|

市场调查报告书

商品编码

1833413

战斗无人机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Combat Drones Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

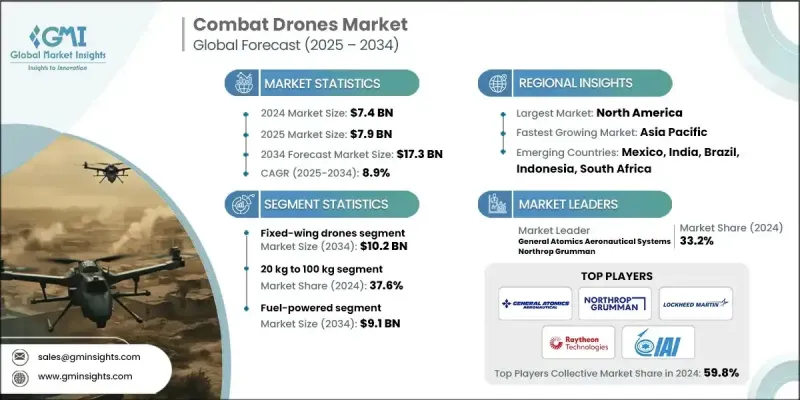

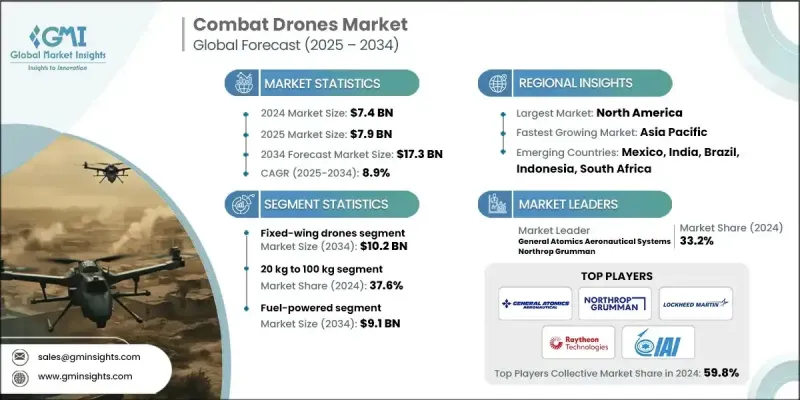

2024 年全球战斗无人机市场价值为 74 亿美元,预计到 2034 年将以 8.9% 的复合年增长率增长至 173 亿美元。

这一激增是由多种因素推动的,包括军队的现代化建设、国防开支的增加以及人工智慧 (AI)、感测器和自主技术的快速发展。随着新兴经济体优先考虑国防现代化,大量资源被分配用于无人作战航空系统的研发。这些努力使各国能够保持与主要军事强国的竞争力,同时也受惠于先进的无人机技术。配备隐形和低可探测技术的作战无人机正日益受到青睐,使军队能够在高威胁环境中作战,同时躲避复杂防空系统的探测。此外,由于协同无人机可以更有效地渗透和摧毁敌方防御,因此蜂群无人机战术的使用也越来越流行。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 74亿美元 |

| 预测值 | 173亿美元 |

| 复合年增长率 | 8.9% |

预计到2034年,固定翼无人机市场规模将达102亿美元。固定翼无人机尤其受到青睐,因为它们拥有更长的续航里程、更高的有效载荷能力,并且更适合执行远程打击和监视任务。预计该领域在北美和亚洲等地区的应用将会成长,因为这些地区已经将固定翼无人机用于边境巡逻和大规模行动。为了保持竞争力,製造商必须专注于增强隐身性能,并整合先进的情报、监视和侦察 (ISR) 负载。

2024年,20公斤至100公斤重量级无人机的市占率为37.6%。由于便携性和价格实惠,该重量级无人机越来越多地用于侦察和精确打击等战术任务。对于那些国防预算有限、寻求经济高效的军队现代化解决方案的国家来说,这些系统极具吸引力。製造商需要专注于生产紧凑型、人工智慧驱动、高效且价格合理的无人机,以满足这些发展中市场的需求。

2024年,美国作战无人机市场规模达28亿美元,这得益于雄厚的国防预算、无人机的广泛应用以及下一代无人作战飞机(UCAV)研发的持续创新。美国在无人机集群技术和人工智慧驱动的自主性方面也保持领先地位。进入该市场的公司必须与美国国防现代化进程保持一致,专注于能够融入当前和未来军事战略的可扩展无人机系统。

战斗无人机市场的主要参与者包括诺斯罗普·格鲁曼公司、通用原子航空系统公司、以色列航太公司 (IAI)、雷神技术公司、埃尔比特系统公司、莱昂纳多公司、波音公司、AeroVironment公司和空中巴士公司等公司。这些公司在开发尖端无人机技术方面处于领先地位,并致力于满足军事行动中日益增长的无人机系统需求。他们的市场策略专注于将创新的人工智慧、自主能力和隐身功能融入其产品中。各公司也大力投资研发,以保持领先于不断变化的国防需求,同时与政府机构建立战略合作伙伴关係,以配合国防优先事项。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 军队现代化和国防开支的增加

