|

市场调查报告书

商品编码

1822644

医院资讯系统市场机会、成长动力、产业趋势分析及2025-2034年预测Hospital Information System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

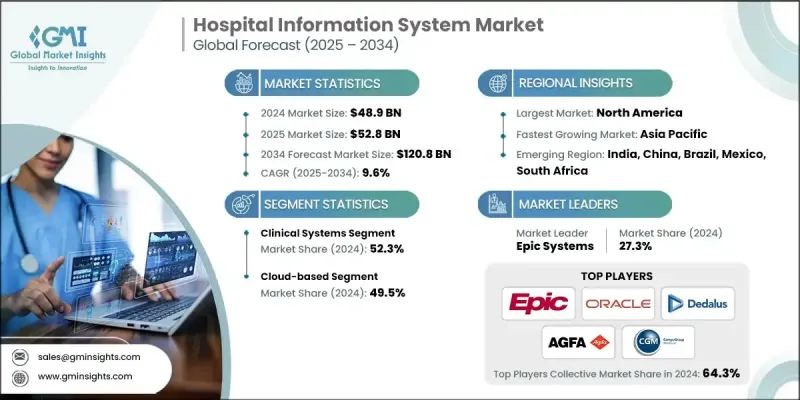

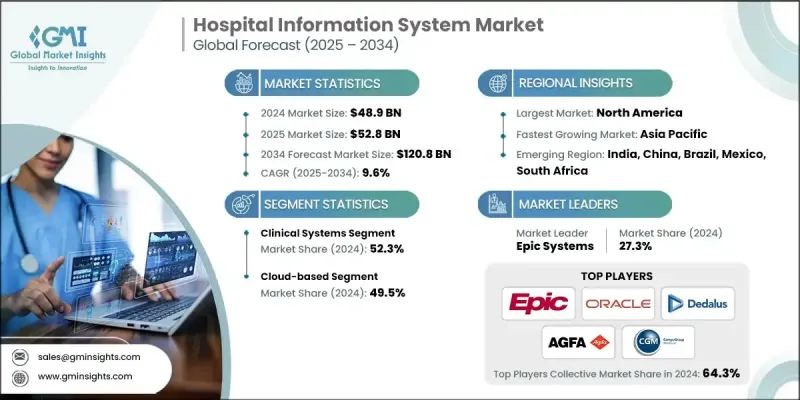

根据 Global Market Insights, Inc. 发布的最新报告,2024 年全球医院资讯系统 (HIS) 市场价值为 489 亿美元,预计将从 2025 年的 528 亿美元增长到 2034 年的 1,208 亿美元,复合年增长率为 9.6%。

医疗保健数位化的不断发展、对可互通解决方案日益增长的需求以及对优化临床工作流程日益增长的需求,正在推动全球范围内 HIS 的采用。越来越多的医院选择整合软体系统来处理病历、临床资讯、医疗帐单和法规遵循。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 489亿美元 |

| 预测值 | 1208亿美元 |

| 复合年增长率 | 9.6% |

关键驱动因素:

1.综合临床和行政资料管理的要求:医院正在实施HIS,以便整合跨部门的不同工作流程。

2.慢性病负担加重和人口老化:有效的患者追踪和优化治疗需要先进的健康资讯平台。

3.基于云端和人工智慧的系统的采用:云端的采用因其较低的 IT 基础设施费用、灵活性和远端存取而变得越来越流行。

4.合规性和资料安全:国际和地区法规迫使医院实施合规、安全和可审计的系统。

关键参与者:

- Epic 将在 2024 年占据医院资讯系统市场的主导地位,市占率为 27.3%。

- Oracle 正在利用其收购 Cerner 的既有 HIS/EHR 地位以及其在云端运算、资料分析和人工智慧方面的优势。

- Dedalus 是欧洲市场领导者,高度重视互通性和开放的数位健康生态系统。

主要挑战:

- 互通性限制: HIS 与遗留系统、实验室、成像和第三方平台的整合仍然具有挑战性。

- 高昂的培训和实施费用:客製化、迁移和员工入职的初始投资可能很高。

- 安全和资料隐私威胁:人们对健康资料外洩和勒索软体的担忧日益加剧,推动了合规性和安全云端部署的提高。

1. 依系统组件划分-临床系统正在兴起

2024年,临床系统组件占据HIS市场的最大份额,约66%。以EMR、CPOE、LIS、RIS为代表的临床系统组件是医院日常运作的坚实基础。

2. 按部署-基于云端的解决方案正在兴起

由于可扩展性增强、基础设施建设资本支出降低以及远端应用程式存取能力增强,基于云端的 HIS 部署正在加速。各地区的医院正在部署云端解决方案,以改善营运、协作和持续护理。

