|

市场调查报告书

商品编码

1833421

滑动托盘盒市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Slide Tray Box Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

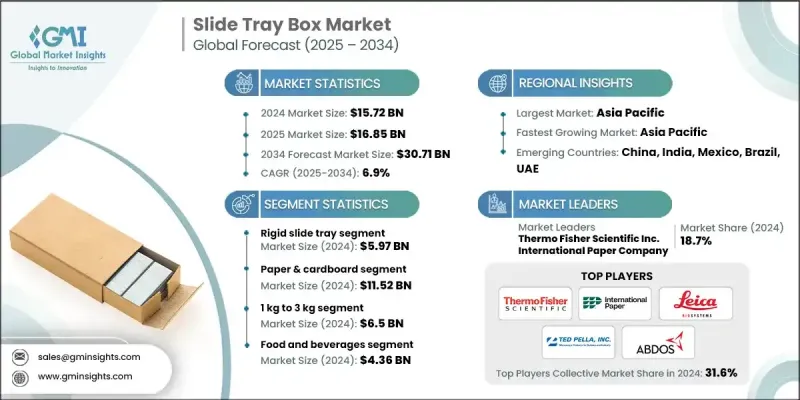

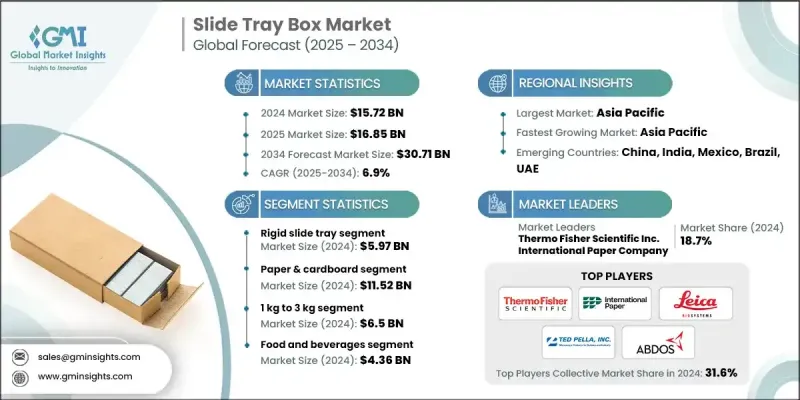

2024 年全球滑动托盘盒市场价值为 157.2 亿美元,预计到 2034 年将以 6.9% 的复合年增长率增长至 307.1 亿美元。

推动这一成长的因素包括:消费者对提升开箱体验的高端包装需求日益增长,日益增长的环保意识推动可持续包装替代品的开发,以及电子商务和直销管道的蓬勃发展。各大品牌正增加对高影响力包装设计的投入,以提升产品认知度并提升顾客互动。滑动托盘盒常用于奢侈品、电子产品、化妆品和特色食品市场,兼具耐用的结构和高端的美感。它们是展示精緻饰面、独立隔层和保护性内衬产品的首选。永续性是另一个主要催化剂,法规和不断变化的买家价值观鼓励使用可回收材料,例如牛皮纸、瓦楞纸或多层纸板。随着履行速度和客製化成为品牌策略的核心,全球市场对滑动托盘盒等灵活、坚固且外观醒目的包装的需求持续增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 157.2亿美元 |

| 预测值 | 307.1亿美元 |

| 复合年增长率 | 6.9% |

2024年,硬质滑动托盘市场产值达到59.7亿美元,这得益于其在电子产品、个人护理和礼品等高端产品领域的日益普及。这些托盘盒透过层压纸板结构、柔软触感涂层和精密表面处理,不断提升其性能,以吸引高端消费者。製造商正在与品牌进行联合创作,以提供快速週转、季节性或网红主导的系列产品,使其在线上和零售环境中都能在视觉和战术上脱颖而出。

2024年,纸质和纸板滑动托盘盒市场规模达115.2亿美元。瓦楞纸结构和多层纸板设计的进步,正在帮助品牌同时满足其可回收性和视觉呈现的需求。这些材料解决方案正被用作塑胶的可持续替代品,且不会损害其耐用性和货架吸引力。

2024年,美国滑动托盘盒市场规模达31.9亿美元,复合年增长率达5.6%。零售包装趋势的上升、D2C品牌的快速成长以及消费者对永续解决方案日益增长的偏好,共同推动了美国滑动托盘盒市场的成长。个人护理、电子产品和美食等行业纷纷采用滑动托盘盒形式,打造独特而奢华的开箱体验。烫金、磁扣和纹理覆膜等精加工技术正逐渐成为主流,促使当地製造商采用数位印刷机和半自动涂胶系统建造模组化生产装置,以高效地处理小批量、以设计为中心的生产任务。

