|

市场调查报告书

商品编码

1833393

汽车测试设备市场机会、成长动力、产业趋势分析及2025-2034年预测Automotive Test Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

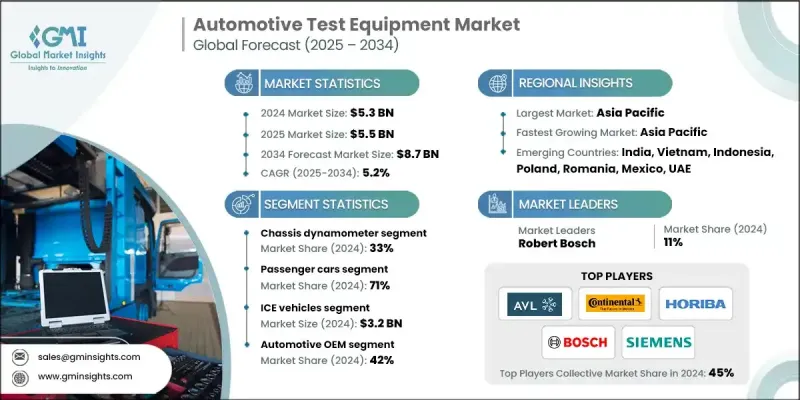

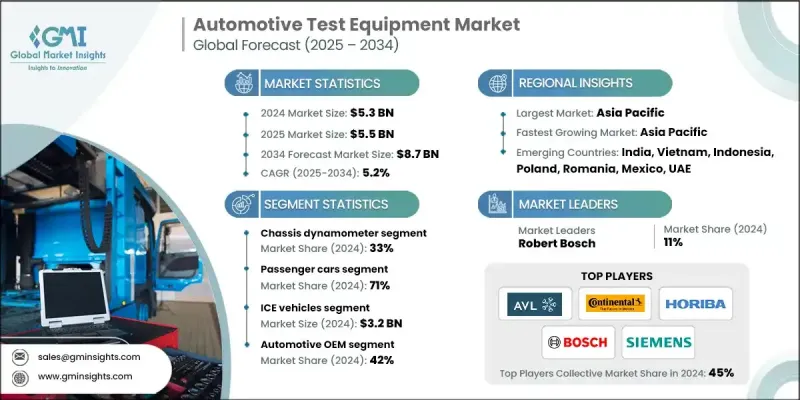

2024 年全球汽车测试设备市场价值为 53 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 87 亿美元。

先进电子设备与下一代驾驶辅助技术的日益融合正在重塑测试设备的角色,使其从传统的诊断工具转变为能够复製真实驾驶条件的先进系统。汽车製造商和一级供应商正增加对高性能测试台架的投资,以模拟各种驾驶场景,尤其是在业界大力推进ADAS开发、车辆互联和自动驾驶功能的情况下。由于车辆复杂性的提升、电动车的普及以及对开发和法规合规性精度日益增长的需求,对尖端测试解决方案的需求持续增长。电气化以及不断变化的法规促使原始设备製造商和售后市场参与者采用模组化、可扩展和智慧化的测试平台。自动化和云端诊断也正成为主流,提高了研发和生产线的产品开发速度、准确性和效率。市场的发展轨迹反映出市场正转向更智慧、更灵活的系统,以满足不断发展的车辆架构和全球排放标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 53亿美元 |

| 预测值 | 87亿美元 |

| 复合年增长率 | 5.2% |

动力总成测试仍然是最大的应用领域,这要归功于向电动动力总成的转变。原始设备製造商 (OEM) 要求在评估电池续航里程、马达功能和逆变器可靠性方面拥有更高的精度,这激发了人们对适应不断变化的电动车技术和区域充电规范的自适应和可扩展测试装置的兴趣。随着汽车电气化的日益普及,这一领域也将继续发展。

底盘测功机市场在2024年占据33%的市场份额,到2034年的复合年增长率为3%。这些系统仍然是模拟道路条件下整车测试的核心,支援燃油效率评估、排放监测和动态性能测试。随着国际排放法规日益严格,对相容于混合动力和电动车的测功机的需求日益增长。这些系统还透过再生煞车评估和高压电动车测试功能不断扩展其应用范围。