3. 按地区划分-北美依然强劲

2024年,北美继续占据最大市场份额,凭藉强大的政府支持、极高的数位素养以及公立和私立医院的强劲增长,北美保持了其在医院资讯系统市场的主导地位。凭藉强大的医疗基础设施、电子病历(EHR)的广泛采用、HIPAA和HITECH等政府法规的实施以及日益增长的基于云端的医疗IT解决方案,北美在医院资讯系统市场保持了主导地位。美国医院和医疗网络正在迅速将临床决策支援、人口健康分析和远距护理模组整合到其核心医院系统中。

医院资讯系统市场的一些主要参与者包括 AGFA Healthcare、CAMBIO、ChipSoft、CompuGroup Medical、Dedalus、Docaposte、Engineering Ingegneria Informatica、Epic Systems、InterSystems、Meierhofer AG、NextGen、Nexus、Oracle、SECTRA 和 Veradigm。

市场上主要的 HIS 参与者正在利用云端整合、向其他地区扩展、支援 AI 的模组以及与医疗保健领导者达成的合作协议来打造竞争优势。 Epic Systems 继续引领北美市场,与表现最佳的医疗系统达成长期协议。 Dedalus 和 InterSystems 正在扩展其云端平台并添加互通功能。 CompuGroup Medical 和 AGFA Healthcare 正在将决策支援功能整合到其 HIS 平台中。甲骨文在收购 Cerner 后,正在整合其整合的云端和资料分析功能,最终为 EHR 和人口健康提供更有价值的模组。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 数位健康解决方案的采用率不断提高

- 政府措施和法规

- 医疗保健支出不断增加

- 全面医疗保健系统需求激增

- 产业陷阱与挑战

- 实施和维护成本高

- 资料安全和隐私问题

- 市场机会

- 政府医疗数位化措施不断增加

- 对分析和商业智慧工具的需求不断增长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 消费者行为和趋势

- 各地区医院数量

- 医院数位生态系概述

- 电子病历(EMR)/电子健康纪录(EHR)

- 远距医疗和远距病人监控

- 网路安全和资料保护

- 波特的分析

- PESTEL分析

- 人工智慧与电子病历 (EMR) 的整合

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲和中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按系统组件,2021 - 2034 年

- 主要趋势

- 临床系统

- 电子病历(EMR)/电子健康纪录(EHR)

- 放射资讯系统(RIS)

- 药房资讯系统

- 实验室资讯系统(LIS)

- 其他临床系统

- 行政/后台系统

- 财务和计费

- 供应链管理

- 设施管理/人力资源

- 作业系统

- 入院、出院及转院 (ADT)/床位管理系统 (BMS)

- 营运标准支援/调度系统

- 面向患者的技术

- 行动健康应用程式

- 患者门户

- 整合层

- 介面引擎/API

- 健康资讯交换(HIE)

- 资料和安全

- 临床资料储存库

- 身分和存取管理 (IAM)

- 一般资料保护规范(GDPR)

第六章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 基于云端

- 基于网路

- 本地部署

第七章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- AGFA Healthcare

- CAMBIO

- ChipSoft

- CompuGroup Medical

- Dedalus

- Docaposte

- Engineering Ingegneria Informatica

- Epic Systems

- InterSystems

- Meierhofer AG

- NextGen

- Nexus

- Oracle

- SECTRA

- Veradigm

The global hospital information system (HIS) market was valued at USD 48.9 billion in 2024 and is projected to grow from USD 52.8 billion in 2025 to USD 120.8 billion by 2034, expanding at a CAGR of 9.6%, according to the latest report published by Global Market Insights, Inc.

Growing healthcare digitization, increasing requirements for interoperable solutions, and mounting need for optimized clinical workflows are driving the adoption of HIS around the world. Hospitals are increasingly opting for integrated software systems to handle patient records, clinical information, medical billing, and regulatory adherence.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48.9 Billion |

| Forecast Value | $120.8 Billion |

| CAGR | 9.6% |

Key Drivers:

1. Requirement for integrated clinical and administrative data management: Hospitals are implementing HIS in order to integrate disparate workflows across departments.

2. Increased burden of chronic diseases and aging population: Effective patient tracking and optimized treatment require advanced health information platforms.

3. Cloud and AI-based systems' adoption: Cloud adoption is becoming popular with lower IT infrastructure expense, flexibility, and remote access.

4. Compliance and data security: International and regional regulations are forcing hospitals to implement compliant, secure, and auditable systems.

Key Players:

- Epic dominates the hospital information system market with a 27.3% market share in 2024.

- Oracle is harnessing its purchase of Cerner's established HIS/EHR position together with its respective strengths in cloud computing, data analytics, and AI.

