|

市场调查报告书

商品编码

1822604

游艇市场机会、成长动力、产业趋势分析及2025-2034年预测Yacht Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

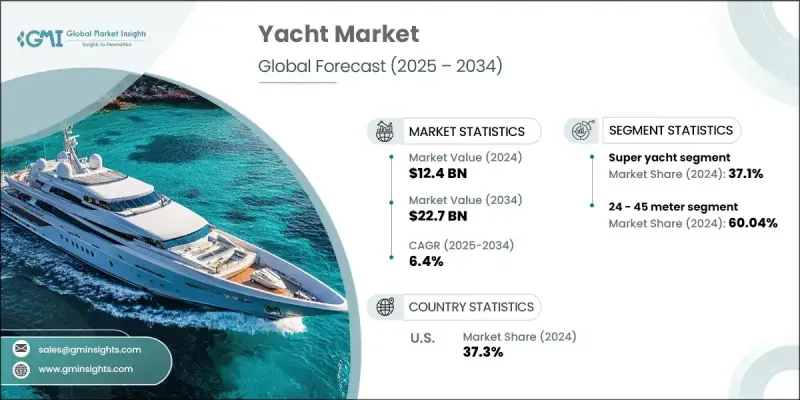

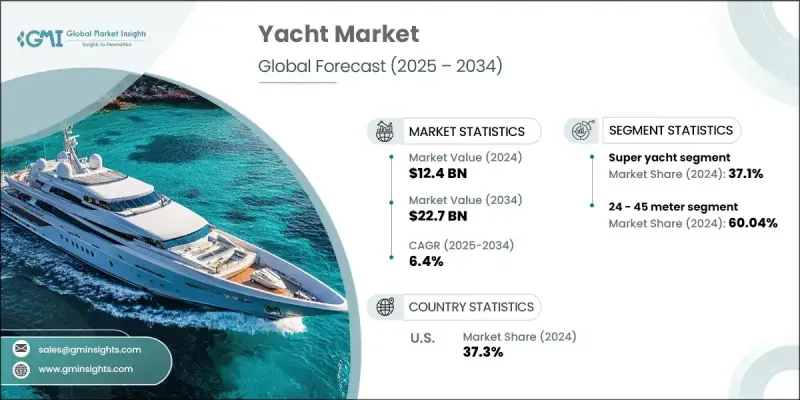

全球游艇市场规模达124亿美元,预计到2034年将以6.4%的复合年增长率增长,达到227亿美元,这得益于可支配收入的增加以及奢华和休閒活动日益普及。随着全球财富的增长,尤其是高净值人士的财富增长,豪华游艇作为尊贵身份和个人享受的象征,其需求日益增长。私人巡航体验的魅力,加上现代游艇设计提供的客製化选项,使游艇成为富裕人士颇具吸引力的生活方式选择。例如,义大利造船厂Cantiere delle Marche于2024年7月推出了一艘「一次性」的42.6公尺探险游艇B2。游艇工程领域的创新,例如燃油效率的提高、导航系统的改进以及环保技术,进一步提升了游艇对买家的吸引力。

尖端设施和永续特性(例如混合动力推进系统和节能设计)的结合,以满足兼顾奢华与环保的现代消费者不断变化的偏好,将推动市场成长。整个游艇行业按类型、长度、推进力和地区细分。根据类型,预计到2032年,运动游艇市场的规模将持续成长。运动游艇配备先进的技术和空气动力学设计,可提供卓越的航行体验,并经常出现在着名的帆船赛和帆船比赛中。人们对帆船运动和高端赛事的兴趣日益浓厚,再加上游艇设计和材料的进步,进一步增强了富裕买家和划船爱好者对运动游艇的渴望。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 124亿美元 |

| 预测值 | 227亿美元 |

| 复合年增长率 | 6.4% |

预计到2032年,风帆推进型游艇市场将实现显着成长,这得益于帆船运动的传统和环保特性。此外,帆船将优雅、性能和永续性完美结合,吸引了那些欣赏风力航行技巧和经验的买家。人们对环保意识和减少碳足迹的日益重视,也增加了人们对帆船运动的兴趣,使其成为比机动游艇更环保的替代方案。到2032年,亚太地区游艇产业规模将大幅成长。这归因于中高净值人群的不断增长,尤其是在中国、印度和澳洲等国家,这些国家日益增长的富裕程度正在刺激对豪华休閒资产的需求。包括码头和游艇俱乐部在内的沿海基础设施的扩建,为该地区提供了更好的设施和航海机会,进一步增强了游艇拥有者的吸引力。