- 人工智慧、感测器和自主技术的快速进步

- 安全威胁情势与地缘政治不稳定不断升级

- 监理转变与出口自由化

- 策略联盟和供应链扩张

- 产业陷阱与挑战

- 开发和采购成本高

- 严格的监管和出口管制限制

- 市场机会

- 人工智慧与机器学习的融合

- 扩展无人机群能力

- 混合和隐形技术的采用日益增多

- 向新兴国防市场出口的潜力

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 国防预算分析

- 全球国防开支趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 重点国防现代化项目

- 预算预测(2025-2034)

- 对产业成长的影响

- 各国国防预算

- 供应链弹性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 合併、收购和策略伙伴关係格局

- 风险评估与管理

- 主要合约授予(2021-2024)

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按无人机类型,2021 - 2034 年

- 主要趋势

- 固定翼无人机

- 旋翼无人机

- 单旋翼

- 多旋翼

- 混合无人机

第六章:市场估计与预测:按有效载荷能力,2021 - 2034 年

- 主要趋势

- 最多 2 公斤

- 2公斤至19公斤

- 20公斤至100公斤

- 100公斤以上

第七章:市场估计与预测:按电源,2021 - 2034

- 主要趋势

- 电池供电

- 油电混合

- 燃料驱动

第八章:市场估计与预测:按技术分类,2021 - 2034 年

- 主要趋势

- 遥控无人机

- 半自动无人机

- 全自动无人机

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 致命的作战无人机

- 隐形无人机

- 巡飞弹药无人机

- 目标无人机

- 其他的

第 10 章:市场估计与预测:按发射模式,2021 年至 2034 年

- 主要趋势

- 垂直起降(VTOL)

- 自动起飞和降落(ATOL)

- 弹射无人机

- 手射无人机

第 11 章:市场估计与预测:按最终用途应用,2021 - 2034 年

- 主要趋势

- 军事行动

- 战略监视

- 战术战斗

- 侦察任务

- 训练与模拟

- 战斗训练

- 打靶

- 边境和海上安全

- 海岸监视

- 边境巡逻

- 反恐与执法

- 都市监控

- 战术干预

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- 全球关键参与者

- Northrop Grumman Corporation

- Raytheon Technologies Corporation (RTX)

- Lockheed Martin Corporation

- 区域关键参与者

- 北美洲

- General Atomics Aeronautical Systems, Inc.

- AeroVironment, Inc.

- The Boeing Company (Insitu, Inc.)

- 欧洲

- Airbus SE

- Leonardo SpA

- BAE Systems plc

- 亚太地区

- Israel Aerospace Industries Ltd. (IAI)

- Turkish Aerospace Industries, Inc. (TAI)

- Safran SA

- 北美洲

- 利基市场参与者/颠覆者

- Elbit Systems Ltd.

- QinetiQ Group plc

- Kratos Defense & Security Solutions, Inc.

- Anduril Industries, Inc.

- Textron Inc.

- Thales Group

- Griffon Aerospace

- Sistemas de Control Remoto (SCR)

The Global Combat Drones Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 17.3 billion by 2034.

This surge is driven by several factors, including modernization efforts in military forces, increased defense spending, and rapid advancements in artificial intelligence (AI), sensors, and autonomous technologies. As emerging economies prioritize defense modernization, significant resources are being allocated for the development of unmanned combat aerial systems. These efforts allow nations to stay competitive with major military powers while benefiting from advanced drone technologies. Combat drones equipped with stealth and low-observable technologies are gaining traction, enabling military forces to operate in high-threat environments while evading detection by sophisticated air defense systems. Additionally, the use of swarm drone tactics is becoming increasingly popular, as coordinated UAVs can infiltrate and neutralize enemy defenses more effectively.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $17.3 Billion |

| CAGR | 8.9% |

The fixed-wing drone segment is expected to reach USD 10.2 billion by 2034. Fixed-wing drones are particularly favored due to their longer operational range, enhanced payload capacity, and suitability for long-range strike and surveillance missions. The segment's adoption is expected to rise in regions like North America and Asia, where they are already used for border patrols and mass operations. Manufacturers must focus on enhancing stealth features and incorporating advanced intelligence, surveillance, and reconnaissance (ISR) payloads to remain competitive.

The 20 kg to 100 kg weight class segment held a 37.6% share in 2024. Drones within this weight range are increasingly used for tactical missions such as reconnaissance and precision strikes due to their portability and affordability. These systems are attractive to nations with limited defense budgets seeking cost-effective solutions for modernizing their armed forces. Manufacturers will need to focus on producing compact, AI-powered drones that are both effective and affordable for these developing markets.

