|

市场调查报告书

商品编码

1822608

子宫内膜异位症治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Endometriosis Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

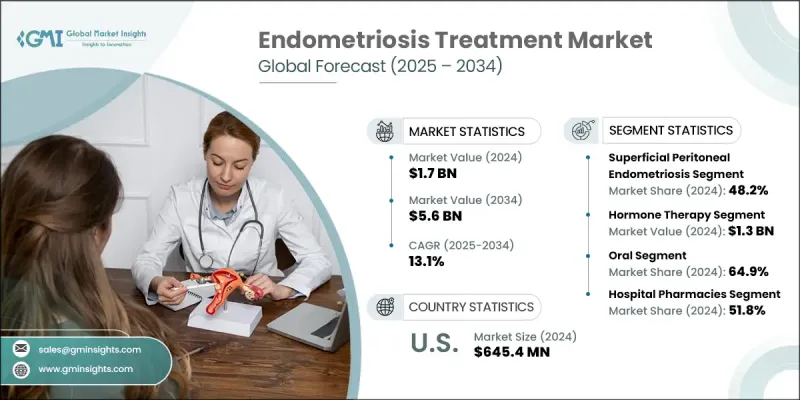

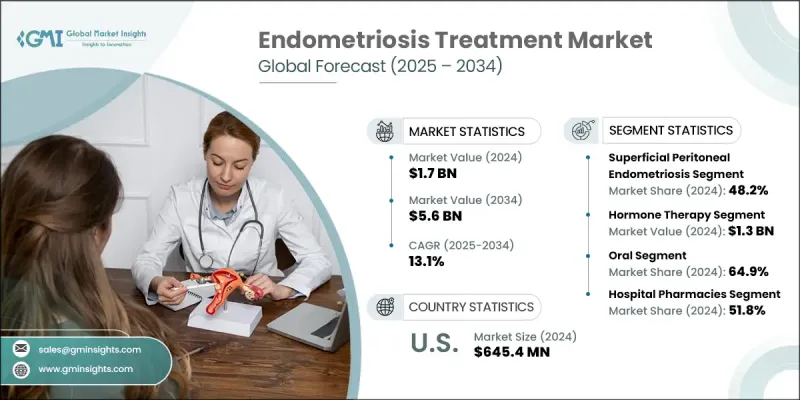

全球子宫内膜异位症治疗市场规模预计在2024年达到17亿美元,预计到2034年将以13.1%的复合年增长率增长,达到56亿美元,这得益于人们认知度的提高、医疗技术的进步以及医疗服务可及性的改善。加强教育和早期诊断工作正在帮助更多患者在早期阶段寻求医疗干预,从而刺激对有效治疗方案的需求。医疗保健提供者正专注于综合管理策略,这些策略不仅能立即缓解症状,还能改善长期健康。政府措施和倡导团体在消除对子宫内膜异位症的偏见方面发挥关键作用,鼓励更多女性寻求治疗方案。研发投入的不断增加也有助于扩大治疗选择,製药公司正在探索创新疗法以增强患者护理。

医疗保健支出的增加和保险覆盖范围的扩大使得子宫内膜异位症的治疗更加便捷,使更多患者能够及时获得医疗救治。随着相关宣传活动不断强调子宫内膜异位症未得到治疗的长期影响,越来越多的患者正在寻求专科治疗。对非侵入性治疗方案的需求激增,尤其是在寻求手术介入替代方案的年轻患者中。医疗保健专业人员正在努力整合个人化治疗方法,以满足患者的个人化需求,进一步推动市场发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 56亿美元 |

| 复合年增长率 | 13.1% |

按疾病类型划分,市场细分为不同类型,其中浅层性腹膜子宫内膜异位症在2024年占据41.3%的主导份额。这种疾病的特征是腹膜表面出现病变,比深层子宫内膜异位症更广泛、更容易辨识。因此,这种疾病的诊断率更高,从而可以更快地进行医疗干预,并增加针对此类疾病的治疗需求。表浅性腹膜子宫内膜异位症的早期发现和治疗能力使其成为市场中最常见的疾病类型。

子宫内膜异位症的治疗方案主要分为荷尔蒙疗法和疼痛管理,其中荷尔蒙疗法在2024年的收入为8.029亿美元。医生通常会开立避孕药、黄体素和荷尔蒙调节药物来缓解骨盆腔疼痛和月经过多等症状。这些治疗方法因其有效性、易于给药以及能够改善患者生活品质而越来越受欢迎。越来越多的人选择荷尔蒙疗法,因为它们无需侵入性手术即可缓解症状。

2024年,美国子宫内膜异位症治疗市场规模达5.821亿美元,这得益于公共卫生倡议和宣传活动的持续推进。致力于普及子宫内膜异位症的症状和影响,鼓励患者做出积极的医疗保健决策,并减少了人们对该疾病的偏见。医学研究的进步、对生殖健康的日益关注以及专科医疗服务的普及,进一步加速了市场扩张。随着对创新治疗方案的需求持续增长,製药公司和医疗保健提供者正致力于透过更先进、更有针对性的治疗方法来改善患者的治疗效果。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 子宫内膜异位症的盛行率和认知度不断上升

