|

市场调查报告书

商品编码

1822657

电气安全产品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electrical Safety Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

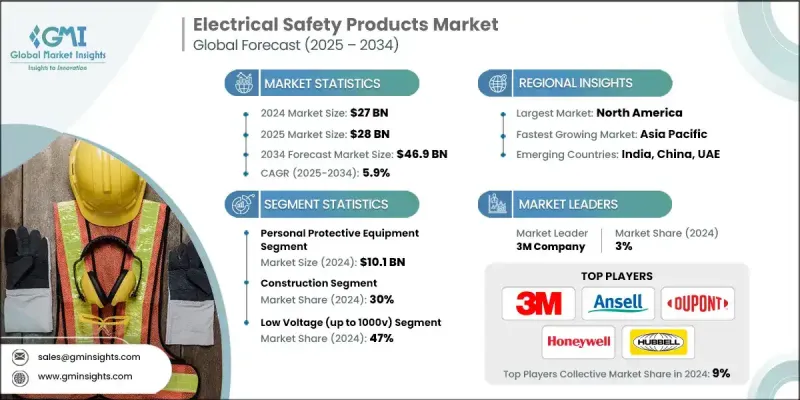

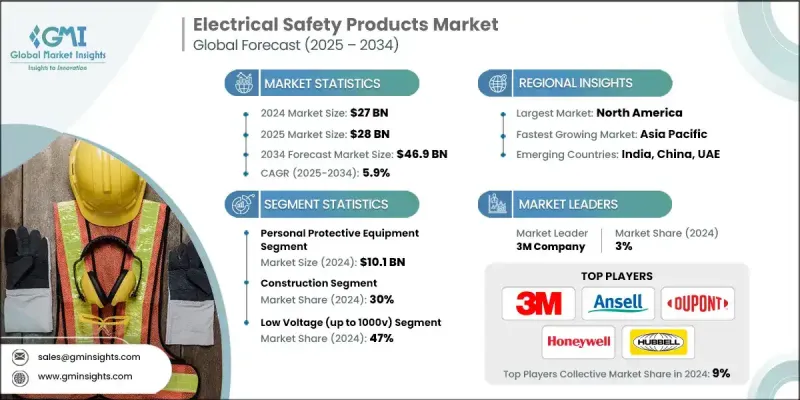

2024 年全球电气安全产品市场价值为 270 亿美元,预计到 2034 年将以 5.9% 的复合年增长率增长至 469 亿美元。

全球各国政府和监管机构正在实施更严格的职业安全标准,尤其是在建筑、製造和能源等行业。遵守职业安全与健康管理局 (OSHA) 和 IEC 标准等法规,推动了对认证电气安全产品的需求成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 270亿美元 |

| 预测值 | 469亿美元 |

| 复合年增长率 | 5.9% |

个人防护设备需求不断成长

个人防护装备 (PPE) 市场在 2024 年占据了相当大的份额,这得益于其在保护工人免受电击、烧伤和电弧闪光方面发挥的关键作用。从绝缘手套和阻燃服到绝缘鞋和麵罩,PPE 对各行各业的一线技术人员至关重要。随着企业优先考虑工作场所安全和法规合规性,PPE 需求持续成长,尤其是在公用事业和製造业等高风险产业。

建筑业采用率不断上升

由于在施工现场进行电气作业本身就具有危险性,建筑业在2024年的估值中占有相当大的份额。由于临时布线、裸露的连接以及重型设备的使用,触电或电弧闪光事故的风险很高。随着政府加强安全规定,承包商面临的责任风险日益增加,为工人配备可靠的安全装备并实施更严格的上锁/挂牌程序的势头强劲。

对低压(高达1000V)的需求不断增加

受住宅、商业和轻工业领域需求成长的推动,2024年,1000V以下低压应用领域的电气安全产品市场将占据显着份额。儘管低压环境的危险性被认为低于高压系统,但它仍然存在触电和火灾等风险,尤其是在安装和维护期间。绝缘手动工具、电压侦测器和耐电弧个人防护装备等产品对于安全操作至关重要。

