|

市场调查报告书

商品编码

1822651

视讯远端资讯处理市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Video Telematics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

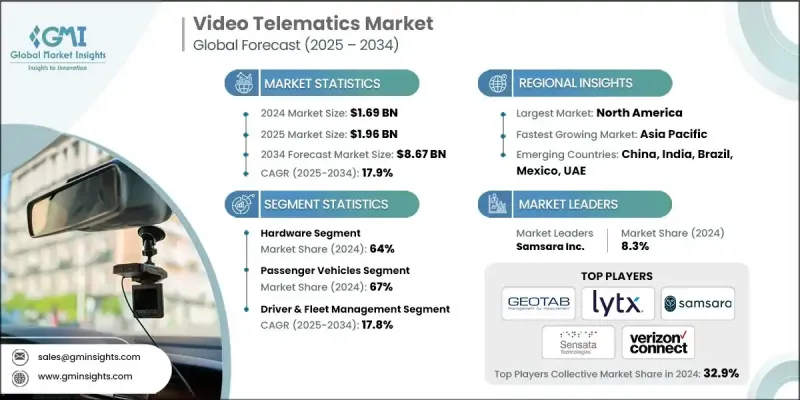

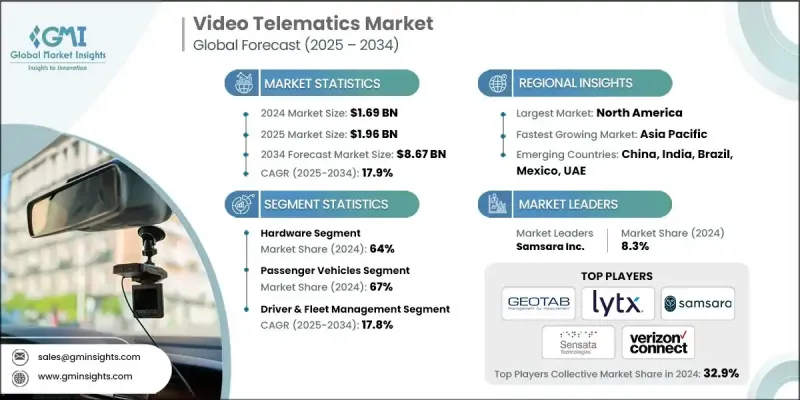

根据 Global Market Insights Inc. 发布的最新报告,全球视讯远端资讯处理市场规模在 2024 年估计为 16.9 亿美元,预计将从 2025 年的 19.6 亿美元增长到 2034 年的 86.7 亿美元,复合年增长率为 17.9%。

美国 ELD(电子记录设备)授权和其他全球安全标准等法规正在推动车队管理人员采用整合视讯和远端资讯处理解决方案,以确保法律合规性和报告准确性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16.9亿美元 |

| 预测值 | 86.7亿美元 |

| 复合年增长率 | 17.9% |

硬体采用率不断上升

2024年,硬体领域占据了显着份额,这主要得益于行车记录器、车内摄影机、DVR以及感测器配件等设备的推动。随着车队营运商越来越重视即时视觉洞察以确保安全性和合规性,对坚固耐用、高解析度且整合AI功能的硬体的需求持续成长。製造商正致力于提升设备的耐用性、连接性和安装便利性,以支援从乘用车到长途卡车等各种车型。

乘用车需求不断成长

2025-2034年,乘用车市场将迎来强劲成长,这得益于人身安全、保险折扣和防盗需求的不断增长。叫车服务、公司车队,甚至个人消费者都在为车辆配备智慧行车记录仪,以提供即时警报、驾驶行为追踪和事故记录功能。各公司正在客製化解决方案,使其更加谨慎、用户友好,并与行动应用程式相容,以吸引这群精通科技的人。

