|

市场调查报告书

商品编码

1833406

水痘带状疱疹病毒感染治疗市场机会、成长动力、产业趋势分析及2025-2034年预测Varicella Zoster Virus Infection Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

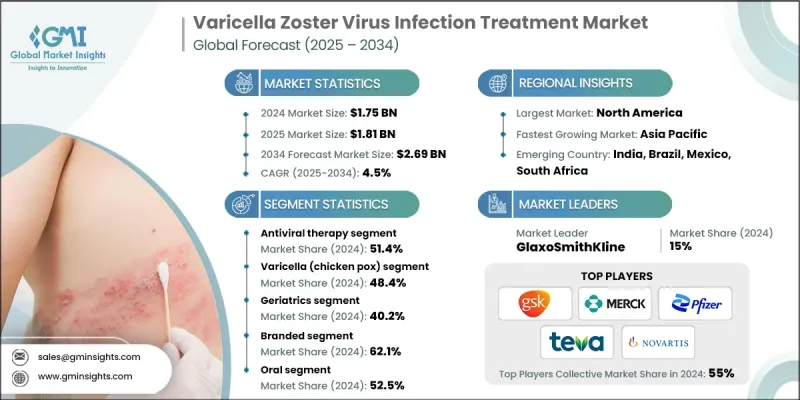

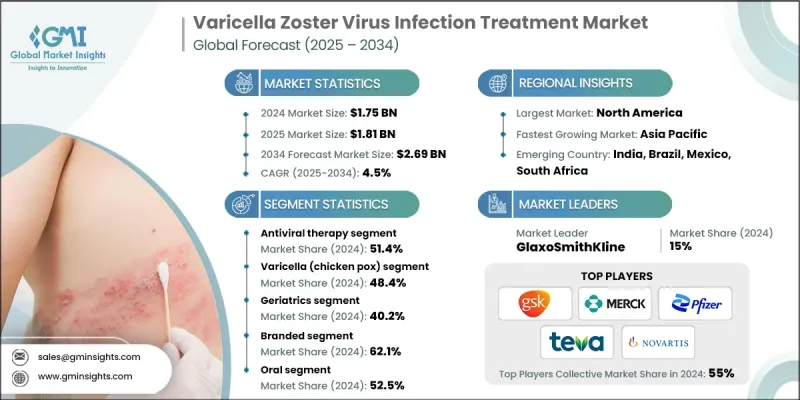

2024 年全球水痘带状疱疹病毒感染治疗市场价值为 17.5 亿美元,预计将以 4.5% 的复合年增长率成长,到 2034 年达到 26.9 亿美元。

随着全球人口老化,免疫系统较弱的人数显着增加,这大大增加了他们患带状疱疹的风险,带状疱疹是一种由水痘带状疱疹病毒重新激活引起的疼痛性皮疹。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17.5亿美元 |

| 预测值 | 26.9亿美元 |

| 复合年增长率 | 4.5% |

抗病毒疗法的采用率不断上升

抗病毒治疗领域在2024年占了相当大的份额,这得益于阿昔洛韦、伐昔洛韦和泛昔洛韦等药物在治疗带状疱疹和减少带状疱疹后神经痛等併发症方面的有效性。这些药物通常用于免疫功能正常和免疫功能低下的患者,老年族群和免疫防御能力较弱的人群对这些药物的需求正在增加。

水痘盛行率不断上升

水痘疫苗在2024年占据了相当大的份额。突破性感染和未接种疫苗的人群仍然需要治疗,尤其是在发展中地区。虽然抗病毒药物可用于治疗严重的儿童或成人病例,但主要重点仍然是预防。为了巩固市场地位,各公司正在与公共卫生部门密切合作,扩大水痘疫苗的覆盖面,并透过学校免疫计画提高公众意识。

老年人盛行率不断上升

由于老年人罹患带状疱疹及其併发症的风险增加,老年医学领域将在2025-2034年期间实现良好的复合年增长率。随着年龄增长,免疫力逐渐下降,老年人尤其容易感染病毒,通常需要及时抗病毒治疗,在许多情况下还需要长期的疼痛管理。重组带状疱疹疫苗等高效疫苗的推出已将重点转向预防,但在漏接种疫苗或疫苗无效的情况下,对支持性治疗的需求仍然强劲。

北美将成为利润丰厚的地区

到2034年,北美水痘-带状疱疹病毒感染治疗市场有望实现显着增长,这得益于强大的医疗基础设施、较高的疫苗覆盖率以及庞大的老龄化人口。在美国,带状疱疹疫苗的接种率很高,并得到了公共和私人支付机构的报销支持。此外,早期采用先进的抗病毒疗法有助于减少因治疗延迟而导致的併发症。

水痘带状疱疹病毒感染治疗市场的主要参与者有圣克鲁斯生物技术公司、迈兰公司、辉瑞公司、SK化学公司、长春百川生物技术公司、梯瓦製药公司、Apotex公司、诺华公司、博士伦生物技术公司、Kamada公司、山德士公司、葛兰素史克公司、默克公司、Glenmark-Bio-Bio科学技术公司。

为了在水痘带状疱疹病毒感染治疗市场中维持并扩大影响力,各公司正在采取多管齐下的策略,将产品创新、地理扩张和公共卫生合作融为一体。研发投入正转向下一代抗病毒药物和具有更持久免疫力的改良疫苗配方。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 带状疱疹盛行率不断上升

