|

市场调查报告书

商品编码

1833402

脑性麻痹治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cerebral Palsy Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

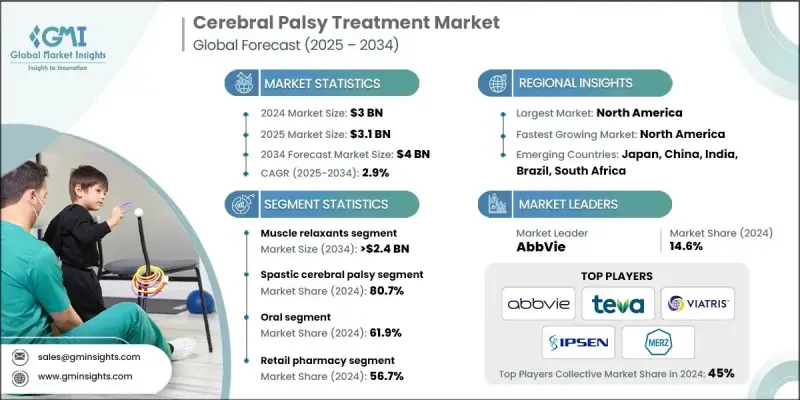

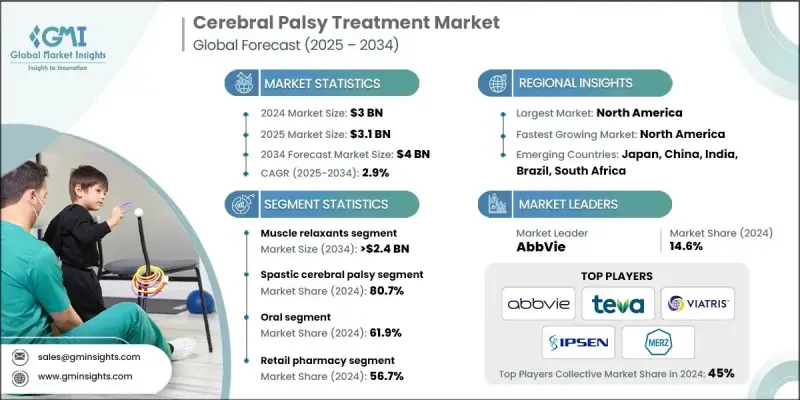

2024 年全球脑性麻痹治疗市场价值为 30 亿美元,预计将以 2.9% 的复合年增长率成长,到 2034 年达到 40 亿美元。

脑性麻痹盛行率的上升是推动市场成长的重要因素。新生儿护理和医疗技术的进步提高了早产儿和低出生体重儿的存活率,而这些婴儿患脑性麻痹的风险较高。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30亿美元 |

| 预测值 | 40亿美元 |

| 复合年增长率 | 2.9% |

肌肉鬆弛剂需求不断增加

2024年,肌肉鬆弛剂市场占有重要份额,因为这些药物通常用于治疗肌肉僵硬和痉挛,而肌肉僵硬和痉挛是脑性麻痹患者最严重的两种症状。巴氯芬、地西泮和替扎尼定等药物被广泛用于降低肌肉张力过高、改善活动能力,从而更好地参与物理治疗。随着对非侵入性和药物干预措施的需求不断增长,该市场将继续保持成长动能。

痉挛脑性麻痹节段

痉挛性脑性麻痹在2024年占据了相当大的份额,占确诊病例的很大一部分。这种亚型的特征是肌肉紧张或僵硬,从而影响运动和姿势。因此,它是大多数治疗计划和干预策略的主要临床重点。由于人们越来越重视早期诊断、多学科护理模式以及药物和物理治疗的引入,该领域的市场需求强劲。

口服药物的采用率不断上升

口服药物市场在2024年占据了显着的市场份额,这得益于其易于给药、患者依从性高以及治疗应用范围广。肌肉鬆弛剂和抗痉挛剂等药物通常配製成口服剂型,尤其适用于那些可能因注射或输液而感到不适的儿童。这种给药方式在长期治疗计画中仍受到医师和照护人员的青睐。

北美将成为利润丰厚的地区

2024年,北美脑性麻痹治疗市场显着成长,这得益于确诊病例数的增加和治疗方案的进步。该地区完善的医疗基础设施以及对研究和创新的高度重视,推动了市场发展。美国和加拿大的患者能够更方便地获得各种治疗方案,包括肉毒桿菌疗法、骨科手术和辅助设备。护理人员意识的提高以及早期介入计画的进展,进一步支持了市场扩张。

脑性麻痹治疗市场的主要参与者有 Teva、Novartis、UCB、CHEPLAPHARM、Amneal、Roche、GSK、Dr.Reddy's、AbbVie、VIATRIS、Merz Pharmaceuticals 和 IPSEN。

在北美脑性麻痹治疗市场营运的公司正致力于多管齐下的策略,以巩固其市场地位。他们大力投资研发,以创新更有效、更侵入性更低的治疗方案。与医院、復健中心和学术机构的合作促进了临床研究和产品验证。透过与医疗保健提供者和专科诊所的合作,增强分销网络,改善患者获得治疗的管道。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 脑性麻痹盛行率上升

- 药物配方的进步

- 提高认识和早期诊断

- 研发活动投资激增

- 产业陷阱与挑战

- 与药物相关的不良反应

- 市场机会

- 标靶治疗的发展

- 製药公司与儿科医院之间的策略伙伴关係

- 成长动力

- 成长潜力分析

- 监管格局

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 家庭医疗保健在脑性麻痹管理中的作用

- 居家照护对脑性瘫痪患者的重要性

- 家庭治疗服务(物理、职业、语言)