United States Combat Drones Market generated USD 2.8 billion in 2024, driven by a robust defense budget, extensive use of drones, and ongoing innovation in the development of next-generation unmanned combat aerial vehicles (UCAVs). The U.S. also remains a leader in swarm technology and AI-driven autonomy in drones. Companies entering the market must align with U.S. defense modernization efforts, focusing on scalable drone systems that can integrate into both current and future military strategies.

Key players in the combat drones market include companies like Northrop Grumman, General Atomics Aeronautical Systems, Israel Aerospace Industries (IAI), Raytheon Technologies, Elbit Systems, Leonardo, Boeing, AeroVironment, and Airbus. These companies are at the forefront of developing cutting-edge drone technologies and meeting the growing demand for unmanned aerial systems in military operations. Their market strategies focus on incorporating innovative AI, autonomous capabilities, and stealth features into their products. Companies also invest heavily in R&D to stay ahead of evolving defense needs while fostering strategic partnerships with government agencies to align with national defense priorities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Drone type trends

- 2.2.2 Payload capacity trends

- 2.2.3 Power source trends

- 2.2.4 Technology trends

- 2.2.5 Application trends

- 2.2.6 Launching mode trends

- 2.2.7 End use application trends

- 2.2.8 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Force modernization and rising defense spending

- 3.2.1.2 Rapid technological advancements in AI, sensors, and autonomy

- 3.2.1.3 Escalating security threat landscape and geopolitical instability

- 3.2.1.4 Regulatory shifts and export liberalization

- 3.2.1.5 Strategic alliances and supply-chain expansion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and procurement costs

- 3.2.2.2 Stringent regulatory and export control restrictions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of artificial intelligence and machine learning

- 3.2.3.2 Expansion of swarm drone capabilities

- 3.2.3.3 Growing adoption of hybrid and stealth technologies

- 3.2.3.4 Export potential to emerging defense markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Drone Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fixed-wing drones

- 5.3 Rotary-wing drones

- 5.3.1 Single-rotor

- 5.3.2 Multi-rotor

- 5.4 Hybrid drones

Chapter 6 Market Estimates and Forecast, By Payload Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Up to 2 kg

- 6.3 2 kg to 19 kg

- 6.4 20 kg to 100 kg

- 6.5 Above 100 kg

Chapter 7 Market Estimates and Forecast, By Power Source, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Battery-powered

- 7.3 Hybrid-powered

- 7.4 Fuel-powered

Chapter 8 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Remotely operated drones

- 8.3 Semi-autonomous drones

- 8.4 Fully autonomous drones

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Lethal combat drones

- 9.3 Stealth drones

- 9.4 Loitering munition drones

- 9.5 Target drones

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Launching Mode, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 Vertical take-off and landing (VTOL)

- 10.3 Automatic take-off and landing (ATOL)

- 10.4 Catapult-launched drones

- 10.5 Hand-launched drones

Chapter 11 Market Estimates and Forecast, By End Use Application, 2021 - 2034 (USD Million & Units)

- 11.1 Key trends

- 11.2 Military operations

- 11.2.1 Strategic surveillance

- 11.2.2 Tactical combat

- 11.2.3 Reconnaissance missions

- 11.3 Training & simulation

- 11.3.1 Combat training

- 11.3.2 Target practice

- 11.4 Border & maritime security

- 11.4.1 Coastal surveillance

- 11.4.2 Border patrol

- 11.5 Counter-terrorism & law enforcement

- 11.5.1 Urban surveillance

- 11.5.2 Tactical interventions

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global Key Players

- 13.1.1 Northrop Grumman Corporation

- 13.1.2 Raytheon Technologies Corporation (RTX)

- 13.1.3 Lockheed Martin Corporation

- 13.2 Regional Key Players

- 13.2.1 North America

- 13.2.1.1 General Atomics Aeronautical Systems, Inc.

- 13.2.1.2 AeroVironment, Inc.

- 13.2.1.3 The Boeing Company (Insitu, Inc.)

- 13.2.2 Europe

- 13.2.2.1 Airbus SE

- 13.2.2.2 Leonardo S.p.A.

- 13.2.2.3 BAE Systems plc

- 13.2.3 APAC

- 13.2.3.1 Israel Aerospace Industries Ltd. (IAI)

- 13.2.3.2 Turkish Aerospace Industries, Inc. (TAI)

- 13.2.3.3 Safran SA

- 13.2.1 North America

- 13.3 Niche Players / Disruptors

- 13.3.1 Elbit Systems Ltd.

- 13.3.2 QinetiQ Group plc

- 13.3.3 Kratos Defense & Security Solutions, Inc.

- 13.3.4 Anduril Industries, Inc.

- 13.3.5 Textron Inc.

- 13.3.6 Thales Group

- 13.3.7 Griffon Aerospace

- 13.3.8 Sistemas de Control Remoto (SCR)