|

市场调查报告书

商品编码

1833409

厌食症市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Anorexiants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

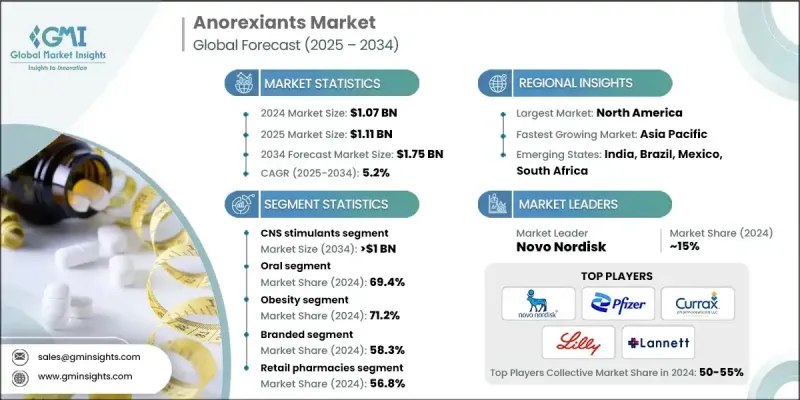

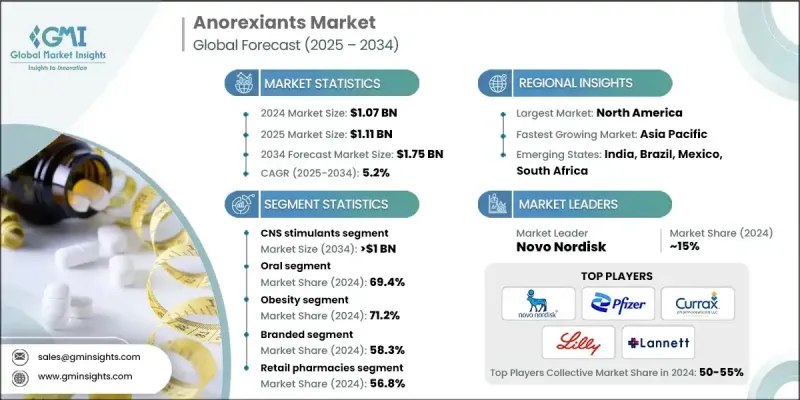

2024 年全球厌食症市场价值为 10.7 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 17.5 亿美元。

全球肥胖和超重人口的成长是厌食药市场的主要驱动力之一。随着第2型糖尿病、高血压和心血管疾病等生活方式疾病的日益普遍,包括厌食药在内的体重管理药物的需求持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 10.7亿美元 |

| 预测值 | 17.5亿美元 |

| 复合年增长率 | 5.2% |

中枢神经兴奋剂的采用率不断上升

2024年,中枢神经兴奋剂市场在食慾抑制和体重管理的推动下,收入可观。此类药物,例如芬特明和二乙丙酮,透过提高大脑中的多巴胺和去甲肾上腺素水平来发挥作用,从而抑制食慾并促进能量消耗。随着越来越多的患者转向使用能够帮助控制肥胖症和第2型糖尿病等相关疾病的药物,预计该市场将持续成长,尤其是在处方减重领域。

口服药物获得青睐

2024年,口服厌食药市场占据了相当大的份额,这得益于患者对易于使用、非侵入性治疗的偏好。奥利司他和芬特明/托吡酯等口服厌食药因其便捷、易得且疗效确切而广受欢迎。这些药物通常作为更广泛的体重管理方案的一部分,该方案还包括饮食调整和身体活动。

肥胖盛行率不断上升

受全球肥胖危机加剧的推动,肥胖领域在2024年占据了强劲的市场份额。随着与高血压、第2型糖尿病和心血管疾病等慢性疾病相关的肥胖率不断上升,对有效减肥疗法的需求也随之激增。该领域的厌食症药物被视为管理中度至重度肥胖的关键工具,尤其是在单靠饮食和运动等生活方式改变不足的情况下。

北美将成为利润丰厚的地区

由于完善的医疗基础设施、高水准的医疗支出以及人们对肥胖相关健康风险的认识不断提高,北美厌食症药物市场将在2025-2034年期间实现可观的复合年增长率。因此,北美公司正专注于推出新的厌食症药物,并利用直接面向消费者的行销策略来提高药物的接受度。

厌食症药物市场的主要参与者有 KVK-Tech、Teva Pharmaceuticals、Lannett Company、Novo Nordisk、Valeant Pharmaceuticals、Currax Pharmaceuticals、Eli Lilly and Company、Aventis Pharmaceuticals、Zydus Pharmaceuticals、Pfizer 和 Vivus。

为了巩固其市场地位和立足点,厌食症药物市场的公司正在采取各种关键策略。这些策略包括创新产品开发,特别是联合疗法和非兴奋剂配方,以满足不同患者的偏好和需求。该公司也大力投资患者教育和数位健康解决方案,例如应用程式和线上咨询服务,以提高治疗依从性并优化减肥效果。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 肥胖和代谢紊乱的盛行率不断上升

