|

市场调查报告书

商品编码

1822642

防水膜市场机会、成长动力、产业趋势分析及2025-2034年预测Waterproofing Membrane Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

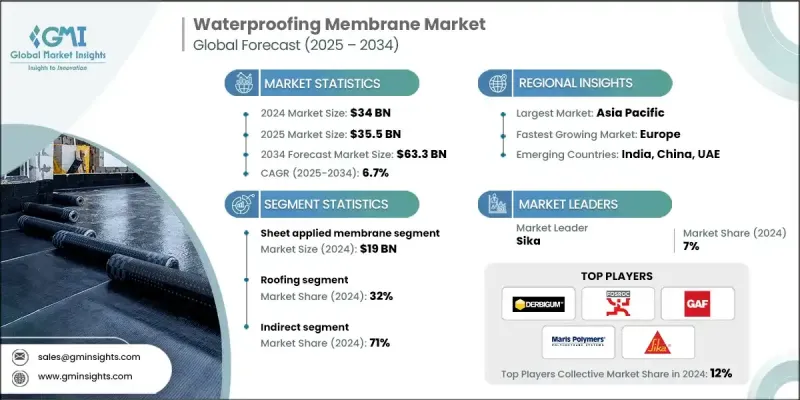

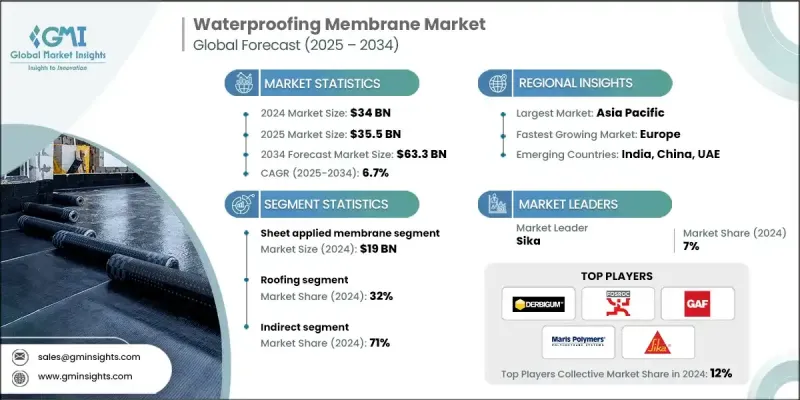

根据 Global Market Insights Inc. 发布的报告,全球防水膜市场规模预计在 2024 年为 340 亿美元,预计将从 2025 年的 355 亿美元增长到 2034 年的 633 亿美元,复合年增长率为 6.7%。

在亚洲、拉丁美洲和非洲部分地区,快速城镇化地区的建筑活动激增,这推动了防水膜的需求。随着政府和私营部门对基础设施、住房、商业建筑和工业设施的大力投资,人们越来越重视结构的长期耐久性和防潮性能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 340亿美元 |

| 预测值 | 633亿美元 |

| 复合年增长率 | 6.7% |

片状应用膜获得牵引力

片状防水卷材市场在2024年占据了显着的市场份额,这得益于其可靠性和易于安装的特点。这类卷材通常由改质沥青或热塑性塑胶製成,厚度均匀,且具有优异的抗渗水性,因此在商业和住宅建筑中广受欢迎。建筑业主和承包商青睐这类卷材,因为它具有可预测的性能、耐用性以及与各种基材的兼容性。

屋顶材料应用日益普及

2024年,受新建筑和屋顶更换专案的推动,屋顶市场占据了相当大的份额。屋顶暴露在恶劣的天气条件下,因此坚固的防水措施对于防止漏水和结构损坏至关重要。绿色屋顶和凉爽屋顶解决方案的采用也增加了对结合防水和隔热功能的先进薄膜技术的需求。

间接销售需求不断成长

预计间接防水领域在2025年至2034年期间将以可观的复合年增长率成长,主要受惠于隧道、桥樑和地下结构等应用。这些应用需要高度专业的防水膜来承受极端压力和环境压力。该领域的特点是需要具有优异机械强度、耐化学性和长寿命的防水膜。城市基础设施项目和公共交通网络的成长显着推动了这一需求。

区域洞察

亚太地区将崛起为利润丰厚的地区

受中国、印度和东南亚等国家大规模城镇化和大型基础建设项目的推动,到2034年,亚太地区防水膜市场将创造可观的收入。政府在经济适用房、商业综合体和交通基础设施的支出不断增加,对高性能防水解决方案的需求也随之激增。该地区气候多样,从热带潮湿气候到极端季风气候,更凸显了对能够适应各种环境条件的多功能防水膜的需求。

防水膜市场的主要参与者有 Pidilite Industries、陶氏、Danrae Group、Kemper System、Asian Paints、Fosroc、Derbigum International、Bauder、BASF、Sika、Xypex Chemical、Maris Polymers、Alchimica Building Chemicals、Koster Bauchemie 和 GAF Materials。

防水膜市场中的企业正在采取多种策略来巩固其市场地位。产品创新仍然是重中之重,企业正在投入研发资金,开发能够减少挥发性有机化合物 (VOC) 排放并增强耐用性的环保防水膜。与建筑公司和分销商建立策略合作伙伴关係,可以扩大市场覆盖范围并加快产品普及速度。此外,企业正专注于在地化生产,以降低成本并提高亚太等关键地区的供应链效率。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 快速城市化和基础设施发展