- 在家中使用辅助设备和行动辅助设备

- 居家照护和照护人员支持动态

- 居家照护与医院照护的成本效益

- 报销场景

- 品牌分析

- 管道分析

- 新兴治疗疗法

- 定价分析

- 消费者行为分析

- 投资前景

- 流行病学情景

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按药物类型,2021 - 2034 年

- 主要趋势

- 肌肉鬆弛剂

- 抗惊厥药

- 抗胆碱药物

- 抗忧郁药

- 其他药物类型

第六章:市场估计与预测:依疾病类型,2021 - 2034 年

- 主要趋势

- 痉挛性脑性麻痹

- 四肢瘫痪

- 双瘫

- 偏瘫

- 运动障碍性脑性麻痹

- 共济失调性脑性麻痹

- 混合性脑性麻痹

第七章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 注射剂

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 零售药局

- 医院药房

- 网路药局

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AbbVie

- Amneal

- CHEPLAPHARM

- Dr.Reddy's

- GSK

- IPSEN

- Merz Pharmaceuticals

- Novartis

- Roche

- Teva

- UCB

- VIATRIS

The Global Cerebral Palsy Treatment Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 2.9% to reach USD 4 billion by 2034.

The rising prevalence of cerebral palsy is a significant factor driving growth in the market. Advances in neonatal care and medical technology have led to improved survival rates of premature and low-birth-weight infants who are at higher risk for developing cerebral palsy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 2.9% |

Rising Demand for Muscle Relaxants

The muscle relaxants segment held a significant share in 2024, as these medications are commonly prescribed to manage muscle stiffness and spasticity, two of the most debilitating symptoms in cerebral palsy patients. Drugs like baclofen, diazepam, and tizanidine are widely used to reduce excessive muscle tone and improve mobility, allowing for better participation in physical therapy. The segment continues to gain momentum as demand for non-invasive and drug-based interventions grows.

Spastic Cerebral Palsy Segment

The spastic cerebral palsy generated a notable share in 2024, accounting for many diagnosed cases. This subtype is characterized by tight or stiff muscles, which impair movement and posture. As a result, it represents the primary clinical focus of most treatment plans and intervention strategies. The market demand in this segment is robust, driven by a growing emphasis on early diagnosis, multidisciplinary care models, and the introduction of both drug-based and physical therapies.

Rising Adoption of Oral Drugs

The oral segment generated a notable share in 2024, driven by its ease of administration, patient compliance, and broad therapeutic applicability. Medications such as muscle relaxants and antispastic agents are often formulated for oral use, especially in children who may find injections or infusions distressing. This delivery route continues to be favored by physicians and caregivers alike for long-term treatment plans.

North America to Emerge as a Lucrative Region

North America cerebral palsy treatment market witnessed notable growth in 2024, driven by an increasing number of diagnosed cases and advancements in therapeutic options. The market benefits from the region's well-established healthcare infrastructure and strong focus on research and innovation. Patients in the U.S. and Canada are gaining better access to a wide range of treatments, including botulinum toxin therapies, orthopedic surgeries, and assistive devices. Growing awareness among caregivers and early intervention programs further supports market expansion.

Major Players in the cerebral palsy treatment market are Teva, Novartis, UCB, CHEPLAPHARM, Amneal, Roche, GSK, Dr.Reddy's, AbbVie, VIATRIS, Merz Pharmaceuticals, and IPSEN.

Companies operating in the North America cerebral palsy treatment market are focusing on a multi-pronged strategy to strengthen their foothold. They invest heavily in research and development to innovate more effective and less invasive treatment options. Collaborations with hospitals, rehabilitation centers, and academic institutions facilitate clinical studies and product validation. Enhancing distribution networks through partnerships with healthcare providers and specialty clinics improves patient access to therapies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug type trends

- 2.2.3 Disease type trends

- 2.2.4 Route of administration trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cerebral palsy

- 3.2.1.2 Advancements in drug formulations

- 3.2.1.3 Increased awareness and early diagnosis

- 3.2.1.4 Surging investments in research and development activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects associated with drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Development of targeted therapies

- 3.2.3.2 Strategic partnerships between pharma companies and pediatric hospitals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Role of home healthcare in cerebral palsy management

- 3.6.1 Importance of home-based care for CP patients

- 3.6.2 Home-based therapy services (physical, occupational, speech)

- 3.6.3 Use of assistive devices and mobility aids at home

- 3.6.4 Home nursing and caregiver support dynamics

- 3.6.5 Cost-benefit aspects of home care vs hospital care

- 3.7 Reimbursement scenario

- 3.8 Brand analysis

- 3.9 Pipeline analysis

- 3.10 Emerging treatment therapies

- 3.11 Pricing analysis

- 3.12 Consumer behaviour analysis

- 3.13 Investment landscape

- 3.14 Epidemiological scenario

- 3.15 Gap analysis

- 3.16 Porter's analysis

- 3.17 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Muscle relaxants

- 5.3 Anticonvulsants

- 5.4 Anticholinergics

- 5.5 Antidepressants

- 5.6 Other drug types

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Spastic cerebral palsy

- 6.2.1 Quadriplegia

- 6.2.2 Diplegia

- 6.2.3 Hemiplegia

- 6.3 Dyskinetic cerebral palsy

- 6.4 Ataxic cerebral palsy

- 6.5 Mixed cerebral palsy

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacy

- 8.3 Hospital pharmacy

- 8.4 Online pharmacy

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amneal

- 10.3 CHEPLAPHARM

- 10.4 Dr.Reddy's

- 10.5 GSK

- 10.6 IPSEN

- 10.7 Merz Pharmaceuticals

- 10.8 Novartis

- 10.9 Roche

- 10.10 Teva

- 10.11 UCB

- 10.12 VIATRIS