|

市场调查报告书

商品编码

1833394

口腔临床营养市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Oral Clinical Nutrition Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

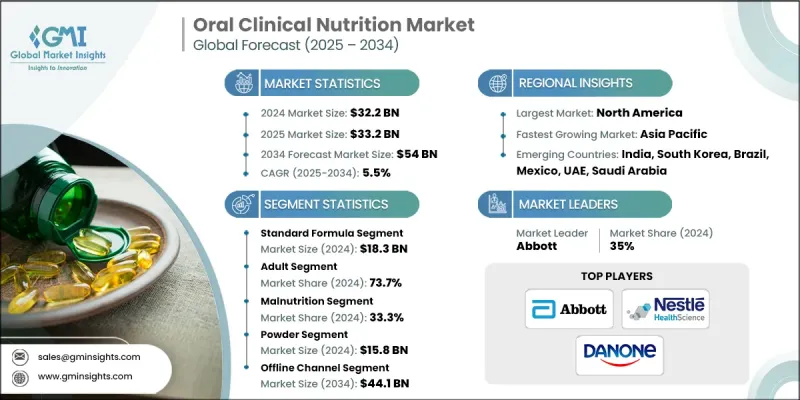

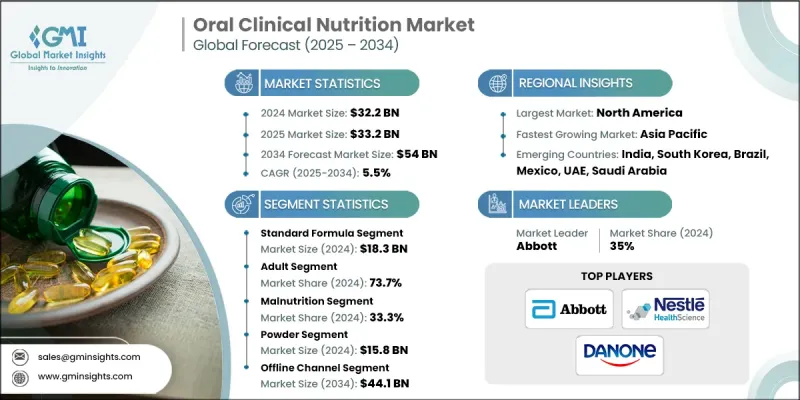

2024 年全球口腔临床营养市场价值为 322 亿美元,预计将以 5.5% 的复合年增长率成长,到 2034 年达到 540 亿美元。

癌症、糖尿病、胃肠道疾病和慢性阻塞性肺病 (COPD) 等疾病增加了营养管理的需求。口服临床营养产品通常用于支持康復和维持营养状态。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 322亿美元 |

| 预测值 | 540亿美元 |

| 复合年增长率 | 5.5% |

标准配方奶粉使用率上升

标准配方奶粉市场在2024年保持了可持续的份额,这得益于其能够满足各种一般营养需求的多功能性。这些配方奶粉适用于不需要特定疾病配方但仍需要高热量和营养补充品的患者。医院、门诊和长期照护机构通常会开立标准配方奶粉,用于术后恢復、短期营养不良和一般饮食支持。

成年人采用率不断提高

由于慢性病发病率上升、与老化相关的营养挑战以及人们对疾病相关营养不良的认识不断提高,成人市场在2024年占据了相当大的份额。接受癌症治疗、术后復健或治疗糖尿病和胃肠道疾病等疾病的成年人通常需要口服营养支持来维持体重和功能状态。

营养不良问题将受到重视

2024年,营养不良领域收入可观,这得益于临床和老年护理机构的支持。儘管营养不良是一种可预防和可治疗的疾病,但它仍然诊断不足,尤其是在老年人和慢性病患者中。市场对旨在解决蛋白质-能量营养不良和微量营养素缺乏症的针对性口服营养补充剂的需求激增。

北美将成为利润丰厚的地区

受人口老化、高昂的医疗支出以及强大的临床基础设施的推动,北美口服临床营养市场预计在2025-2034年期间实现可观的复合年增长率。主要市场参与者的加入,加上优惠的报销政策和完善的分销网络,进一步推动了该地区的成长。此外,大众和专业人士对营养在慢性病管理中重要性的认识不断提高,也加速了口服营养补充品的普及。

口腔临床营养产业的主要参与者包括明治控股、辉瑞、Nutriset、雅培营养、大冢製药、Kate Farms、B. Braun、葛兰素史克、雀巢健康科学、AYMES Nutrition、达能、Medifood International、费森尤斯卡比和美赞臣(利洁时)。

为了巩固其在口服临床营养市场的立足点,各公司正在采取一系列措施,包括产品创新、策略合作伙伴关係和地理扩张。领先的製造商正在大力投资研发,以开发针对特定疾病的配方,以满足糖尿病、肾臟病或癌症患者的独特饮食需求。此外,各品牌也着重口味改善和便利性,例如即饮型,以提高患者的依从性。与医院、家庭医疗保健提供者和保险公司的策略合作有助于扩大市场覆盖范围并提高产品的可及性。这些策略共同使公司能够保持竞争优势,同时满足不同患者群体不断变化的营养需求。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 与疾病相关的营养不良和慢性病发病率不断上升