驾驶员和车队管理获得牵引力

驾驶员和车队管理细分市场在2024年占据了显着的份额,这得益于企业对监控驾驶员行为、提高燃油效率和降低营运风险的需求。即时视讯结合GPS、加速计和人工智慧分析技术,使车队管理人员能够侦测疲劳驾驶、分心驾驶、急煞车和路线偏差等情况。这种数据丰富的方法使管理人员能够有效地指导驾驶员,同时优化路线和维护计划。随着云端整合和即时决策的持续创新推动各行各业的采用,该细分市场的规模预计将超过30亿美元。

区域洞察

北美将成为推动力地区

2024年,北美视讯远端资讯处理市场占据了强劲的市场份额,这得益于严格的车队安全法规、商用车普及率的提高以及驾驶员责任意识的不断增强。光是美国就占据了相当大的市场收入份额,其应用领域涵盖物流、现场服务、客运和公共部门车队。强大的基础设施和高技术渗透率使北美成为视讯远端资讯处理应用持续创新和扩展的有利环境。

视讯远端资讯处理市场的主要参与者有 Trimble Transportation(Trimble Inc.)、Nauto、Verizon Connect(Verizon Communications Inc.)、VisionTrack、Lytx、Geotab、SmartWitness(Sensata Technologies)、MiX Telematics、Samsara 和 Netradyne。

为了巩固市场地位,视讯远端资讯处理市场中的公司正专注于人工智慧驱动的创新、策略合作伙伴关係以及针对特定产业的解决方案。市场领导者正在嵌入人工智慧,以实现即时驾驶指导、自动事故侦测和预测性维护洞察。与保险公司、车队租赁公司和物流供应商的合作有助于扩大客户群并改善服务整合。

目录

第一章:方法论

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- GMI 专有 AI 系统

- 人工智慧驱动的研究增强

- 来源一致性协议

- 人工智慧准确度指标

- 预测模型

- 初步研究和验证

- 市场估计的主要趋势

- 量化市场影响分析

- 生长参数对预测的数学影响

- 情境分析框架

- 一些主要来源(但不限于)

- 资料探勘来源

- 次要

- 付费来源

- 公共资源

- 来源(按地区)

- 次要

- 研究路径和信心评分

- 研究路径组成部分:

