|

市场调查报告书

商品编码

1822622

自动门市场机会、成长动力、产业趋势分析及2025-2034年预测Automatic Door Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

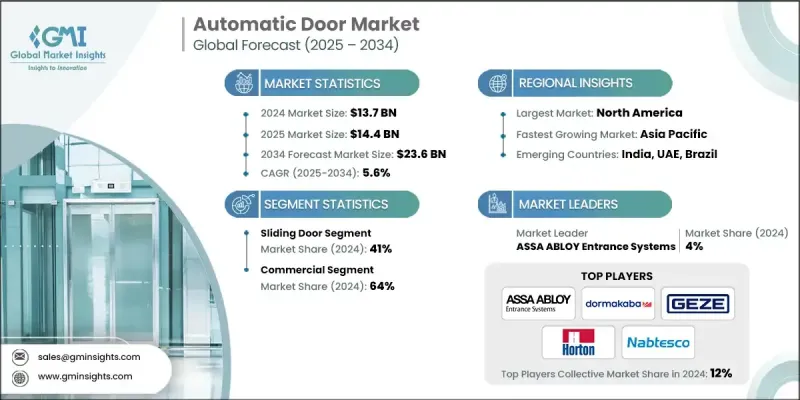

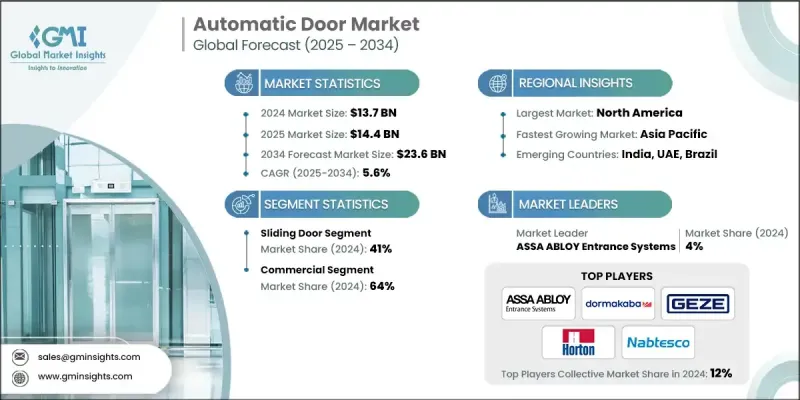

2024 年全球自动门市场价值为 137 亿美元,预计到 2034 年将以 5.6% 的复合年增长率增长至 236 亿美元。

新冠疫情爆发后,人们的卫生和公共卫生意识增强,显着加速了向非接触式技术的转变。自动门已成为最大程度减少实体接触点的关键解决方案,尤其是在医院、机场、零售店和办公大楼等人流量大的环境中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 137亿美元 |

| 预测值 | 236亿美元 |

| 复合年增长率 | 5.6% |

滑动门需求不断成长

2024年,滑动门市场占据了显着份额,这得益于其在高人流量区域的高效性和最大化空间利用的能力。这类门在机场、医院和零售连锁店等商业环境中备受青睐,因为这些场所注重人流的连续性和便利的出入。滑动门外观时尚现代,通常配备运动感应器,可实现无缝操作。其低摩擦机制和极小的占地面积使其成为新建和改造专案的实用选择。随着建筑设计持续强调开放空间和可及性,对滑动自动门的需求仍然强劲,并持续推动市场成长。

商业领域将获得发展动力

2024年,商业领域收入可观,这得益于购物中心、办公大楼、饭店和医疗机构的广泛应用。这些空间需要可靠、使用者友善的入口系统,能够在不影响安全性和美观性的情况下应对持续的人流。商业应用中的自动门不仅能提升使用者体验,还能透过控制气流和温度稳定性来提高能源效率。随着消费者对便利性和卫生要求的不断提高,企业正在优先考虑自动入口解决方案,以提高营运效率和客户满意度。

区域洞察

北美将成为推动力地区

2024年,北美自动门市场占据了强劲的市场份额,这得益于其强大的基础设施、严格的建筑标准以及对无障碍设施的监管重视。在后疫情时代,美国医疗、零售和公共部门建筑中非接触式门禁系统的采用率不断提高。随着节能和智慧建筑的日益普及,自动门正作为一种功能性和美观元素融入现代建筑。

自动门市场的主要参与者有 Ultra Safe Security Doors、Dormakaba Group、GEZE GmbH、Record USA、Wilcox Door Service Inc.、TORMAX USA Inc.、浙江西康门业有限公司、Royal Boon Edam International BV、松下公司、Stanley Access Technologies(Dormakaba 的一部分)、Vort Industries Automatics。

为了巩固市场地位,自动门产业的公司正在部署多项有针对性的策略。产品创新仍然是核心,重点是整合物联网功能、先进的运动感测器和节能组件。公司还投资与建筑和智慧建筑技术供应商建立策略合作伙伴关係,将自动门融入更广泛的基础设施项目。此外,公司正在扩展售后服务、维护合约和客製化选项,以建立客户忠诚度并确保经常性收入。透过併购和分销协议进行地理扩张有助于品牌进入新市场,而遵守区域安全和无障碍标准则增强了竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 都市化与智慧基础设施

- 更重视卫生和非接触式访问

- 能源效率与安全

- 产业陷阱与挑战

- 前期安装和维护成本高昂

- 与智慧门相关的网路安全威胁

- 机会

- 智慧建筑和智慧城市计画的全球成长

- 发展中经济体尚未实现的机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按门类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 多边环境协定