- 诊断技术的进步

- 增加政府资金和倡议

- 产业陷阱与挑战

- 先进治疗成本高

- 市场机会

- 非荷尔蒙疗法的发展

- 新兴市场的扩张

- 成长动力

- 成长潜力分析

- 监管格局

- 技术进步

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 差距分析

- 管道分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按疾病类型,2021 - 2034 年

- 主要趋势

- 表浅腹膜子宫内膜异位症

- 卵巢子宫内膜异位症

- 深部浸润型子宫内膜异位症

- 其他疾病

第六章:市场估计与预测:依治疗类型,2021 - 2034

- 主要趋势

- 荷尔蒙疗法

- 止痛药

第七章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- 促性腺激素释放激素

- 非类固醇抗发炎药

- 口服避孕药

- 其他药物类别

第 8 章:市场估计与预测:按管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 注射剂

- 其他给药途径

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- AbbVie

- AstraZeneca

- Bayer

- Debiopharm

- Gedeon Richter

- Kissei Pharmaceutical

- Pfizer

- Sanofi

- Teva Pharmaceutical

- Zydus

The Global Endometriosis Treatment Market, valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 13.1% to reach USD 5.6 billion by 2034, driven by rising awareness, advances in medical treatments, and improved healthcare accessibility. Increased education and early diagnosis efforts are helping more individuals seek medical intervention at earlier stages, boosting demand for effective therapeutic solutions. Healthcare providers are focusing on comprehensive management strategies that not only address immediate symptom relief but also improve long-term health outcomes. Government initiatives and advocacy groups are playing a critical role in destigmatizing the condition, encouraging more women to pursue treatment options. The growing investment in research and development is also contributing to the expansion of treatment choices, with pharmaceutical companies exploring innovative therapies to enhance patient care.

Rising healthcare expenditure and improved insurance coverage have made endometriosis treatments more accessible, allowing more patients to receive timely medical attention. As awareness campaigns continue to highlight the long-term impact of untreated endometriosis, an increasing number of patients are seeking specialized care. The demand for non-invasive treatment options has surged, particularly among younger patients looking for alternatives to surgical interventions. Healthcare professionals are working to integrate personalized treatment approaches that cater to individual patient needs, further driving the market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $5.6 Billion |

| CAGR | 13.1% |

By disease type, the market is segmented into different forms, with the superficial peritoneal endometriosis segment holding a dominant 41.3% share in 2024. This form of the condition, characterized by lesions on the peritoneal surface, is widespread and more easily identifiable than deeper forms of endometriosis. As a result, it is diagnosed more frequently, leading to quicker medical intervention and higher demand for treatments targeting this type. The ability to detect and manage superficial peritoneal endometriosis early has positioned it as the most prevalent segment within the market.

Endometriosis treatment options are primarily divided into hormone therapy and pain management, with hormone therapy generating USD 802.9 million in 2024. Physicians commonly prescribe contraceptives, progestins, and hormone-modulating drugs to alleviate symptoms such as pelvic pain and excessive menstrual bleeding. These treatments are gaining popularity due to their effectiveness, ease of administration, and ability to improve patients' quality of life. More individuals are opting for hormone-based therapies as they provide symptom relief without the need for invasive procedures.

The United States endometriosis treatment market accounted for USD 582.1 million in 2024, fueled by increasing public health initiatives and awareness campaigns. Efforts to educate individuals about the symptoms and implications of endometriosis have encouraged proactive healthcare decisions and reduced stigma surrounding the condition. Advancements in medical research, a stronger focus on reproductive health, and improved access to specialized healthcare services are further accelerating market expansion. As demand for innovative treatment solutions continues to grow, pharmaceutical companies and healthcare providers are working to enhance patient outcomes through more advanced and targeted therapeutic approaches.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Disease type trends

- 2.2.3 Treatment type trends

- 2.2.4 Drug class trends

- 2.2.5 Route of administration trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence and awareness of endometriosis

- 3.2.1.2 Advancement in diagnostic techniques

- 3.2.1.3 Increased government funding and initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Development of non-hormonal therapies

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Pipeline analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Superficial peritoneal endometriosis

- 5.3 Ovarian endometriomas

- 5.4 Deep infiltrating endometriosis

- 5.5 Other diseases

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hormone therapy

- 6.3 Pain medication

Chapter 7 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Gonadotropin-releasing hormone

- 7.3 NSAIDs

- 7.4 Oral contraceptive

- 7.5 Other drug classes

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Injectable

- 8.4 Other routes of administration

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AbbVie

- 11.2 AstraZeneca

- 11.3 Bayer

- 11.4 Debiopharm

- 11.5 Gedeon Richter

- 11.6 Kissei Pharmaceutical

- 11.7 Pfizer

- 11.8 Sanofi

- 11.9 Teva Pharmaceutical

- 11.10 Zydus