- 评分组件

- 研究透明度附录

- 来源归因框架

- 品质保证指标

- 我们对信任的承诺

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 事故率的上升推动了监控解决方案的采用。

- 政府强制要求采取电子记录和安全措施。

- 保险与诈欺预防

- 车队旨在透过路线和燃料优化来削减成本。

- 人工智慧、物联网和云端增强了视讯远端资讯处理功能。

- 产业陷阱与挑战

- 实施成本高

- 资料隐私和安全问题

- 市场机会

- 电子商务和物流需求不断成长

- 人工智慧与高阶分析集成

- 新兴市场扩张

- 保险远端资讯处理程序

- 成长动力

- 技术与创新格局

- 硬体组件和摄影系统

- 多摄影机配置和放置

- 影像感测器技术和分辨率

- 储存和资料管理系统

- 连接和通讯模组

- 软体平台和分析引擎

- 即时视讯处理演算法

- 人工智慧和机器学习集成

- 事件检测与分类

- 驾驶员行为分析与评分

- 云端基础架构和资料管理

- 视讯储存和检索系统

- 边缘运算和本地处理

- 资料压缩和频宽优化

- API 整合和第三方连接

- 使用者介面和仪表板系统

- 车队经理仪表板和报告

- 司机行动应用程式

- 即时警报和通知系统

- 硬体组件和摄影系统

- 成长潜力分析

- 监管格局

- 全球隐私与资料保护框架

- 运输和车队安全法规

- 保险和风险管理法规

- 网路安全和资料安全标准

- 波特的分析

- PESTEL分析

- 技术趋势与创新

- 人工智慧和机器学习的进步

- 电脑视觉和物体识别

- 用于语音分析的自然语言处理

- 预测模型和风险评估

- 边缘运算和即时处理

- 装置上的 AI 处理能力

- 减少延迟和频宽要求

- 离线操作和资料同步

- 先进的相机和感光元件技术

- 4K 和超高清视频

- 夜视和低光性能

- 360度多角度覆盖

- 与物联网和联网汽车生态系统的集成

- 车联网 (V2X) 通信

- 智慧基础设施集成

- 互联车队生态系统发展

- 人工智慧和机器学习的进步

- 专利分析

- 用例

- 最佳情况

- 消费者行为分析

- 成本效益分析与投资报酬率框架

- 总拥有成本(TCO)分析

- 投资报酬率(ROI)模型

- 实施和部署成本分析

- 按行业垂直分類的财务影响评估

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 新兴竞争威胁

- 新市场进入者

- 科技颠覆者

- 替代商业模式

- 竞争情报框架

- 重要新闻和倡议

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 市场进入障碍与竞争护城河

- 技术和智慧财产权保护

- 客户转换成本和锁定

- 规模和网路效应

第五章:市场估计与预测:依组件划分,2021 - 2034 年

- 主要趋势

- 硬体

- 行车记录仪

- GPS追踪设备

- 感应器

- 车载诊断 (OBD) 设备

- 软体

- 视讯分析和人工智慧处理软体

- 车队管理和仪表板平台

- 整合和 API 软体

- 服务

- 安装服务

- 维护和支援服务

- 託管服务

- 咨询服务

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 嵌入式系统

- 互联繫统

- 独立系统

第七章:市场估计与预测:依车型,2021 - 2034

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车(LCV)

- 中型商用车(HCV)

- 重型商用车(HCV)

- 特种车辆和紧急车辆

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 驾驶员和车队管理

- 预测性维护

- 保险远端资讯处理

- 资产追踪

- 执法

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 运输与物流

- 建筑和基础设施

- 卫生保健

- 零售和消费者服务

- 政府和公共安全

- 能源和公用事业

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球领导者

- Geotab

- 莱特克斯

- 轮迴

- 天宝

- 威瑞森通讯

- Motive Technologies(原 KeepTruckin)

- 阿祖加

- Webfleet Solutions(普利司通)

- Teletrac 导航员

- 地区球员/冠军

- 舰队完成

- MiX 远端资讯处理

- 森萨塔科技

- Quartix技术公司

- 速康有限公司

- 视觉追踪

- 新兴参与者/颠覆者

- 美国电话电报公司

- 舰队摄影机

- LightMetrics

- 诺托

- Netradyne

- 一步式GPS

The global video telematics market was estimated at USD 1.69 billion in 2024 and is expected to grow from USD 1.96 billion in 2025 to USD 8.67 billion by 2034, at a CAGR of 17.9%, according to the latest report published by Global Market Insights Inc.

Regulations such as the ELD (Electronic Logging Device) mandate in the U.S. and other global safety standards are pushing fleet managers to adopt integrated video and telematics solutions to ensure legal compliance and reporting accuracy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.69 Billion |

| Forecast Value | $8.67 Billion |

| CAGR | 17.9% |

Rising Adoption in Hardware

The hardware segment held a notable share in 2024, driven by devices such as dashcams, in-cabin cameras, DVRs, and sensor-enabled accessories. As fleet operators increasingly prioritize real-time visual insights for safety and compliance, the demand for rugged, high-resolution, and AI-integrated hardware continues to rise. Manufacturers are focusing on improving device durability, connectivity, and ease of installation to support diverse vehicle types, from passenger cars to long-haul trucks.

Growing Demand in Passenger Vehicles

The passenger vehicles segment will witness strong growth during 2025-2034, driven by the rising demand for personal safety, insurance discounts, and theft prevention. Ride-hailing services, company car fleets, and even private consumers are equipping vehicles with intelligent dashcams that offer real-time alerts, driver behavior tracking, and accident recording capabilities. Companies tailoring solutions to be discreet, user-friendly, and compatible with mobile apps to appeal to this tech-savvy demographic.

