|

市场调查报告书

商品编码

1822661

製冰机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Ice maker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

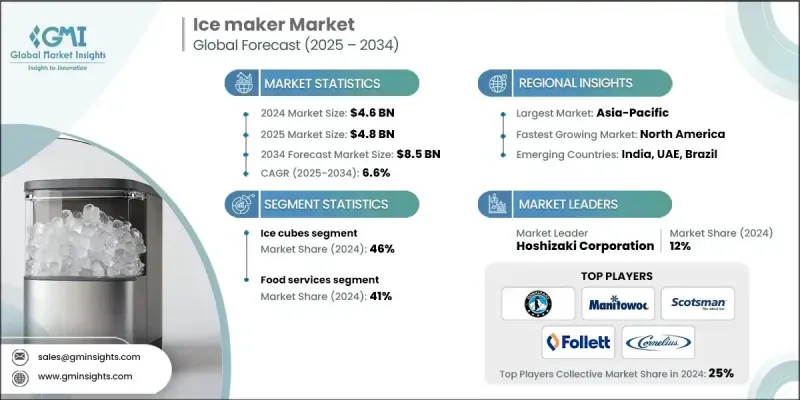

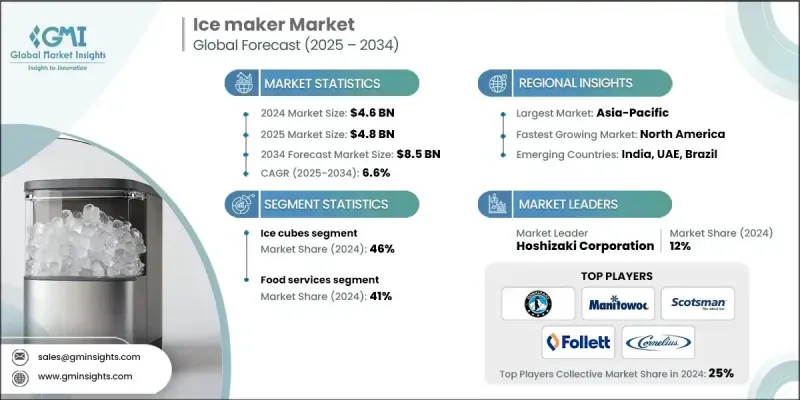

2024 年全球製冰机市场价值为 46 亿美元,预计到 2034 年将以 6.6% 的复合年增长率增长至 85 亿美元。

餐饮服务业是製冰机市场的主要驱动力,因为餐厅、咖啡馆、酒吧和餐饮服务等场所的日常运营严重依赖稳定且卫生的冰块供应。从冷藏饮料、展示海鲜到保存食材和调製鸡尾酒,冰块在食物呈现和食品安全方面都发挥着至关重要的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 46亿美元 |

| 预测值 | 85亿美元 |

| 复合年增长率 | 6.6% |

冰块需求不断成长

2024年,冰块市场占据了显着份额,这得益于其在餐饮、酒店、医疗保健和住宅领域的广泛应用。冰块因其用途广泛、融化缓慢以及与多种饮料类型的兼容性而成为最受欢迎的製冰形式。从餐厅酒吧到饭店迷你吧和自动贩卖机,对冰块机的需求依然强劲。此外,消费者对卫生和新鲜度的期望日益增长,促使企业安装现场冰块製冰机,而非依赖包装冰,也推动了该市场的发展。

食品服务领域采用率不断提高

2024年,餐饮服务业收入可观,这得益于餐厅、咖啡馆、快餐连锁店和餐饮公司数量的不断增长。在该行业,冰不仅对于饮料的製作至关重要,而且对于食品的展示、保存和卫生也至关重要。随着户外活动、外带餐饮和冷饮消费的激增,商业厨房面临越来越大的压力,需要按需生产大量清洁、高品质的冰块。

区域洞察

亚太地区将崛起成为推动力地区

受城镇化进程加快、食品饮料产业蓬勃发展以及冷链物流需求不断增长的推动,亚太地区製冰机市场在2024年将占据相当大的份额。中国、印度、日本和韩国等国家的饭店、零售和医疗保健产业正在经历显着成长,这些产业都需要可靠的製冰解决方案。快餐店的激增以及热带地区冷饮的日益普及,并持续推动着设备销售。此外,新兴经济体政府对食品安全和医疗基础设施的重视,也推动了该地区对节能卫生製冰机的需求。

製冰机市场的主要参与者有海尔、RACOLD、State Industries、Vaillant、Linuo Ritter International、Bradford White Corporation、Jaquar India、Bosch Industriekessel、Rinnai Corporation、AO Smith、AQUAMAX AUSTRALIA、FERROLI、Hubbell Heaters、Bajajrisals、Viessmann 完成 Applianced、VERROS、bell Heaters、Bajajrisals. Company 和 Havells India。

为了巩固市场地位,製冰机市场的公司正专注于产品创新、产能扩张和策略合作伙伴关係。领先的製造商正在投资节能技术和智慧功能,例如自清洁系统、非接触式取冰和物联网监控,以打造差异化产品。许多公司正在扩展其全球分销网络和售后服务能力,以提升客户体验并确保正常运行时间。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 餐饮和酒店业的成长

