|

市场调查报告书

商品编码

1822641

运动防护装备市场机会、成长动力、产业趋势分析及2025-2034年预测Sports Protective Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

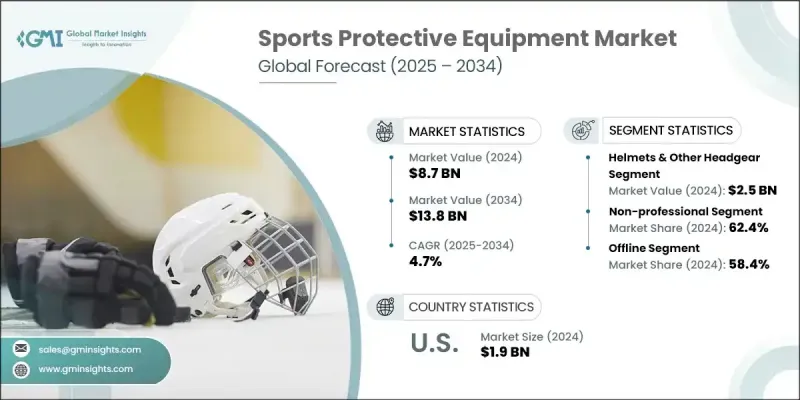

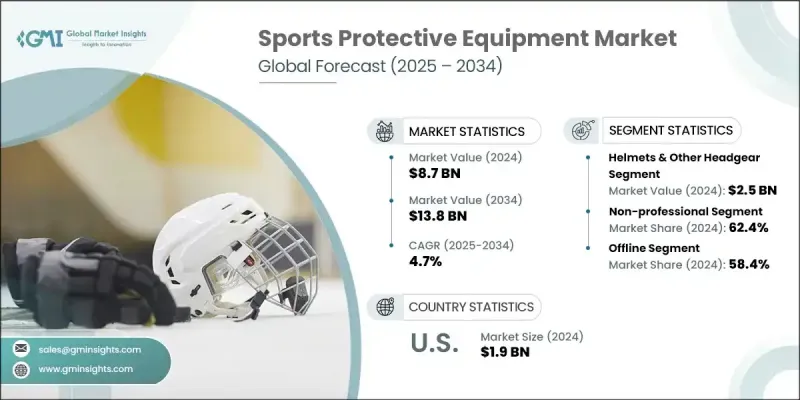

2024 年全球运动防护装备市场价值为 87 亿美元,预计到 2034 年将以 4.7% 的复合年增长率增长至 138 亿美元。

运动防护装备对于最大限度地降低身体活动的受伤风险至关重要,涵盖头盔、护具、护垫和其他身体保护装置等。随着运动在休閒和专业层面越来越受欢迎,对这些产品的需求持续攀升。健身意识的增强以及消费者在健康和运动参与方面的支出不断增加,进一步推动了市场的扩张。业余和有组织体育运动对安全的关注度不断提高,促使先进防护装备得到广泛采用,这促使製造商提供符合安全标准的高品质解决方案。人们对头部受伤、骨折和肌肉拉伤的担忧日益加剧,这更凸显了定期更换磨损或损坏装备的重要性。随着公众对学校、学院和体育项目的健身和安全要求的日益关注,对可靠舒适防护的需求继续推动市场发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 87亿美元 |

| 预测值 | 138亿美元 |

| 复合年增长率 | 4.7% |

2024年,头盔和头部防护装备市场规模达25亿美元,预计2034年将以4.7%的复合年增长率成长。该领域的成长得益于人们对头部创伤和脑损伤的认识不断提高,以及竞技和非竞技运动领域新的安全规程的出台。智慧头盔、多密度泡棉衬垫和碳纤维外壳等防护设计的创新,正推动製造商不断升级产品,使其在保持最大抗衝击性能的同时,提升舒适度和透气性。

非专业领域在2024年占据了62.4%的份额,预计到2034年将以4.6%的复合年增长率成长。这一主导地位反映了人们对休閒和健身活动的参与度日益提高。随着越来越多的人追求积极的生活方式,健身房、健身工作室、学校和社区运动项目的需求激增。该领域的消费者优先考虑既方便又可靠的防护装备,这推动了头盔、护垫和其他通用装备的购买增加。

2024年,美国运动防护装备市场规模达19亿美元,持续维持北美运动防护装备产业的领先地位。美国蓬勃发展的体育文化、积极参与有组织的联赛以及政府强制执行的安全标准持续推动着运动防护装备的销售成长。广泛的零售通路和持续的产品改进提升了运动防护装备的可及性。全民对接触性和高速运动的热情持续推动着运动防护装备需求的稳定成长,而运动专用装备的创新则进一步巩固了市场领先地位。