目录

第一章:方法论

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- GMI 专有 AI 系统

- 人工智慧驱动的研究增强

- 来源一致性协议

- 人工智慧准确度指标

- 预测模型

- 初步研究和验证

- 市场估计的主要趋势

- 量化市场影响分析

- 生长参数对预测的数学影响

- 情境分析框架

- 一些主要来源(但不限于)

- 资料探勘来源

- 次要

- 付费来源

- 公共资源

- 来源(按地区)

- 次要

- 研究路径和信心评分

- 研究路径组成部分:

- 评分组件

- 研究透明度附录

- 来源归因框架

- 品质保证指标

- 我们对信任的承诺

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 游艇製造商和建造商

- 码头和基础设施提供商

- 包机和管理公司

- 维护和改装服务

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 供应商格局

- 经济影响评估

- 直接和间接的经济贡献

- 各地区GDP贡献

- 就业创造分析

- 税收和政府收入

- 贸易平衡和出口影响

- 创造就业机会和技能发展

- 製造业直接就业

- 服务业间接就业

- 技能发展和培训计划

- 职涯道路和晋昇机会

- 旅游和酒店业的联繫

- 目的地旅游影响

- 饭店和餐厅整合

- 本地服务提供者的优势

- 文化和环境影响

- 直接和间接的经济贡献

- 市场演变与历史发展

- 产业起源与早期发展

- 重要的历史里程碑与转折点

- 技术演进时间表

- 市场成熟阶段

- 产业衝击力

- 成长动力

- 财富增长和高净值人士(HNWI)

- 奢华旅游和休閒活动日益普及

- 技术进步和定制

- 游艇租赁市场的扩张

- 加强沿海基础设施建设

- 产业陷阱与挑战

- 维护和营运成本高

- 经济和市场波动

- 市场机会

- 亚太地区的新兴市场与财富成长

- 环保且永续的游艇

- 数位化和智慧游艇技术

- 游艇共享和部分所有权模式的成长

- 成长动力

- 成长潜力分析

- 生产统计

- 监管格局

- 国际海事法规

- MARPOL 公约合规性

- 国际海事组织温室气体战略

- NOX Tier III 排放标准

- 区域监理框架

- 欧盟法规

- 地中海繫泊规定

- 美国船舶排放法规

- 亚太地区监理发展

- 环境合规要求

- 碳减排目标

- 废弃物管理和处理标准

- 海洋保护区限制

- 永续性报告要求

- 安全及安保法规

- 海事劳工公约(MLC 2006)

- 智慧游艇的网路安全标准

- 船旗国合规要求

- 税务和法律考虑

- 增值税结构和影响

- 所有权和註册要求

- 包机许可证和经营许可证

- 国际海事法规

- 专利分析

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 永续推进系统

- 电动和混合动力游艇技术

- 氢燃料电池集成

- 替代能源(太阳能、风能)

- 燃油效率优化

- 智慧游艇技术

- 物联网 (IoT) 集成

- 人工智慧和自动化

- 先进的导航和安全系统

- 连线解决方案(Starlink、5G)

- 设计和材料创新

- 先进复合材料

- 轻量化建筑技术

- 环保材料应用

- 模组化和可自订的设计理念

- 游艇产业的数位转型

- 虚拟实境与扩增实境应用

- 数位预订和包机平台

- 预测性维护技术

- 区块链在游艇交易中的应用

- 永续推进系统

- 专利分析

- 供应炼和製造分析

- 全球製造业格局

- 供应链结构与动态

- 製造能力和利用率

- 供应链的挑战与机会

- 用例

- 最佳情况

- 消费者行为分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 新兴竞争威胁

- 新市场进入者

- 科技颠覆者

- 替代商业模式

- 竞争情报框架

- 重要新闻和倡议

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 飞桥游艇

- 运动游艇

- 超级游艇

- 其他(长航程游艇、巡洋舰、探险游艇)