2024年,乘用车市场占了71%的市场份额,预计在2025年至2034年期间将维持6%的复合年增长率。系统复杂性日益增加,尤其是在混合动力和电动车领域,促使原始设备製造商和服务供应商使用先进的排放分析仪、电池测试系统和多功能诊断工具来增强测试能力。 ADAS和资讯娱乐平台的日益整合也推动了自动化、软体驱动的测试环境的采用。在售后工具中,受全球电动车队扩张和服务需求的推动,电池测试仪正经历最强劲的成长。

2024年,美国汽车测试设备市场规模达9.629亿美元。凭藉成熟的汽车生产格局和强劲的售后市场生态系统,美国仍然是北美市场的重要参与者。随着汽车保有量的成长以及人们对电动车日益增长的兴趣,排放测试仪、煞车测试系统和数位诊断设备的需求仍然强劲。 SUV和轻型卡车的普及进一步推动了OEM和售后市场对测试设备的需求。

影响汽车测试设备市场的知名公司包括 Moog、Softing、Horiba、AVL List、西门子、ABB、Actia、Continental、罗伯特·博世和霍尼韦尔。汽车测试设备市场领导者采用的关键策略是加速创新,以满足电动、混合动力和软体定义汽车不断变化的需求。各公司正在投资开发模组化和支援人工智慧的测试平台,以实现即时诊断和预测分析。云端连接和远端测试功能也受到重视,从而实现跨各种应用程式的可扩展性。与原始设备製造商和研究中心的策略合作有助于扩展产品功能,而法规遵循和永续性正在推动生态高效系统的创建。各公司正在进一步加强全球服务和支援基础设施,以提升用户体验和长期价值。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 严格的监管标准和合规要求

- 电动车市场成长与测试需求

- 自动驾驶汽车开发与验证

- 车联网技术集成

- 产业陷阱与挑战

- 高资本投资和设备成本

- 监理合规的复杂性

- 市场机会

- 电动车检测设备扩建

- 自动驾驶汽车验证市场成长

- 数位转型与自动化

- 基于云端的测试平台开发

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 物联网整合和连接测试设备

- 巨量资料分析与预测性维护

- 新兴技术

- 人工智慧和机器学习的实施

- 数位孪生技术集成

- 技术演进时间表

- 当前的技术趋势

- 数位转型与产业4.0融合

- 测试设备中的物联网集成

- 人工智慧与机器学习

- 巨量资料分析与云端运算

- 数位孪生技术

- 基于云端的测试平台

- 测试设备中的网路安全

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本分解分析

- 专利分析

- 按技术类别和测试分類的有效专利

- 电动车和自动驾驶汽车测试设备的专利申请趋势

- 智慧财产权授权和技术转移模式

- 专利诉讼风险评估

- 投资与融资分析

- 按设备类别分類的研发投入

- 创投与私募股权活动

- 政府资助和研究补助

- 企业投资与收购活动

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

- 未来展望与产业转型时间表

- 近期中断(2025-2027)

- 中期中断(2028-2030)

- 长期中断(2031-2034)

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 产品组合与技术比较

- 创新领导力与科技发展

- 专利申请和智慧财产权组合分析

- 研究合作与伙伴关係

- 新创企业生态系统与创新

- 市场进入策略和障碍

- 技术壁垒分析

- 资本投资要求

- 监管和认证障碍

- 品牌认知度与顾客信任度

- 客户决策标准与供应商选择

- 技术性能要求

- 成本和总所有权考虑

- 供应商可靠性和支持

- 整合和相容性因素

第五章:市场估计与预测:依产品,2021 - 2034

- 主要趋势

- 底盘测功机

- 引擎测功机

- 车轮定位测试仪

- 排放分析仪

- 汽车废气分析仪

- 电池测试仪

- 其他诊断工具

第六章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 搭乘用车

- 轿车

- SUV

- 掀背车

- 商用车

- 轻型商用车(LCV)

- 重型商用车(HCV)

- 中型商用车(MCV)

第七章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 内燃机汽车

- 电动车

- 纯电动车(BEV)

- 插电式混合动力车(PHEV)

- 混合动力电动车(HEV)

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 汽车OEM

- 一级和二级供应商

- 汽车服务中心和车间

- 监管机构和测试机构

- 研发中心

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 波兰

- 罗马尼亚

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Global companies

- AVL List

- Horiba

- MTS Systems

- National Instruments (NI)

- Keysight Technologies

- Robert Bosch

- dSPACE

- ETAS

- ABB

- Actia

- Continental

- Honeywell

- Moog

- Softing

- Technology providers

- ANSYS

- Bruel & Kjar Sound & Vibration

- HBK (Hottinger Bruel & Kjar)

- IPG Automotive

- MathWorks

- Rohde & Schwarz

- Siemens

- Tektronix

- Vector Informatik

- Testing service providers

- Applus+

- Bureau Veritas

- DEKRA

- Element Materials Technology

- Intertek

- Millbrook Proving Ground

- SGS

- TUV SUD

The Global Automotive Test Equipment Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 8.7 billion by 2034.