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按门类型,2021 - 2034

- 主要趋势

- 旋转门

- 折迭门

- 旋转门

- 双折门

- 其他的

第六章:市场估计与预测:依功能,2021 - 2034

- 主要趋势

- 基于感测器

- 基于运动

- 按钮

- 存取控制

第七章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 住宅

- 商业的

- 工业的

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- ASSA ABLOY Entrance Systems

- Dormakaba Group

- GEZE GmbH

- Horton Automatics

- Nabtesco Corporation

- Entrematic

- Panasonic Corporation

- Record USA

- Royal Boon Edam International BV

- Stanley Access Technologies (a part of Dormakaba)

- TORMAX USA Inc.

- Ultra Safe Security Doors

- Vortex Industries, Inc.

- Wilcox Door Service Inc.

- Zhejiang Seacon Door Technology Co., Ltd.

The Global Automatic Door Market was valued at USD 13.7 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 23.6 billion by 2034.

The heightened awareness of hygiene and public health, after the COVID-19 pandemic, has significantly accelerated the shift toward contactless technologies. Automatic doors have become a critical solution in minimizing physical touchpoints, especially in high-traffic environments such as hospitals, airports, retail stores, and office buildings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.7 Billion |

| Forecast Value | $23.6 Billion |

| CAGR | 5.6% |

Rising Demand for Sliding Door

The sliding door segment held a significant share in 2024, driven by its efficiency in high-traffic areas and ability to maximize space. These doors are favored in commercial environments such as airports, hospitals, and retail chains where continuous flow and ease of access are essential. Sliding doors offer a sleek, modern look and are often equipped with motion sensors for seamless operation. Their low-friction mechanism and minimal footprint make them a practical choice for both new constructions and retrofits. As building designs continue to emphasize open spaces and accessibility, demand for sliding automatic doors remains strong, contributing steadily to market growth.

Commercial Segment to Gain Traction

The commercial segment generated sizeable revenues in 2024, owing to the widespread adoption across shopping malls, office buildings, hospitality venues, and healthcare facilities. These spaces require reliable, user-friendly entry systems that can handle constant foot traffic without compromising on safety or aesthetics. Automatic doors in commercial applications not only improve user experience but also support energy efficiency by controlling airflow and temperature stability. As consumer expectations for convenience and hygiene continue to rise, businesses are prioritizing automated entry solutions to enhance operational efficiency and customer satisfaction.

Regional Insights

North America to Emerge as a Propelling Region

North America automatic door market held a robust share in 2024, backed by strong infrastructure, high construction standards, and regulatory emphasis on accessibility. The United States has witnessed increased adoption of touchless entry systems across healthcare, retail, and public sector buildings in the post-pandemic era. With a growing focus on energy-efficient and smart buildings, automatic doors are being integrated into modern construction as a functional and aesthetic element.

Major players in the automatic door market are Ultra Safe Security Doors, Dormakaba Group, GEZE GmbH, Record USA, Wilcox Door Service Inc., TORMAX USA Inc., Zhejiang Seacon Door Technology Co., Ltd., Royal Boon Edam International B.V., Panasonic Corporation, Stanley Access Technologies (a part of Dormakaba), Vortex Industries, Inc., Entrematic, ASSA ABLOY Entrance Systems, Nabtesco Corporation, and Horton Automatics.

To strengthen their market position, companies in the automatic door industry are deploying several targeted strategies. Product innovation remains central, with a focus on integrating IoT capabilities, advanced motion sensors, and energy-efficient components. Firms are also investing in strategic partnerships with construction and smart building technology providers to embed automatic doors into broader infrastructure projects. In addition, after-sales services, maintenance contracts, and customization options are being expanded to build customer loyalty and ensure recurring revenue. Geographic expansion through mergers, acquisitions, and distribution agreements helps brands access new markets, while adherence to regional safety and accessibility standards strengthens their competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Door type

- 2.2.3 Function

- 2.2.4 End Use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & Smart Infrastructure

- 3.2.1.2 Improving focus on hygiene & contactless access

- 3.2.1.3 Energy efficiency & security

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Large up-front installation and maintenance costs

- 3.2.2.2 Cybersecurity threats associated with smart door

- 3.2.3 Opportunities

- 3.2.3.1 Global growth of smart building and smart city initiatives

- 3.2.3.2 Unrealized opportunities in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By door type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Door Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Swinging door

- 5.3 Folding door

- 5.4 Revolving door

- 5.5 Bi-fold doors

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Function, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Sensor based

- 6.3 Motion based

- 6.4 Push button

- 6.5 Access control

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ASSA ABLOY Entrance Systems

- 10.2 Dormakaba Group

- 10.3 GEZE GmbH

- 10.4 Horton Automatics

- 10.5 Nabtesco Corporation

- 10.6 Entrematic

- 10.7 Panasonic Corporation

- 10.8 Record USA

- 10.9 Royal Boon Edam International B.V.

- 10.10 Stanley Access Technologies (a part of Dormakaba)

- 10.11 TORMAX USA Inc.

- 10.12 Ultra Safe Security Doors

- 10.13 Vortex Industries, Inc.

- 10.14 Wilcox Door Service Inc.

- 10.15 Zhejiang Seacon Door Technology Co., Ltd.