第六章:市场估计与预测:依长度,2021 - 2034

- 主要趋势

- 24米以下

- 24 - 45米

- 45米以上

第七章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 引擎

- 帆

- 混合动力/电动

第八章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- 全球参与者

- Abeking & Rasmussen

- Amels / Damen Yachting

- Benetti

- CRN

- Feadship

- Ferretti Group

- Fincantieri

- Group Beneteau

- Heesen Yachts

- Lurssen

- Malibu Boats

- MasterCraft Boat Holdings

- Oceanco

- Princess Yachts

- Sanlorenzo

- Sea Ray

- The Italian Sea Group

- Sunseeker International

- Viking Yachts

- Yamaha Marine

- 区域参与者

- Turquoise Yachts

- Nimbus Group

- Cheoy Lee Shipyards

- Boston Whaler

- Hatteras Yachts

- Nobiskrug

- Nautique Boat Company

- 新兴参与者/颠覆者

- Malibu Boats

- Turquoise Yachts

The Global Yacht market was valued at USD 12.4 billion and is estimated to grow at a CAGR of 6.4% to reach USD 22.7 billion by 2034, driven by increasing disposable incomes and the rising popularity of luxury and recreational activities. With the expanding global wealth, particularly among high-net-worth individuals, there is growing demand for luxury yachts as symbols of prestige and personal indulgence. The allure of private cruising experiences, combined with the customization options available in modern yacht designs are making yachts an attractive lifestyle choice for affluent individuals. For instance, in July 2024, Italian shipyard Cantiere delle Marche launched a "one off" 42.6-metre explorer yacht B2. Innovations in yacht engineering, such as enhanced fuel efficiency, improved navigation systems, and eco-friendly technologies, are further turning yachts more appealing to buyers.

The incorporation of cutting-edge amenities and sustainable features, such as hybrid propulsion systems and energy-efficient designs to cater to the evolving preferences of modern consumers who prioritize both luxury and environmental responsibility will drive the market growth. The overall yacht industry is segmented into type, length, propulsion, and region. Based on type, the market size from the sports yacht segment is anticipated to witness growth through 2032. Sports yachts, equipped with advanced technology and aerodynamics, offer superior sailing experiences and are often featured in prestigious regattas and sailing competitions. The increasing interest in sailing sports and high-profile events, coupled with advancements in yacht design and materials, are further enhancing the desirability of sports yachts among affluent buyers and racing aficionados.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.4 Billion |

| Forecast Value | $22.7 Billion |

| CAGR | 6.4% |

Yacht market from the sail propulsion segment is predicted to record notable gains up to 2032 due to traditional and eco-friendly aspects of sailing. Moreover, sailing yachts offer a unique combination of elegance, performance, and sustainability, appealing to buyers who appreciate the skill and experience involved in navigating by wind power. The growing emphasis on environmental consciousness and reduced carbon footprints has also increased the interest in sailing as a greener alternative to motorized yachting. Asia Pacific yacht industry size will grow significantly through 2032. This is attributed to rising middle and high-net-worth population, particularly in countries like China, India, and Australia, where increasing affluence is fueling the demand for luxury recreational assets. The expansion of coastal infrastructure, including marinas and yacht clubs, is further enhancing the appeal of yacht ownership by providing better facilities and access to sailing opportunities in the region.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Length

- 2.2.4 Propulsion

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Yacht manufacturers and builders

- 3.1.1.2 Marina and infrastructure providers

- 3.1.1.3 Charter and management companies

- 3.1.1.4 Maintenance and refit services

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.1.1 Supplier landscape

- 3.2 Economic impact assessment

- 3.2.1 Direct and indirect economic contributions

- 3.2.1.1 GDP contribution by region

- 3.2.1.2 Employment generation analysis

- 3.2.1.3 Tax revenue and government income

- 3.2.1.4 Trade balance and export impact

- 3.2.2 Employment generation and skills development

- 3.2.2.1 Direct employment in manufacturing

- 3.2.2.2 Indirect employment in services

- 3.2.2.3 Skill development and training programs

- 3.2.2.4 Career pathway and advancement opportunities

- 3.2.3 Tourism and hospitality sector linkages

- 3.2.3.1 Destination tourism impact

- 3.2.3.2 Hotel and restaurant integration

- 3.2.3.3 Local service provider benefits

- 3.2.3.4 Cultural and environmental impact

- 3.2.1 Direct and indirect economic contributions

- 3.3 Market evolution and historical development

- 3.3.1 Industry genesis and early development

- 3.3.2 Key historical milestones and turning points

- 3.3.3 Technology evolution timeline

- 3.3.4 Market maturation phases

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising wealth and high net-worth individuals (HNWIs)

- 3.4.1.2 Growing popularity of luxury tourism and leisure activities

- 3.4.1.3 Technological advancements and customization

- 3.4.1.4 Expansion of yacht charter market

- 3.4.1.5 Increasing coastal infrastructure development

- 3.4.2 Industry pitfalls and challenges

- 3.4.2.1 High maintenance and operating costs

- 3.4.2.2 Economic and market volatility

- 3.4.3 Market opportunities

- 3.4.3.1 Emerging markets and increasing wealth in Asia-Pacific

- 3.4.3.2 Eco-friendly and sustainable yachts

- 3.4.3.3 Digitalization and smart yacht technologies

- 3.4.3.4 Growth of yacht sharing and fractional ownership models

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Production statistics

- 3.7 Regulatory landscape

- 3.7.1 International maritime regulations

- 3.7.1.1 MARPOL convention compliance

- 3.7.1.2 IMO greenhouse gas strategy

- 3.7.1.3 NOX tier III emissions standards

- 3.7.2 Regional Regulatory Frameworks

- 3.7.2.1 European union regulations

- 3.7.2.2 Mediterranean mooring regulations

- 3.7.2.3 U.S. marine emissions rules

- 3.7.2.4 Asia-Pacific regulatory developments

- 3.7.3 Environmental compliance requirements

- 3.7.3.1 Carbon emission reduction targets

- 3.7.3.2 Waste management and treatment standards

- 3.7.3.3 Marine protected area restrictions

- 3.7.3.4 Sustainability reporting requirements

- 3.7.4 Safety and security regulations

- 3.7.4.1 Maritime labour convention (MLC 2006)

