|

市场调查报告书

商品编码

1822653

钻石工具市场机会、成长动力、产业趋势分析及2025-2034年预测Diamond Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

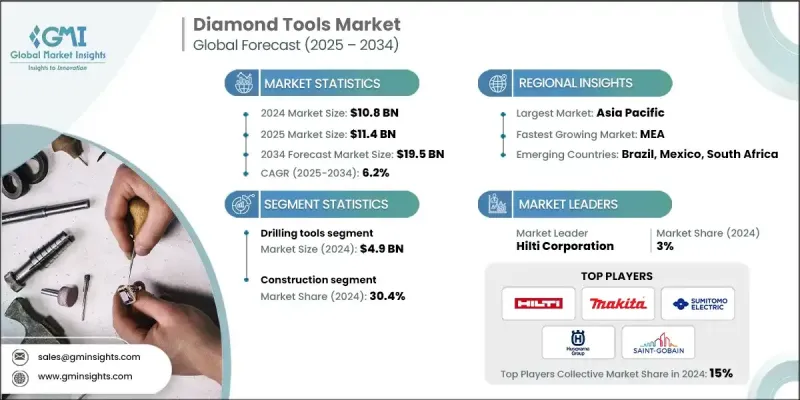

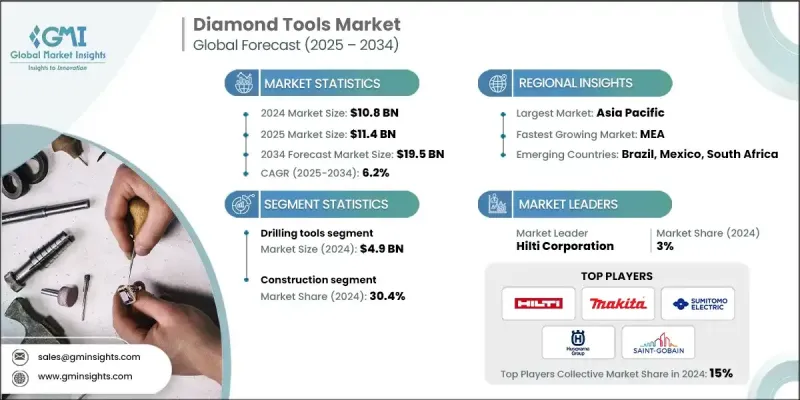

2024 年全球钻石工具市场价值为 108 亿美元,预计到 2034 年将以 6.2% 的复合年增长率增长至 195 亿美元。

全球城镇化的快速发展和基础设施投资的不断增加是推动钻石工具市场需求的主要力量。随着政府和私人开发商加大住宅区、商业建筑、高速公路、桥樑和地铁系统的建设力度,对耐用且精密的工具的需求也随之激增。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 108亿美元 |

| 预测值 | 195亿美元 |

| 复合年增长率 | 6.2% |

钻井工具获得牵引力

钻井工具领域在2024年占据了相当大的份额,这得益于其在采矿、建筑和石油勘探等高要求应用领域的广泛应用。这些工具对于在混凝土、石材和钢筋材料等坚硬表面进行钻孔至关重要,而传统工具则无法有效发挥作用。钻石钻头精度高、停机时间短、使用寿命长,使其成为手动和自动化系统的首选。

建筑业采用率不断上升

受全球住宅、商业和基础设施建设持续扩张的推动,建筑业在2024年创造了可观的收入。钻石锯片、岩芯钻和砂轮等工具对于切割和塑造混凝土、沥青和瓷砖等硬建筑材料至关重要。随着建筑标准不断发展,要求更快的周转时间和更高的精度,承包商越来越依赖钻石工具来以最少的浪费交付高品质的成果。