- Dedalus is a European market leader with a strong focus on interoperability and open digital health ecosystems.

Key Challenges:

- Interoperability constraints: HIS integration with legacy systems, labs, imaging, and third-party platforms continues to be challenging.

- High training and implementation expenses: Initial investments in customization, migration, and employee onboarding can be high.

- Security and data privacy threats: Increasing fears of health data breaches and ransomware are driving increased compliance and secure cloud deployments.

1. By System Component - Clinical Systems on the Rise

Clinical system components made up the largest share of the HIS market at approximately 66% in 2024. The clinical system components represented by EMR, CPOE, LIS, and RIS are the hard-working foundations of daily hospital operations.

2. By Deployment - Cloud-Based Solutions on the Rise

Cloud-based HIS deployability is accelerating due to the increased scalability, lower capital expenditures to support the infrastructure, and increased access to remote applications. The hospitals in the Regions are deploying cloud solutions to improve operations, collaboration, and continuum of care.

3. By Region - North America Remains Strong

North America continued to have the largest market share in 2024, maintaining their lead with strong government support, very high levels of digital literacy, and strong uptake in both public and private hospitals. North America maintains its dominance in the hospital information system market with strong healthcare infrastructure, prevalent adoption of EHR, government regulations like HIPAA and HITECH, and increasing presence of cloud-based health IT solutions. American hospitals and health networks are quickly integrating clinical decision support, population health analytics, and remote care modules into their core hospital systems.

Some of the major players in the hospital information system market are AGFA Healthcare, CAMBIO, ChipSoft, CompuGroup Medical, Dedalus, Docaposte, Engineering Ingegneria Informatica, Epic Systems, InterSystems, Meierhofer AG, NextGen, Nexus, Oracle, SECTRA, and Veradigm.

Key HIS players in the market are employing cloud integration, expansions into other geographies, AI-enabled modules, and collaboration agreements with healthcare leaders to create a competitive edge.;Epic Systems continues to lead the North American market with long-term deals with top-performing health systems. Dedalus and InterSystems are growing their cloud platforms and adding interoperability features. CompuGroup Medical and AGFA Healthcare are integrating decision support capabilities into their HIS platforms. Oracle is incorporating its integrated cloud and data analytics capabilities after acquiring Cerner to ultimately produce more valuable modules for EHR and population health.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 System component trends

- 2.2.3 Deployment trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of digital health solutions

- 3.2.1.2 Government initiatives and regulations

- 3.2.1.3 Rising expenditure on healthcare

- 3.2.1.4 Surging demand for integrated healthcare systems

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High implementation and maintenance costs

- 3.2.2.2 Data security and privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing government healthcare digitization initiatives

- 3.2.3.2 Growing demand for analytics and business intelligence tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behaviour and trends

- 3.8 No. of hospitals, by Region

- 3.9 Overview of hospital digital ecosystem

- 3.9.1 Electronic medical records (EMR)/electronic health records (EHR)

- 3.9.2 Telemedicine and remote patient monitoring

- 3.9.3 Cybersecurity and data protection

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Integration of AI in EMR

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America & MEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By System Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Clinical systems

- 5.2.1 Electronic medical records (EMR)/electronic health records (EHR)

- 5.2.2 Radiology information system (RIS)

- 5.2.3 Pharmacy information system

- 5.2.4 Laboratory information system (LIS)

- 5.2.5 Other clinical systems

- 5.3 Administrative/back-office systems

- 5.3.1 Finance and billing

- 5.3.2 Supply chain management

- 5.3.3 Facilities management/Human resources

- 5.4 Operational systems

- 5.4.1 Admission, discharge, and transfer (ADT)/bed management systems (BMS)

- 5.4.2 Operational standards support/scheduling systems

- 5.5 Patient-facing technologies

- 5.5.1 Mobile health applications

- 5.5.2 Patient portals

- 5.6 Integration layer

- 5.6.1 Interface engines/APIs

- 5.6.2 Health information exchange (HIE)

- 5.7 Data and security

- 5.7.1 Clinical data repository

- 5.7.2 Identity and access management (IAM)

- 5.7.3 General data protection regulation (GDPR)

Chapter 6 Market Estimates and Forecast, By Deployment, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 Web-based

- 6.4 On-premise

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AGFA Healthcare

- 8.2 CAMBIO

- 8.3 ChipSoft

- 8.4 CompuGroup Medical

- 8.5 Dedalus

- 8.6 Docaposte

- 8.7 Engineering Ingegneria Informatica

- 8.8 Epic Systems

- 8.9 InterSystems

- 8.10 Meierhofer AG

- 8.11 NextGen

- 8.12 Nexus

- 8.13 Oracle

- 8.14 SECTRA

- 8.15 Veradigm