- 3.7.4.2 Cybersecurity standards for smart yachts

- 3.7.4.3 Flag state compliance requirements

- 3.7.5 Tax and Legal Considerations

- 3.7.5.1 VAT structures and implications

- 3.7.5.2 Ownership and registration requirements

- 3.7.5.3 Charter license and operating permits

- 3.7.1 International maritime regulations

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Technology and innovation landscape

- 3.11.1 Sustainable propulsion systems

- 3.11.1.1 Electric and hybrid yacht technologies

- 3.11.1.2 Hydrogen fuel cell integration

- 3.11.1.3 Alternative energy sources (solar, wind)

- 3.11.1.4 Fuel efficiency optimization

- 3.11.2 Smart yacht technologies

- 3.11.2.1 Internet of things (IoT) integration

- 3.11.2.2 Artificial intelligence and automation

- 3.11.2.3 Advanced navigation and safety systems

- 3.11.2.4 Connectivity solutions (Starlink, 5G)

- 3.11.3 Design and materials innovation

- 3.11.3.1 Advanced composite materials

- 3.11.3.2 Lightweight construction technologies

- 3.11.3.3 Eco-friendly material applications

- 3.11.3.4 Modular and customizable design concepts

- 3.11.4 Digital transformation in yachting

- 3.11.4.1 Virtual reality and augmented reality applications

- 3.11.4.2 Digital booking and charter platforms

- 3.11.4.3 Predictive maintenance technologies

- 3.11.4.4 Blockchain applications in yacht transactions

- 3.11.1 Sustainable propulsion systems

- 3.12 Patent analysis

- 3.13 Supply Chain And Manufacturing Analysis

- 3.13.1 Global manufacturing landscape

- 3.13.2 Supply chain structure and dynamics

- 3.13.3 Manufacturing capacity and utilization

- 3.13.4 Supply chain challenges and opportunities

- 3.14 Use cases

- 3.15 Best-case scenario

- 3.16 Consumer behaviour analysis

- 3.17 Sustainability and Environmental Aspects

- 3.17.1 Sustainable practices

- 3.17.2 Waste reduction strategies

- 3.17.3 Energy efficiency in production

- 3.17.4 Eco-friendly Initiatives

- 3.17.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Emerging competitive threats

- 4.6.1 New market entrants

- 4.6.2 Technology disruptors

- 4.6.3 Alternative business models

- 4.6.4 Competitive intelligence framework

- 4.7 Key news and initiatives

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Flybridge Yacht

- 5.3 Sport Yacht

- 5.4 Super Yachts

- 5.5 Others (Long Range, Cruisers, Expedition Yachts)

Chapter 6 Market Estimates & Forecast, By Length, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Below 24 meter

- 6.3 24 - 45 meter

- 6.4 Above 45 meter

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Motor

- 7.3 Sail

- 7.4 Hybrid/electric

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 Abeking & Rasmussen

- 9.1.2 Amels / Damen Yachting

- 9.1.3 Benetti

- 9.1.4 CRN

- 9.1.5 Feadship

- 9.1.6 Ferretti Group

- 9.1.7 Fincantieri

- 9.1.8 Group Beneteau

- 9.1.9 Heesen Yachts

- 9.1.10 Lurssen

- 9.1.11 Malibu Boats

- 9.1.12 MasterCraft Boat Holdings

- 9.1.13 Oceanco

- 9.1.14 Princess Yachts

- 9.1.15 Sanlorenzo

- 9.1.16 Sea Ray

- 9.1.17 The Italian Sea Group

- 9.1.18 Sunseeker International

- 9.1.19 Viking Yachts

- 9.1.20 Yamaha Marine

- 9.2 Regional Players

- 9.2.1 Turquoise Yachts

- 9.2.2 Nimbus Group

- 9.2.3 Cheoy Lee Shipyards

- 9.2.4 Boston Whaler

- 9.2.5 Hatteras Yachts

- 9.2.6 Nobiskrug

- 9.2.7 Nautique Boat Company

- 9.3 Emerging Players / Disruptors

- 9.3.1 Malibu Boats

- 9.3.2 Turquoise Yachts