- 人口老化和免疫功能低下的患者

- 疫苗技术的进步

- 政府免疫计划

- 产业陷阱与挑战

- 品牌抗病毒药物和疫苗成本高昂

- 发展中地区的认知有限

- 市场机会

- 联合疗法和长效疗法的开发

- 个人化免疫策略

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 未来市场趋势

- 管道分析

- 定价分析

- 专利格局

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按治疗类型,2021 - 2034

- 主要趋势

- 抗病毒治疗

- 阿昔洛韦

- 伐昔洛韦

- 泛昔洛韦

- 其他抗病毒疗法

- 皮质类固醇和抗发炎药

- 疫苗

- 其他治疗类型

第六章:市场估计与预测:按适应症,2021 - 2034 年

- 主要趋势

- 水痘

- 带状疱疹

- 其他适应症

第七章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 儿科

- 成年人

- 老年病学

第 8 章:市场估计与预测:按产品类型,2021 - 2034 年

- 主要趋势

- 品牌

- 泛型

第九章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 外用

- 注射剂

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 居家照护环境

- 其他最终用途

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Apotex

- Bausch Health

- Bio-Rad Laboratories

- Changchun BCHT Biotechnology

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Kamada

- Merck & Co.

- Mylan

- Novartis

- Pfizer

- Sandoz

- Santa Cruz Biotechnology

- Sinovac

- SK Chemicals

- Teva Pharmaceuticals

The Global Varicella Zoster Virus Infection Treatment Market was valued at USD 1.75 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 2.69 billion by 2034.

As the global population continues to age, there is a marked rise in the number of individuals experiencing a weakened immune system, which significantly increases their risk of developing shingles (herpes zoster), a painful skin rash caused by the reactivation of the varicella zoster virus.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.75 Billion |

| Forecast Value | $2.69 Billion |

| CAGR | 4.5% |

Rising Adoption of Antiviral Therapy

The antiviral therapy segment held a substantial share in 2024, owing to the effectiveness of agents like acyclovir, valacyclovir, and famciclovir in managing herpes zoster and reducing complications such as postherpetic neuralgia. These medications are typically prescribed to both immunocompetent and immunocompromised patients, with demand rising among aging populations and those with weakened immune defenses.

Increasing Prevalence of Varicella (Chickenpox)

The varicella segment generated a substantial share in 2024. The breakthrough infections and unvaccinated populations continue to present treatment needs, particularly in developing regions. While antivirals may be used in severe pediatric or adult cases, the primary focus remains on prevention. To enhance their foothold, companies are working closely with public health authorities to expand access to varicella vaccines and raise awareness through school-based immunization programs.

Growing Prevalence Among Geriatrics

The geriatrics segment will grow at a decent CAGR during 2025-2034, owing to the increased risk of herpes zoster and its complications among older adults. As immunity wanes with age, seniors are particularly vulnerable to reactivation of the virus, often requiring prompt antiviral therapy and, in many cases, long-term pain management. The introduction of highly effective vaccines like the recombinant zoster vaccine has shifted the focus toward prevention, yet there remains strong demand for supportive treatments in cases where vaccination is missed or ineffective.

North America to Emerge as a Lucrative Region

North America varicella zoster virus infection treatment market is poised to witness significant growth by 2034, supported by robust healthcare infrastructure, high vaccine coverage, and a large aging population. The United States has seen strong uptake of shingles vaccines, with reimbursement support from both public and private payers. In addition, early adoption of advanced antiviral therapies has helped reduce complications associated with delayed treatment.

Major players in the varicella zoster virus infection treatment market are Santa Cruz Biotechnology, Mylan, Pfizer, SK Chemicals, Changchun BCHT Biotechnology, Teva Pharmaceuticals, Apotex, Novartis, Bausch Health, Kamada, Sandoz, GlaxoSmithKline, Merck & Co., Glenmark Pharmaceuticals, Bio-Rad Laboratories, and Sinovac.

To maintain and grow their foothold in the varicella zoster virus infection treatment market, companies are employing multi-pronged strategies that combine product innovation, geographic expansion, and public health collaboration. R&D investment is being directed toward next-generation antivirals and improved vaccine formulations with longer-lasting immunity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Indication trends

- 2.2.4 Age group trends

- 2.2.5 Product type trends

- 2.2.6 Route of administration trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of herpes zoster

- 3.2.1.2 Aging population and immunocompromised patients

- 3.2.1.3 Advancements in vaccine technology

- 3.2.1.4 Government immunization programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded antivirals and vaccines

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of combination and long-acting therapies

- 3.2.3.2 Personalized immunization strategies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Pipeline analysis

- 3.7 Pricing analysis

- 3.8 Patent landscape

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antiviral therapy

- 5.2.1 Acyclovir

- 5.2.2 Valacyclovir

- 5.2.3 Famciclovir

- 5.2.4 Other antiviral therapies

- 5.3 Corticosteroids and anti-inflammatory agents

- 5.4 Vaccines

- 5.5 Other treatment types

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Varicella (chicken pox)

- 6.3 Herpes zoster (shingles)

- 6.4 Other indications

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatrics

- 7.3 Adults

- 7.4 Geriatrics

Chapter 8 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Branded

- 8.3 Generics

Chapter 9 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Oral

- 9.3 Topical

- 9.4 Injectables

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals and clinics

- 10.3 Homecare settings

- 10.4 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Apotex

- 12.2 Bausch Health

- 12.3 Bio-Rad Laboratories

- 12.4 Changchun BCHT Biotechnology

- 12.5 GlaxoSmithKline

- 12.6 Glenmark Pharmaceuticals

- 12.7 Kamada

- 12.8 Merck & Co.

- 12.9 Mylan

- 12.10 Novartis

- 12.11 Pfizer

- 12.12 Sandoz

- 12.13 Santa Cruz Biotechnology

- 12.14 Sinovac

- 12.15 SK Chemicals

- 12.16 Teva Pharmaceuticals