- 永续性和绿建筑趋势

- 产业陷阱与挑战

- 原物料价格波动

- 严格的环境法规

- 机会

- 新兴经济体的扩张

- 绿屋顶与永续建筑

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 液体涂膜

- 聚氨酯

- 丙烯酸纤维

- 沥青

- 水泥基

- 其他(硅胶等)

- 片状膜

- PVC

- 三元乙丙橡胶

- 磷酸酯酶

- 其他(丁腈橡胶等)

第六章:市场估计与预测:依原料,2021 - 2034 年

- 主要趋势

- 沥青

- 聚合物

- 橡皮

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 屋顶

- 地下室和地基

- 墙壁和外墙

- 垃圾掩埋场和隧道

- 其他(阳台等)

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

- 基础设施

第九章:市场估计与预测:按配销通路,2021 - 2034

- 主要趋势

- 直销

- 间接销售

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Alchimica Building Chemicals

- Asian Paints

- BASF

- Bauder

- Danrae Group

- Derbigum International

- Dow

- Fosroc

- GAF Materials

- Kemper System

- Koster Bauchemie

- Maris Polymers

- Pidilite Industries

- Sika

- Xypex Chemical

The global waterproofing membrane market was estimated at USD 34 billion in 2024 and is expected to grow from USD 35.5 billion in 2025 to USD 63.3 billion by 2034, at a CAGR of 6.7%, according to the report published by Global Market Insights Inc.

The global surge in construction activity in rapidly urbanizing regions across Asia, Latin America, and parts of Africa is boosting demand for waterproofing membranes. As governments and private sectors invest heavily in infrastructure, housing, commercial buildings, and industrial facilities, there is a growing emphasis on long-term structural durability and moisture protection.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34 Billion |

| Forecast Value | $63.3 Billion |

| CAGR | 6.7% |

Sheet Applied Membrane to Gain Traction

The sheet-applied membrane segment held a notable share in 2024, driven by its reliability and ease of installation. These membranes, often made from modified bitumen or thermoplastics, provide consistent thickness and excellent resistance to water infiltration, making them popular in commercial and residential construction. Building owners and contractors favor this segment because it offers predictable performance, durability, and compatibility with various substrates.

Rising Adoption in Roofing

The roofing segment generated a significant share in 2024, fueled by new construction and roof replacement projects. Roofs are exposed to harsh weather conditions, making robust waterproofing essential to prevent leaks and structural damage. The adoption of green roofs and cool roofing solutions has also increased the need for advanced membrane technologies that combine waterproofing with thermal insulation.

Growing Demand in Indirect Sales

The indirect segment is expected to grow at a decent CAGR during 2025-2034, driven by applications such as tunnels, bridges, and underground structures. They require highly specialized waterproofing membranes to withstand extreme pressure and environmental stress. This segment is characterized by the need for membranes with superior mechanical strength, chemical resistance, and longevity. Growth in urban infrastructure projects and public transportation networks is significantly boosting the demand.

Regional Insights

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific waterproofing membrane market will generate substantial revenues by 2034, driven by extensive urbanization and large-scale infrastructure projects in countries like China, India, and Southeast Asia. Increased government spending on affordable housing, commercial complexes, and transportation infrastructure is creating substantial demand for high-performance waterproofing solutions. The region's diverse climate, ranging from tropical humidity to extreme monsoons, emphasizes the need for versatile membranes capable of adapting to varying environmental conditions.

Major players in the waterproofing membrane market are Pidilite Industries, Dow, Danrae Group, Kemper System, Asian Paints, Fosroc, Derbigum International, Bauder, BASF, Sika, Xypex Chemical, Maris Polymers, Alchimica Building Chemicals, Koster Bauchemie, and GAF Materials.

Companies in the waterproofing membrane market are adopting several strategies to strengthen their market foothold. Product innovation remains a top priority, with firms investing in research to develop eco-friendly membranes that reduce VOC emissions and enhance durability. Strategic partnerships with construction firms and distributors enable wider market reach and faster adoption. Additionally, companies are focusing on localized manufacturing to reduce costs and improve supply chain efficiency in key regions like Asia Pacific.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Raw material

- 2.2.4 Application

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid urbanization & infrastructure development

- 3.2.1.2 Sustainability & green building trends

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Fluctuating raw material prices

- 3.2.2.2 Strict environmental regulations

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in emerging economies

- 3.2.3.2 Green roofing and sustainable construction

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade Statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Liquid-applied membrane

- 5.2.1 Polyurethane

- 5.2.2 Acrylic

- 5.2.3 Bituminous

- 5.2.4 Cementitious

- 5.2.5 Others (silicone etc.)

- 5.3 Sheet membrane

- 5.3.1 PVC

- 5.3.2 EPDM

- 5.3.3 TPO

- 5.3.4 Others (nitrile rubber etc.)

Chapter 6 Market Estimates & Forecast, By Raw Material, 2021 - 2034 ($Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Bitumen

- 6.3 Polymers

- 6.4 Rubber

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Roofing

- 7.3 Basement & foundation

- 7.4 Walls & facades

- 7.5 Landfills & tunnels

- 7.6 Others (balconies etc.)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

- 8.5 Infrastructure

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alchimica Building Chemicals

- 11.2 Asian Paints

- 11.3 BASF

- 11.4 Bauder

- 11.5 Danrae Group

- 11.6 Derbigum International

- 11.7 Dow

- 11.8 Fosroc

- 11.9 GAF Materials

- 11.10 Kemper System

- 11.11 Koster Bauchemie

- 11.12 Maris Polymers

- 11.13 Pidilite Industries

- 11.14 Sika

- 11.15 Xypex Chemical