全球运动防护装备市场的知名企业包括 Puma、Schutt Sports、Adidas、Warrior Sports、Nike、Warrix、Mizuno、BRG Sports、Harrow Sports、McDavid、Amer Sports、Rawlings Sporting Goods、Shock Doctor、Under Armour 和 Bauer Hockey。为了保持竞争力,运动防护装备市场的公司专注于推出采用先进材料製成的符合人体工学设计、重量轻且性能高的商品。各品牌正在利用运动员代言并投资于有针对性的行销,以提高在青少年和非专业用户中的知名度。许多品牌正在整合衝击感测器和穿戴式追踪系统等智慧技术,以增强产品吸引力。公司也透过电子商务和专业运动零售管道扩大分销,使防护装备更容易获得。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 国内和国际体育赛事日益普及

- 网路销售趋势成长

- 消费者在体育器材上的支出增加

- 消费者健康和健身意识的增强

- 增加体育活动参与度

- 产业陷阱与挑战

- 仿冒品数量增加

- 原料成本不断上涨

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 贸易分析(HS编码:95069960)

- 主要进口国家

- 主要出口国

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 防护眼镜

- 风镜

- 护眼罩

- 脸部防护和护齿

- 头盔和其他头饰

- 护肩

- 护胫

- 护膝

- 其他的

第六章:市场估计与预测:依用途 2021-2034

- 主要趋势

- 专业的

- 非专业

第七章:市场估计与预测:依价格区间,2021-2034

- 主要趋势

- 低(<25 美元)

- 中(25-50美元)

- 高(>50 美元)

第八章:市场估计与预测:依体育项目,2021-2034

- 主要趋势

- 球类运动

- 排球

- 足球

- 手球

- 篮球

- 其他的

- 赛车运动

- 骑马

- 赛车

- 自行车比赛

- 骑自行车

- 其他的

- 水上运动

- 游泳

- 潜水

- 衝浪

- 帆船

- 其他的

- 溜冰

- 滑雪

- 蟋蟀

- 曲棍球

- 其他的

第九章:市场估计与预测:依消费者群体,2021-2034

- 主要趋势

- 男士

- 女性

- 孩子们

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要动向:按配销通路

- 线上通路

- 电子商务

- 公司网站

- 线下通路

- 专卖店

- 大型零售商店

- 其他的

第 11 章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 12 章:公司简介

- Adidas

- Amer Sports

- Bauer Hockey

- BRG Sports

- McDavid

- Mizuno

- Nike

- Puma

- Harrow Sports

- Rawlings Sporting Goods

- Schutt Sports

- Shock Doctor

- Under Armour

- Warrior Sports

- Warrix

The Global Sports Protective Equipment Market was valued at USD 8.7 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 13.8 billion by 2034.

Sports protective equipment is essential for minimizing injury risk during physical activities, covering gear such as helmets, guards, pads, and other body protectors. The demand for these products continues to climb as sports become more popular at both recreational and professional levels. Fitness awareness and increasing consumer expenditure on health and athletic participation have further fueled market expansion. Enhanced attention to safety in amateur and organized sports has led to widespread adoption of advanced protective gear, encouraging manufacturers to deliver high-quality solutions that comply with safety standards. Rising concerns over head injuries, fractures, and muscle strain have reinforced the importance of regularly replacing worn or damaged gear. With greater public interest in fitness and safety mandates across schools, colleges, and athletic programs, the need for reliable and comfortable protection continues to drive market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 4.7% |

In 2024, the helmets and head protection gear segment generated USD 2.5 billion and is projected to grow at a CAGR of 4.7% through 2034. This segment's growth is tied to increasing awareness around head trauma and brain injuries, as well as new safety protocols in competitive and non-competitive sports. Innovations in protective design, such as smart helmets, multi-density foam liners, and carbon fiber shells, are pushing manufacturers to upgrade offerings with features that enhance comfort and ventilation while maintaining maximum impact resistance.

The non-professional segment held a 62.4% share in 2024 and is expected to grow at a CAGR of 4.6% through 2034. This dominance reflects growing involvement in leisure and fitness activities. Demand from gyms, fitness studios, schools, and community sports programs has surged as more individuals pursue active lifestyles. Consumers in this segment prioritize protective gear that is both accessible and reliable, supporting increased purchases of helmets, pads, and other gear designed for general use.