Driver & Fleet Management to Gain Traction

The driver & fleet management segment generated a notable share in 2024, driven by the organizations ' need to monitor driver behavior, improve fuel efficiency, and reduce operational risk. Real-time video combined with GPS, accelerometers, and AI-powered analytics allows fleet managers to detect fatigue, distracted driving, harsh braking, and route deviations. This data-rich approach empowers managers to coach drivers effectively while optimizing routes and maintenance schedules. The segment is on track to exceed USD 3 billion, with continuous innovations in cloud integration and real-time decision-making driving adoption across industries.

Regional Insights

North America to Emerge as a Propelling Region

North America video telematics market held a robust share in 2024, driven by stringent fleet safety regulations, rising commercial vehicle adoption, and increasing awareness around driver accountability. The U.S. alone is responsible for a significant portion of market revenue, with adoption spanning logistics, field services, passenger transport, and public sector fleets. Robust infrastructure and high technology penetration make North America a favorable environment for continuous innovation and expansion in video telematics applications.

Major players in the video telematics market are Trimble Transportation (Trimble Inc.), Nauto, Verizon Connect (Verizon Communications Inc.), VisionTrack, Lytx, Geotab, SmartWitness (Sensata Technologies), MiX Telematics, Samsara, and Netradyne.

To solidify their presence, companies in the video telematics market are focusing on AI-driven innovation, strategic partnerships, and vertical-specific solutions. Market leaders are embedding artificial intelligence to enable real-time driver coaching, automated incident detection, and predictive maintenance insights. Collaborations with insurance firms, fleet leasing companies, and logistics providers help expand customer bases and improve service integration.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technology

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing accident rates drive adoption of monitoring solutions.

- 3.2.1.2 Governments mandate electronic logging and safety measures.

- 3.2.1.3 Insurance & Fraud Prevention

- 3.2.1.4 Fleets aim to cut costs through route and fuel optimization.

- 3.2.1.5 AI, IoT, and cloud enhance video telematics capabilities.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Implementation Costs

- 3.2.2.2 Data Privacy & Security Concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growing E-commerce & Logistics Demand

- 3.2.3.2 AI & Advanced Analytics Integration

- 3.2.3.3 Expansion in Emerging Markets

- 3.2.3.4 Insurance Telematics Programs

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.3.1 Hardware components and camera systems

- 3.3.1.1 Multi-camera configuration and placement

- 3.3.1.2 Image sensor technology and resolution

- 3.3.1.3 Storage and data management systems

- 3.3.1.4 Connectivity and communication modules

- 3.3.2 Software platform and analytics engine

- 3.3.2.1 Real-time video processing algorithms

- 3.3.2.2 AI and machine learning integration

- 3.3.2.3 Event detection and classification

- 3.3.2.4 Driver behavior analysis and scoring

- 3.3.3 Cloud infrastructure and data management

- 3.3.3.1 Video storage and retrieval systems

- 3.3.3.2 Edge computing and local processing

- 3.3.3.3 Data compression and bandwidth optimization

- 3.3.3.4 API integration and third-party connectivity

- 3.3.4 User interface and dashboard systems

- 3.3.4.1 Fleet manager dashboard and reporting

- 3.3.4.2 Driver mobile applications

- 3.3.4.3 Real-time alert and notification systems

- 3.3.1 Hardware components and camera systems

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Global privacy and data protection framework

- 3.5.2 Transportation and fleet safety regulations

- 3.5.3 Insurance and risk management regulations

- 3.5.4 Cybersecurity and data security standards

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology trends and innovations