Rising integration of advanced electronics and next-gen driver assistance technologies is reshaping the role of test equipment, transforming it from traditional diagnostic tools into highly advanced systems capable of replicating real-world driving conditions. Automakers and Tier-1 suppliers are increasingly investing in high-performance test benches to simulate various driving scenarios, especially as the industry pushes forward with ADAS development, vehicle connectivity, and autonomous functionality. The demand for cutting-edge testing solutions continues to grow, driven by rising vehicle complexity, the expansion of electric mobility, and a growing need for precision in development and regulatory compliance. Electrification, along with evolving regulations, is prompting OEMs and aftermarket players to adopt modular, scalable, and intelligent testing platforms. Automated and cloud-enabled diagnostics are also becoming mainstream, improving product development speed, accuracy, and efficiency across both R&D and production lines. The market's trajectory reflects a shift toward smarter, more flexible systems that meet evolving vehicle architecture and global emission standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 5.2% |

Powertrain testing remains the largest application area, underpinned by the shift toward electric powertrains. OEMs are demanding greater accuracy in evaluating battery range, motor functionality, and inverter reliability, which has fueled interest in adaptive and scalable test setups that align with changing EV technologies and regional charging norms. This segment continues to evolve as vehicle electrification becomes more widespread.

The chassis dynamometers segment held 33% in 2024, with a 3% CAGR through 2034. These systems remain central to full vehicle testing under simulated road conditions, supporting fuel efficiency assessments, emissions monitoring, and dynamic performance testing. As international emissions regulations grow stricter, there's increased demand for dynamometers compatible with hybrid and electric vehicles. These systems are also expanding their utility with regenerative braking assessments and high-voltage EV testing capabilities.

The passenger cars segment held a 71% share in 2024 and is projected to maintain growth at 6% CAGR between 2025 and 2034. Increasing system complexity, particularly in hybrid and electric vehicles, is encouraging OEMs and service providers to enhance testing with advanced emissions analyzers, battery testing systems, and multi-functional diagnostic tools. The rising integration of ADAS and infotainment platforms is also encouraging the adoption of automated, software-driven testing environments. Among aftermarket tools, battery testers are experiencing the strongest growth, driven by the global expansion of EV fleets and service requirements.

United States Automotive Test Equipment Market was valued at USD 962.9 million in 2024. The country remains a key market player in North America, backed by a mature automotive production landscape and a robust aftermarket ecosystem. With high vehicle ownership levels and growing interest in electric vehicles, demand remains strong for emissions testers, brake testing systems, and digital diagnostic equipment. The prevalence of SUVs and light trucks adds further momentum to testing equipment needs in both OEM and aftermarket sectors.

Prominent companies shaping the Automotive Test Equipment Market include Moog, Softing, Horiba, AVL List, Siemens, ABB, Actia, Continental, Robert Bosch, and Honeywell. Key strategies adopted by leading players in the automotive test equipment market center around accelerating innovation to meet the evolving demands of electric, hybrid, and software-defined vehicles. Companies are investing in the development of modular and AI-enabled test platforms that allow for real-time diagnostics and predictive analytics. Emphasis is also being placed on cloud connectivity and remote testing capabilities, enabling scalability across various applications. Strategic collaborations with OEMs and research centers are helping expand product capabilities, while regulatory compliance and sustainability are driving the creation of eco-efficient systems. Companies are further strengthening global service and support infrastructure to enhance user experience and long-term value.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Propulsion

- 2.2.5 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

- 2.6.1 For equipment manufacturers

- 2.6.2 For end users

- 2.6.3 For testing service providers

- 2.6.4 For investors & financial institutions

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent regulatory standards & compliance requirements

- 3.2.1.2 Electric vehicle market growth & testing needs

- 3.2.1.3 Autonomous vehicle development & validation

- 3.2.1.4 Connected vehicle technology integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment & equipment costs

- 3.2.2.2 Regulatory compliance complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Electric vehicle testing equipment expansion