活跃于载玻片托盘盒市场的主要参与者包括徕卡生物系统公司 Nussloch GmbH、希思罗科学公司 (Heathrow Scientific)、泰德佩拉公司 (Ted Pella, Inc.)、分子生物学产品公司 (Molecular Biology Products Inc. (MBPS)、ProSciTech、Abdos Labtech Private Limited、科学科技公司 (Hurst Scient)、Labtech 公司 (International (Internology)、国际纸业公司 (International)、国际纸业公司 (International)、国际纸业公司 (International (Hurst)、科学科技公司 (Internology)、国际纸业公司 (Internettech Private)、国际纸业公司 (International)、国际纸业公司 (Internology)、国际纸业公司 (Internology)、国际纸业公司 (Internology)、国际纸业公司 (Hurational)、Labtech Private) Company)、赛默飞世尔科技公司 (Thermo Fisher Scientific Inc.) 和 Agar Scientific Ltd.。 领先的公司正致力于可持续发展,转向可回收和可生物降解的材料,以满足监管和消费者的期望。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对优质品牌和开箱体验的需求不断增长

- 永续性和监管推动环保包装

- 电子商务和直接面向消费者 (D2C) 品牌蓬勃发展

- 包装设计的客製化和灵活性

- 奢侈品和礼品市场的成长

- 产业陷阱与挑战

- 生产和供应链成本高

- 自动化製造的可扩展性有限

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 公司简介 市占率分析

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 关键参与者的竞争基准化分析

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理分布比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 刚性滑动托盘盒

- 可折迭滑动托盘盒

- 窗户滑动托盘盒

- 磁性载玻片托盘盒

第六章:市场估计与预测:依材料类型,2021-2034 年

- 主要趋势

- 纸张和纸板

- 维珍董事会

- 再生板

- 牛皮纸基

- 塑胶

- 宠物

- PVC

- 可生物降解塑料

- 金属

- 锡

- 铝

- 木头

第七章:市场估计与预测:按产能,2021 - 2034

- 主要趋势

- 最多 1 公斤

- 1公斤至3公斤

- 3公斤至5公斤

- 5公斤以上

第 8 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 消费性电子产品

- 化学品

- 製药和医疗保健

- 消费品

- 个人护理和化妆品

- 服装和配件

- 文具及礼品

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 荷兰

- 鱼子

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太区

- 拉丁美洲

- 巴西

- 墨西哥

- 罗拉塔姆

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

- 罗马

第十章:公司简介

- 全球参与者

- Merck

- International Paper Company

- Leica Biosystems Nussloch GmbH

- Thermo Fisher Scientific Inc.

- 区域参与者

- Abdos Labtech Private Limited

- Agar Scientific Ltd.

- Heathrow Scientific

- Heinrich Buhl GmbH

- Hurst Scientific

- Molecular Biology Products Inc. (MBPS)

- Ted Pella, Inc.

- 新兴玩家

- Duke Packaging

- ProSciTech

The Global Slide Tray Box Market was valued at USD 15.72 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 30.71 billion by 2034.

The growth is driven by increasing consumer demand for premium packaging that enhances unboxing experiences, rising environmental concerns pushing sustainable packaging alternatives, and the booming presence of e-commerce and direct-to-consumer channels. Brands are increasingly investing in high-impact packaging designs to improve product perception and elevate customer interaction. Slide tray boxes, often used in luxury, electronics, cosmetics, and specialty food markets, offer both a durable structure and a high-end aesthetic. They are a top choice for showcasing products with refined finishes, separate compartments, and protective inner linings. Sustainability is another major catalyst, with regulations and shifting buyer values encouraging the use of recyclable materials such as kraft, corrugated, or layered paperboard. As fulfillment speed and customization become central to brand strategies, the demand for flexible, sturdy, and visually striking packaging like slide tray boxes continues to rise across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.72 billion |

| Forecast Value | $30.71 billion |

| CAGR | 6.9% |

The rigid slide tray segment generated USD 5.97 billion in 2024, driven by its rising use in premium product segments like electronics, personal care, and gifting. These boxes are increasingly enhanced through layered board construction, soft-touch coatings, and precision finishes that appeal to upscale consumers. Manufacturers are tapping into co-creation with brands to deliver quick-turn, seasonal, or influencer-led collections that stand out visually and tactically in both online and retail environments.

