|

市场调查报告书

商品编码

1822648

本地碳管理系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测On-premises Carbon Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

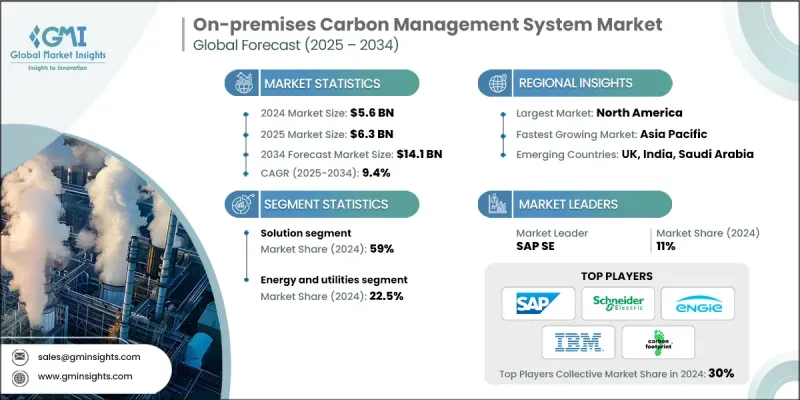

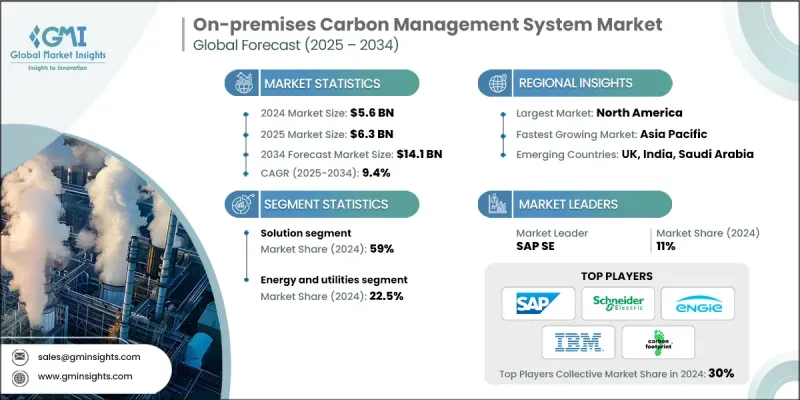

2024 年全球内部部署碳管理系统市场规模估计为 56 亿美元。根据 Global Market Insights Inc. 发布的最新报告,预计该市场规模将从 2025 年的 63 亿美元成长到 2034 年的 141 亿美元,复合年增长率为 9.4%。

随着企业寻求更好地控制其环境资料,对本地碳管理系统的需求日益增长。对于处理敏感或专有排放资讯的产业(例如製造业、石油天然气和国防),本地解决方案可提供增强的资料隐私性、安全性以及对内部IT协议的合规性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 56亿美元 |

| 预测值 | 141亿美元 |

| 复合年增长率 | 9.4% |

解决方案领域的采用率不断上升

2024年,由于对客製化即时工具的需求日益增长,解决方案部门创造了可观的收入,这些工具可帮助企业监控、管理和减少碳足迹。这些平台提供强大的分析功能、排放追踪、合规性仪錶板和进阶报告功能,所有这些都安全地託管在企业本身的IT环境中。

能源和公用事业板块将获得发展动力

2024年,能源和公用事业领域占据了永续份额,这得益于本地碳管理系统的采用。由于排放量庞大,且需要持续遵守国家和国际气候目标,公用事业提供者无法承受资料不准确或漏洞的后果。本地系统允许能源公司将排放追踪直接与其SCADA和营运系统集成,从而实现即时监控、客製化报告以及对敏感可持续性资料的完全所有权。

区域洞察

北美将成为利润丰厚的地区

2024年,北美本地碳管理系统市场占据了显着份额,这得益于强有力的监管框架、早期技术应用以及企业气候责任。美国企业,尤其是製造业、公用事业和石油天然气产业的企业,正在优先考虑符合内部合规协议和IT安全标准的碳追踪基础设施。随着美国证券交易委员会(SEC)对气候资讯揭露的压力日益加大,以及投资者对ESG(环境、社会和治理)的兴趣日益浓厚,北美企业正在利用本地系统来保持透明度、保护敏感的排放资料,并确保其可持续发展报告流程面向未来。

本地碳管理系统市场的主要参与者包括 Greenly、Microsoft、Intelex、Plan A、Trinity Consultants、ESP、Graforce Hydro GmbH、SAP SE、Accuvio、Carbon Footprint Ltd.、Sphera、BlueSens Gas Sensor GmbH、ENGIE、施耐德电气、Ener Softwaregy、IBM、Pmner Software、Envim、Eneral、Hmerk、Emeraming、Bales、Ener Software、Bales、Capner、Bales、Ener Software、Pales Software、Ener Software、Pales、Pales、壳组