区域洞察

北美将成为利润丰厚的地区

2024年,受先进电气安全技术应用的推动,北美电气安全产品市场收入强劲,成为全球最成熟的市场之一。强大的合规文化、严格的劳工标准以及广泛的工业化进程,加速了能源、製造和建筑等产业对认证安全产品的使用。在该地区营运的公司正专注于创新、合规认证和数位安全工具,以满足不断变化的工作场所安全要求。

电气安全产品市场的主要参与者有 Panduit、Ansell、Milliken & Company、Tyndale Company、Cementex Products、Oberon Company、Brady、Saf-T-Gard、Hubbell、3M Company、MSA Safety、Leviton Manufacturing、National Safety Apparel、DuPont Nemours 和 Honey International。

为了巩固其在电气安全产品市场的立足点,各公司正在寻求产品创新、法规协调和战略合作伙伴关係的整合。许多公司正在投资研发,以开发更轻、更符合人体工学、技术更先进的个人防护装备,在不影响防护性能的前提下提高舒适度。其他公司则专注于整合安全解决方案,将硬体与即时监控或智慧警报结合。与培训提供者和数位安全平台的合作,正在帮助品牌将自己定位为全方位安全合作伙伴。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 提高对电气危险的认识

- 严格的监管要求和职业安全标准

- 产业陷阱与挑战

- 安全设备的初始成本高

- 缺乏意识和培训

- 机会

- 新兴市场电气化

- 智慧和物联网安全解决方案

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 个人防护装备(PPE)

- 头部防护

- 安全帽

- 耐电弧罩

- 防护头罩(巴拉克拉法帽)

- 眼部和脸部防护

- 安全眼镜

- 面罩

- 听力保护

- 耳塞

- 耳罩

- 防电弧服装

- 防护鞋

- 手部防护

- 皮革防护手套

- 绝缘(橡胶)手套

- 绝缘(橡胶)套管

- 其他(内衣等)

- 绝缘材料

- 绝缘垫

- 绝缘毯

- 绝缘套管

- 塑胶防护罩和盖子

- 其他(绝缘梯子等)

- 其他(锁定/挂牌(LOTO)设备、测试和测量设备等)

第六章:市场估计与预测:按电压,2021 - 2034

- 主要趋势

- 低电压(最高1000V)

- 中压(1000V至36KV)

- 高压(36kV以上)

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 电弧闪光服装洗涤和修復。

- 经过认证的实验室测试。

- 现场测试

- 其他(现场电气安全培训计划、线上电气安全培训等)

第 8 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 电力

- 发电

- 传染

- 分配

- 电焊

- 电信

- 石油和天然气

- 矿业

- 机械

- 建造

- 汽车

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034

- 主要趋势

- 直销

- 间接销售

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 3M Company

- Ansell

- Brady

- Cementex Products

- DuPont de Nemours

- Honeywell International

- Hubbell

- Leviton Manufacturing

- Milliken & Company

- MSA Safety

- National Safety Apparel

- Oberon Company

- Panduit

- Saf-T-Gard

- Tyndale Company

The Global Electrical Safety Products Market was valued at USD 27 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 46.9 billion by 2034.

Governments and regulatory bodies across the globe are enforcing stricter occupational safety standards, especially in industries like construction, manufacturing, and energy. Compliance with regulations such as OSHA and IEC standards is driving increased demand for certified electrical safety products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27 Billion |

| Forecast Value | $46.9 Billion |

| CAGR | 5.9% |

Increasing Demand for Personal Protective Equipment

The personal protective equipment (PPE) segment held a significant share in 2024, driven by its critical role in safeguarding workers from shocks, burns, and arc flashes. From insulated gloves and flame-resistant clothing to dielectric footwear and face shields, PPE is essential for frontline technicians across industries. Demand continues to grow as companies prioritize workplace safety and regulatory compliance, especially in high-risk sectors like utilities and manufacturing.

Rising Adoption in Construction

The construction segment was valued at a decent share in 2024, owing to the inherently hazardous nature of electrical work on active job sites. With temporary wiring, exposed connections, and heavy equipment in use, the risk of electrocution or arc flash incidents is high. As governments tighten safety mandates and contractors face mounting liability risks, there is strong momentum toward equipping workers with reliable safety gear and implementing stricter lockout/tagout procedures.