- 老年人和青少年人口不断增加

- 增强临床意识和治疗指南

- 数位健康和远距医疗平台的扩展

- 产业陷阱与挑战

- 品牌疗法和生物疗法成本高昂

- 安全性问题和副作用

- 市场机会

- 新兴市场需求不断成长

- 个人化和联合疗法日益成为趋势

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 未来市场趋势

- 临床试验分析

- 定价分析

- 技术和创新格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

第五章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- GLP-1受体激动剂

- 中枢神经兴奋剂

- 其他药物类别

第六章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 肠外

第七章:市场估计与预测:按适应症,2021 - 2034

- 主要趋势

- 肥胖

- 体重过重伴随合併症

第 8 章:市场估计与预测:按药物类型,2021 - 2034 年

- 主要趋势

- 品牌

- 泛型

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 零售药局

- 医院药房

- 网路药局

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Aventis Pharmaceuticals

- Currax Pharmaceuticals

- Eli Lilly

- KVK-Tech

- Lannett Company

- Novo Nordisk

- Pfizer

- Teva Pharmaceuticals

- Valeant Pharmaceuticals

- Vivus

- Zydus Pharmaceuticals

The Global Anorexiants Market was valued at USD 1.07 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 1.75 billion by 2034.

The global rise in obesity and overweight populations is one of the primary drivers of the anorexiants market. As lifestyle diseases like type 2 diabetes, hypertension, and cardiovascular diseases become more prevalent, demand for weight management drugs, including anorexiants, continues to grow.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.07 Billion |

| Forecast Value | $1.75 Billion |

| CAGR | 5.2% |

Rising Adoption of CNS Stimulants

The CNS stimulants segment generated significant revenues in 2024, driven by appetite suppression and weight management. Medications in this category, like phentermine and diethylpropion, work by increasing dopamine and norepinephrine levels in the brain, which suppresses appetite and promotes energy expenditure. This segment is expected to witness continued growth, particularly in the prescription weight loss space, as more patients turn to medications that can help them manage obesity and related conditions like type 2 diabetes.

Oral to Gain Traction

The oral segment of the anorexiants market held a substantial share in 2024, driven by patient preference for easy-to-use, non-invasive treatments. Oral anorexiants like Orlistat and phentermine/topiramate have become popular choices due to their convenience, availability, and proven efficacy. These drugs are often prescribed as part of a broader weight management regimen that includes dietary changes and physical activity.

Increasing Prevalence of Obesity

The obesity segment held a robust share in 2024, driven by the escalating global obesity crisis. With increasing rates of obesity linked to chronic diseases like hypertension, type 2 diabetes, and cardiovascular diseases, demand for effective weight-loss therapies is surging. Anorexiants in this segment are viewed as critical tools in the management of moderate to severe obesity, especially when lifestyle changes like diet and exercise alone are insufficient.

North America to Emerge as a Lucrative Region

North America anorexiants market will grow at a decent CAGR during 2025-2034, owing to well-established healthcare infrastructure, high levels of healthcare spending, and increasing awareness about obesity-related health risks. As a result, North American companies are focusing on launching new anorexiants and leveraging direct-to-consumer marketing strategies to increase drug adoption.

Major players in the anorexiants market are KVK-Tech, Teva Pharmaceuticals, Lannett Company, Novo Nordisk, Valeant Pharmaceuticals, Currax Pharmaceuticals, Eli Lilly and Company, Aventis Pharmaceuticals, Zydus Pharmaceuticals, Pfizer, and Vivus.

To strengthen their presence and market foothold, companies in the anorexiants market are employing a variety of key strategies. These include innovative product development, particularly regarding combination therapies and non-stimulant formulations, which cater to different patient preferences and needs. Companies are also investing heavily in patient education and digital health solutions, such as apps and online counseling services, to increase treatment adherence and optimize weight loss outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug class

- 2.2.3 Route of administration

- 2.2.4 Indication

- 2.2.5 Drug Type

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of obesity and metabolic disorders

- 3.2.1.2 Growing geriatric and adolescent populations

- 3.2.1.3 Enhanced clinical awareness and treatment guidelines

- 3.2.1.4 Expansion of digital health and telemedicine platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded and biologic therapies

- 3.2.2.2 Safety concerns and side effects

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand in emerging markets

- 3.2.3.2 Growing shift toward personalized and combination therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Clinical trial analysis

- 3.7 Pricing analysis

- 3.8 Technology and innovation landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 GLP-1 receptor agonists

- 5.3 CNS stimulants

- 5.4 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Obesity

- 7.3 Overweight with comorbidities

Chapter 8 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Branded

- 8.3 Generics

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Retail pharmacies

- 9.3 Hospital pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aventis Pharmaceuticals

- 11.2 Currax Pharmaceuticals

- 11.3 Eli Lilly

- 11.4 KVK-Tech

- 11.5 Lannett Company

- 11.6 Novo Nordisk

- 11.7 Pfizer

- 11.8 Teva Pharmaceuticals

- 11.9 Valeant Pharmaceuticals

- 11.10 Vivus

- 11.11 Zydus Pharmaceuticals