|

市场调查报告书

商品编码

1822655

工业安全手套市场机会、成长动力、产业趋势分析及2025-2034年预测Industrial Safety Gloves Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

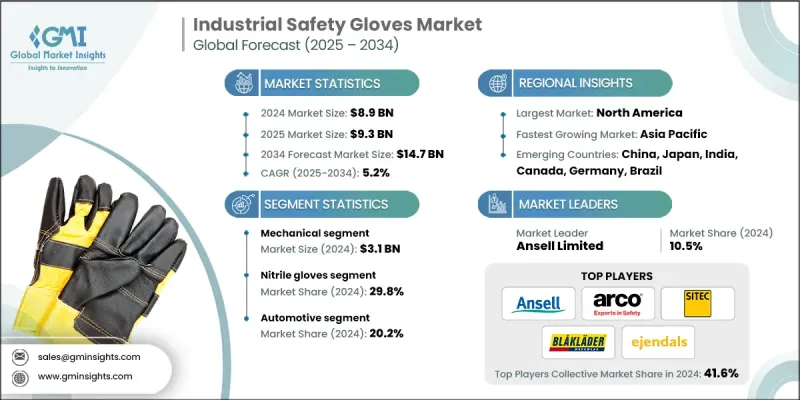

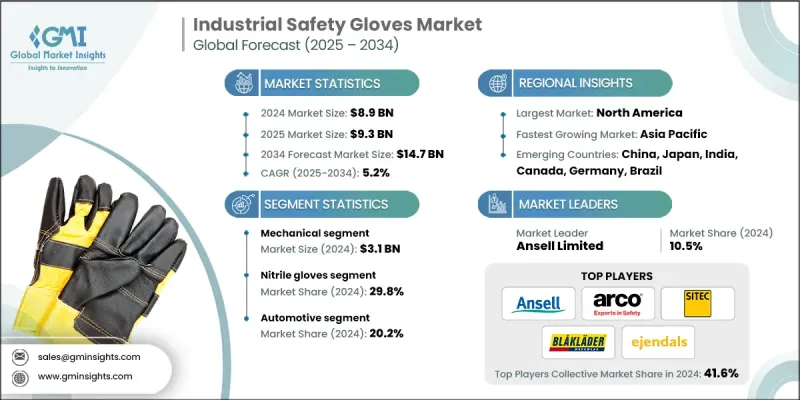

根据 Global Market Insights, Inc. 发布的最新报告,2024 年全球工业安全手套市场价值为 89 亿美元,预计将从 2025 年的 93 亿美元增长到 2034 年的 147 亿美元,复合年增长率为 5.2%。强劲的市场成长受到确保工人安全的严格监管措施、製造业和汽车行业的发展以及职业风险意识的提高的推动。

工业安全手套在个人防护装备 (PPE) 市场中占有重要份额。这些手套旨在保护工人免受机械危害、化学物质、割伤和磨损。工业安全手套在汽车、石油天然气、建筑和製造等行业的使用量正在稳步增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 89亿美元 |

| 预测值 | 147亿美元 |

| 复合年增长率 | 5.2% |

关键驱动因素:

1.工作场所安全法规和合规性:安全监管机构和保险公司的严格规定推动了高风险工作环境中手套的使用。

2.汽车和建筑业的成长:汽车製造和基础建设的显着成长将推动对抗衝击耐用手套的需求。

3.手套材质技术的进步:增强丁腈、乳胶和聚氨酯涂层,提高抓握力、灵活性和抗切割性。

4.向永续和绿色 PPE 转变:製造商正在投资可回收和可生物降解的手套材料,以最大限度地减少对环境的影响。

关键参与者:

前 7 名的公司分别是 Ansell Limited、Arco Limited、ATG Sitec GmbH、Blaklader BV、Ejendals AB、Ekastu Safety GmbH 和 Hartalega Holdings Berhad,市占率为 41.6%。

安思尔有限公司 (Ansell Limited) 2024 年的市占率为 10.5%。

主要挑战:

- 原物料价格波动:橡胶、腈纶和聚氨酯价格不稳定可能会影响製造利润。

- 非正规市场渗透率低:在发展中经济体,由于成本因素和缺乏合规性,安全手套的使用仍然不均衡。

- 环境影响:一次性手套的需求和使用量的增加引发了消费者和监管机构对永续性的担忧。

1. 依产品分类-机械手套占比最高

2024年,机械手套仍将占据最大的市场份额,因为它们在汽车维修、建筑和一般製造业中被广泛使用。机械手套的高强度结构、抗衝击性和耐磨性使其非常适合使用工具和机械进行手工作业。

2. 依材质分类-丁腈手套占据主导地位

丁腈手套因其耐化学性、抗穿刺性和低过敏性而日益受到青睐。在大多数石油天然气和化学品处理等工业应用中,丁腈手套正在取代乳胶手套。

3. 按应用划分-汽车产业推动市场需求

2024 年,汽车产业贡献了最大份额。从事汽车组装、维修和零件製造的员工需要手套来抵御机械风险、油和油脂防护。

4. 按地区划分-北美占据全球市场主导地位

北美的主导地位得益于其强大的安全意识、防护设备的进步以及航太、金属加工和工业生产等行业的行业需求。随着智慧工厂和机器人技术的发展,其应用将进一步增加。

工业安全手套产业的主要参与者包括 Ansell Limited、Arco Limited、ATG Sitec GmbH、Blaklader BV、Ejendals AB、Ekastu Safety GmbH、Hartalega Holdings Berhad、Honeywell International, Inc.、Kachele Cama Latex GmbH、Kossan Rubber Industries BY、Atlaser (Shelby Group International, Inc.) 与 Showa Glove Co.

主要参与者正着力于合併、设施扩建、产品开发和策略合作,以扩大市场覆盖范围。安思尔有限公司推出了针对汽车和石油天然气行业的新型耐化学腐蚀丁腈手套。霍尼韦尔正在手套生产线中嵌入智慧感测器,以加强对工人安全的监控。贺特佳和高产柅品橡胶正在加大「永续」手套的生产力度,而Ejendals则正在投资防切割技术,尤其针对精密工业。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计资料(HS 编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品,2021-2034

- 主要趋势

- 机械的

- 化学和液体防护

- 热的

- 特殊保护

第六章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 丁腈手套

- 天然橡胶手套

- 乙烯基手套

- 氯丁橡胶手套

- 聚乙烯手套

- 其他的

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 汽车

- 化学

- 机械设备

- 金属製造

- 石油和天然气

- 矿业

- 其他的

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Ansell Limited

- Arco Limited

- ATG Sitec GmbH

- Blaklader BV

- Ejendals AB

- Ekastu Safety GmbH

- Hartalega Holdings Berhad

- Honeywell International, Inc.

- Kachele Cama Latex GmbH

- Kossan Rubber Industries Bhd

- Atlas Safety Products

- Lebon Protection Industrielle

- MAPA Professional

- MCR Safety (Shelby Group International, Inc.)

- Showa Glove Co.

The global industrial safety gloves market was valued at USD 8.9 billion in 2024 and is projected to grow from USD 9.3 billion in 2025 to USD 14.7 billion by 2034, expanding at a CAGR of 5.2%, according to the latest report published by Global Market Insights, Inc. Strong market growth is being driven by stringent regulatory measures for ensuring worker safety, growing manufacturing and automotive industries, and rising awareness of occupational risks.

Industrial safety gloves capture a major share of the personal protective equipment (PPE) market. These are designed to safeguard workers from mechanical hazards, chemicals, cuts, and abrasion. Industrial safety glove usage is steadily growing throughout industries like automotive, oil & gas, construction, and manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $14.7 Billion |

| CAGR | 5.2% |

Key Drivers:

1. Workplace safety regulation and compliance: Strong regulations from safety regulators and insurers drive glove use in high-hazard work environments.

2. Growth in the automotive and construction sectors: a visible rise in vehicle manufacturing and infrastructure development will drive demand for durable gloves with impact-resistance.