区域洞察

亚太地区将崛起成为推动力地区

2024年,亚太地区钻石工具市场实现了显着成长,这得益于蓬勃发展的建筑业、工业化进程以及汽车和电子製造中心的崛起。中国、印度和韩国等国家正在经历大规模的基础设施投资和製造业规模扩张,这两者都需要高性能的切割、研磨和钻孔解决方案。该地区强大的原材料供应链和相对较低的生产成本使本地製造商拥有竞争优势。

钻石工具市场的主要参与者有 OX Group International、住友电工株式会社、博世、MK Diamond Products、Core Plus Specialist、圣戈班、Metabo Power Tools、Asahi Diamond Industrial、Tyrolit、Hilti、Continental Diamond Tool Corporation、Husqvarna AB、Oregon Construction Business、Milti、Continental Diamond Tool Corporation、Husqvarna AB、Oregon Construction Business。

为了巩固市场地位,钻石工具市场中的企业正优先进行研发,以开发出具有更高耐用性、更快切割速度和更强耐热性的产品。许多企业正在采用雷射焊接和精密黏合等先进製造技术,以提高产品性能和一致性。与建筑公司和设备製造商建立策略合作伙伴关係也有助于品牌将其工具整合到更广泛的系统中,从而提高各行业的使用率。此外,企业正在透过併购和分销网络扩大其全球影响力,尤其是在新兴市场,同时也投资数位平台,以改善客户互动和售后支援。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 建筑、石材加工、机械加工等各行业的需求不断增长

- 精密加工需求不断成长

- 电子和半导体产业扩张

- 产业陷阱与挑战

- 初始成本高

- 替代材料的可用性

- 机会

- 采用自动化和智慧製造

- 再生能源领域的成长

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021-2034

- 主要趋势

- 磨料

- 钻石砂轮

- 钻石抛光垫

- 钻石研磨膏

- 钻石砂带

- 切削刀具

- 钻石涂层立铣刀

- 钻石车刀

- 钻石切削刀片

- PCD(聚晶钻石)工具

- 钻井工具

- 钻石岩心钻头

- 钻石麻花钻

- 钻石钻头旋转钻

- 电镀钻石钻头

- 锯切工具

- 钻石锯片(圆形、排形、线状)

- 钻石线锯

- 分段式钻石锯片

- 其他(连续边缘钻石锯片等)

第六章:市场估计与预测:依製造方法,2021-2034 年

- 主要趋势

- 金属结合

- 树脂黏合

- 电镀

- 烧结

- 其他(焊焊等)

第七章:市场估计与预测:按应用 2021-2034

- 主要趋势

- 石材加工

- 运输

- 加工

- 地质勘探

- 建造

第 8 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Asahi Diamond Industrial

- Bosch

- Bosun

- Hilti

- Husqvarna AB

- Lackmond

- Makita

- Metabo Power Tools

- MK Diamond Products

- Nanjing Sanchao Advanced Materials

- Oregon Construction Business

- OX Group International

- Saint-Gobain

- Sumitomo Electric Industries, Ltd.

- Tyrolit

The Global Diamond Tools Market was valued at USD 10.8 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 19.5 billion by 2034.

The rapid pace of urbanization and increasing investment in infrastructure worldwide are major forces driving demand in the diamond tools market. As governments and private developers ramp up construction of residential complexes, commercial buildings, highways, bridges, and metro systems, the need for durable and precise tools has surged.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.8 Billion |

| Forecast Value | $19.5 Billion |

| CAGR | 6.2% |

Drilling Tools to Gain Traction

The drilling tools segment held a significant share in 2024 owing to its widespread use in demanding applications such as mining, construction, and oil exploration. These tools are essential for boring into hard surfaces like concrete, stone, and reinforced materials where conventional tools fail to perform efficiently. Diamond drill bits offer high precision, reduced downtime, and extended operational life, making them a preferred choice in both manual and automated systems.