United States Sports Protective Equipment Market generated USD 1.9 billion in 2024, maintaining its lead in the North American sports protective equipment industry. The country's robust sporting culture, strong participation in organized leagues, and government-enforced safety standards continue to boost sales. Widespread retail availability and ongoing product advancements have increased accessibility. National interest in contact and high-speed sports continues to contribute to steady demand, while innovations in sport-specific gear further sustain market leadership.

Prominent players in the Global Sports Protective Equipment Market include Puma, Schutt Sports, Adidas, Warrior Sports, Nike, Warrix, Mizuno, BRG Sports, Harrow Sports, McDavid, Amer Sports, Rawlings Sporting Goods, Shock Doctor, Under Armour, and Bauer Hockey. To maintain competitive strength, companies in the sports protective equipment market are focused on launching ergonomically designed, lightweight, and high-performance products made with advanced materials. Brands are leveraging athlete endorsements and investing in targeted marketing to boost visibility among youth and non-professional users. Many are integrating smart technologies such as impact sensors and wearable tracking systems to enhance product appeal. Companies are also expanding distribution through both e-commerce and specialty sports retail channels, making protective gear more accessible.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Usage

- 2.2.4 Price range

- 2.2.5 Consumer group

- 2.2.6 Sport

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing popularity of national and international sports events

- 3.2.1.2 Increase in the trend of online sales

- 3.2.1.3 Rise in consumer spending on sports equipment

- 3.2.1.4 Increase in growth of consumer awareness regarding health and fitness

- 3.2.1.5 Increase in participation of sports activities

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Increase in number of counterfeit products

- 3.2.2.2 Growing cost of raw materials

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Trade analysis (HS Code: 95069960)

- 3.6.1 Top importing countries

- 3.6.2 Top exporting countries

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Regulatory framework

- 3.8.1 Standards and certifications

- 3.8.2 Environmental regulations

- 3.8.3 Import export regulations

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034, (USD Billion; Million Units)

- 5.1 Key trends

- 5.2 Protective eyewear

- 5.2.1 Goggles

- 5.2.2 Eye shield

- 5.3 Face protection & mouth guards

- 5.4 Helmets & other headgear

- 5.5 Shoulder guards

- 5.6 Shin guards

- 5.7 Knee pads

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Usage 2021-2034, (USD Billion; Million Units)

- 6.1 Key trends

- 6.2 Professional

- 6.3 Non-professional

Chapter 7 Market Estimates & Forecast, By Price Range, 2021-2034, (USD Billion; Million Units)

- 7.1 Key trends

- 7.2 Low (<25$)

- 7.3 Mid (25$-50$)

- 7.4 High (>50$)

Chapter 8 Market Estimates & Forecast, By Sport, 2021-2034, (USD Billion; Million Units)

- 8.1 Key trends

- 8.2 Ball based sports

- 8.2.1 Volleyball

- 8.2.2 Football

- 8.2.3 Handball

- 8.2.4 Basketball

- 8.2.5 Others

- 8.3 Racing sports

- 8.3.1 Horse riding

- 8.3.2 Auto racing

- 8.3.3 Bike racing

- 8.3.4 Cycling

- 8.3.5 Others

- 8.4 Water based sports

- 8.4.1 Swimming

- 8.4.2 Diving

- 8.4.3 Surfing

- 8.4.4 Sailing

- 8.4.5 Others

- 8.5 Skating

- 8.6 Skiing

- 8.7 Cricket

- 8.8 Hockey

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Consumer Group, 2021-2034, (USD Billion; Million Units)

- 9.1 Key trends

- 9.2 Men

- 9.3 Women

- 9.4 Kids

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021-2034, (USD Billion; Million Units)

- 10.1 Key trends, by distribution channel

- 10.2 Online channels

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline channels

- 10.3.1 Specialty Stores

- 10.3.2 Mega Retail stores

- 10.3.3 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034, (USD Billion; Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Adidas

- 12.2 Amer Sports

- 12.3 Bauer Hockey

- 12.4 BRG Sports

- 12.5 McDavid

- 12.6 Mizuno

- 12.7 Nike

- 12.8 Puma

- 12.9 Harrow Sports

- 12.10 Rawlings Sporting Goods

- 12.11 Schutt Sports

- 12.12 Shock Doctor

- 12.13 Under Armour

- 12.14 Warrior Sports

- 12.15 Warrix