3. Advances in glove material technology: Enhanced nitrile, latex, and PU coatings, which are improving grip, dexterity, and cut-resistance.

4. A shift toward sustainable and green PPE: Manufacturers are investing in recyclable and biodegradable glove materials to minimize the environmental impact.

Key Players:

Top 7 firms are Ansell Limited, Arco Limited, ATG Sitec GmbH, Blaklader B.V., Ejendals AB, Ekastu Safety GmbH, and Hartalega Holdings Berhad, with a market share of 41.6%.

Ansell Limited accounted for a 2024 market share of 10.5%.

Key Challenges:

- Volatility of raw material prices: Unstable prices of rubber, nitrile, and polyurethane could affect manufacturing margins.

- Low penetration in informal markets: In developing economies, the use of safety gloves is still uneven due to cost factors and lack of compliance.

- Environmental Impact: Increasing demand and uptake of disposable gloves has fueled sustainability concerns among consumers and regulators.

1. By Product - Mechanical Gloves Have the Highest Share

In 2024, mechanical gloves still hold the largest share of the market as they are heavily used in car repair, construction, and general manufacturing. The high-strength construction, impact resistance, and abrasion protection associated with mechanical gloves make them suitable for manual work with tools and machinery.

2. By Material - Nitrile Gloves Take the Forefront

Nitrile gloves are experiencing rising demand based on their resistance to chemicals, puncture resistance, and hypoallergenic nature. They are taking the place of latex in most industrial applications across a majority of oil & gas and chemical handling processes.

3. By Application - Automotive Sector Drives Market Demand

The automotive sector contributed the lion's share in 2024. Employees in vehicle assembly, repair, and parts manufacturing need gloves for mechanical risks, oil, and grease protection.

4. By Region - North America Dominates Global Market

North American dominance is supported by strong safety awareness, advancements in protection equipment, and industry demand from industries such as aerospace, metalworking, and industrial production. Adoption will further increase with the growth of smart factories and robotic assimilation.

Key players in the industrial safety gloves industry are Ansell Limited, Arco Limited, ATG Sitec GmbH, Blaklader B.V., Ejendals AB, Ekastu Safety GmbH, Hartalega Holdings Berhad, Honeywell International, Inc., Kachele Cama Latex GmbH, Kossan Rubber Industries Bhd, Atlas Safety Products, Lebon Protection Industrielle, MAPA Professional, MCR Safety (Shelby Group International, Inc.), and Showa Glove Co.

Major players are emphasizing mergers, facility expansions, product development, and strategic collaborations to increase their market reach. Ansell Limited introduced new chemical-resistant nitrile gloves targeted at the automotive and oil & gas industries. Honeywell is embedding smart sensors in glove lines to increase the monitoring of worker safety. Hartalega and Kossan Rubber are increasing 'sustainable' glove manufacturing, while Ejendals is making investments in cut-resistant technologies, particularly for precision industries

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Livestock

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trend

- 5.2 Mechanical

- 5.3 Chemical & liquid protection

- 5.4 Thermal

- 5.5 Special protection

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Nitrile gloves

- 6.3 Natural rubber gloves

- 6.4 Vinyl gloves

- 6.5 Neoprene gloves

- 6.6 Polyethylene gloves

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trend

- 7.2 Automotive

- 7.3 Chemical

- 7.4 Machinery & equipment

- 7.5 Metal fabrication

- 7.6 Oil & gas

- 7.7 Mining

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Ansell Limited

- 9.2 Arco Limited

- 9.3 ATG Sitec GmbH

- 9.4 Blaklader B.V.

- 9.5 Ejendals AB

- 9.6 Ekastu Safety GmbH

- 9.7 Hartalega Holdings Berhad

- 9.8 Honeywell International, Inc.

- 9.9 Kachele Cama Latex GmbH

- 9.10 Kossan Rubber Industries Bhd

- 9.11 Atlas Safety Products

- 9.12 Lebon Protection Industrielle

- 9.13 MAPA Professional

- 9.14 MCR Safety (Shelby Group International, Inc.)

- 9.15 Showa Glove Co.