- 3.8.1 Artificial intelligence and machine learning advancement

- 3.8.1.1 Computer vision and object recognition

- 3.8.1.2 Natural language processing for voice analysis

- 3.8.1.3 Predictive modeling and risk assessment

- 3.8.2 Edge computing and real-time processing

- 3.8.2.1 On-device AI processing capabilities

- 3.8.2.2 Reduced latency and bandwidth requirements

- 3.8.2.3 Offline operation and data synchronization

- 3.8.3 Advanced camera and sensor technology

- 3.8.3.1 4K and ultra-high definition video

- 3.8.3.2 Night vision and low-light performance

- 3.8.3.3 360-degree and multi-angle coverage

- 3.8.4 Integration with IoT and connected vehicle ecosystem

- 3.8.4.1 Vehicle-to-everything (V2X) communication

- 3.8.4.2 Smart infrastructure integration

- 3.8.4.3 Connected fleet ecosystem development

- 3.8.1 Artificial intelligence and machine learning advancement

- 3.9 Patent analysis

- 3.10 Use cases

- 3.11 Best-case scenario

- 3.12 Consumer behaviour analysis

- 3.13 Cost-benefit analysis and ROI framework

- 3.13.1 Total cost of ownership (TCO) analysis

- 3.13.2 Return on investment (ROI) models

- 3.13.3 Implementation and deployment cost analysis

- 3.13.4 Financial impact assessment by industry vertical

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Emerging competitive threats

- 4.6.1 New market entrants

- 4.6.2 Technology disruptors

- 4.6.3 Alternative business models

- 4.6.4 Competitive intelligence framework

- 4.7 Key news and initiatives

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans and funding

- 4.8 Market entry barriers and competitive moats

- 4.8.1 Technology and IP protection

- 4.8.2 Customer switching costs and lock-in

- 4.8.3 Scale and network effects

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Dash cams

- 5.2.2 GPS tracking devices

- 5.2.3 Sensors

- 5.2.4 Onboard diagnostics (OBD) devices

- 5.3 Software

- 5.3.1 Video analytics and AI processing software

- 5.3.2 Fleet management and dashboard platforms

- 5.3.3 Integration and API software

- 5.4 Services

- 5.4.1 Installation services

- 5.4.2 Maintenance & support services

- 5.4.3 Managed services

- 5.4.4 Consulting services

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Embedded systems

- 6.3 Connected systems

- 6.4 Standalone systems

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCVs)

- 7.3.2 Medium commercial vehicles (HCVs)

- 7.3.3 Heavy commercial vehicles (HCVs)

- 7.4 Specialty and emergency vehicles

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Driver & fleet management

- 8.3 Predictive maintenance

- 8.4 Insurance telematics

- 8.5 Asset tracking

- 8.6 Law enforcement

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Transportation & logistics

- 9.3 Construction and infrastructure

- 9.4 Healthcare

- 9.5 Retail and consumer services

- 9.6 Government & public safety

- 9.7 Energy and utilities

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1.1 Global Leaders

- 11.1.1.1 Geotab

- 11.1.1.2 Lytx

- 11.1.1.3 Samsara

- 11.1.1.4 Trimble

- 11.1.1.5 Verizon Communications

- 11.1.1.6 Motive Technologies (formerly KeepTruckin)

- 11.1.1.7 Azuga

- 11.1.1.8 Webfleet Solutions (Bridgestone)

- 11.1.1.9 Teletrac Navman

- 11.1.2 Regional Players / Champions

- 11.1.2.1 Fleet Complete

- 11.1.2.2 MiX Telematics

- 11.1.2.3 Sensata Technologies

- 11.1.2.4 Quartix Technologies

- 11.1.2.5 SureCam Limited

- 11.1.2.6 VisionTrack

- 11.1.3 Emerging Players / Disruptors

- 11.1.3.1 AT&T

- 11.1.3.2 FleetCam

- 11.1.3.3 LightMetrics

- 11.1.3.4 Nauto

- 11.1.3.5 Netradyne

- 11.1.3.6 One Step GPS