- 医疗保健和医药用途增加

- 气候变迁和天然冰供应减少

- 产业陷阱与挑战

- 能耗高

- 供应链中断和供应商产品短缺

- 机会

- 新兴市场的新市场采用

- 环保冷媒和能源

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 多边环境协定

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034

- 主要趋势

- 冰块

- 冰片

- 冰块

第六章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 医疗保健产业

- 餐饮服务

- 零售

- 其他的

第七章:市场估计与预测:按配销通路,2021 - 2034

- 主要趋势

- 在线的

- 离线

第八章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第九章:公司简介

- Hoshizaki Corporation

- Manitowoc Ice

- Scotsman Ice Systems

- Follett Ice

- Cornelius, Inc.

- Ice-o-Matic

- KOLD-DRAFT

- Brema Ice Makers

- Icematic

- Marx Ice

- Marvel Refrigeration

- U-Line Corporation

- Polar Ice

- Howe Corporation

- Newair

The Global Ice Maker Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 8.5 billion by 2034.

The foodservice sector is a major driver of the ice maker market, as establishments like restaurants, cafes, bars, and catering services depend heavily on a steady and hygienic supply of ice for daily operations. From chilling beverages and displaying seafood to preserving ingredients and preparing cocktails, ice plays a vital role in both food presentation and safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $8.5 Billion |

| CAGR | 6.6% |

Rising Demand for Ice Cubes

The ice cubes segment held a notable share in 2024, driven by its widespread application across foodservice, hospitality, healthcare, and residential sectors. Ice cubes are the most preferred form of ice due to their versatility, slow melting properties, and compatibility with a broad range of beverage types. From restaurants and bars to hotel minibars and vending machines, the demand for cube ice machines remains strong. The segment also benefits from growing consumer expectations for hygiene and freshness, pushing businesses to install on-site cube ice makers instead of relying on packaged ice.

Growing Adoption in Food Services

The food services segment generated substantial revenues in 2024, fueled by the growing number of restaurants, cafes, quick-service chains, and catering companies. In this sector, ice is essential not only for beverage preparation but also for food display, preservation, and sanitation purposes. With the surge in outdoor events, delivery-based dining, and cold beverage consumption, commercial kitchens are under increasing pressure to produce large volumes of clean, high-quality ice on demand.

Regional Insights

Asia Pacific to Emerge as a Propelling Region

Asia Pacific ice maker market held a sizeable share in 2024, driven by rising urbanization, a booming food and beverage industry, and increasing demand for cold chain logistics. Countries like China, India, Japan, and South Korea are witnessing significant growth in hospitality, retail, and healthcare sectors, all of which require reliable ice production solutions. The proliferation of quick-service restaurants and the growing popularity of cold beverages in tropical climates continue to fuel equipment sales. Additionally, the government's focus on food safety and medical infrastructure in emerging economies is boosting demand for energy-efficient and hygienic ice machines across the region.

Major players in the ice maker market are Haier, RACOLD, State Industries, Vaillant, Linuo Ritter International, Bradford White Corporation, Jaquar India, Bosch Industriekessel, Rinnai Corporation, A. O. Smith, AQUAMAX AUSTRALIA, FERROLI, Hubbell Heaters, Bajaj Electricals, Viessmann Climate Solutions SE, Stiebel Eltron, Ariston Holding, GE Appliances, Rheem Manufacturing Company, and Havells India.

To strengthen their presence, companies in the ice maker market are focusing on product innovation, capacity expansion, and strategic partnerships. Leading manufacturers are investing in energy-efficient technologies and smart features such as self-cleaning systems, touchless dispensing, and IoT-enabled monitoring to differentiate their offerings. Many are expanding their global distribution networks and after-sales service capabilities to enhance customer experience and ensure operational uptime.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in foodservice and hospitality industries

- 3.2.1.2 Increase in healthcare and pharmaceutical uses

- 3.2.1.3 Climate change and decreasing natural ice supply

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High energy consumption

- 3.2.2.2 Supply chain interruptions and supplier product shortages

- 3.2.3 Opportunities

- 3.2.3.1 New market adoption in emerging market

- 3.2.3.2 Eco-friendly refrigerants and energy

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Ice cubes

- 5.3 Ice flakes

- 5.4 Ice nuggets

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Healthcare industry

- 6.3 Food services

- 6.4 Retail

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Malaysia

- 8.4.7 Indonesia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Hoshizaki Corporation

- 9.2 Manitowoc Ice

- 9.3 Scotsman Ice Systems

- 9.4 Follett Ice

- 9.5 Cornelius, Inc.

- 9.6 Ice-o-Matic

- 9.7 KOLD-DRAFT

- 9.8 Brema Ice Makers

- 9.9 Icematic

- 9.10 Marx Ice

- 9.11 Marvel Refrigeration

- 9.12 U-Line Corporation

- 9.13 Polar Ice

- 9.14 Howe Corporation

- 9.15 Newair