合年增长率 | 11.6% |

乘用车需求不断成长

由于连网汽车、资讯娱乐系统和自动驾驶技术的快速发展,乘用车在2024年汽车网路安全市场中占据了可持续的份额。随着消费者对更智慧、更安全、更数位化驾驶体验的期望,汽车製造商正在将先进的网路安全协定直接整合到乘用车中。

车载网路安全的普及率不断提高

2024年,车载网路安全领域占据了相当大的份额,这得益于对保护电子控制单元 (ECU)、资讯娱乐系统、远端资讯处理系统和车辆网路免受外部威胁的重视。随着车辆的功能越来越像行动计算机,车载网路安全能够确保即时威胁侦测、安全通讯和资料完整性。如今,原始设备製造商 (OEM) 正在从头开始设计安全性,将软体防火墙、入侵侦测系统和加密技术直接嵌入车辆硬体和软体堆迭中。

应用程式获得关注

2024年,汽车网路安全市场的应用领域创造了可观的收入,这得益于从远端资讯处理和资讯娱乐到ADAS(高级驾驶辅助系统)以及动力总成控制的应用。现代车辆内部的每个数位接触点都需要保护。随着车辆架构的复杂性日益增加,网路安全应用也需要根据每个系统进行客製化,以确保端到端的保护。

北美将成为利润丰厚的地区

2024年,北美汽车网路安全市场保持强劲成长,这得益于强有力的监管支援、消费者对技术的热情以及领先的网路安全和汽车创新企业的涌现。美国正在将网路弹性嵌入行动出行解决方案中。随着美国网路安全行政命令等监管框架的出台以及消费者资料隐私意识的不断提升,汽车製造商正在加快对强大的车载安全系统的投资。此外,原始设备製造商与大型科技公司之间的合作正在推动车辆安全协议的新突破。

汽车网路安全市场的主要参与者有 Karamba Security、Lear、Harman International、Denso、Upstream Security、NXP、Blackberry、Aptiv、Continental 和 Intertek。

汽车网路安全市场的公司正专注于创新,透过广泛的研发来开发尖端的安全解决方案,以应对连网和自动驾驶汽车中出现的威胁。与汽车製造商、技术提供者和监管机构的策略合作伙伴关係和协作正在加速产品整合和合规性。许多参与者正在大力投资即时威胁侦测系统和人工智慧驱动的网路安全框架,以增强车辆安全性。透过收购和合资企业扩大全球影响力是另一种占领新市场和新客户群的常用策略。

目录

第一章:方法论

- 研究设计

- 研究方法

- 资料收集方法

- GMI 专有 AI 系统

- 人工智慧驱动的研究增强

- 来源一致性协议

- 人工智慧准确度指标

- 基础估算与计算

- 基准年计算

- 预测模型

- 市场估计的主要趋势

- 量化市场影响分析

- 生长参数对预测的数学影响

- 情境分析框架

- 初步研究与验证

- 一些主要来源(但不限于)

- 资料探勘来源

- 次要

- 付费来源

- 公共资源

- 来源(按地区)

- 次要

- 研究路径和信心评分

- 研究路径组成部分:

- 评分组件

- 研究透明度附录

- 来源归因框架

- 品质保证指标

- 我们对信任的承诺

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 汽车OEM

- 网路安全解决方案提供商

- 云端服务供应商

- 一级供应商

- 技术整合商

- 最终用途

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 供应商格局

- 产业衝击力

- 成长动力

- 连网汽车的普及率不断提高

- 针对汽车製造商的严格网路安全法规

- 车辆结构日益复杂

- 无线更新的激增

- 产业陷阱与挑战

- 网路安全解决方案实施中的成本限制

- 遗留系统集成

- 市场机会

- 连网汽车普及率不断上升

- 向软体定义汽车转变

- 监理推动和合规标准

- 电动车和自动驾驶汽车的扩张

- 成长动力

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 传统安全方法与局限性

- 下一代安全架构

- 与汽车开发流程集成

- 新兴技术

- 人工智慧和机器学习应用

- 行为分析和异常检测

- 区块链用于安全车辆通信

- 量子计算对密码学的影响

- 零信任安全性架构

- 汽车系统策略实施

- 网路分段与微分段

- 身分识别和存取管理 (IAM) 解决方案

- 软体定义车辆 (SDV) 安全

- 安全设计原则

- 持续安全监控

- 动态安全性策略管理

- 未来科技颠覆(2025-2034)