The paper & cardboard-based slide tray boxes segment was valued at USD 11.52 billion in 2024. Advancements in corrugated structures and multi-layer board designs are helping brands meet their recyclability and visual presentation needs simultaneously. These material solutions are being adopted as sustainable alternatives to plastic without compromising durability or shelf appeal.

U.S. Slide Tray Box Market was valued at USD 3.19 billion in 2024, growing at a CAGR of 5.6%. Growth across the U.S. is influenced by elevated retail packaging trends, fast growth in D2C brand launches, and mounting consumer preference for sustainable solutions. Sectors such as personal care, electronics, and gourmet foods use slide tray formats to create unique and luxurious unboxing experiences. Finishing techniques like foil stamping, magnetic closures, and textured laminates are becoming mainstream, driving local manufacturers to install modular production setups using digital presses and semi-automated gluing systems to handle small-volume, design-centric runs efficiently.

Key players active in the Slide Tray Box Market include Leica Biosystems Nussloch GmbH, Heathrow Scientific, Ted Pella, Inc., Molecular Biology Products Inc. (MBPS), ProSciTech, Abdos Labtech Private Limited, Hurst Scientific, International Paper Company, Thermo Fisher Scientific Inc., and Agar Scientific Ltd. Leading firms are focusing on sustainability by shifting toward recyclable and biodegradable materials, meeting both regulatory and consumer expectations. Partnerships with luxury brands, electronics companies, and D2C labels help drive co-branded, customized packaging solutions. Players are also investing in advanced printing technologies, automation, and short-run digital equipment to enhance production agility and precision.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1. Product type

- 2.2.2 Material type

- 2.2.3 Capacity

- 2.2.4 End use industry

- 2.2.5 North America

- 2.2.6 Europe

- 2.2.7 Asia Pacific

- 2.2.8 Latin America

- 2.2.9 Middle East & Africa

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspective: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for premium branding & unboxing experience

- 3.2.1.2 Sustainability and regulatory push toward eco-friendly packaging

- 3.2.1.3 Boom in e-commerce and direct-to-consumer (D2C) brands

- 3.2.1.4 Customization and flexibility in packaging design

- 3.2.1.5 Growth of the luxury and gifting market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production and supply chain costs

- 3.2.2.2 Limited scalability in automated manufacturing

- 3.2.3 Market Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction Company market share analysis

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Rigid slide tray boxes

- 5.3 Foldable slide tray boxes

- 5.4 Window slide tray boxes

- 5.5 Magnetic slide tray boxes

Chapter 6 Market estimates & forecast, By Material Type, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Paper & cardboard

- 6.2.1 Virgin board

- 6.2.2 Recycled board

- 6.2.3 Kraft paper-based

- 6.3 Plastic

- 6.3.1 PET

- 6.3.2 PVC

- 6.3.3 Biodegradable plastics

- 6.4 Metal

- 6.4.1 Tin

- 6.4.2 Aluminum

- 6.5 Wood

Chapter 7 Market estimates & forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Up to 1 Kg

- 7.3 1 Kg to 3 Kg

- 7.4 3 Kg to 5 Kg

- 7.5 Above 5 Kg

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Food and beverages

- 8.3 Consumer electronics

- 8.4 Chemicals

- 8.5 Pharmaceuticals and healthcare

- 8.6 Consumer goods

- 8.6.1 Personal care & cosmetics

- 8.6.2 Apparel & accessories

- 8.6.3 Stationery & gifts

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Netherlands

- 9.3.6 ROE

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 RoAPAC

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 RoLATAM

- 9.6 Middle East & Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

- 9.6.4 RoMEA

Chapter 10 Company Profile

- 10.1 Global Players

- 10.1.1 Merck

- 10.1.2 International Paper Company

- 10.1.3 Leica Biosystems Nussloch GmbH

- 10.1.4 Thermo Fisher Scientific Inc.

- 10.2 Regional Players

- 10.2.1 Abdos Labtech Private Limited

- 10.2.2 Agar Scientific Ltd.

- 10.2.3 Heathrow Scientific

- 10.2.4 Heinrich Buhl GmbH

- 10.2.5 Hurst Scientific

- 10.2.6 Molecular Biology Products Inc. (MBPS)

- 10.2.7 Ted Pella, Inc.

- 10.3 Emerging Players

- 10.3.1 Duke Packaging

- 10.3.2 ProSciTech