- 老年人口不断增加

- 纳入临床指引

- 个人化营养的进步

- 产业陷阱与挑战

- 专业产品成本高

- 认识和筛检有限

- 市场机会

- 家庭医疗保健的扩展

- 技术整合

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

- 管道分析

- 定价分析

- 差距分析

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 标准公式

- 针对特定疾病的配方

第六章:市场估计与预测:按消费者,2021 - 2034 年

- 主要趋势

- 儿科

- 成人

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 癌症护理

- 慢性肾臟病

- 糖尿病

- 胃肠道疾病

- 营养不良

- 其他应用

第八章:市场估计与预测:按剂型,2021 - 2034

- 主要趋势

- 液体

- 粉末

- 半固体

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 线下通路

- 医院药房

- 零售药局

- 其他线下通路

- 线上通路

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abbott Nutrition

- AYMES Nutrition

- B. Braun

- Danone

- Fresenius Kabi

- GlaxoSmithKline

- Kate Farms

- Mead Johnson (Reckitt)

- Medifood International

- Meiji Holdings

- Nestle Health Science

- Nutriset

- Otsuka Pharmaceutical

- Pfizer

The Global Oral Clinical Nutrition Market was valued at USD 32.2 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 54 billion by 2034.

Conditions like cancer, diabetes, gastrointestinal disorders, and COPD increase the need for nutritional management. Oral clinical nutrition products are commonly used to support recovery and maintain nutritional status.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.2 Billion |

| Forecast Value | $54 Billion |

| CAGR | 5.5% |

Rising Use of Standard Formula

The standard formula segment held a sustainable share in 2024, driven by its versatility in addressing a wide range of general nutritional needs. These formulas are used for patients who do not require condition-specific formulations but still need calorie-dense and nutrient-rich supplements. Hospitals, outpatient clinics, and long-term care facilities routinely prescribe standard formulas for post-operative recovery, short-term malnutrition, and general dietary support.

Increasing Adoption Among Adults

The adult segment held a sizeable share in 2024, owing to the rising incidence of chronic illnesses, aging-related nutritional challenges, and growing awareness around disease-related malnutrition. Adults undergoing cancer therapy, recovering from surgery, or managing conditions like diabetes and gastrointestinal disorders often require oral nutrition support to maintain body mass and functional status.

Malnutrition to Gain Traction

The malnutrition segment generated notable revenues in 2024, backed by clinical and elderly care settings. Despite being a preventable and treatable condition, malnutrition remains underdiagnosed, especially among older adults and patients with chronic illnesses. The market has seen a surge in demand for targeted oral nutrition supplements designed to address protein-energy malnutrition and micronutrient deficiencies.

North America to Emerge as a Lucrative Region

North America oral clinical nutrition market is poised to witness a decent CAGR during 2025-2034, driven by an aging population, high healthcare expenditure, and robust clinical infrastructure. The presence of major market players, combined with favorable reimbursement policies and well-established distribution networks, further fuels regional growth. In addition, increasing public and professional awareness of the importance of nutrition in managing chronic diseases has accelerated the adoption of oral nutrition supplements.

Major players operating in the oral clinical nutrition industry include Meiji Holdings, Pfizer, Nutriset, Abbott Nutrition, Otsuka Pharmaceutical, Kate Farms, B. Braun, GlaxoSmithKline, Nestle Health Science, AYMES Nutrition, Danone, Medifood International, Fresenius Kabi, and Mead Johnson (Reckitt).

To strengthen their foothold in the oral clinical nutrition market, companies are pursuing a mix of product innovation, strategic partnerships, and geographic expansion. Leading manufacturers are investing heavily in R&D to develop condition-specific formulations that cater to the unique dietary needs of patients with diabetes, renal disease, or cancer. Additionally, brands are focusing on taste improvement and convenience, such as ready-to-drink formats, to boost patient compliance. Strategic collaborations with hospitals, home healthcare providers, and insurance companies have helped extend market reach and improve product accessibility. These strategies collectively enable companies to maintain a competitive advantage while addressing the evolving nutritional demands of diverse patient populations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Consumer

- 2.2.4 Application

- 2.2.5 Dosage form

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of disease-related malnutrition and chronic conditions

- 3.2.1.2 Growing elderly population

- 3.2.1.3 Integration into clinical guidelines

- 3.2.1.4 Advancements in personalized nutrition

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of specialized products

- 3.2.2.2 Limited awareness and screening

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in home healthcare

- 3.2.3.2 Technological integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Rest of the world

- 3.5 Pipeline analysis

- 3.6 Pricing analysis

- 3.7 Gap analysis

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Standard formulas

- 5.3 Disease-specific formulas

Chapter 6 Market Estimates and Forecast, By Consumer, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric

- 6.3 Adult

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cancer care

- 7.3 Chronic kidney disease

- 7.4 Diabetes

- 7.5 Gastrointestinal disorders

- 7.6 Malnutrition

- 7.7 Other applications

Chapter 8 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Liquid

- 8.3 Powder

- 8.4 Semi-solid

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Offline channel

- 9.2.1 Hospital pharmacies

- 9.2.2 Retail pharmacies

- 9.2.3 Other offline channels

- 9.3 Online channel

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Nutrition

- 11.2 AYMES Nutrition

- 11.3 B. Braun

- 11.4 Danone

- 11.5 Fresenius Kabi

- 11.6 GlaxoSmithKline

- 11.7 Kate Farms

- 11.8 Mead Johnson (Reckitt)

- 11.9 Medifood International

- 11.10 Meiji Holdings

- 11.11 Nestle Health Science

- 11.12 Nutriset

- 11.13 Otsuka Pharmaceutical

- 11.14 Pfizer