- 抗量子密码学实现

- 6G网路安全要求

- 边缘运算安全挑战

- 自动驾驶汽车安全发展

- 技术就绪程度(TRL)评估

- 目前技术成熟度分析

- 商业化时程预测

- 投资需求和投资报酬率分析

- 当前的技术趋势

- 专利分析

- 定价趋势与经济分析

- 成本分析和投资报酬率评估

- 网路安全投资分析

- CSMS实施成本评估

- 事故成本影响分析

- 区域成本差异

- 成本优化策略

- 财务风险评估

- 威胁情报和攻击分析

- 当前威胁情势评估

- 攻击向量分类与分析

- 关键系统漏洞

- 高阶持续性威胁 (APT) 分析

- 事件回应和取证能力

- 威胁情报共享与协作

- 用例

- 投资前景和资金分析

- 成本效益分析

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依车型,2021 - 2034

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第六章:市场估计与预测:按证券,2021 - 2034

- 主要趋势

- 应用

- 网路

- 端点

第七章:市场估计与预测:依部署模式,2021 - 2034

- 主要趋势

- 基于云端

- 本地

- 杂交种

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- ADAS 和安全

- 身体控制和舒适度

- 资讯娱乐

- 远端资讯处理

- 动力传动系统

- 通讯系统

第九章:市场估计与预测:依形式,2021 - 2034

- 主要趋势

- 车载网路安全

- 外部云端网路安全

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Argus Cyber Security

- Blackberry

- Bosch

- BT Group

- Cisco Systems

- Continental

- Denso

- ESCRYPT

- Harman International

- Intel

- Irdeto Automotive

- Karamba Security

- Lear Corporation

- Microsoft

- NXP Semiconductors

- Symantec

- Trillium Secure

- Vector Informatik

- 区域参与者

- Aptiv

- Eneos Cyber Solutions

- Intertek

- OneLayer

- SafeRide Technologies

- Tuxera Automotive

- 新兴玩家

- Arilou Technologies

- AutoCrypt

- GuardKnox

- Karamba Security

- Keen Security Lab

- Upstream Security

The global automotive cybersecurity market was estimated at USD 3.52 billion in 2024. The market is expected to grow from USD 3.87 billion in 2025 to USD 10.42 billion by 2034 at a CAGR of 11.6%, according to latest report published by Global Market Insights Inc.

As vehicles become increasingly connected via V2X (vehicle-to-everything) communications and embedded infotainment systems, the attack surface for hackers grows significantly. This pushes automakers to invest in robust cybersecurity solutions to protect real-time data exchange, vehicle networks, and digital systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.52 Billion |

| Forecast Value | $10.42 Billion |

| CAGR | 11.6% |

Rising demand in Passenger Vehicle

The passenger vehicle segment in the automotive cybersecurity market held sustainable share in 2024, owing to the rapid growth of connected cars, infotainment systems, and autonomous driving technologies. As consumers expect smarter, safer, and more digital driving experiences, automakers are integrating advanced cybersecurity protocols directly into passenger vehicles.

Growing Adoption of In-Vehicle Cybersecurity

In-vehicle cybersecurity segment held substantial share in 2024 driven by the focus on safeguarding electronic control units (ECUs), infotainment systems, telematics, and vehicle networks from external threats. As vehicles increasingly function like mobile computers, in-vehicle cybersecurity ensures real-time threat detection, secure communication, and data integrity. OEMs are now designing security from the ground up, embedding software firewalls, intrusion detection systems, and encryption directly into vehicle hardware and software stacks.

Application to Gain Traction

The application segment in automotive cybersecurity market generated notable revenues in 2024 fueled by telematics and infotainment to ADAS (Advanced Driver Assistance Systems) and powertrain control. Every digital touchpoint inside a modern vehicle needs protection. As the complexity of vehicle architecture grows, cybersecurity applications are being tailored to each system, ensuring end-to-end protection.

North America to Emerge as a Lucrative Region

North America automotive cybersecurity market held robust growth in 2024 driven by strong regulatory backing, tech-savvy consumers, and the presence of leading cybersecurity and automotive innovators. The U.S. sets embedding cyber resilience in mobility solutions. With regulatory frameworks like the U.S. Cybersecurity Executive Order and rising consumer awareness around data privacy, automakers are accelerating investments in robust in-vehicle security systems. Additionally, partnerships between OEMs and major tech firms are fueling new breakthroughs in vehicle security protocols.

Major players in the automotive cybersecurity market are Karamba Security, Lear, Harman International, Denso, Upstream Security, NXP, Blackberry, Aptiv, Continental, Intertek.

Companies in the automotive cybersecurity market are focusing on innovation through extensive R&D to develop cutting-edge security solutions that address emerging threats in connected and autonomous vehicles. Strategic partnerships and collaborations with automakers, technology providers, and regulatory bodies are accelerating product integration and compliance. Many players are investing heavily in real-time threat detection systems and AI-driven cybersecurity frameworks to enhance vehicle safety. Expanding their global footprint through acquisitions and joint ventures is another common tactic to capture new markets and customer segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 GMI proprietary AI system

- 1.1.3.1 AI-Powered research enhancement

- 1.1.3.2 Source consistency protocol

- 1.1.3.3 AI accuracy metrics

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Primary research & validation

- 1.5 Some of the primary sources (but not limited to)

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

- 1.7 Research Trail & Confidence Scoring

- 1.7.1 Research Trail Components:

- 1.7.2 Scoring Components

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Security

- 2.2.4 Form

- 2.2.5 Application

- 2.2.6 Deployment Mode

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Automotive OEM

- 3.1.1.2 Cybersecurity solution providers

- 3.1.1.3 Cloud service providers

- 3.1.1.4 Tier 1 Suppliers

- 3.1.1.5 Technology integrators

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.1.1 Supplier landscape

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing connected vehicle adoption

- 3.2.1.2 Strict cybersecurity regulations for automotive manufacturers

- 3.2.1.3 Growing complexity of vehicle architecture

- 3.2.1.4 Proliferation of Over-the-Air Updates

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cost constraints in the implementation of cybersecurity solutions

- 3.2.2.2 Legacy system integration

- 3.2.3 Market opportunities

- 3.2.3.1 Rising connected vehicle adoption

- 3.2.3.2 Shift toward software-defined vehicles

- 3.2.3.3 Regulatory push and compliance standards

- 3.2.3.4 Expansion of EVs and autonomous vehicles

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.1.1 Traditional security approaches and limitations

- 3.6.1.2 Next-generation security architecture

- 3.6.1.3 Integration with automotive development processes

- 3.6.2 Emerging technologies

- 3.6.2.1 Artificial intelligence and machine learning applications

- 3.6.2.2 Behavioral analytics and anomaly detection

- 3.6.2.3 Blockchain for secure vehicle communications

- 3.6.2.4 Quantum computing impact on cryptography

- 3.6.3 Zero trust security architecture

- 3.6.3.1 Implementation of strategies for automotive systems

- 3.6.3.2 Network segmentation and micro-segmentation

- 3.6.3.3 Identity and access management (IAM) solutions

- 3.6.4 Software-defined vehicle (SDV) security

- 3.6.4.1 Security-by-design principles

- 3.6.4.2 Continuous security monitoring

- 3.6.4.3 Dynamic security policy management

- 3.6.5 Future technology disruptions (2025-2034)

- 3.6.5.1 Quantum-resistant cryptography implementation

- 3.6.5.2 6G network security requirements

- 3.6.5.3 Edge computing security challenges

- 3.6.5.4 Autonomous vehicle security evolution

- 3.6.6 Technology Readiness Level (TRL) Assessment

- 3.6.6.1 Current technology maturity analysis

- 3.6.6.2 Commercialization timeline projections

- 3.6.6.3 Investment requirements and ROI analysis

- 3.6.1 Current technological trends

- 3.7 Patent analysis

- 3.8 Pricing trends and economic analysis

- 3.9 Cost Analysis and ROI Assessment

- 3.9.1 Cybersecurity investment analysis

- 3.9.2 CSMS implementation cost assessment

- 3.9.3 Incident cost impact analysis

- 3.9.4 Regional cost variations

- 3.9.5 Cost optimization strategies

- 3.9.6 Financial risk assessment

- 3.10 Threat intelligence and attack analysis

- 3.10.1 Current threat landscape assessment

- 3.10.2 Attack vector classification and analysis

- 3.10.3 Critical system vulnerabilities

- 3.10.4 Advanced persistent threat (APT) analysis

- 3.10.5 Incident response and forensics capabilities

- 3.10.6 Threat intelligence sharing and collaboration

- 3.11 Use cases

- 3.12 Investment landscape and funding analysis

- 3.13 Cost-benefit analysis

- 3.14 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicle

- 5.3.1 Light commercial vehicle (LCVs)

- 5.3.2 Medium commercial vehicle (MCVs)

- 5.3.3 Heavy commercial vehicle (HCVs)

Chapter 6 Market Estimates & Forecast, By Security, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Application

- 6.3 Network

- 6.4 Endpoint

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud-based

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 ADAS & safety

- 8.3 Body control & comfort

- 8.4 Infotainment

- 8.5 Telematics

- 8.6 Powertrain systems

- 8.7 Communication systems

Chapter 9 Market Estimates & Forecast, By Form, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 In-vehicle cybersecurity

- 9.3 External cloud cybersecurity

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Argus Cyber Security

- 11.1.2 Blackberry

- 11.1.3 Bosch

- 11.1.4 BT Group

- 11.1.5 Cisco Systems

- 11.1.6 Continental

- 11.1.7 Denso

- 11.1.8 ESCRYPT

- 11.1.9 Harman International

- 11.1.10 Intel

- 11.1.11 Irdeto Automotive

- 11.1.12 Karamba Security

- 11.1.13 Lear Corporation

- 11.1.14 Microsoft

- 11.1.15 NXP Semiconductors

- 11.1.16 Symantec

- 11.1.17 Trillium Secure

- 11.1.18 Vector Informatik

- 11.2 Regional Players

- 11.2.1 Aptiv

- 11.2.2 Eneos Cyber Solutions

- 11.2.3 Intertek

- 11.2.4 OneLayer

- 11.2.5 SafeRide Technologies

- 11.2.6 Tuxera Automotive

- 11.3 Emerging Players

- 11.3.1 Arilou Technologies

- 11.3.2 AutoCrypt

- 11.3.3 GuardKnox

- 11.3.4 Karamba Security

- 11.3.5 Keen Security Lab

- 11.3.6 Upstream Security