Rising Adoption in Construction

The construction segment generated notable revenues in 2024, driven by the ongoing expansion of residential, commercial, and infrastructure developments worldwide. Tools like diamond saw blades, core drills, and grinding wheels are critical for cutting and shaping hard construction materials such as concrete, asphalt, and tiles. As construction standards evolve to demand faster turnaround times and higher precision, contractors increasingly rely on diamond tools to deliver quality results with minimal waste.

Regional Insights

Asia Pacific to Emerge as a Propelling Region

Asia Pacific diamond tools market held a sizeable growth in 2024, supported by booming construction activity, industrialization, and the rise of automotive and electronics manufacturing hubs. Countries like China, India, and South Korea are witnessing massive infrastructure investments and manufacturing scale-ups, both of which require high-performance cutting, grinding, and drilling solutions. The region's strong raw material supply chain and relatively lower production costs give local manufacturers a competitive edge.

Major players in the diamond tools market are OX Group International, Sumitomo Electric Industries, Ltd., Bosch, MK Diamond Products, Core Plus Specialist, Saint-Gobain, Metabo Power Tools, Asahi Diamond Industrial, Tyrolit, Hilti, Continental Diamond Tool Corporation, Husqvarna AB, Oregon Construction Business, Makita, and Bosun.

To strengthen their market position, companies in the diamond tools market are prioritizing R&D to develop products with higher durability, faster cutting speeds, and enhanced heat resistance. Many firms are adopting advanced manufacturing techniques such as laser welding and precision bonding to improve product performance and consistency. Strategic partnerships with construction firms and equipment manufacturers are also helping brands integrate their tools into broader systems, increasing usage across industries. Additionally, companies are expanding their global footprint through mergers, acquisitions, and distribution networks, particularly in emerging markets, while also investing in digital platforms for better customer engagement and after-sales support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Manufacturing method

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand from various industries such as construction, stone processing, and machining

- 3.2.1.2 Growing demand for precision machining

- 3.2.1.3 Electronics and semiconductor industry expansion

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost

- 3.2.2.2 Availability of alternative materials

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of automation and smart manufacturing

- 3.2.3.2 Growth in renewable energy sector

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Abrasive

- 5.2.1 Diamond grinding wheels

- 5.2.2 Diamond polishing pads

- 5.2.3 Diamond lapping compounds

- 5.2.4 Diamond abrasive belts

- 5.3 Cutting Tools

- 5.3.1 Diamond-coated end mills

- 5.3.2 Diamond turning tools

- 5.3.3 Diamond cutting inserts

- 5.3.4 PCD (Polycrystalline Diamond) tools

- 5.4 Drilling Tools

- 5.4.1 Diamond core drill bits

- 5.4.2 Diamond twist drills

- 5.4.3 Diamond-tipped rotary drills

- 5.4.4 Electroplated diamond drills

- 5.5 Sawing Tools

- 5.5.1 Diamond saw blades (circular, gang, wire)

- 5.5.2 Diamond wire saws

- 5.5.3 Segmented diamond blades

- 5.5.4 Others (Continuous rim diamond blades, etc.)

Chapter 6 Market Estimates and Forecast, By Manufacturing Method, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Metal bonded

- 6.3 Resin bonded

- 6.4 Electroplated

- 6.5 Sintering

- 6.6 Others (brazing, etc.)

Chapter 7 Market Estimates and Forecast, By Application 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Stone processing

- 7.3 Transportation

- 7.4 Machining

- 7.5 Geological prospecting

- 7.6 Construction

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Asahi Diamond Industrial

- 10.2 Bosch

- 10.3 Bosun

- 10.4 Hilti

- 10.5 Husqvarna AB

- 10.6 Lackmond

- 10.7 Makita

- 10.8 Metabo Power Tools

- 10.9 MK Diamond Products

- 10.10 Nanjing Sanchao Advanced Materials

- 10.11 Oregon Construction Business

- 10.12 OX Group International

- 10.13 Saint-Gobain

- 10.14 Sumitomo Electric Industries, Ltd.

- 10.15 Tyrolit