- 3.2.3.2 Autonomous vehicle validation market growth

- 3.2.3.3 Digital transformation & automation

- 3.2.3.4 Cloud-based testing platform development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 IoT integration & connected testing equipment

- 3.7.1.2 Big data analytics & predictive maintenance

- 3.7.2 Emerging technologies

- 3.7.2.1 AI & machine learning implementation

- 3.7.2.2 Digital twin technology integration

- 3.7.3 Technology evolution timeline

- 3.7.1 Current technological trends

- 3.8 Digital transformation & industry 4.0 integration

- 3.8.1 IoT integration in testing equipment

- 3.8.2 Artificial intelligence & machine learning

- 3.8.3 Big data analytics & cloud computing

- 3.8.4 Digital twin technology

- 3.8.5 Cloud-based testing platforms

- 3.8.6 Cybersecurity in testing equipment

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.12.1 Active patents by technology category & testing

- 3.12.2 Patent filing trends in EV & AV testing equipment

- 3.12.3 IP licensing & technology transfer models

- 3.12.4 Patent litigation risk assessment

- 3.13 Investment & funding analysis

- 3.13.1 R&D investment by equipment category

- 3.13.2 Venture capital & private equity activity

- 3.13.3 Government funding & research grants

- 3.13.4 Corporate investment & acquisition activity

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

- 3.15 Future outlook & industry transformation timeline

- 3.15.1 Near-term disruptions (2025-2027)

- 3.15.2 Medium-term disruptions (2028-2030)

- 3.15.3 Long-term disruptions (2031-2034)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Product portfolio & technology comparison

- 4.8 Innovation leadership & technology development

- 4.8.1 Patent filing & IP portfolio analysis

- 4.8.2 Research collaboration & partnerships

- 4.8.3 Startup ecosystem & innovation

- 4.9 Market entry strategies & barriers

- 4.9.1 Technology barrier analysis

- 4.9.2 Capital investment requirements

- 4.9.3 Regulatory & certification barriers

- 4.9.4 Brand recognition & customer trust

- 4.10 Customer decision criteria & vendor selection

- 4.10.1 Technology performance requirements

- 4.10.2 Cost & total ownership considerations

- 4.10.3 Vendor reliability & support

- 4.10.4 Integration & compatibility factors

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Chassis dynamometer

- 5.3 Engine dynamometer

- 5.4 Wheel alignment tester

- 5.5 Emission analyzer

- 5.6 Vehicle exhaust gas analyzer

- 5.7 Battery testers

- 5.8 Other diagnostic tools

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Heavy commercial vehicles (HCV)

- 6.3.3 Medium commercial vehicles (MCV)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 ICE vehicles

- 7.3 Electric vehicles

- 7.3.1 Battery electric vehicles (BEV)

- 7.3.2 Plug-in hybrid vehicles (PHEV)

- 7.3.3 Hybrid electric vehicles (HEV)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Automotive OEM

- 8.3 Tier-1 & tier-2 suppliers

- 8.4 Automotive service centers & workshops

- 8.5 Regulatory bodies & testing agencies

- 8.6 Research & development centers

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.3.8 Poland

- 9.3.9 Romania

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Vietnam

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 AVL List

- 10.1.2 Horiba

- 10.1.3 MTS Systems

- 10.1.4 National Instruments (NI)

- 10.1.5 Keysight Technologies

- 10.1.6 Robert Bosch

- 10.1.7 dSPACE

- 10.1.8 ETAS

- 10.1.9 ABB

- 10.1.10 Actia

- 10.1.11 Continental

- 10.1.12 Honeywell

- 10.1.13 Moog

- 10.1.14 Softing

- 10.2 Technology providers

- 10.2.1 ANSYS

- 10.2.2 Bruel & Kjar Sound & Vibration

- 10.2.3 HBK (Hottinger Bruel & Kjar)

- 10.2.4 IPG Automotive

- 10.2.5 MathWorks

- 10.2.6 Rohde & Schwarz

- 10.2.7 Siemens

- 10.2.8 Tektronix

- 10.2.9 Vector Informatik

- 10.3 Testing service providers

- 10.3.1 Applus+

- 10.3.2 Bureau Veritas

- 10.3.3 DEKRA

- 10.3.4 Element Materials Technology

- 10.3.5 Intertek

- 10.3.6 Millbrook Proving Ground

- 10.3.7 SGS

- 10.3.8 TUV SUD