Increasing Demand for Low Voltage (Up to 1000V)

The electrical safety products market from the low voltage applications up to 1000V segment held a notable share in 2024, driven by the growing demand across residential, commercial, and light industrial sectors. Despite being considered less hazardous than high-voltage systems, low-voltage environments still present risks like electric shock and fire, especially during installation and maintenance. Products such as insulated hand tools, voltage detectors, and arc-rated PPE are essential for safe handling.

Regional Insights

North America to Emerge as a Lucrative Region

North America electrical safety products market generated robust revenues in 2024, driven by the adoption of advanced electrical safety technologies, making it one of the most mature markets globally. Strong compliance culture, high labor standards, and widespread industrialization have accelerated the use of certified safety products across sectors like energy, manufacturing, and construction. Companies operating in the region are focusing on innovation, compliance certifications, and digital safety tools to meet evolving workplace safety requirements.

Major players in the electrical safety products market are Panduit, Ansell, Milliken & Company, Tyndale Company, Cementex Products, Oberon Company, Brady, Saf-T-Gard, Hubbell, 3M Company, MSA Safety, Leviton Manufacturing, National Safety Apparel, DuPont de Nemours, and Honeywell International.

To strengthen their foothold in the electrical safety products market, companies are pursuing a blend of product innovation, regulatory alignment, and strategic partnerships. Many are investing in R&D to develop lighter, more ergonomic, and technologically enhanced PPE that increases comfort without compromising protection. Others are focusing on integrated safety solutions, combining hardware with real-time monitoring or smart alerts. Collaborations with training providers and digital safety platforms are helping brands position themselves as holistic safety partners.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Voltage

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising awareness of electrical hazards

- 3.2.1.2 Stringent regulatory requirements & occupational safety standards

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs of safety equipment

- 3.2.2.2 Lack of awareness and training

- 3.2.3 Opportunities

- 3.2.3.1 Emerging markets electrification

- 3.2.3.2 Smart & IoT-enabled safety solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade Statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.1.1 Personal Protective Equipment (PPE)

- 5.1.2 Head protection

- 5.1.3 Hard hats

- 5.1.4 Arc rated hoods

- 5.1.5 Protection hoods (balaclavas)

- 5.1.6 Eye & face protection

- 5.1.7 Safety glasses

- 5.1.8 Face shield

- 5.1.9 Hearing protection

- 5.1.10 Ear plugs

- 5.1.11 Ear muffs

- 5.1.12 Arc rated clothing

- 5.1.13 Protective footwear

- 5.1.14 Hand protection

- 5.1.15 Leather protective gloves

- 5.1.16 Insulating (rubber) gloves

- 5.1.17 Insulating (rubber) sleeves

- 5.1.18 Others (under garments, etc.)

- 5.2 Insulating Materials

- 5.2.1 Insulating Mats

- 5.2.2 Insulating Blankets

- 5.2.3 Insulating Sleeves

- 5.2.4 Plastic Guards & Covers

- 5.2.5 Others (Insulated ladders, etc.)

- 5.3 Others (Lockout/Tagout (LOTO) devices, testing and measurement equipment, etc.)

Chapter 6 Market Estimates & Forecast, By Voltage, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Low voltage (up to 1000v)

- 6.3 Medium voltage (1000v to 36kv)

- 6.4 High voltage (above 36kv)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Arc flash clothing laundering and repair.

- 7.3 Certified laboratory testing.

- 7.4 On-site testing

- 7.5 Others (On-site electrical safety training programs, Online electrical safety training, etc.)

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.1.1 Electrical

- 8.1.2 Power generation

- 8.1.3 Transmission

- 8.1.4 Distribution

- 8.1.5 Electrical welding

- 8.1.6 Telecom

- 8.2 Oil & Gas

- 8.3 Mining

- 8.4 Machinery

- 8.5 Construction

- 8.6 Automotive

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3M Company

- 11.2 Ansell

- 11.3 Brady

- 11.4 Cementex Products

- 11.5 DuPont de Nemours

- 11.6 Honeywell International

- 11.7 Hubbell

- 11.8 Leviton Manufacturing

- 11.9 Milliken & Company

- 11.10 MSA Safety

- 11.11 National Safety Apparel

- 11.12 Oberon Company

- 11.13 Panduit

- 11.14 Saf-T-Gard

- 11.15 Tyndale Company