本地碳管理系统市场的主要参与者正专注于策略性收购、技术合作、产品创新和以企业为中心的客製化等多种方式,以提升其市场份额。微软、IBM 和 SAP SE 等科技巨头正在将碳追踪功能整合到更广泛的企业软体套件中,使企业更容易将永续性融入核心营运。同时,施耐德电机、Sphera 和 ENGIE 等公司正在建立垂直整合平台,将碳资料分析与能源管理和合规工具结合。 Persefoni、Greenly 和 Plan A 等公司则注重资料准确性和审计准备度,提供支援严格监管行业的模组化本地系统。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 新兴机会和趋势

- 数位化和物联网集成

- 新兴市场渗透

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争基准测试

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依组件划分,2021 - 2034 年

- 主要趋势

- 解决方案

- 服务

第六章:市场规模及预测:依产业,2021 - 2034

- 主要趋势

- 能源和公用事业

- 製造业

- 住宅及商业建筑

- 运输与物流

- IT和电信

- 其他的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Accuvio

- BlueSens Gas Sensor GmbH

- Carbon Footprint Ltd.

- Dakota Software

- EnergyCap

- ENGIE

- Envirosoft

- ESP

- Graforce Hydro GmbH

- Greenly

- Intelex

- IBM

- Microsoft

- Plan A

- Persefoni

- Salesforce

- SAP SE

- Schneider Electric

- Sphera

- Trinity Consultants

The global on-premises carbon management system market was estimated at USD 5.6 billion in 2024. The market is expected to grow from USD 6.3 billion in 2025 to USD 14.1 billion by 2034, at a CAGR of 9.4%, according to the latest report published by Global Market Insights Inc.

The demand for on-premises carbon management systems is rising as organizations seek greater control over their environmental data. For industries handling sensitive or proprietary emissions information such as manufacturing, oil & gas, and defense, on-premises solutions offer enhanced data privacy, security, and compliance with internal IT protocols.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.6 Billion |

| Forecast Value | $14.1 Billion |

| CAGR | 9.4% |

Rising Adoption of Solutions Segment

The solutions segment generated significant revenues in 2024 owing to the growing demand for tailored, real-time tools that help organizations monitor, manage, and reduce their carbon footprint. These platforms offer robust analytics, emissions tracking, compliance dashboards, and advanced reporting capabilities, all hosted securely within a company's own IT environment.

Energy And Utilities Segment to Gain Traction

The energy and utilities segment held sustainable share in 2024 driven by adopters of on-premises carbon management systems. With massive emissions volumes and a constant need for compliance with national and international climate goals, utility providers can't afford inaccuracies or data vulnerabilities. On-premises systems allow energy companies to integrate emissions tracking directly with their SCADA and operational systems, enabling real-time monitoring, customized reporting, and full ownership of sensitive sustainability data.

Regional Insights

North America to Emerge as a Lucrative Region

North America on-premises carbon management system market held notable share in 2024, driven by strong regulatory frameworks, early technology adoption, and corporate climate responsibility. U.S.-based enterprises, particularly in manufacturing, utilities, and oil & gas, are prioritizing carbon tracking infrastructure that aligns with internal compliance protocols and IT security standards. With increasing pressure from the SEC on climate disclosures and growing investor interest in ESG, North American firms are leveraging on-premises systems to maintain transparency, safeguard sensitive emissions data, and future-proof their sustainability reporting processes.

Major players involved in the on-premises carbon management system market include Greenly, Microsoft, Intelex, Plan A, Trinity Consultants, ESP, Graforce Hydro GmbH, SAP SE, Accuvio, Carbon Footprint Ltd., Sphera, BlueSens Gas Sensor GmbH, ENGIE, Schneider Electric, EnergyCap, IBM, Persefoni, Envirosoft, Salesforce, Dakota Software

Major players in the on-premises carbon management system market are focusing on a mix of strategic acquisitions, technology partnerships, product innovation, and enterprise-focused customization to increase their market share. Tech giants like Microsoft, IBM, and SAP SE are integrating carbon tracking capabilities into broader enterprise software suites, making it easier for companies to embed sustainability into core operations. Meanwhile, companies like Schneider Electric, Sphera, and ENGIE are building vertically integrated platforms that combine carbon data analytics with energy management and compliance tools. Players such as Persefoni, Greenly, and Plan A are emphasizing data accuracy and audit-readiness, offering modular on-premises systems that support highly regulated industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Solutions

- 5.3 Services

Chapter 6 Market Size and Forecast, By Industry, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Energy & utilities

- 6.3 Manufacturing

- 6.4 Residential & commercial building

- 6.5 Transportation & logistics

- 6.6 IT & telecom

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 Saudi Arabia

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Accuvio

- 8.2 BlueSens Gas Sensor GmbH

- 8.3 Carbon Footprint Ltd.

- 8.4 Dakota Software

- 8.5 EnergyCap

- 8.6 ENGIE

- 8.7 Envirosoft

- 8.8 ESP

- 8.9 Graforce Hydro GmbH

- 8.10 Greenly

- 8.11 Intelex

- 8.12 IBM

- 8.13 Microsoft

- 8.14 Plan A

- 8.15 Persefoni

- 8.16 Salesforce

- 8.17 SAP SE

- 8.18 Schneider Electric

- 8.19 Sphera

- 8.20 Trinity Consultants